Get Generic Direct Deposit Form

Key takeaways

Key Takeaways for Filling Out the Generic Direct Deposit Form:

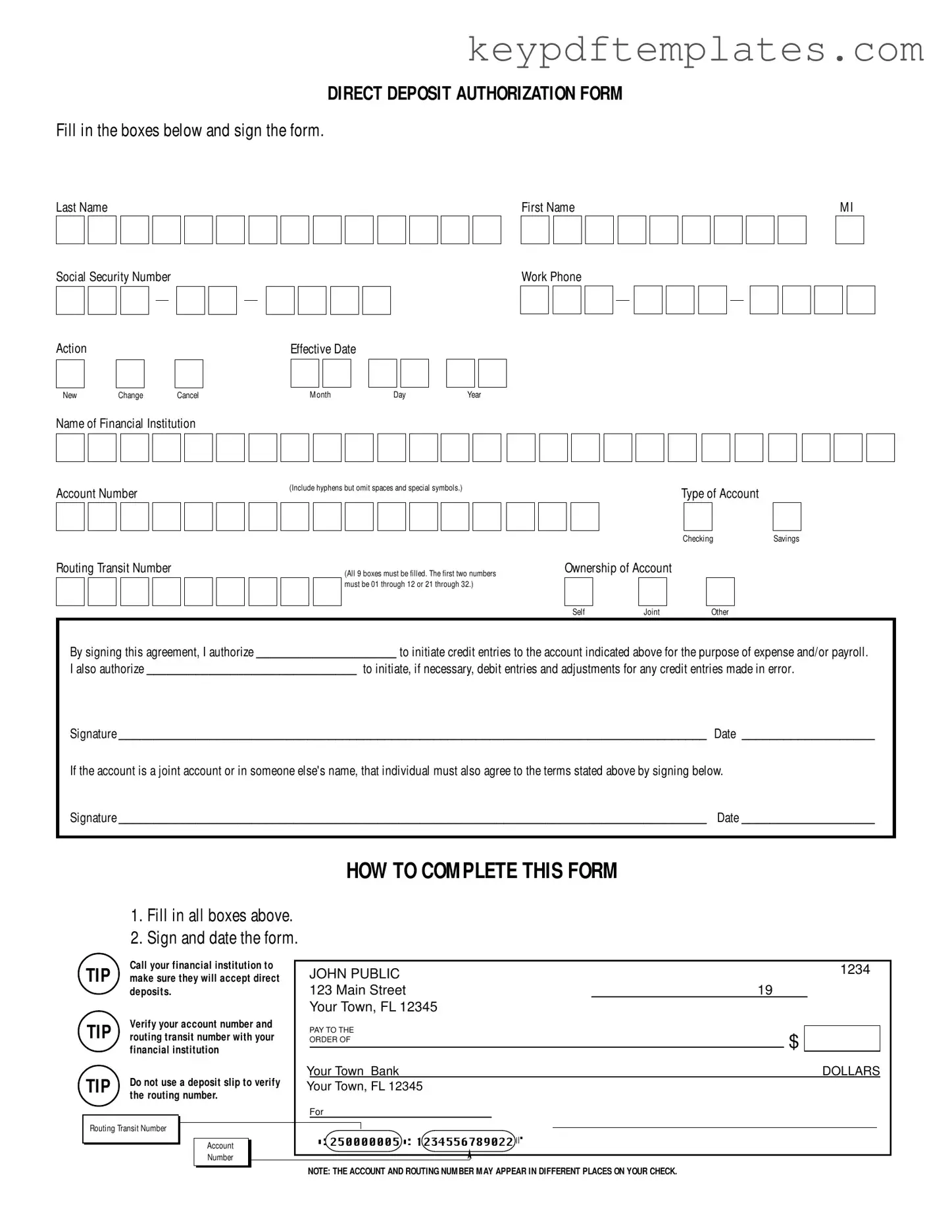

- Ensure all boxes are filled out completely, including your last name, first name, Social Security number, and account details.

- Choose the correct action: new, change, or cancel, and provide the effective date for the requested changes.

- Double-check your account number and routing transit number with your financial institution to avoid errors.

- Sign and date the form to authorize the direct deposit; if the account is joint, the other account holder must also sign.

- Do not rely on a deposit slip to verify the routing number; contact your financial institution directly for accurate information.

Similar forms

- Payroll Authorization Form: Similar to the Generic Direct Deposit form, this document allows employees to authorize their employer to deposit wages directly into their bank accounts. It requires personal information and account details, ensuring timely and secure payment.

- Automatic Payment Authorization Form: This form enables individuals to set up automatic payments for bills or services. Like the direct deposit form, it requires bank account information and authorizes a company to withdraw funds directly from a bank account.

- Bank Account Application: When opening a new bank account, individuals must provide personal information and account preferences. This process is similar to filling out the direct deposit form, as both require details about the account holder and their financial institution.

Trailer Bill of Sale: The Florida Trailer Bill of Sale form is a legal document that records the sale and transfer of ownership of a trailer in the state of Florida. This form serves as proof of the transaction between the buyer and seller, ensuring that both parties have a clear understanding of the terms of the sale. Properly completing this document can help prevent future disputes and provide necessary information for registration and titling. For more details, visit allfloridaforms.com.

- Direct Debit Authorization Form: This document allows a company to withdraw money from a person's account on a scheduled basis. It shares similarities with the direct deposit form, as both involve authorizing transactions between a bank account and a third party.

- W-4 Form: The W-4 form is used by employees to indicate their tax withholding preferences. While it serves a different purpose, it also requires personal information and signatures, similar to the direct deposit authorization process.

- Change of Address Form: This form notifies financial institutions of a change in address. Both documents require personal details and signatures, ensuring that important information is up to date for processing.

- Loan Application Form: When applying for a loan, individuals must provide personal and financial information. This form is similar to the direct deposit form in that it involves sensitive information and authorizations related to financial transactions.

- Tax Refund Direct Deposit Form: This document allows taxpayers to specify how they want their tax refunds deposited. It mirrors the direct deposit form by requiring bank account information and authorization for electronic funds transfer.

Misconceptions

Here are six common misconceptions about the Generic Direct Deposit form, along with explanations to clarify each point:

- Only employees can use the form. Many people believe that only employees can set up direct deposit. In reality, anyone receiving regular payments, such as freelancers or pensioners, can use this form to receive funds directly into their bank accounts.

- The form is only for payroll deposits. While many associate direct deposit with payroll, it can also be used for various types of payments, including government benefits, tax refunds, and other recurring payments.

- All banks accept the same routing numbers. Some assume that routing numbers are universal. However, each bank has specific routing numbers that can vary by location and account type. It’s essential to verify the correct routing number with your financial institution.

- Signing the form is optional. Some people think that they can submit the form without a signature. This is incorrect. A signature is required to authorize the initiation of deposits and any necessary adjustments.

- Joint account holders do not need to sign. Many believe that only one account holder's signature is sufficient. In fact, if the account is joint, all parties must sign the form to authorize direct deposits.

- Deposit slips are a reliable way to verify account information. There is a misconception that using a deposit slip is an acceptable method to confirm account details. This is not true. It is recommended to verify account and routing numbers directly with the bank to avoid errors.

More PDF Templates

Streamlined Foreign Offshore Procedures - If individual residency statuses differ, these must be disclosed clearly in the submitted documentation.

Download Dvla D1 Form - Check off all necessary documents before submitting your application.

The Texas Transfer-on-Death Deed form offers an efficient way for property owners to ensure their real estate is transferred to a chosen beneficiary without the complexities of probate. It simplifies estate planning, allowing heirs to receive property directly upon the owner's passing. For those looking to streamline this process and secure their assets, more information can be found at https://txtemplate.com/transfer-on-death-deed-pdf-template, guiding you through filling out the necessary form.

Sfa Age Range - Each completed form contributes to a broader understanding of student dynamics.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Generic Direct Deposit form allows individuals to authorize direct deposits into their bank accounts for payroll or expense reimbursements. |

| Required Information | Users must provide personal details such as name, Social Security Number, financial institution name, account number, and routing transit number. |

| Types of Accounts | Individuals can choose between a savings or checking account for the direct deposit. |

| Authorization | By signing the form, the individual authorizes their employer or organization to initiate credit and, if needed, debit entries for corrections. |

| Joint Accounts | If the account is joint, all account holders must sign the form to authorize the direct deposit. |

| Governing Law | In Florida, the governing law for direct deposit authorizations is found under the Florida Uniform Commercial Code, specifically Chapter 670. |

| Verification Tips | It’s important to verify the account and routing numbers with the financial institution. Avoid using deposit slips for this purpose. |

Documents used along the form

When setting up direct deposit, several other forms and documents may be required to ensure the process runs smoothly. Each of these documents serves a specific purpose and helps verify your banking information or employment status. Below is a list of common documents often used alongside the Generic Direct Deposit form.

- W-4 Form: This form is used by employers to determine the amount of federal income tax to withhold from an employee's paycheck. It requires information about your filing status and number of dependents.

- Employee Information Form: This document collects personal details from new employees, such as contact information, Social Security number, and emergency contacts. It helps employers maintain accurate records.

- Georgia WC-14 Form: The Georgia WC-14 form is essential for notifying the Georgia State Board of Workers' Compensation about workplace injury claims and can be pivotal in ensuring timely resolutions. For more details, refer to Georgia PDF.

- Bank Verification Letter: A letter from your bank confirming your account details, including the account number and routing number. This document helps ensure that your direct deposit information is accurate.

- Pay Stub: A document issued by your employer that outlines your earnings, deductions, and net pay for a specific pay period. It may be requested to verify employment and income.

- Employment Verification Form: This form is often required by banks or financial institutions to confirm your employment status and salary. It may need to be completed by your employer.

- Consent Form for Direct Deposit: A document that may be required by your employer, indicating that you consent to receive payments via direct deposit. This form usually includes your banking information.

Having these documents ready can facilitate the direct deposit setup process and help avoid any delays in receiving your payments. Always check with your employer or financial institution for specific requirements.