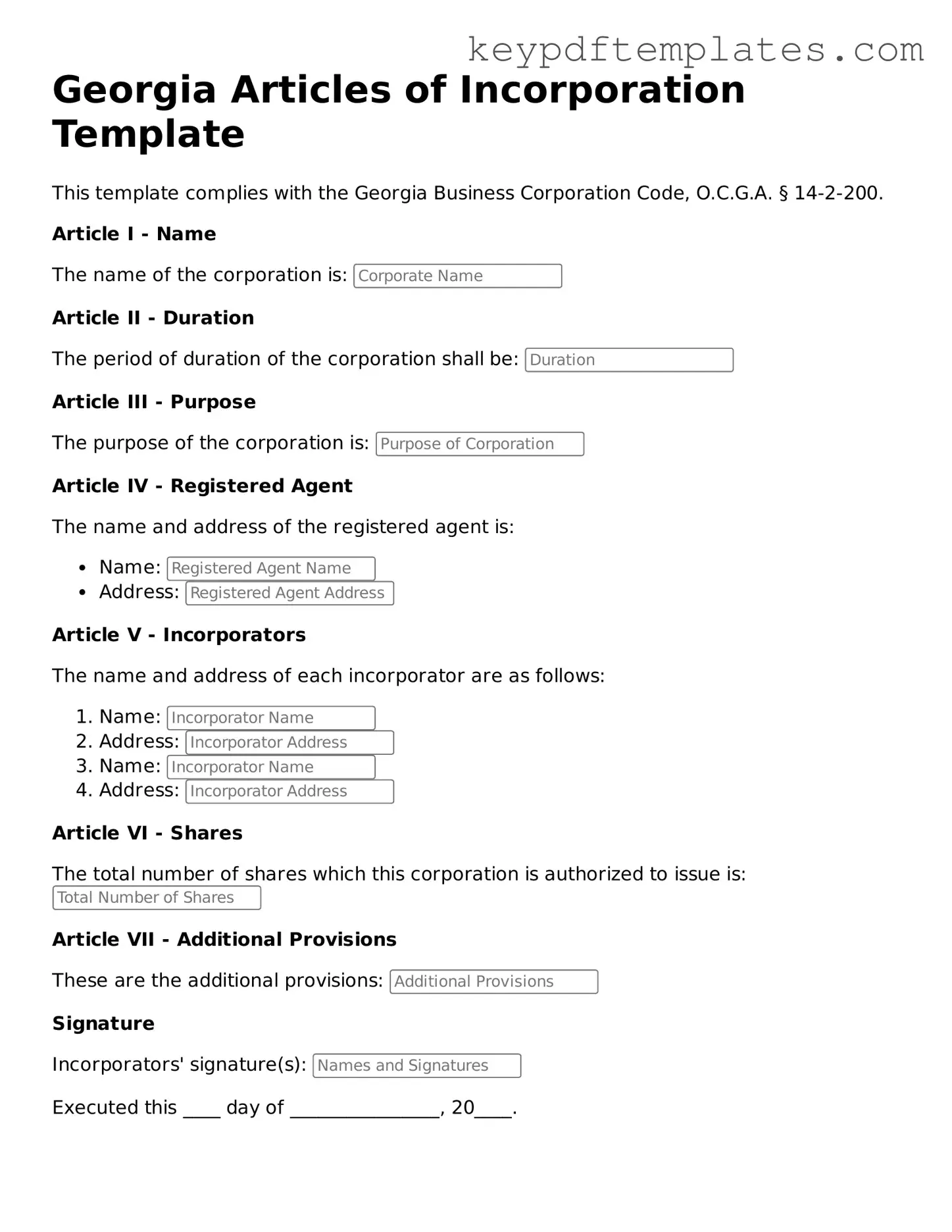

Legal Articles of Incorporation Document for the State of Georgia

Key takeaways

When filling out and using the Georgia Articles of Incorporation form, keep these key takeaways in mind:

- Understand the Purpose: The Articles of Incorporation establish your business as a legal entity in Georgia.

- Choose a Unique Name: Ensure your business name is not already in use. It must comply with Georgia naming rules.

- Designate a Registered Agent: This person or entity will receive legal documents on behalf of your corporation.

- Provide Accurate Information: Double-check all details, including the names and addresses of the incorporators and directors.

- Specify the Business Purpose: Clearly outline the purpose of your corporation. This can be broad or specific.

- Include the Number of Shares: State the total number of shares the corporation is authorized to issue.

- File with the Secretary of State: Submit your completed form online or by mail, along with the required filing fee.

- Keep Copies: Retain a copy of the filed Articles of Incorporation for your records.

- Consider Additional Filings: After incorporation, you may need to file for an Employer Identification Number (EIN) and other licenses.

- Stay Compliant: Maintain compliance with state regulations to avoid penalties and ensure good standing.

Completing this form accurately is crucial for establishing your corporation successfully. Take your time and ensure every detail is correct.

Similar forms

- Bylaws: These are the rules that govern the internal management of a corporation. Like Articles of Incorporation, they outline key operational guidelines but focus more on day-to-day procedures.

- Operating Agreement: This document is used by LLCs to outline management structure and member responsibilities. Similar to Articles of Incorporation, it serves as a foundational document for the organization.

- Certificate of Formation: This is often used interchangeably with Articles of Incorporation in some states. Both documents establish a business entity and provide basic information about it.

- Partnership Agreement: This document outlines the terms of a partnership. Like Articles of Incorporation, it defines roles and responsibilities among partners, although it pertains to partnerships rather than corporations.

- Business License: This is a permit issued by a government agency that allows a business to operate legally. While Articles of Incorporation create the entity, a business license is necessary for operational legitimacy.

- Bill of Sale: A Bill of Sale is a crucial document that ensures the proper handling of transactions involving personal property transfers. For details on how to create a Bill of Sale in Georgia, visit Georgia PDF.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders. Similar to Articles of Incorporation, it helps define the structure of ownership and governance in a corporation.

- Non-Disclosure Agreement (NDA): This legal contract protects confidential information. While not a foundational document like Articles of Incorporation, it serves to safeguard sensitive business information during operations.

- Minutes of Meetings: These are official records of the proceedings of meetings. They complement the Articles of Incorporation by documenting decisions made by the board of directors or shareholders.

- Registration Statement: This document is filed with the SEC when a company wants to sell securities. Like Articles of Incorporation, it provides essential information about the company but focuses on financial aspects.

Misconceptions

Understanding the Georgia Articles of Incorporation form is crucial for anyone looking to establish a corporation in the state. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

-

Filing the Articles of Incorporation guarantees business success.

Many believe that simply filing the Articles of Incorporation will ensure their business thrives. In reality, while this step is essential for legal recognition, success depends on various factors, including business planning, market research, and effective management.

-

All businesses must file Articles of Incorporation.

This is not accurate. Only those intending to form a corporation need to file this document. Other business structures, such as sole proprietorships or partnerships, do not require Articles of Incorporation.

-

The Articles of Incorporation are the only documents needed to start a business.

While the Articles of Incorporation are vital, they are not the only documents required. Additional filings, such as obtaining an Employer Identification Number (EIN) and necessary licenses or permits, are also essential to operate legally.

-

Once filed, the Articles of Incorporation cannot be changed.

This misconception can deter potential business owners. In fact, amendments can be made to the Articles of Incorporation as needed, allowing for flexibility as the business evolves.

Being informed about these misconceptions can help individuals navigate the incorporation process more effectively and set a solid foundation for their businesses.

Fill out Popular Articles of Incorporation Forms for Specific States

Articles of Incorporation Sunbiz - The process helps clarify roles and expectations within the organization.

Obtaining the Texas Certificate of Insurance is a vital step for Master Plumbers, as it validates their coverage and compliance with state regulations. Without this document, the ability to operate under an RMP license could be jeopardized, especially in specialized fields like medical gas and fire protection sprinklers. For further guidance on the process and to access the necessary templates, you can visit https://txtemplate.com/texas-certificate-insurance-pdf-template.

Bizfileonline - Some corporations include clauses that manage the dissolution process if necessary.

PDF Details

| Fact Name | Details |

|---|---|

| Purpose | The Articles of Incorporation form is used to legally establish a corporation in Georgia. |

| Governing Law | The form is governed by the Georgia Business Corporation Code, specifically O.C.G.A. § 14-2-201. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations wishing to operate in Georgia. |

| Information Needed | The form requires basic information, including the corporation's name, registered agent, and principal office address. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. As of October 2023, the fee is $100. |

| Processing Time | Typically, the processing time for the Articles of Incorporation is around 10 to 15 business days. |

| Amendments | Once filed, amendments to the Articles of Incorporation can be made by submitting a separate form and paying an additional fee. |

| Public Record | Once approved, the Articles of Incorporation become a public document, accessible to anyone who wishes to view it. |

Documents used along the form

When forming a corporation in Georgia, several documents and forms accompany the Articles of Incorporation. Each plays a crucial role in ensuring compliance with state regulations and establishing a solid foundation for your business. Below is a list of important documents you may need.

- Bylaws: These are the internal rules governing how your corporation operates. They outline the responsibilities of directors and officers, meeting procedures, and voting rights.

- Operating Agreement: While typically used for LLCs, this document can clarify management structure and operational procedures for a corporation, especially if there are multiple shareholders.

- Power of Attorney: Having a Power of Attorney form can be essential, especially in unexpected situations. The Florida Power of Attorney form is a legal document that allows one person to grant another the authority to make decisions on their behalf. To learn more and to fill out the form, visit Florida PDF Forms.

- Initial Report: Some states require an initial report shortly after incorporation. This document provides the state with information about your business, including its address and the names of its officers.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is essential for tax purposes. It allows your corporation to hire employees and open bank accounts.

- Business License: Depending on your location and type of business, you may need various licenses or permits to operate legally.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders, including how shares can be transferred and how disputes will be resolved.

- Minutes of the First Meeting: After incorporation, it's important to document the decisions made during the first meeting of directors and shareholders, including the adoption of bylaws.

- State Tax Registration: Registering for state taxes is necessary to ensure compliance with Georgia's tax laws, including sales tax and corporate income tax.

- Annual Report: Many states require corporations to file an annual report, providing updated information about the business and ensuring it remains in good standing.

Understanding these documents will help you navigate the incorporation process more smoothly. Each one serves a specific purpose and contributes to the overall health and legality of your business. Ensure that you have all necessary documents prepared and filed correctly to set your corporation up for success.