Legal Deed Document for the State of Georgia

Key takeaways

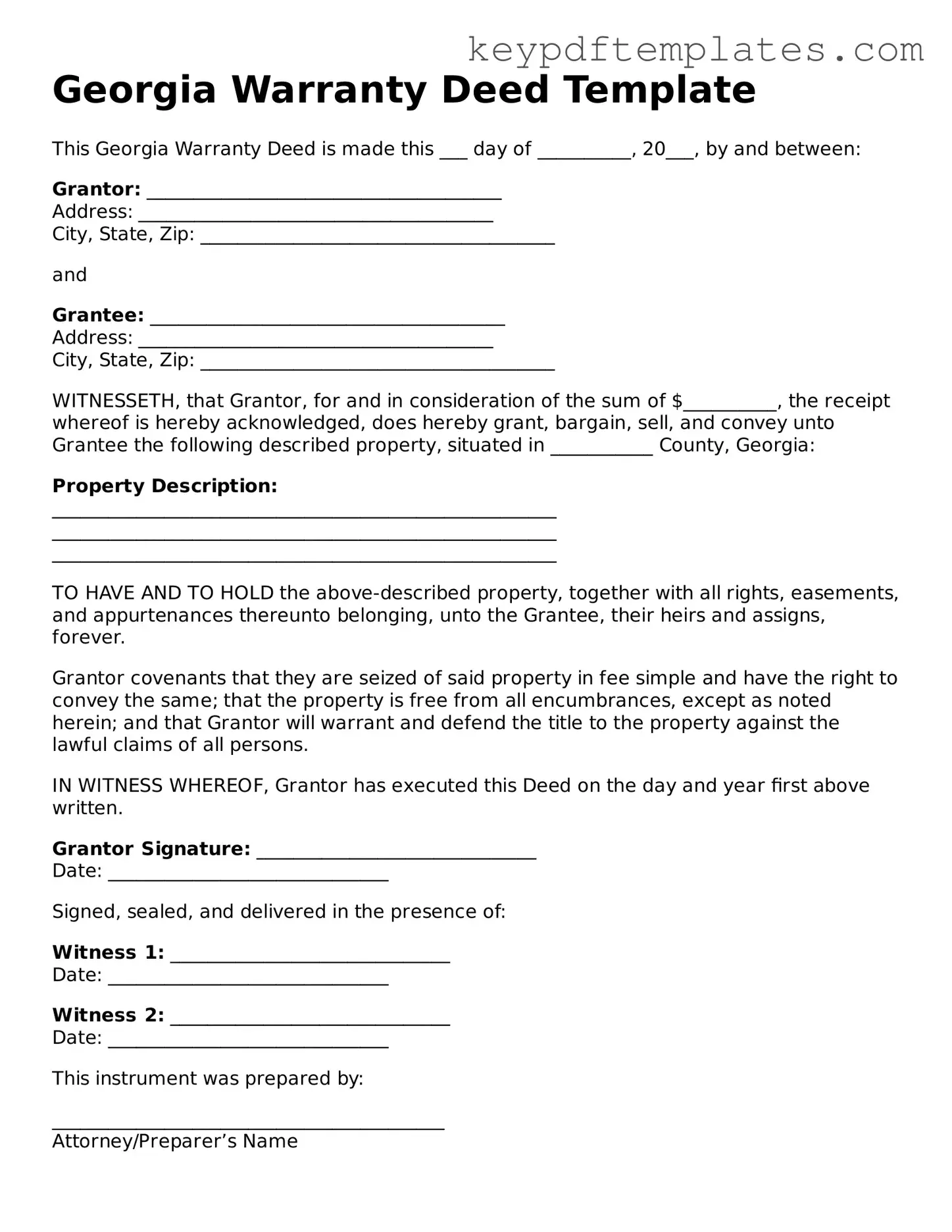

When filling out and using the Georgia Deed form, there are several important points to keep in mind. These takeaways will help ensure that the process goes smoothly and that the deed is valid.

- Understand the Types of Deeds: Georgia recognizes various types of deeds, including warranty deeds and quitclaim deeds. Each serves a different purpose, so it's crucial to choose the right one for your situation.

- Accurate Property Description: The deed must include a clear and accurate description of the property. This typically includes the address, parcel number, and legal description to avoid any confusion.

- Names of Parties: Ensure that the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) are correctly spelled and match their legal documents.

- Consideration Amount: The deed should state the consideration amount, which is the price paid for the property. Even if the transfer is a gift, a nominal amount should be included.

- Signatures Required: The grantor must sign the deed in the presence of a notary public. This signature validates the transfer and is a crucial step in the process.

- Filing the Deed: After the deed is signed and notarized, it must be filed with the county clerk's office where the property is located. This step makes the transfer official and public.

- Keep Copies: Always keep copies of the executed deed for your records. Having documentation is important for future reference and can help resolve any potential disputes.

By following these key points, you can navigate the process of filling out and using the Georgia Deed form with confidence.

Similar forms

- Bill of Sale: This document serves as proof of the transfer of ownership of personal property. Like a deed, it provides a written record that outlines the details of the transaction, including the parties involved and the item being sold.

- Lease Agreement: A lease agreement establishes the terms under which one party rents property from another. Similar to a deed, it involves the transfer of rights to use property, though it typically covers a specified period and includes conditions for use.

Georgia WC-3 Form: The Georgia WC-3 form serves as a Notice to Controvert, which allows an employer or insurer to dispute a worker's compensation claim. This form must be filed with the State Board of Workers' Compensation and shared with the employee and any other interested parties. If you need to fill out this form, click the button below. For more information, visit Georgia PDF.

- Title Certificate: A title certificate verifies ownership of property, similar to a deed. It confirms that the seller has the legal right to transfer ownership and provides a clear history of the property’s ownership.

- Trust Agreement: A trust agreement outlines the terms under which property is held by one party for the benefit of another. Like a deed, it involves the transfer of property rights but focuses on management and distribution rather than outright ownership.

Misconceptions

Understanding the Georgia Deed form is crucial for anyone involved in property transactions in the state. However, several misconceptions can lead to confusion and potential legal issues. Here are four common misconceptions:

- The Georgia Deed form is the same as a title. Many people believe that completing a deed form automatically transfers ownership of the property. In reality, a deed is a legal document that conveys title, but it must be properly executed and recorded to be effective.

- All types of deeds are interchangeable. Some assume that any deed form can be used for any transaction. However, there are different types of deeds—such as warranty deeds and quitclaim deeds—each serving distinct purposes and providing varying levels of protection for the buyer.

- Notarization is optional. A common myth is that notarizing the deed is not necessary. In Georgia, a deed must be signed in front of a notary public to be legally binding. Failing to notarize can result in challenges to the deed's validity.

- Recording the deed is unnecessary. Some individuals think that once a deed is signed, it does not need to be recorded. This is incorrect. Recording the deed with the county clerk is essential for protecting ownership rights and providing public notice of the transaction.

Awareness of these misconceptions can help ensure a smoother property transaction process. It is advisable to consult with a legal expert when dealing with real estate matters to avoid pitfalls and misunderstandings.

Fill out Popular Deed Forms for Specific States

Florida Deed Form - Provides a clear chain of title for real estate.

For those looking to understand their responsibilities in rental agreements, this useful guide to completing a Notice to Quit form can provide clarity.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special purpose deeds. |

| Governing Law | The transfer of property in Georgia is governed by Title 44 of the Official Code of Georgia Annotated. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) in the presence of a notary public. |

| Recording | To protect the interests of the new owner, the deed should be recorded in the county where the property is located. |

| Consideration | The form typically requires a statement of consideration, which is the value exchanged for the property. |

| Legal Description | A precise legal description of the property must be included to clearly identify the parcel being transferred. |

Documents used along the form

When dealing with real estate transactions in Georgia, several documents often accompany the Georgia Deed form. Each of these forms plays a crucial role in ensuring the legality and clarity of the transaction. Below is a list of important documents you may encounter.

- Title Search Report: This document confirms the current ownership of the property and checks for any liens or encumbrances. It ensures that the seller has the legal right to sell the property.

- Purchase and Sale Agreement: This contract outlines the terms and conditions of the sale, including the purchase price and any contingencies that must be met before the sale can be finalized.

- Closing Disclosure: This form provides a detailed account of all closing costs and fees associated with the transaction. It must be provided to the buyer at least three days before closing.

- Affidavit of Title: This sworn statement from the seller confirms their ownership and discloses any potential issues that could affect the title.

- Power of Attorney: If a party cannot be present at closing, this document allows someone else to act on their behalf in the transaction.

- Property Disclosure Statement: This form requires the seller to disclose any known defects or issues with the property, ensuring transparency in the sale.

- Loan Documents: If the buyer is financing the purchase, various documents related to the loan will be necessary, including the mortgage agreement and promissory note.

- Title Insurance Policy: This document protects the buyer and lender from any future claims against the title that were not discovered during the title search.

- Employee Handbook: For guidance on organizational policies and employee rights, refer to the Employee Policy Manual, which is essential for understanding workplace expectations and responsibilities.

- Settlement Statement: This document summarizes the financial aspects of the transaction, detailing all payments made by both the buyer and seller at closing.

Understanding these documents is essential for anyone involved in a real estate transaction in Georgia. Each serves a specific purpose, ensuring that the sale proceeds smoothly and legally. Being informed can help you navigate the process with confidence.