Legal Deed in Lieu of Foreclosure Document for the State of Georgia

Key takeaways

Filling out and using the Georgia Deed in Lieu of Foreclosure form can be a straightforward process, but it is essential to understand the key elements involved. Here are nine important takeaways to consider:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a borrower to transfer property ownership to the lender to avoid foreclosure.

- Eligibility Criteria: Not all borrowers qualify. Ensure that you meet the lender’s requirements before proceeding.

- Consult with Professionals: It is wise to seek advice from a real estate attorney or financial advisor to navigate the process effectively.

- Property Condition: The property should be in good condition. Lenders may inspect the property before accepting the deed.

- Clear Title: Ensure that the title is clear of liens or other encumbrances. This can facilitate a smoother transaction.

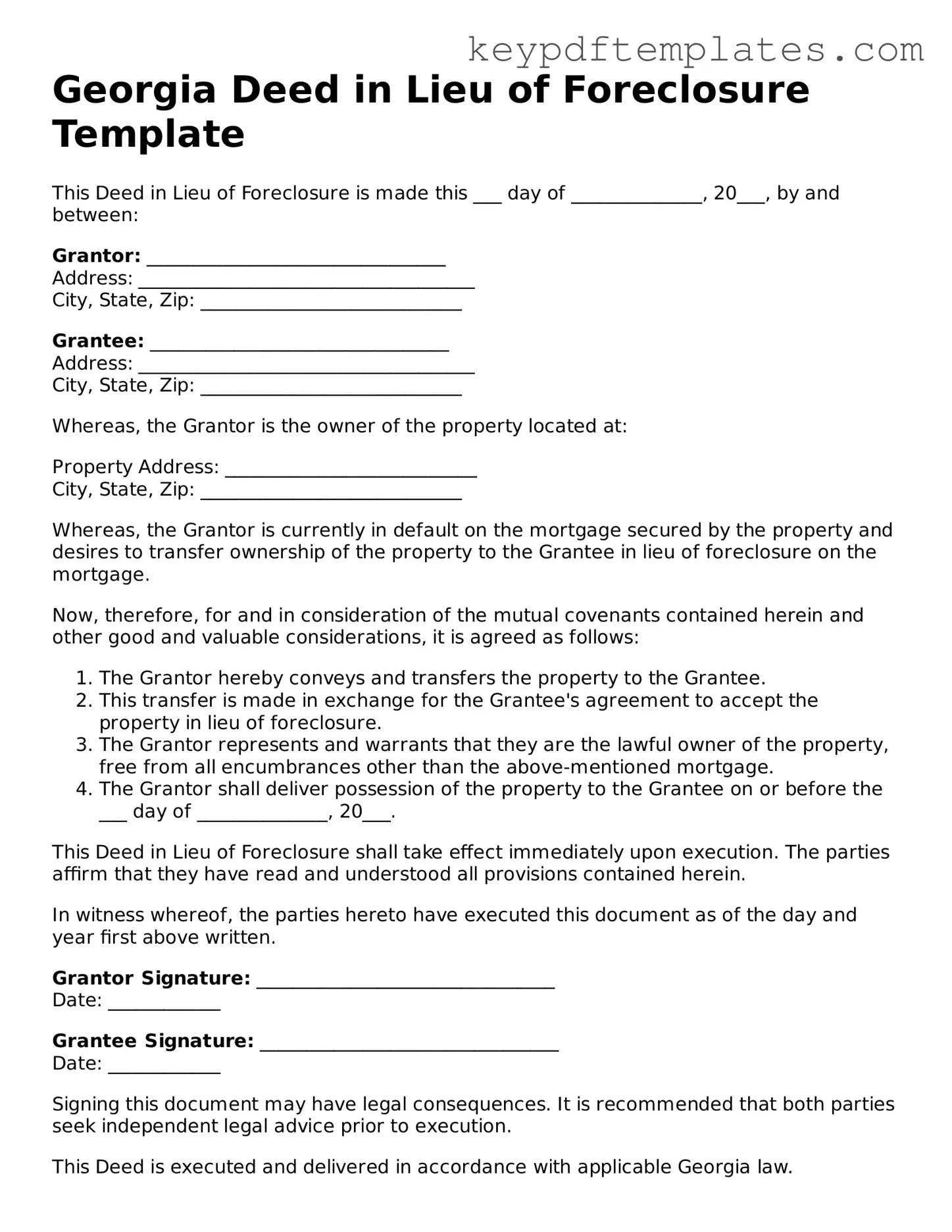

- Document Preparation: Complete the Deed in Lieu of Foreclosure form accurately. Double-check all information for accuracy.

- Signatures Required: All parties involved must sign the document. This includes both the borrower and the lender.

- Record the Deed: Once executed, the deed should be recorded with the county clerk’s office to make it official.

- Tax Implications: Be aware of any potential tax consequences resulting from the transfer of property. Consulting a tax professional can be beneficial.

By keeping these takeaways in mind, you can approach the Deed in Lieu of Foreclosure process with greater confidence and clarity.

Similar forms

- Short Sale Agreement: Similar to a deed in lieu of foreclosure, a short sale allows homeowners to sell their property for less than what they owe on their mortgage. Both options aim to help homeowners avoid foreclosure while relieving them of their mortgage burden.

- Mortgage Modification Agreement: This document modifies the terms of an existing mortgage. Like a deed in lieu, it seeks to make mortgage payments more manageable for the homeowner, potentially preventing foreclosure.

- Forbearance Agreement: A forbearance agreement temporarily pauses or reduces mortgage payments. It provides immediate relief, similar to a deed in lieu, by offering a way to avoid foreclosure while the homeowner regains financial stability.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a structured way to manage debts. Both options can protect the homeowner from losing their property, although bankruptcy is a more complex legal process.

- Repayment Plan: A repayment plan outlines how a homeowner can catch up on missed mortgage payments over time. This is similar to a deed in lieu in that it seeks to keep the homeowner in their home while addressing financial difficulties.

- Quitclaim Deed: A quitclaim deed transfers ownership of property without any warranties. While it’s often used in different contexts, it can be similar in that it allows a homeowner to relinquish their interest in the property, similar to a deed in lieu.

- New York Trailer Bill of Sale Form: For those transferring trailer ownership, the comprehensive Trailer Bill of Sale form resource ensures legal compliance and smooth transitions.

- Release of Mortgage: This document releases the borrower from their mortgage obligations once the debt is satisfied. It parallels a deed in lieu as both result in the homeowner no longer being responsible for the mortgage, effectively resolving the debt.

Misconceptions

When it comes to the Georgia Deed in Lieu of Foreclosure, there are several misconceptions that can lead to confusion. Understanding the truth behind these myths can help homeowners make informed decisions. Here’s a breakdown of ten common misconceptions:

- It eliminates all debts associated with the property. Many believe that signing a Deed in Lieu automatically wipes out all financial obligations. However, it typically only addresses the mortgage debt, not other debts like taxes or HOA fees.

- It guarantees that the lender will accept the deed. Some homeowners think that if they offer a Deed in Lieu, the lender must accept it. In reality, lenders have the discretion to accept or deny the offer based on their policies and the homeowner's financial situation.

- It will not affect your credit score. A common myth is that a Deed in Lieu has no impact on credit. In fact, it can negatively affect your credit score, similar to a foreclosure.

- It’s a quick and easy process. Many assume that a Deed in Lieu is a simple solution. While it can be faster than foreclosure, the process still involves negotiations and paperwork that can take time.

- Homeowners can stay in the property until the process is complete. Some think they can remain in their home during the Deed in Lieu process. However, once the deed is signed, the lender may require the homeowner to vacate the property.

- It is only for homeowners in extreme financial distress. While often used by those facing foreclosure, a Deed in Lieu can also be an option for homeowners looking to avoid the lengthy foreclosure process, even if they are not in dire straits.

- All lenders offer Deeds in Lieu. Not every lender provides this option. Homeowners should check with their specific lender to see if a Deed in Lieu is available to them.

- It releases homeowners from all liability. Some believe that signing a Deed in Lieu means they are free from all liability. However, lenders may still pursue deficiency judgments for any remaining balance after the property is sold.

- Legal representation isn’t necessary. Many think they can handle the process alone. While it’s possible, having legal guidance can help navigate the complexities and ensure that all rights are protected.

- It is the same as a short sale. Some confuse a Deed in Lieu with a short sale. While both involve transferring property to avoid foreclosure, a short sale requires the lender to approve the sale price, whereas a Deed in Lieu is a direct transfer of ownership.

Understanding these misconceptions can empower homeowners to make better decisions regarding their financial futures. Always consult with a professional for personalized advice tailored to your specific situation.

Fill out Popular Deed in Lieu of Foreclosure Forms for Specific States

Sample Deed in Lieu of Foreclosure - Homeowners should be aware of laws related to property transfer in their state.

To ensure a smooth transaction and protect your interests, it is advisable to use the Texas Vehicle Purchase Agreement form when buying or selling a vehicle in Texas. This document will clarify the terms of the sale and safeguard both parties' rights. For those looking to obtain this essential agreement, you can download the form now.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | The laws governing Deeds in Lieu of Foreclosure in Georgia are primarily found in the Official Code of Georgia Annotated (O.C.G.A.) § 44-14-162. |

| Eligibility | Homeowners facing financial difficulties may be eligible for a Deed in Lieu of Foreclosure if they can no longer afford their mortgage payments. |

| Benefits | This option can help homeowners avoid the lengthy and stressful foreclosure process, potentially allowing for a smoother transition. |

| Impact on Credit | A Deed in Lieu of Foreclosure may have a less severe impact on a homeowner's credit score compared to a full foreclosure. |

| Negotiation | Homeowners should negotiate the terms of the Deed in Lieu with their lender, including any potential deficiency judgments that could arise from the transaction. |

Documents used along the form

When navigating the complexities of real estate transactions, especially in situations involving foreclosure, several forms and documents may be necessary alongside the Georgia Deed in Lieu of Foreclosure. Each of these documents serves a specific purpose and plays a vital role in ensuring a smooth transition of property ownership. Below is a list of common forms that are often used in conjunction with the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines the terms of a modification to an existing mortgage loan. It may include changes to the interest rate, payment schedule, or loan duration, helping borrowers avoid foreclosure.

- Notice of Default: This is a formal notification sent to the borrower indicating that they have defaulted on their loan obligations. It serves as a warning and initiates the foreclosure process.

- Power of Attorney: This crucial document allows individuals to appoint someone to make legal and financial decisions on their behalf, particularly important during real estate transactions, ensuring that actions taken align with their wishes, such as the use of a POA.

- Foreclosure Mediation Agreement: In some cases, borrowers and lenders may enter mediation to discuss alternatives to foreclosure. This document outlines the terms and outcomes of that mediation process.

- Release of Liability: This form releases the borrower from further liability on the mortgage after the property is transferred. It ensures that the borrower is not held accountable for any remaining debt associated with the property.

- Property Condition Disclosure Statement: This document provides information about the condition of the property being transferred. It helps the new owner understand any existing issues or repairs needed.

- Settlement Statement (HUD-1): This form details all the financial transactions involved in the property transfer, including fees, costs, and the distribution of funds. It ensures transparency in the financial aspects of the transaction.

- Quitclaim Deed: A quitclaim deed is used to transfer any interest the grantor has in the property without making any guarantees about the title. It is often used to clear up title issues or to transfer property between family members.

- Affidavit of Title: This is a sworn statement by the seller affirming their ownership of the property and disclosing any liens or claims against it. It provides assurance to the buyer regarding the title's status.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. It may be necessary if the property owner is unable to sign the deed themselves.

Understanding these documents is crucial for anyone involved in a deed in lieu of foreclosure. Each form plays a significant role in protecting the interests of both the borrower and the lender, facilitating a smoother process during a challenging time. By being informed about these additional documents, individuals can navigate their real estate transactions with greater confidence and clarity.