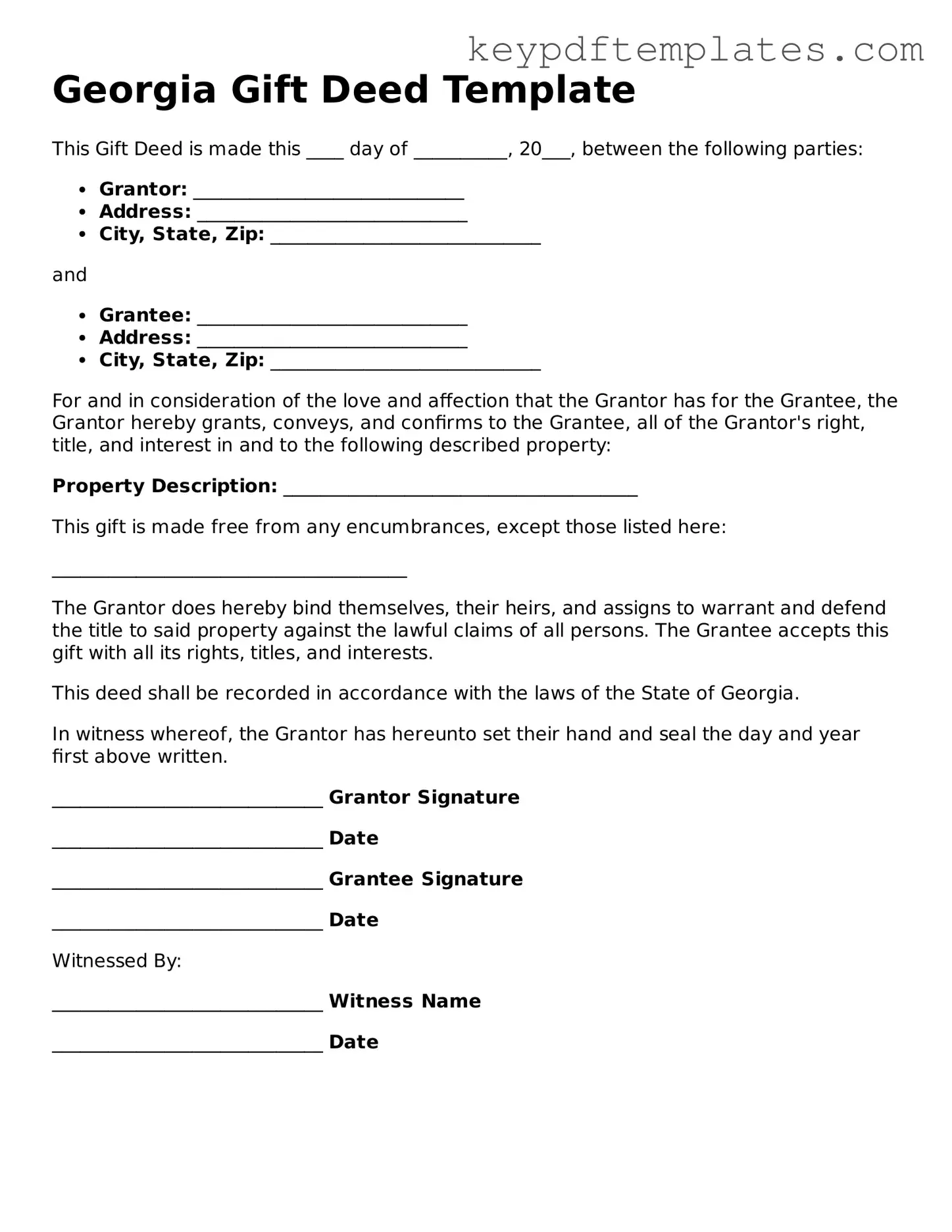

Legal Gift Deed Document for the State of Georgia

Key takeaways

When filling out and using the Georgia Gift Deed form, consider the following key takeaways:

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any payment. It is essential for gifting real estate.

- Identify the Parties: Clearly identify the donor (the person giving the gift) and the recipient (the person receiving the gift) with their full legal names.

- Provide Accurate Property Details: Include a complete description of the property being gifted, including the address and any relevant legal descriptions.

- Consider Tax Implications: Be aware that gifts may have tax consequences. Consulting a tax professional is advisable to understand potential liabilities.

- Signatures Required: Ensure that both the donor and the recipient sign the form. Notarization may also be necessary to validate the deed.

- Record the Deed: After completing the form, file it with the local county clerk’s office. This step is crucial for the transfer to be legally recognized.

- Consult Legal Advice: If there are any uncertainties, seeking legal advice can provide clarity and ensure that all requirements are met.

Similar forms

A Gift Deed is a legal document used to transfer ownership of property or assets from one person to another without any exchange of money. Several other documents serve similar purposes in various contexts. Here are five documents that share similarities with a Gift Deed:

- Will: A will outlines how a person's assets should be distributed after their death. Like a Gift Deed, it involves the transfer of property, but a will takes effect only upon the individual's passing, whereas a Gift Deed is effective immediately.

- Bill of Sale: A Bill of Sale is a vital document that officially records the sale of personal property, ensuring both buyer and seller are protected in the transaction. For assistance with crafting this important legal form, visit Georgia PDF.

- Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of another. Both documents facilitate the transfer of property, but a trust can manage assets over time, while a Gift Deed is a one-time transfer.

- Quitclaim Deed: A quitclaim deed transfers any ownership interest one person has in a property to another, similar to a Gift Deed. However, a quitclaim deed does not guarantee that the property is free of claims or debts, while a Gift Deed typically involves a clear intention to transfer ownership without encumbrances.

- Sales Contract: A sales contract outlines the terms of a sale, including the exchange of money for property. While a Gift Deed involves a transfer without payment, both documents formalize the transfer of ownership and detail the rights of the parties involved.

- Assignment Agreement: An assignment agreement transfers rights or interests in a contract or property from one party to another. Similar to a Gift Deed, it involves a change in ownership, but an assignment often requires consideration or compensation, unlike the gratuitous nature of a gift.

Misconceptions

Understanding the Georgia Gift Deed form is crucial for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Below is a list of common misconceptions, along with clarifications to help navigate this important legal document.

- Gift Deeds are the same as regular deeds. Many people believe that a gift deed functions just like a standard property deed. While both transfer ownership, a gift deed specifically denotes that no payment is exchanged, highlighting the nature of the transaction as a gift.

- You do not need to record a gift deed. Some individuals think that recording a gift deed is unnecessary. However, recording the deed with the county clerk provides public notice of the transfer, which can help prevent future disputes over ownership.

- Gift deeds are only for family members. It is a common belief that gift deeds can only be used to transfer property to relatives. In reality, anyone can gift property to another person, regardless of their relationship.

- A gift deed cannot be revoked. Some assume that once a gift deed is executed, it cannot be undone. While it is true that a gift deed is generally irrevocable, there are specific circumstances under which a gift may be contested or revoked.

- You do not need a lawyer to create a gift deed. Many people think that they can create a gift deed without legal assistance. While it is possible to draft a gift deed independently, consulting a lawyer ensures that the document complies with all legal requirements and accurately reflects the intentions of the parties involved.

- Gift deeds are not subject to taxes. There is a misconception that transferring property through a gift deed is completely tax-free. While there may not be immediate tax implications for the giver, the recipient may face gift tax obligations depending on the value of the property and current tax laws.

- A gift deed does not require witnesses. Some individuals believe that witnesses are not necessary for a gift deed. In Georgia, it is advisable to have at least two witnesses sign the deed to validate the transaction and prevent future disputes.

- Only real estate can be transferred via a gift deed. There is a common misunderstanding that gift deeds apply solely to real estate. In fact, various types of property, including personal belongings and financial assets, can also be transferred as gifts.

- Gift deeds do not require a legal description of the property. It is often thought that a gift deed can be vague regarding the property being transferred. However, a clear legal description is essential to accurately identify the property and avoid ambiguity.

- All gift deeds are the same across states. Many believe that the rules governing gift deeds are uniform nationwide. In truth, each state has its own laws and requirements for gift deeds, making it important to understand Georgia's specific regulations.

By addressing these misconceptions, individuals can better prepare for the process of transferring property as a gift and ensure that their intentions are clearly communicated and legally recognized.

Fill out Popular Gift Deed Forms for Specific States

How to Transfer Property Title to Family Member in California - The transfer of property via a Gift Deed is typically irrevocable.

By utilizing the Florida PDF Forms, you can ensure that your Power of Attorney is properly executed, providing peace of mind that your affairs will be managed according to your wishes when you are unable to do so yourself.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property as a gift without any exchange of money. |

| Governing Law | Gift deeds in Georgia are governed by Title 44, Chapter 5 of the Official Code of Georgia Annotated (OCGA). |

| Requirements | The deed must be in writing, signed by the donor, and notarized to be valid. |

| Consideration | No monetary consideration is required; the transfer is made voluntarily as a gift. |

| Tax Implications | Gift tax may apply, depending on the value of the property transferred and the donor's tax situation. |

| Recording | To protect the interests of the recipient, the gift deed should be recorded with the county clerk. |

| Revocation | Once executed and delivered, a gift deed generally cannot be revoked unless specific conditions are met. |

| Legal Advice | It's advisable to consult a legal professional before executing a gift deed to ensure compliance with state laws. |

Documents used along the form

When preparing a Georgia Gift Deed, several other documents may be needed to ensure a smooth transfer of property. Each of these forms serves a specific purpose in the process, helping to clarify ownership and intentions. Here are some common forms and documents that you might encounter:

- Property Deed: This document outlines the legal description of the property and confirms the current ownership. It is essential for establishing the basis of the gift.

- Certificate of Insurance: Essential for Master Plumbers, the Texas Certificate of Insurance form serves as proof of minimum required insurance coverage. For more information, visit txtemplate.com/texas-certificate-insurance-pdf-template/.

- Affidavit of Gift: A sworn statement that confirms the intent to gift the property. This document may be required to provide proof of the gift for tax purposes.

- Tax Form (IRS Form 709): This form is used for reporting gifts to the IRS. If the value of the gift exceeds a certain threshold, filing this form is necessary.

- Title Insurance Policy: This document protects the new owner against any claims or disputes over the property title. It may be advisable to obtain this for peace of mind.

- Quitclaim Deed: Sometimes used in conjunction with a Gift Deed, this form transfers any interest the grantor has in the property to the recipient without guaranteeing that the title is clear.

- Real Estate Transfer Tax Form: This form is often required to report the transfer of property for tax purposes. It may be necessary to submit this along with the Gift Deed.

- Power of Attorney: If the giver cannot sign the Gift Deed in person, a Power of Attorney allows someone else to act on their behalf, ensuring the process can proceed smoothly.

- Notice of Gift: This document formally notifies relevant parties, such as lenders or homeowners associations, about the property transfer, which can help prevent future disputes.

Gathering these documents can help streamline the gifting process and ensure that all legal requirements are met. Always consider consulting with a legal professional to navigate any complexities involved in property transfers.