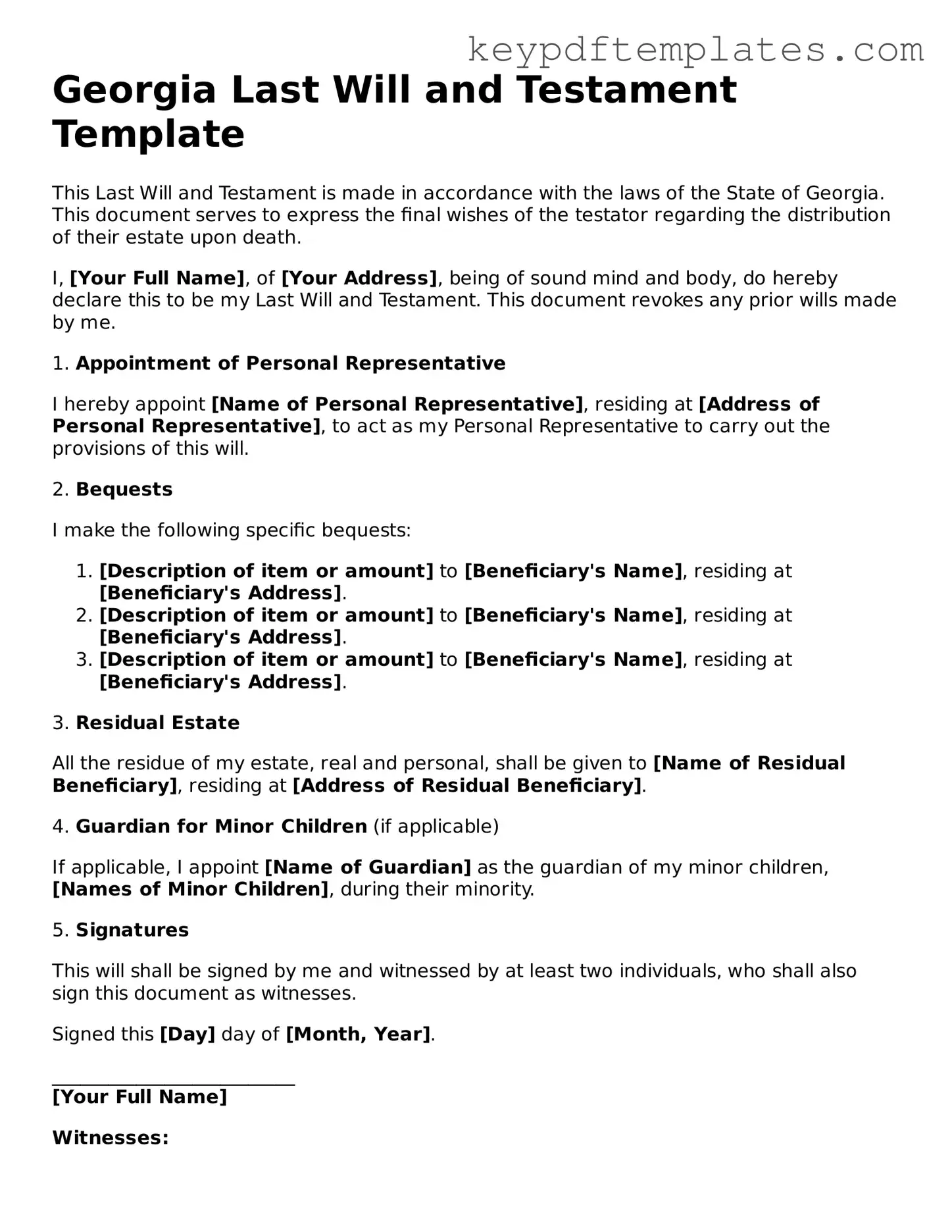

Legal Last Will and Testament Document for the State of Georgia

Key takeaways

When filling out and using the Georgia Last Will and Testament form, consider the following key points:

- The form must be signed by the testator, who is the person making the will.

- At least two witnesses are required to sign the will. They must be present when the testator signs.

- Witnesses should not be beneficiaries of the will to avoid potential conflicts of interest.

- The will should clearly state how the testator's assets will be distributed after their death.

- It's important to date the will to establish the most current version.

- Keep the original signed will in a safe place, such as a safe deposit box or with a trusted attorney.

- Consider updating the will after significant life events, such as marriage, divorce, or the birth of a child.

- While not required, having the will notarized can add an extra layer of validity.

- Review the will periodically to ensure it reflects the testator's current wishes.

Similar forms

The Last Will and Testament is a crucial document for outlining how your assets will be distributed after your passing. It shares similarities with several other legal documents. Here are four of those documents and how they relate to a Last Will:

- Living Will: While a Last Will addresses the distribution of your estate, a Living Will specifies your wishes regarding medical treatment if you become unable to communicate. Both documents reflect your intentions, but one focuses on end-of-life care and the other on asset distribution.

- Trust: A Trust allows you to manage your assets during your lifetime and after death. Like a Last Will, it dictates how your assets will be handled, but a Trust can offer more control and may help avoid probate, which is the legal process of validating a will.

- Georgia SOP Form: Understanding the guidelines and requirements of the Georgia SOP form is crucial for anyone looking to facilitate visitation; Georgia PDF provides the necessary information.

- Power of Attorney: This document grants someone the authority to make decisions on your behalf if you are incapacitated. Similar to a Last Will, it ensures your wishes are respected, but it focuses on financial and legal matters rather than asset distribution after death.

- Beneficiary Designations: These are often found on accounts like life insurance policies or retirement plans. Like a Last Will, they dictate who receives your assets, but they operate outside of probate and can take precedence over a will in some cases.

Misconceptions

When it comes to creating a Last Will and Testament in Georgia, many people hold misconceptions that can lead to confusion and potential legal issues. Here’s a list of ten common misconceptions, along with clarifications to help you understand the process better.

- Only wealthy people need a will. Many believe that wills are only for the rich. In reality, anyone with assets or dependents should consider having a will to ensure their wishes are honored.

- Wills are only for after I die. Some think a will is only relevant posthumously. However, a will can also address issues like guardianship for minor children while you are still alive.

- Verbal wills are valid. Many assume that a verbal agreement can serve as a will. In Georgia, a will must be in writing to be legally recognized.

- Handwritten wills are not valid. There is a belief that only typed wills are legitimate. In Georgia, handwritten (holographic) wills can be valid if they meet certain criteria.

- I can create my will without any help. While it's possible to draft your own will, it’s often wise to seek guidance from a professional to ensure it meets legal standards and accurately reflects your wishes.

- Once I create a will, it cannot be changed. Some think that a will is set in stone. In fact, you can modify or revoke your will at any time as your circumstances change.

- My will doesn’t need witnesses. There’s a misconception that witnesses are unnecessary. In Georgia, you must have at least two witnesses sign your will for it to be valid.

- All assets automatically go to my spouse. Many assume that everything will go to their spouse. In reality, how assets are distributed depends on how they are titled and the provisions in the will.

- A will avoids probate. Some believe that having a will means their estate will bypass probate. However, a will must go through the probate process to be validated.

- Only a lawyer can create a will. While lawyers can provide valuable assistance, individuals can create their own wills using templates, provided they follow Georgia’s legal requirements.

Understanding these misconceptions can help you navigate the process of creating a Last Will and Testament in Georgia more effectively. Taking the time to educate yourself ensures that your wishes are clearly expressed and legally binding.

Fill out Popular Last Will and Testament Forms for Specific States

Template for a Will - Allows individuals to name an executor responsible for carrying out their wishes.

For those looking to buy or sell a vehicle, having the correct paperwork is crucial. Our guide on the essential Motor Vehicle Bill of Sale documentation is here to help you navigate the process effectively. Visit this link for more information on the Motor Vehicle Bill of Sale and ensure a successful transaction.

How to Make a Will Legal - Sets in motion your desires, making the distribution of your estate straightforward.

PDF Details

| Fact Name | Details |

|---|---|

| Legal Requirement | In Georgia, a Last Will and Testament must be in writing to be valid. |

| Age Requirement | The testator (the person making the will) must be at least 14 years old. |

| Witnesses | Two witnesses are required to sign the will for it to be legally binding. |

| Governing Law | The Georgia Probate Code governs the creation and execution of wills. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original. |

| Holographic Wills | Georgia recognizes holographic wills, which are handwritten and signed by the testator. |

| Self-Proving Wills | A self-proving will includes a notarized affidavit from the witnesses, simplifying the probate process. |

| Executor Appointment | The will allows the testator to appoint an executor to manage the estate after death. |

Documents used along the form

When creating a Georgia Last Will and Testament, several other documents may be beneficial to ensure that your wishes are clearly outlined and legally upheld. Below is a list of common forms and documents that often accompany a will.

- Durable Power of Attorney: This document allows you to appoint someone to make financial and legal decisions on your behalf if you become incapacitated.

- Advance Healthcare Directive: This form outlines your healthcare preferences and designates someone to make medical decisions for you if you are unable to communicate.

- Living Will: A living will specifies your wishes regarding medical treatment in situations where you are terminally ill or permanently unconscious.

- Trust Agreement: A trust can help manage your assets during your lifetime and after your death, providing a way to distribute your estate according to your wishes.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance or retirement plans, allowing you to designate who will receive those assets upon your death.

- Texas VTR-60 Form: This form is crucial for individuals needing to replace their vehicle's license plate(s) or registration sticker. It can be accessed and filled out online at https://txtemplate.com/texas-vtr-60-pdf-template.

- Letter of Intent: This informal document provides guidance to your executor or loved ones regarding your wishes and any specific instructions for your estate.

- Guardianship Designation: If you have minor children, this document allows you to name a guardian to care for them in the event of your passing.

Using these documents in conjunction with your Last Will and Testament can help ensure that your wishes are honored and that your loved ones are taken care of according to your preferences. It's essential to keep these documents updated and stored in a secure location.