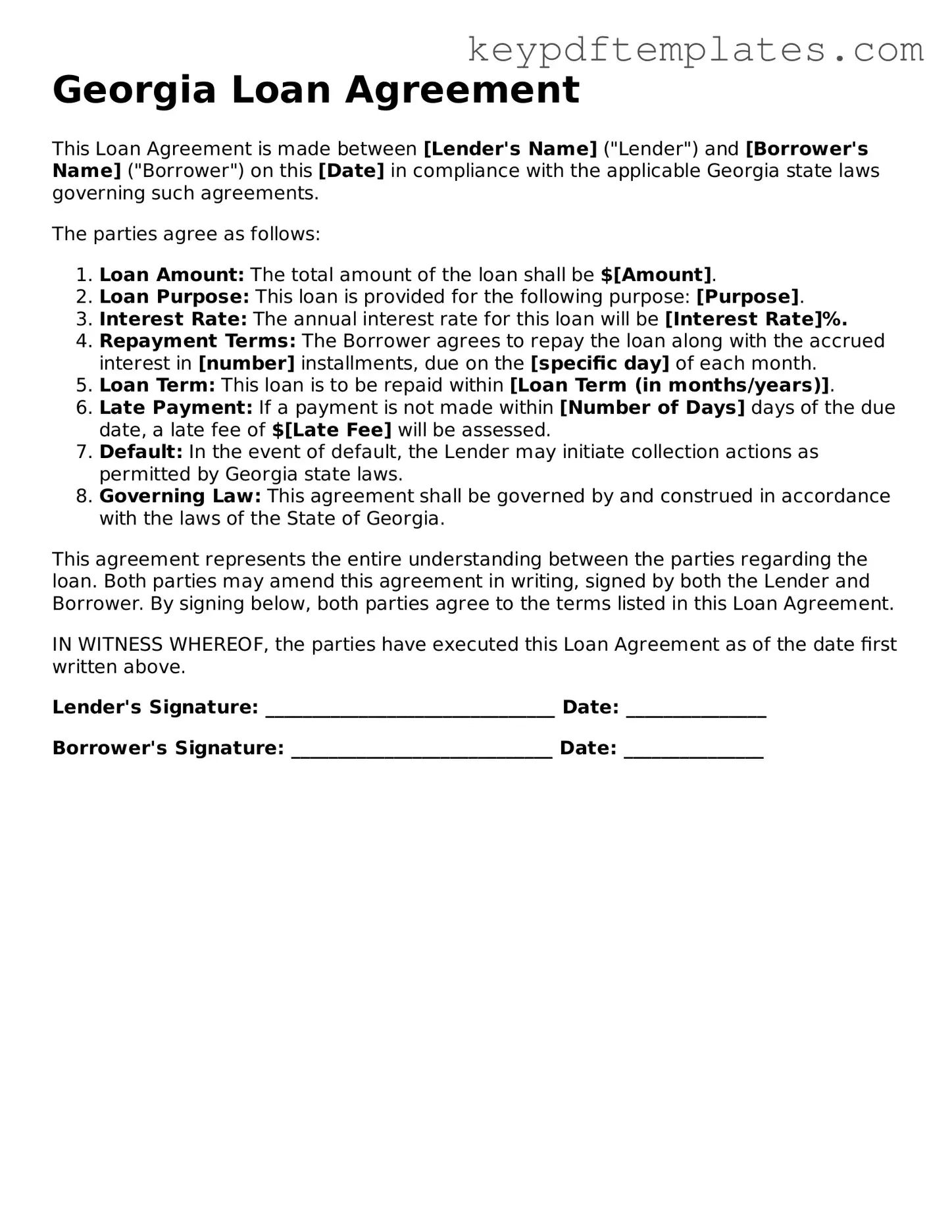

Legal Loan Agreement Document for the State of Georgia

Key takeaways

When filling out and using the Georgia Loan Agreement form, it is important to keep several key points in mind. The following takeaways can help ensure that the process goes smoothly and that all parties understand their rights and responsibilities.

- Understand the Purpose: The loan agreement serves to outline the terms of the loan, including the amount borrowed, interest rates, and repayment schedule.

- Identify the Parties: Clearly identify the lender and borrower. Include full names and addresses to avoid confusion.

- Detail the Loan Amount: Specify the exact amount being loaned. This number should be clearly stated in both words and numbers.

- Include Interest Rates: If applicable, outline the interest rate. Indicate whether it is fixed or variable and how it will be calculated.

- Outline Repayment Terms: Clearly define when payments are due, the frequency of payments, and the total duration of the loan.

- Address Default Conditions: State what constitutes a default on the loan. This may include late payments or failure to pay.

- Include Signatures: Both the lender and borrower must sign the agreement. This signifies that both parties agree to the terms laid out.

- Keep Copies: After signing, both parties should keep a copy of the agreement for their records. This ensures that everyone has access to the terms agreed upon.

By following these takeaways, individuals can navigate the loan agreement process more effectively, ensuring clarity and mutual understanding between the lender and borrower.

Similar forms

- Promissory Note: This document outlines a borrower's promise to repay a loan. Like a Loan Agreement, it specifies the amount borrowed, interest rate, and repayment terms, but is typically simpler and focuses on the borrower's commitment.

- Durable Power of Attorney: This document allows an individual to appoint an agent to make decisions on their behalf if they become incapacitated. It shares the importance of ensuring that one's financial and legal wishes are legally respected, much like the Loan Agreement. For more information, you can visit https://allfloridaforms.com/.

- Mortgage Agreement: This is a specific type of loan agreement used when purchasing real estate. It details the loan terms and secures the loan with the property as collateral, similar to how a Loan Agreement secures the terms of a general loan.

- Security Agreement: This document is used when a borrower pledges collateral to secure a loan. It shares similarities with a Loan Agreement in that it outlines the terms of the loan and the obligations of the borrower.

- Lease Agreement: Although primarily used for rental arrangements, a lease agreement can have similar terms regarding payment schedules and obligations, resembling the structure of a Loan Agreement.

- Personal Loan Agreement: This is a specific type of Loan Agreement for personal loans. It includes terms like interest rates and repayment schedules, much like a general Loan Agreement.

- Business Loan Agreement: Designed for business financing, this document details the loan amount, interest, and repayment terms, mirroring the structure and purpose of a Loan Agreement.

- Credit Agreement: This document outlines the terms of a credit facility, including limits and repayment terms. It shares similarities with a Loan Agreement in defining the relationship between lender and borrower.

- Installment Agreement: This is used when payments are made in installments over time. It resembles a Loan Agreement by detailing payment schedules and amounts due.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It shares a focus on repayment terms similar to a Loan Agreement.

- Forbearance Agreement: This is used when a lender allows a borrower to temporarily reduce or suspend payments. It mirrors a Loan Agreement by addressing the terms of the loan while providing flexibility for the borrower.

Misconceptions

-

Misconception 1: The Georgia Loan Agreement form is only for large loans.

This is not true. The form can be used for loans of various sizes, including personal loans, small business loans, and larger amounts. The key is that the terms are clearly defined, regardless of the loan amount.

-

Misconception 2: A verbal agreement is sufficient without the form.

While verbal agreements can be legally binding, they are often difficult to enforce. The Georgia Loan Agreement form provides a written record that can clarify terms and protect both parties in case of disputes.

-

Misconception 3: The form is only necessary for loans between strangers.

This is misleading. Even loans between friends or family members benefit from a written agreement. It helps set expectations and can prevent misunderstandings.

-

Misconception 4: Once signed, the terms cannot be changed.

While the agreement is binding, parties can negotiate changes to the terms. Any modifications should be documented in writing and signed by both parties to maintain clarity.

-

Misconception 5: All loan agreements are the same.

This is incorrect. Loan agreements can vary significantly based on the type of loan, the interest rates, and the repayment terms. The Georgia Loan Agreement form is designed to be flexible to accommodate different needs.

-

Misconception 6: The form does not need to be notarized.

While notarization is not always required, having a loan agreement notarized can add an extra layer of protection and validity. It can be beneficial in case of disputes.

-

Misconception 7: The lender has all the rights in the agreement.

This is a common misunderstanding. Both parties have rights and obligations outlined in the agreement. Borrowers should be aware of their rights regarding repayment and any potential penalties.

-

Misconception 8: The form is only for personal loans.

In reality, the Georgia Loan Agreement form can be used for various types of loans, including business loans, student loans, and more. It is a versatile document suitable for many borrowing situations.

Fill out Popular Loan Agreement Forms for Specific States

California Promissory Note Template - A Loan Agreement can be legally binding upon signing.

When preparing for instances where a parent or guardian is unavailable to make decisions for their child, it is important to have a Florida Power of Attorney for a Child form in place. This legal document allows another individual to step in and make necessary decisions on behalf of the child, ensuring their welfare is prioritized. For more information and to access the form, please visit Florida PDF Forms.

PDF Details

| Fact Name | Details |

|---|---|

| Purpose | The Georgia Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | The agreement is governed by the laws of the State of Georgia. |

| Parties Involved | The form includes sections for both the lender and the borrower to provide their names and contact information. |

| Loan Amount | The total amount of the loan must be clearly stated in the agreement. |

| Interest Rate | The interest rate applicable to the loan should be specified, including whether it is fixed or variable. |

| Repayment Terms | The form outlines the repayment schedule, including due dates and payment amounts. |

| Default Conditions | Conditions under which the borrower may be considered in default are included in the agreement. |

| Signatures | Both parties must sign the agreement to indicate their acceptance of the terms. |

Documents used along the form

When entering into a loan agreement in Georgia, several other forms and documents may be necessary to ensure that all parties are protected and that the terms of the loan are clearly understood. Below is a list of common documents that are often used in conjunction with a Georgia Loan Agreement. Each document serves a specific purpose and contributes to the overall clarity and legality of the loan transaction.

- Promissory Note: This is a written promise from the borrower to repay the loan amount. It outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments.

- Loan Disclosure Statement: This document provides borrowers with important information about the loan, including the total cost, interest rate, and any fees associated with the loan. It ensures that borrowers are fully informed before agreeing to the terms.

- Security Agreement: If the loan is secured by collateral, this document outlines the specifics of the collateral being used. It details what happens if the borrower defaults on the loan, including the lender's rights to seize the collateral.

- Statement of Fact Texas Form: A necessary document for vehicle transactions in Texas, crucial for providing accurate details and ensuring legal compliance. For more information, visit txtemplate.com/statement-of-fact-texas-pdf-template/.

- Personal Guarantee: In some cases, a personal guarantee may be required from the borrower or a third party. This document indicates that the individual agrees to be personally responsible for repaying the loan if the borrower defaults.

- Loan Application: This form collects essential information about the borrower, including their financial history, creditworthiness, and purpose for the loan. It helps lenders assess the risk involved in granting the loan.

- Amortization Schedule: This document outlines the repayment plan for the loan, detailing each payment amount, due date, and how much of each payment goes toward principal and interest. It helps borrowers understand their payment obligations over time.

These documents work together to create a comprehensive framework for the loan agreement, ensuring transparency and protecting the interests of both the borrower and the lender. Understanding each document's role can help individuals navigate the loan process more effectively.