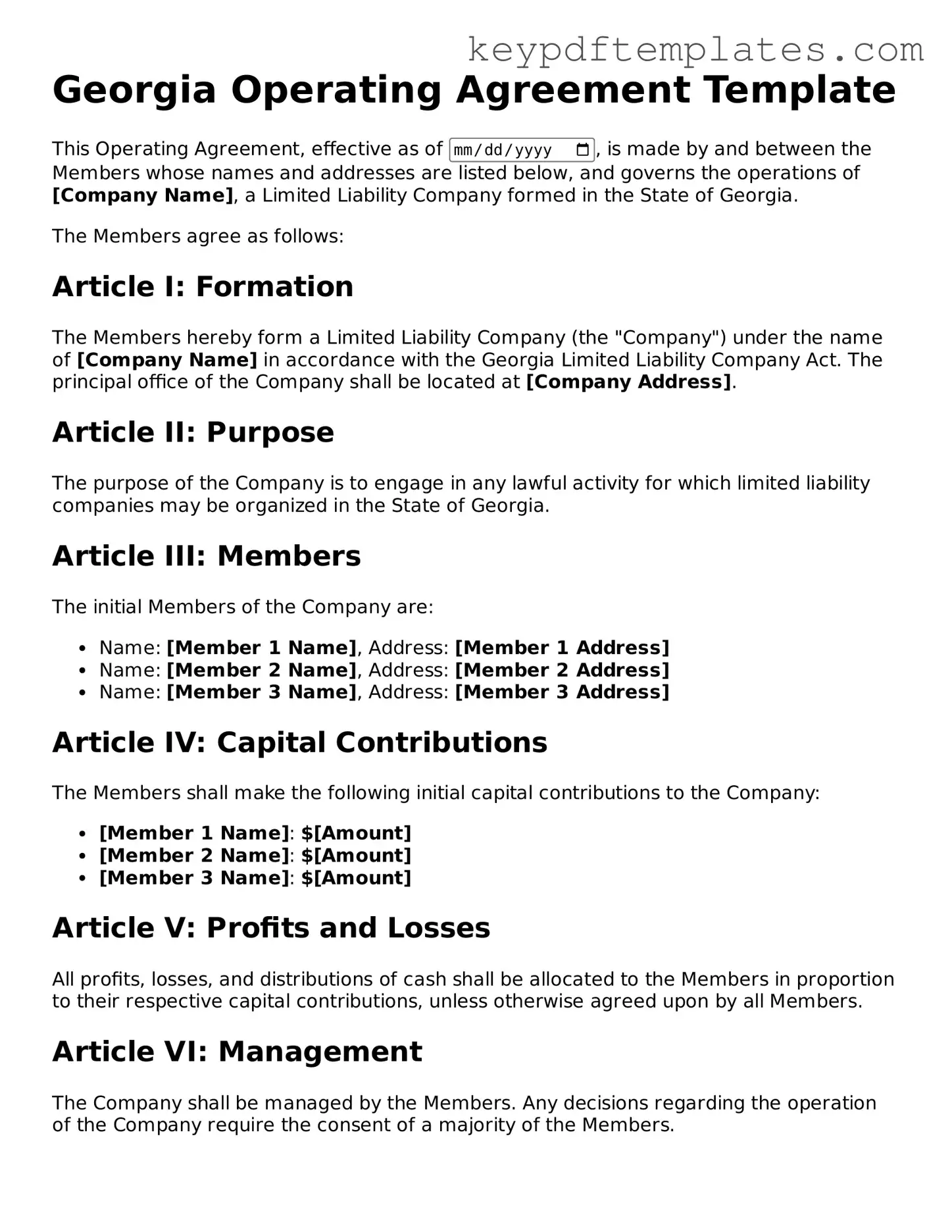

Legal Operating Agreement Document for the State of Georgia

Key takeaways

When filling out and using the Georgia Operating Agreement form, keep these key takeaways in mind:

- Understand the Purpose: The Operating Agreement outlines the management structure and operating procedures of your LLC.

- Identify Members: Clearly list all members of the LLC, including their names and roles.

- Define Ownership Percentages: Specify each member’s ownership interest to avoid future disputes.

- Outline Management Structure: Decide whether the LLC will be member-managed or manager-managed.

- Include Voting Rights: Establish how voting will occur among members, including the percentage needed for decisions.

- Set Profit Distribution: Detail how profits and losses will be shared among members.

- Address Changes: Include provisions for adding or removing members in the future.

- Compliance with State Laws: Ensure the agreement complies with Georgia state laws to maintain legal standing.

- Review Regularly: Periodically review and update the agreement as the business evolves.

By following these guidelines, you can create a comprehensive Operating Agreement that protects all members and clarifies expectations.

Similar forms

- Partnership Agreement: This document outlines the terms and conditions under which partners will operate a business together. Like the Operating Agreement, it defines roles, responsibilities, and profit-sharing arrangements among partners.

- Bylaws: Bylaws govern the internal management of a corporation. They are similar to an Operating Agreement in that both documents set rules for governance, including the election of officers and the conduct of meetings.

- Shareholders Agreement: This agreement details the rights and obligations of shareholders in a corporation. It parallels the Operating Agreement by specifying how shares are managed and how decisions are made within the company.

- Joint Venture Agreement: This document is used when two or more parties collaborate on a specific project. Like an Operating Agreement, it outlines the contributions of each party and how profits and losses will be shared.

- Chick Fil A Job Application: This document serves as the first step for prospective employees to express their interest in joining the renowned fast-food chain. It gathers essential personal, educational, and professional information required for employment consideration, making it a crucial bridge connecting job seekers with potential employment opportunities at Chick Fil A, including the document in pdf.

- Memorandum of Understanding (MOU): An MOU is a non-binding agreement that outlines the intentions of parties to work together. It shares similarities with an Operating Agreement in that it sets expectations and responsibilities, albeit in a less formal manner.

- LLC Membership Certificate: This certificate indicates a person’s membership in an LLC. While it serves a different purpose, it complements the Operating Agreement by providing proof of ownership and rights within the company.

- Franchise Agreement: This document governs the relationship between a franchisor and a franchisee. It is similar to an Operating Agreement because it establishes guidelines for operation, including the responsibilities of each party.

- Employment Agreement: This agreement outlines the terms of employment for an individual within a company. It relates to the Operating Agreement by defining roles and responsibilities, particularly if the employee is also a member of the LLC.

Misconceptions

When dealing with the Georgia Operating Agreement form, several misconceptions often arise. Understanding these can help individuals and businesses navigate their agreements more effectively.

- Misconception 1: The Operating Agreement is only necessary for large businesses.

- Misconception 2: The Operating Agreement is a public document.

- Misconception 3: An Operating Agreement is only about profit distribution.

- Misconception 4: Once created, the Operating Agreement cannot be changed.

This is not true. Even small businesses or single-member LLCs benefit from having an Operating Agreement. It provides clarity on management structure and operational procedures, regardless of the size of the business.

In Georgia, the Operating Agreement is considered a private document. It does not need to be filed with the state, meaning its contents remain confidential unless the members choose to disclose them.

While profit distribution is an important aspect, the Operating Agreement covers much more. It outlines the management structure, member responsibilities, decision-making processes, and procedures for adding or removing members, among other things.

This is incorrect. An Operating Agreement can be amended as needed. Members can agree to changes, which should be documented to ensure clarity and legal standing.

Fill out Popular Operating Agreement Forms for Specific States

Operating Agreement Llc California - It can serve to memorialize agreements reached verbally among members.

Understanding the significance of a General Power of Attorney form in Georgia is crucial, as it provides clarity and control over your financial and legal affairs. By delegating authority to a trusted individual, you ensure that your decisions are respected, especially in unforeseen circumstances. For further information on how to complete this process, visit Georgia PDF.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC) in Georgia. |

| Governing Law | This agreement is governed by the Georgia Limited Liability Company Act, found in Title 14, Chapter 11 of the Georgia Code. |

| Member Rights | It specifies the rights and responsibilities of the members, including profit distribution and decision-making processes. |

| Customization | The agreement can be customized to meet the specific needs of the LLC and its members, allowing for flexibility in governance. |

Documents used along the form

When forming a limited liability company (LLC) in Georgia, the Operating Agreement is a crucial document. However, several other forms and documents often accompany it to ensure compliance with state regulations and to clarify the operational structure of the LLC. Below are some of the key documents you may need.

- Articles of Organization: This document is filed with the Georgia Secretary of State to officially create the LLC. It includes basic information such as the company name, registered agent, and the purpose of the business.

- Texas Resale Certificate 01 339: This important document allows businesses to purchase goods tax-free for resale within Texas, ensuring compliance with local tax laws. For more information, visit txtemplate.com/texas-resale-certificate-01-339-pdf-template/.

- Member Consent Forms: These forms are used to document the agreement of members regarding significant decisions or actions taken by the LLC. They help maintain clear communication and ensure all members are on the same page.

- Operating Procedures Manual: This manual outlines the day-to-day operations of the LLC. It provides guidance on processes, roles, and responsibilities, helping to streamline business activities.

- Tax Registration Forms: LLCs must register for various taxes, such as sales tax or employer identification numbers. These forms ensure that the business complies with federal, state, and local tax regulations.

- Annual Report: In Georgia, LLCs are required to file an annual report with the Secretary of State. This report updates the state on the company's status and any changes in membership or management.

Each of these documents plays a vital role in the formation and operation of an LLC in Georgia. Together with the Operating Agreement, they help establish a solid foundation for the business and ensure compliance with legal requirements.