Legal Promissory Note Document for the State of Georgia

Key takeaways

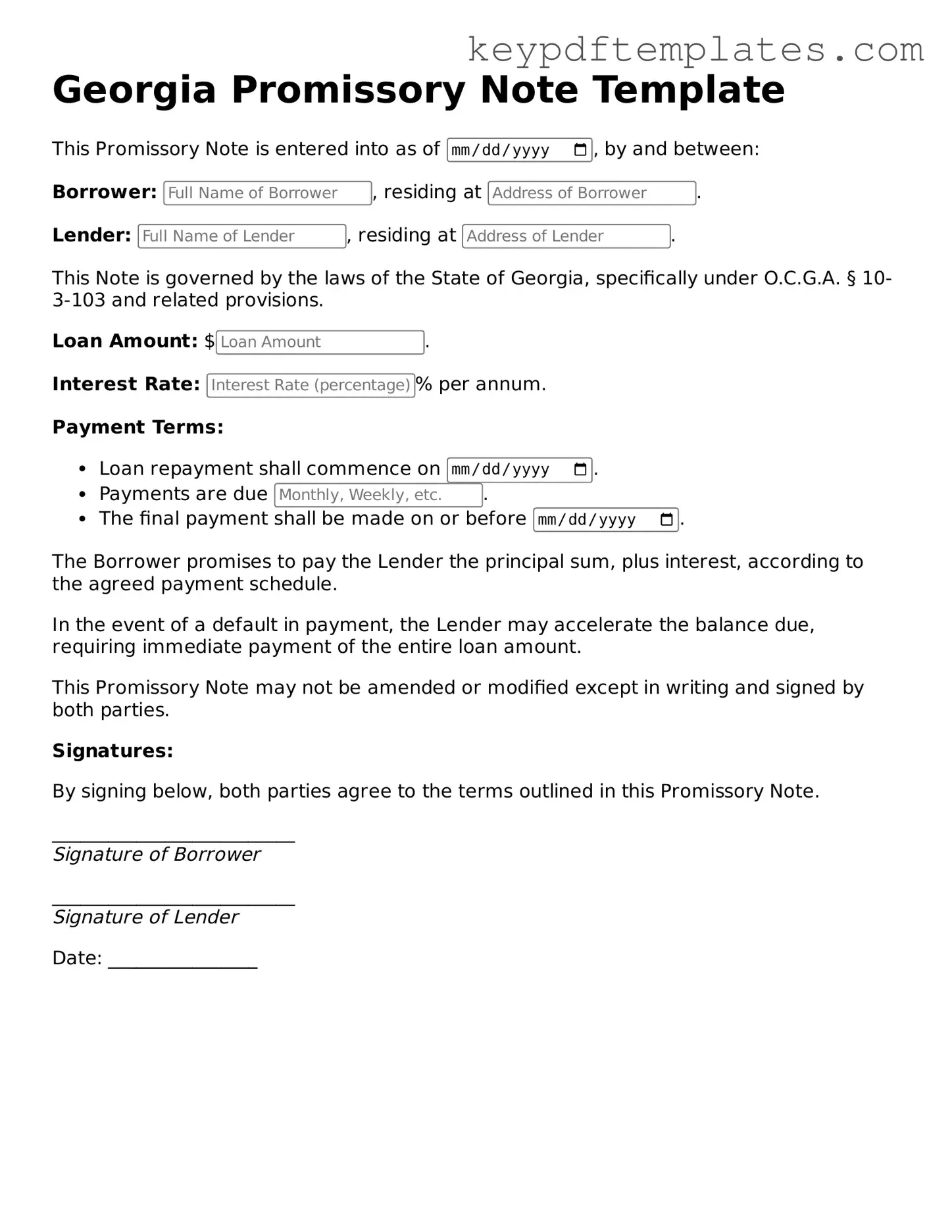

Filling out and using the Georgia Promissory Note form requires attention to detail and understanding of the terms involved. Here are key takeaways to keep in mind:

- Understand the Purpose: A promissory note is a written promise to pay a specific amount of money at a defined time.

- Identify the Parties: Clearly list the lender and borrower, including their full names and addresses.

- Specify the Loan Amount: Clearly state the total amount being borrowed. This figure should be accurate and agreed upon by both parties.

- Outline the Interest Rate: Include the interest rate, if applicable. Specify whether it is fixed or variable.

- Detail the Repayment Schedule: Clearly describe how and when payments will be made. Include due dates and payment frequency.

- Include Late Fees: Specify any penalties for late payments. This can help encourage timely repayment.

- State the Maturity Date: Clearly indicate when the loan will be fully repaid. This is important for both parties to know.

- Consider Collateral: If applicable, identify any collateral securing the loan. This provides additional security for the lender.

- Signatures Are Essential: Ensure both parties sign the document. Without signatures, the note may not be enforceable.

- Keep Copies: Both parties should retain a signed copy of the promissory note for their records. This can prevent disputes in the future.

Using the Georgia Promissory Note form properly can help establish clear expectations and protect the interests of both the lender and borrower.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms under which a borrower agrees to repay a lender. It includes details such as the loan amount, interest rate, and repayment schedule.

- Mortgage: A mortgage serves as a security instrument for a loan used to purchase real estate. It includes a promise to repay the loan, similar to a promissory note, but also grants the lender a claim on the property if the borrower defaults.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower fails to do so. This document shares the same essence of obligation as a promissory note.

- Statement of Fact Texas Form: This form is crucial in Texas vehicle transactions as it provides official details about the vehicle and the transaction, similar to the formalities found in a Promissory Note. For more information, visit txtemplate.com/statement-of-fact-texas-pdf-template.

- Installment Agreement: This document outlines the terms for paying off a debt in installments. It specifies payment amounts and due dates, similar to how a promissory note details repayment terms.

- Credit Agreement: A credit agreement establishes the terms of a credit relationship between a lender and a borrower. It includes obligations and repayment terms, akin to a promissory note.

- Repayment Plan: A repayment plan details how a borrower will pay back a debt over time. It mirrors a promissory note in its focus on repayment terms and schedules.

- Debt Settlement Agreement: This document outlines the terms under which a borrower agrees to settle a debt for less than the full amount owed. It includes payment terms, similar to a promissory note.

- Security Agreement: A security agreement provides collateral for a loan. While it may not include a repayment promise, it serves to secure the obligations outlined in a promissory note.

- Forbearance Agreement: This agreement allows a borrower to temporarily pause or reduce payments on a loan. It often includes terms for repayment, similar to a promissory note.

- Lease Agreement: A lease agreement outlines the terms under which a tenant rents property from a landlord. While it primarily pertains to rental terms, it includes financial obligations akin to those in a promissory note.

Misconceptions

When dealing with financial agreements, misunderstandings can lead to complications. The Georgia Promissory Note form is no exception. Here are seven common misconceptions about this important document:

- All Promissory Notes Are the Same: Many believe that a promissory note is a one-size-fits-all document. In reality, each note can be tailored to fit specific agreements and terms.

- A Promissory Note Is Only for Large Loans: Some people think that promissory notes are only necessary for substantial amounts of money. However, they can be used for any loan amount, no matter how small.

- Verbal Agreements Are Enough: There is a misconception that verbal agreements are sufficient. Written promissory notes provide clear evidence of the loan terms and protect both parties involved.

- Once Signed, a Promissory Note Cannot Be Changed: Many assume that once a promissory note is signed, it cannot be altered. In fact, amendments can be made if both parties agree to the changes in writing.

- Promissory Notes Are Only for Personal Loans: Some people think these notes are exclusive to personal loans. In truth, they are commonly used in business transactions as well.

- Interest Rates Are Mandatory: There is a belief that all promissory notes must include interest rates. While many do, it is not a requirement; a note can be created as an interest-free loan.

- Promissory Notes Are Only Legally Binding in Georgia: Some may think that the Georgia Promissory Note is only valid within the state. However, as long as it meets legal requirements, it can be enforceable in other jurisdictions too.

Understanding these misconceptions can help individuals navigate the complexities of financial agreements with greater confidence. Clarity is essential when it comes to protecting your interests and ensuring that all parties are on the same page.

Fill out Popular Promissory Note Forms for Specific States

Promissory Note California - It details the terms of a loan, including interest rates and repayment schedules.

The Florida Board Nursing Application form is a crucial document for individuals seeking to obtain a nursing license in Florida. It serves as the official request for licensure by examination, ensuring that applicants meet the necessary educational and professional standards. Understanding this form is essential for a smooth application process and successful entry into the nursing profession. For more information and resources, you can visit allfloridaforms.com.

Loan Agreement Template Florida - A clear Promissory Note can help maintain healthy personal or business relationships.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time. |

| Governing Law | The Georgia Promissory Note is governed by the Uniform Commercial Code (UCC) as adopted in Georgia. |

| Parties Involved | The note typically involves two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable. |

| Payment Terms | Payment terms should be clearly outlined, including due dates and payment frequency. |

| Default Clauses | Many notes include clauses that define what constitutes a default and the consequences of defaulting. |

| Signatures | The note must be signed by the maker to be legally binding. |

| Transferability | Promissory notes can often be transferred to other parties, making them negotiable instruments. |

| Legal Enforcement | If the borrower fails to pay, the lender can take legal action to enforce the terms of the note. |

| Document Format | The Georgia Promissory Note can be created in various formats, including printed forms or electronic documents. |

Documents used along the form

In the realm of lending and borrowing, various documents accompany a Georgia Promissory Note. Each of these forms serves a specific purpose, ensuring that the transaction is clear, legally binding, and protects the interests of all parties involved. Understanding these documents is crucial for both lenders and borrowers.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It acts as a comprehensive contract between the lender and borrower.

- Power of Attorney: This essential document allows one person to designate another with the authority to make legal decisions on their behalf, particularly useful in scenarios involving incapacity. For further information on how to complete this form, visit Florida PDF Forms.

- Security Agreement: If the loan is secured by collateral, a security agreement details the specific assets pledged as security for the loan. This protects the lender's interests should the borrower default.

- Disclosure Statement: This document provides borrowers with important information about the loan, such as the total cost, interest rates, and any fees associated with the transaction. It promotes transparency and informed decision-making.

- Guarantee Agreement: In cases where a third party guarantees the loan, this agreement stipulates the guarantor's obligations. It adds an extra layer of security for the lender, ensuring repayment even if the borrower defaults.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular payments over time. It shows how much of each payment goes toward interest and principal, helping borrowers understand their financial commitments.

- Default Notice: Should the borrower fail to meet their obligations, a default notice is issued. This document formally informs the borrower of their default status and outlines the lender's rights and potential actions.

- Release of Liability: Upon full repayment of the loan, this document releases the borrower from any further obligations. It serves as proof that the loan has been satisfied and protects the borrower from future claims related to that debt.

Each of these documents plays a vital role in the lending process. Familiarity with them can significantly impact the success of a loan transaction, ensuring that both parties are well-informed and protected. It is essential to approach these agreements with care and consideration.