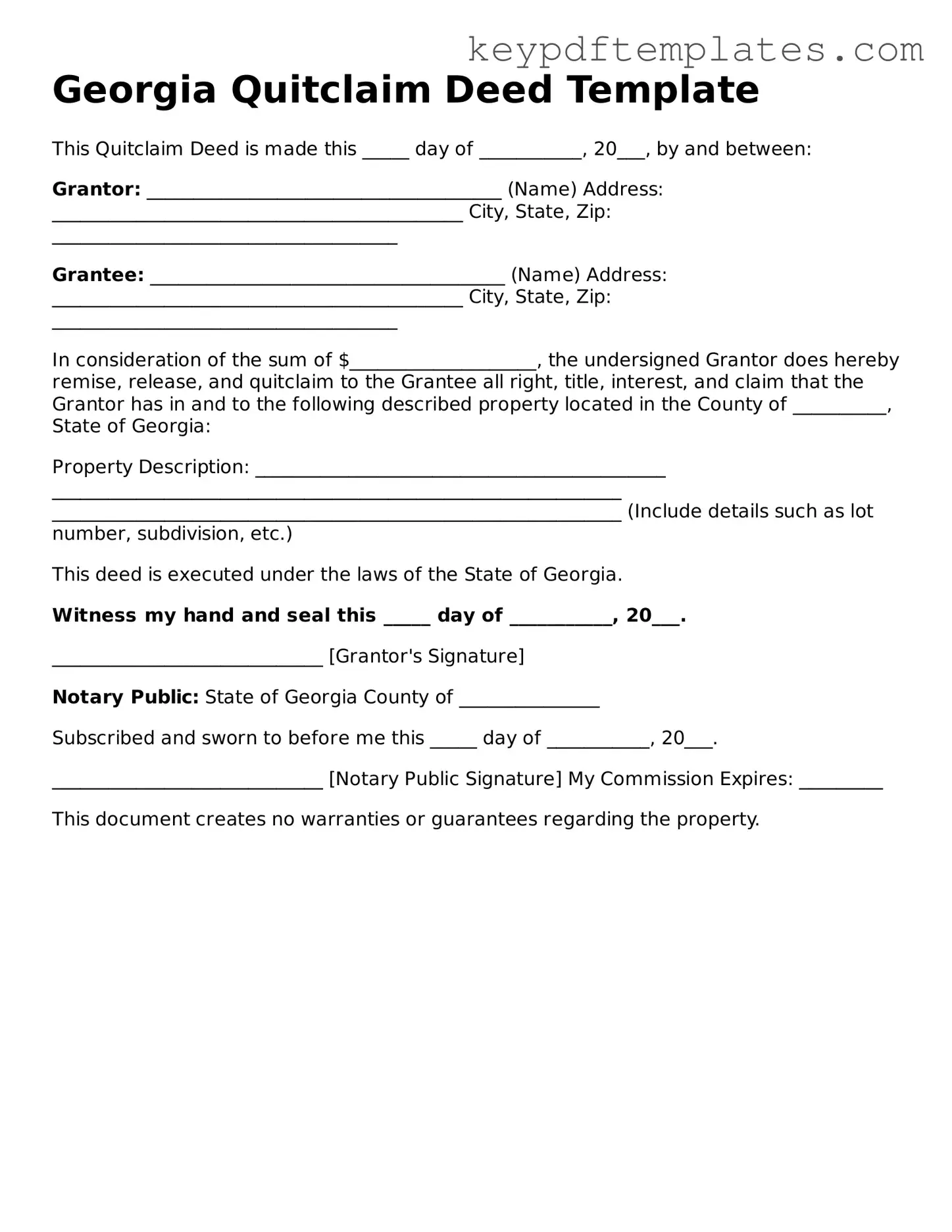

Legal Quitclaim Deed Document for the State of Georgia

Key takeaways

When filling out and using the Georgia Quitclaim Deed form, keep these key takeaways in mind:

- Understand the Purpose: A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. It is often used between family members or in divorce settlements.

- Gather Necessary Information: Collect details about the property, including the legal description, the names of the grantor (seller) and grantee (buyer), and the property address.

- Use Clear Language: Ensure that all names and descriptions are accurate and clearly stated to avoid confusion or disputes later on.

- Signatures Required: The deed must be signed by the grantor. If there are multiple grantors, all must sign the document.

- Notarization: A Quitclaim Deed must be notarized to be legally valid. This step adds an extra layer of authenticity to the document.

- Filing the Deed: After completion, the Quitclaim Deed should be filed with the county clerk's office where the property is located. This makes the transfer official.

- Consider Tax Implications: Transferring property can have tax consequences. Consult a tax professional to understand any potential liabilities.

- Use Caution with Title Issues: Since a Quitclaim Deed does not guarantee a clear title, ensure that the property is free from liens or other encumbrances before proceeding.

- Seek Legal Advice: If unsure about any aspect of the process, consider consulting with a real estate attorney to ensure compliance with Georgia laws.

Similar forms

- Warranty Deed: This document transfers ownership of property and guarantees that the seller holds clear title to the property. Unlike a quitclaim deed, a warranty deed provides a promise that no other claims against the property exist, offering more protection to the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed conveys property ownership. However, it typically includes assurances that the property has not been sold to anyone else and that there are no undisclosed encumbrances, providing a moderate level of protection.

- Deed of Trust: This document secures a loan by placing a lien on the property. While it does not transfer ownership like a quitclaim deed, it involves the property in a financial transaction, ensuring that the lender has a claim to the property if the borrower defaults.

- Notice to Quit Form: To initiate the eviction process, landlords must utilize the Texas Notice to Quit document for proper notification to tenants regarding their lease violations.

- Bill of Sale: Although primarily used for personal property, a bill of sale transfers ownership from one party to another. It is similar in that it documents a change in ownership but does not involve real estate and does not provide any guarantees about the property’s title.

- Affidavit of Title: This document is a sworn statement confirming the seller’s ownership of the property and that there are no undisclosed claims against it. While it does not transfer property, it complements a quitclaim deed by providing assurances about the seller’s title.

Misconceptions

Understanding the Georgia Quitclaim Deed form is crucial for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are five common misconceptions:

- A Quitclaim Deed transfers ownership. Many believe that a Quitclaim Deed guarantees a transfer of ownership. In reality, it only conveys whatever interest the grantor has in the property, if any. There are no warranties about the title.

- Quitclaim Deeds are only for family members. While often used among family members, Quitclaim Deeds can be utilized by anyone. They are common in various situations, including divorce settlements or transferring property to a trust.

- A Quitclaim Deed is the same as a Warranty Deed. This is a major misconception. A Warranty Deed provides guarantees about the title, ensuring the buyer is protected against claims. A Quitclaim Deed offers no such protections.

- Quitclaim Deeds are only valid if notarized. While notarization is essential for the deed to be legally binding, it must also be recorded with the county. Without recording, the deed may not be enforceable against third parties.

- You cannot use a Quitclaim Deed for property sales. Many think Quitclaim Deeds are unsuitable for sales. However, they can be used in sales transactions, especially when the buyer is aware of the title's condition and accepts the risks involved.

Addressing these misconceptions can help ensure a smoother transaction process. Always consider seeking professional advice when dealing with real estate documents.

Fill out Popular Quitclaim Deed Forms for Specific States

Quit Claim Deed Blank Form - Understanding the implications of a Quitclaim Deed can help prevent future disagreements.

Understanding the nuances of a Release of Liability form can be vital for participants in various activities. Those seeking to mitigate risks often refer to this important document, commonly outlined in guides, such as our "key considerations for your Release of Liability." Explore the details at key considerations for your Release of Liability.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties. |

| Governing Law | The quitclaim deed in Georgia is governed by Title 44, Chapter 5 of the Official Code of Georgia Annotated. |

| Parties Involved | The form involves two parties: the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| No Warranties | Unlike other types of deeds, a quitclaim deed offers no guarantees about the property’s title. |

| Use Cases | Commonly used for transferring property between family members or in divorce settlements. |

| Filing Requirements | The completed quitclaim deed must be filed with the county clerk’s office where the property is located. |

| Notarization | The signature of the grantor must be notarized to validate the quitclaim deed. |

| Consideration | While consideration is often required, it can be as little as a nominal amount, such as $1. |

| Impact on Title | Once executed, the quitclaim deed transfers whatever interest the grantor has in the property, if any. |

Documents used along the form

When transferring property ownership in Georgia, a Quitclaim Deed is a vital document. However, it often accompanies other forms and documents to ensure a smooth transaction and to meet legal requirements. Here’s a list of some commonly used forms that may be needed alongside the Quitclaim Deed.

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, it provides a warranty against any future claims on the property.

- Property Transfer Tax Exemption Form: In Georgia, this form may be required to claim an exemption from transfer taxes when transferring property. It provides essential information to the tax authorities.

- Affidavit of Title: This sworn statement assures the buyer that the seller has the legal right to transfer the property and that there are no undisclosed liens or claims against it.

- Title Insurance Policy: Although not a form per se, obtaining title insurance is a common practice. It protects the buyer from any future disputes regarding property ownership and any issues that may arise from past ownership.

- Closing Statement: This document outlines all financial aspects of the property transaction, including the purchase price, closing costs, and any adjustments made at closing.

- Real Estate Purchase Agreement: This contract details the terms of the sale, including the price, financing arrangements, and any contingencies. It serves as the foundation for the transaction.

- Power of Attorney: If the seller cannot be present at the closing, a Power of Attorney allows another person to sign documents on their behalf, ensuring the transaction can proceed smoothly.

- Georgia WC-14 Form: To properly notify the Georgia State Board of Workers' Compensation about a workplace injury claim, you'll need to complete the Georgia PDF form accurately. This step can significantly impact the efficiency of your claim processing.

- Notice of Intent to Vacate: If the property being transferred is currently rented, this notice informs tenants of the change in ownership and any necessary actions they must take.

Each of these documents plays a crucial role in the property transfer process in Georgia. Understanding their purpose can help ensure that all legal requirements are met, protecting the interests of both buyers and sellers. Proper documentation not only facilitates a smooth transaction but also provides peace of mind for all parties involved.