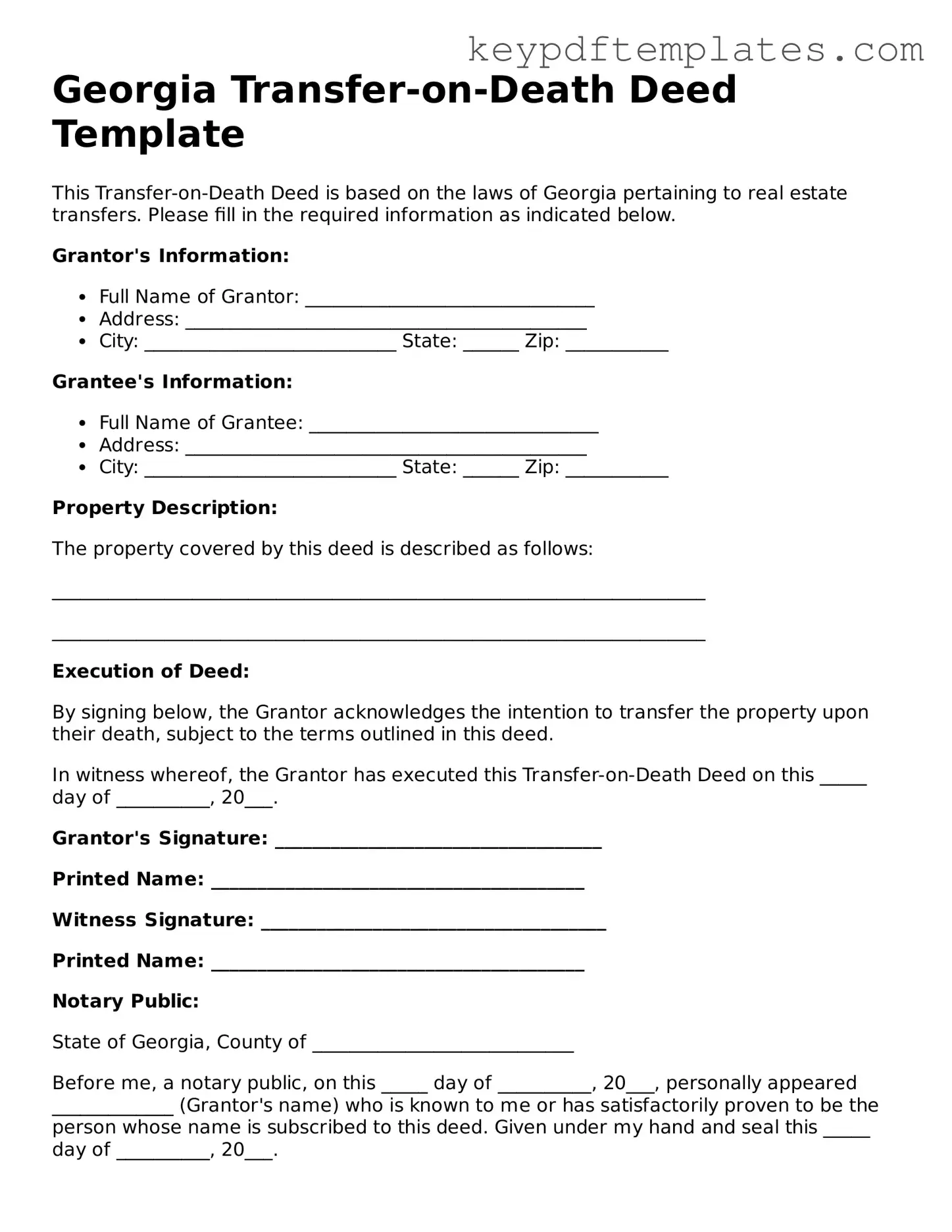

Legal Transfer-on-Death Deed Document for the State of Georgia

Key takeaways

Here are key takeaways about filling out and using the Georgia Transfer-on-Death Deed form:

- The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death.

- To be valid, the deed must be signed by the property owner in the presence of a notary public.

- Ensure that the beneficiaries are clearly identified by full name and relationship to the owner.

- The deed must be recorded with the county clerk's office where the property is located.

- Filing the deed incurs a recording fee, which varies by county.

- It is essential to complete the form accurately to avoid any potential disputes later.

- The property owner retains full control of the property during their lifetime.

- Beneficiaries do not have any rights to the property until the owner's death.

- The deed can be revoked or changed by the owner at any time before their death.

- Consulting with a legal professional can provide clarity and ensure compliance with state laws.

Similar forms

- Last Will and Testament: Both documents allow individuals to specify how their assets will be distributed after their death. However, a will goes through probate, while a Transfer-on-Death Deed does not.

- Living Trust: Similar to a Transfer-on-Death Deed, a living trust enables the transfer of assets without going through probate. However, a living trust is more complex and requires ongoing management.

- Beneficiary Designation Forms: These forms, often used for financial accounts and insurance policies, allow individuals to name beneficiaries who will receive assets upon their death, similar to how a Transfer-on-Death Deed designates heirs for real estate.

- Payable-on-Death (POD) Accounts: Like a Transfer-on-Death Deed, POD accounts allow for the direct transfer of funds to a designated beneficiary upon the account holder's death, bypassing probate.

- Joint Tenancy with Right of Survivorship: This arrangement allows co-owners to automatically inherit the property when one owner passes away, similar to how a Transfer-on-Death Deed functions for real estate.

- Durable Power of Attorney: This legal document, such as a form available at Georgia PDF, allows you to designate someone to make financial and legal decisions on your behalf if you become unable to do so, ensuring your wishes are respected even in times of incapacitation.

- Life Estate Deed: A life estate deed allows a property owner to live in the property for their lifetime while designating a beneficiary to receive the property after their death, akin to the Transfer-on-Death Deed's purpose.

Misconceptions

Many people have misunderstandings about the Georgia Transfer-on-Death Deed form. Here are some common misconceptions:

- It automatically avoids probate. While the Transfer-on-Death Deed allows property to pass outside of probate, it must be properly executed and recorded to be effective.

- It can be used for any type of property. This deed is primarily for real estate. Personal property and other assets are not covered by this type of deed.

- Only one beneficiary can be named. You can name multiple beneficiaries on a Transfer-on-Death Deed, allowing for flexibility in how the property is distributed.

- It revokes existing wills. A Transfer-on-Death Deed does not revoke a will. It simply provides an alternative method for transferring property upon death.

- It is effective immediately upon signing. The deed must be recorded with the county to be legally binding. Until that happens, it does not take effect.

- It cannot be changed once created. You can revoke or change the Transfer-on-Death Deed at any time before your death, as long as you follow the proper procedures.

Understanding these points can help ensure that you use the Transfer-on-Death Deed effectively and in accordance with your wishes.

Fill out Popular Transfer-on-Death Deed Forms for Specific States

Transfer on Death Deed Florida Form - This deed is only applicable to real estate, not to personal property or bank accounts.

The Texas form, a crucial document required for various legal and administrative processes within the state, serves as an official means to submit necessary information. This document is vital for residents engaging in activities ranging from business registration to personal legal matters. For a seamless experience, ensure you have all the relevant details ready before you start. You can find a helpful resource to assist you at txtemplate.com/texas-pdf-template. Click the button below to begin filling out your form.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners in Georgia to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD Deed in Georgia is governed by O.C.G.A. § 44-6-31, which outlines the requirements and procedures for creating and executing the deed. |

| Eligibility | Any individual who owns real estate in Georgia can create a TOD Deed, provided they are of sound mind and at least 18 years old. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property. This designation can be changed or revoked at any time during the owner's lifetime. |

| Execution Requirements | The TOD Deed must be signed by the property owner in the presence of a notary public and recorded in the county where the property is located to be valid. |

| Tax Implications | While the property is still owned by the original owner, it remains part of their estate for tax purposes. However, the transfer to the beneficiary may have tax implications upon the owner's death. |

Documents used along the form

When preparing a Transfer-on-Death Deed in Georgia, several other forms and documents may be necessary to ensure a smooth transfer of property and to address related legal matters. Each of these documents serves a specific purpose in the estate planning process. Below is a list of commonly used forms that may accompany the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how an individual wishes their assets to be distributed upon their death. It can complement the Transfer-on-Death Deed by providing additional instructions regarding other assets.

- Durable Power of Attorney: This form allows an individual to appoint someone else to make financial or legal decisions on their behalf if they become incapacitated. It is essential for managing affairs during one's lifetime.

- Living Will: A Living Will expresses an individual's wishes regarding medical treatment in situations where they cannot communicate their preferences. This document is crucial for healthcare decisions and complements estate planning.

- Health Care Power of Attorney: Similar to the Durable Power of Attorney, this document designates someone to make healthcare decisions on behalf of the individual if they are unable to do so themselves.

- California Vehicle Purchase Agreement: To facilitate a smooth vehicle transaction, it's essential to download and fill out the form that outlines the terms and conditions between buyers and sellers in California.

- Affidavit of Heirship: This form is used to establish the heirs of a deceased person, particularly when there is no will. It can help clarify property ownership and facilitate the transfer of assets.

- Property Deed: This document serves as the official record of property ownership. It is important to ensure that the property is correctly titled in the name of the new owner after the transfer.

- Notice of Transfer: In some cases, a notice may be required to inform interested parties of the transfer of property via a Transfer-on-Death Deed. This can help prevent disputes among heirs.

- Tax Forms: Depending on the value of the property and the estate, certain tax forms may need to be filed. These documents ensure compliance with state and federal tax laws related to inheritance and property transfer.

Understanding these documents and their purposes can help individuals navigate the complexities of property transfer and estate planning. Each form plays a vital role in ensuring that one’s wishes are honored and that the transfer of assets occurs smoothly and legally.