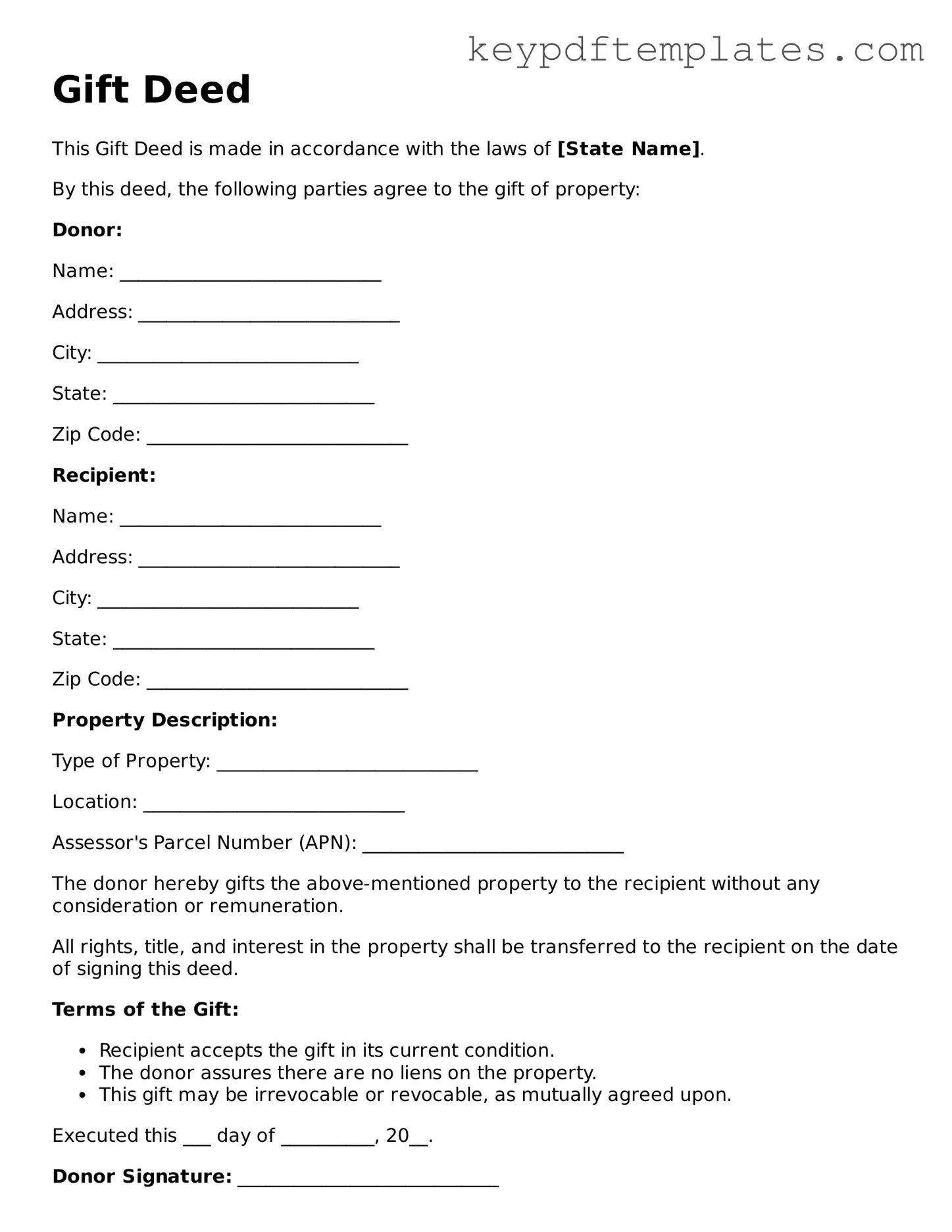

Printable Gift Deed Template

Gift Deed - Tailored for State

Key takeaways

When it comes to transferring property or assets as a gift, understanding the Gift Deed form is crucial. Here are five key takeaways that can help simplify the process:

-

Ensure all parties are clearly identified. The grantor (the person giving the gift) and the grantee (the person receiving the gift) must be accurately named in the deed. This clarity helps prevent any future disputes regarding ownership.

-

Include a detailed description of the gift. Whether it's real estate, cash, or personal property, providing a clear and specific description is essential. This helps define exactly what is being transferred and avoids confusion later.

-

Consider the tax implications. While gifts may not incur taxes at the time of transfer, understanding the potential for gift taxes or implications for the grantee is important. Consulting a tax professional can provide valuable insights.

-

Signatures are vital. The Gift Deed must be signed by the grantor, and it’s advisable for the grantee to sign as well. Depending on state laws, having the deed notarized may also be necessary to ensure its validity.

-

File the deed appropriately. After completing the Gift Deed, it should be filed with the relevant local government office, such as the county recorder’s office. This step is crucial for public record and protects the rights of the grantee.

Similar forms

- Will: A will specifies how a person's assets will be distributed after their death. Like a gift deed, it involves the transfer of property, but a will takes effect only after death, while a gift deed is effective immediately.

- Trust Deed: A trust deed creates a legal arrangement where one party holds property for the benefit of another. Both documents involve transferring property, but a trust deed often has ongoing management and conditions, while a gift deed is a straightforward transfer.

- Sale Deed: A sale deed transfers ownership of property in exchange for payment. Both documents serve to transfer property, but a sale deed involves a financial transaction, while a gift deed does not require payment.

- Quitclaim Deed: A quitclaim deed transfers any interest the grantor has in a property without guaranteeing that the title is clear. Similar to a gift deed, it can be used to transfer property without a sale, but it offers less protection to the recipient.

- Deed of Gift: A deed of gift is essentially another name for a gift deed. Both documents serve the same purpose of transferring property as a gift, but the terminology may vary based on local laws.

- For couples looking to tie the knot, understanding the Florida Marriage Application process is vital. Start by checking the details at https://allfloridaforms.com.

- Property Transfer Agreement: This document outlines the terms for transferring property ownership. While both documents facilitate property transfer, a property transfer agreement may include terms and conditions, whereas a gift deed is typically more straightforward.

Misconceptions

When it comes to the Gift Deed form, several misconceptions can lead to confusion. Understanding these misconceptions is essential for anyone considering this legal document.

- Gift Deeds are only for family members. Many believe that a Gift Deed can only be used to transfer property between family members. In reality, anyone can gift property to another person, regardless of their relationship.

- A Gift Deed is the same as a Will. Some people think that a Gift Deed functions like a Will, transferring property upon death. However, a Gift Deed transfers ownership immediately, while a Will only takes effect after the individual's passing.

- Gift Deeds do not require witnesses. There is a common belief that a Gift Deed can be executed without witnesses. In most cases, having witnesses is crucial for the document's validity, ensuring that the transfer is legally recognized.

- There are no tax implications for Gift Deeds. Many assume that gifting property is entirely tax-free. In truth, there may be tax consequences for both the giver and the recipient, depending on the value of the gift and local laws.

By addressing these misconceptions, individuals can make more informed decisions regarding the use of Gift Deeds.

Other Gift Deed Types:

What Is a Deed in Lieu - Both the borrower and lender must agree on the terms before finalizing the deed transfer.

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees about the property’s title. This form is often used in situations like transferring property between family members or clearing up title issues. If you're ready to complete your transfer, click the button below to fill out the form, or visit Florida PDF Forms for more information.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer property or assets from one person to another without any exchange of money. |

| Requirements | In many states, a Gift Deed must be in writing, signed by the donor, and may need to be notarized. |

| State-Specific Laws | In California, for example, the Gift Deed is governed by the California Civil Code Section 1146. |

| Tax Implications | Gift Deeds may have tax implications for both the giver and the recipient, depending on the value of the gift and federal gift tax laws. |

Documents used along the form

When engaging in the process of gifting property, several important documents accompany the Gift Deed form to ensure a smooth and legally sound transaction. Understanding these documents can help streamline the process and protect all parties involved.

- Title Deed: This document proves ownership of the property being gifted. It provides essential information about the property, including its legal description and any existing liens.

- Affidavit of Gift: This sworn statement confirms the intent to gift the property without any expectation of payment. It serves as a legal declaration that the transfer is a true gift.

- Gift Tax Return (Form 709): Depending on the value of the gift, the donor may need to file this tax form with the IRS. It reports the value of the gift and ensures compliance with tax laws.

- Property Appraisal: An appraisal provides an official valuation of the property. This can be crucial for tax purposes and to establish the fair market value of the gift.

- Identification Documents: Both the donor and the recipient should provide valid identification. This helps verify their identities and ensures that the transaction is legitimate.

- Power of Attorney (if applicable): If the donor cannot be present to sign the Gift Deed, a Power of Attorney document may allow another person to act on their behalf.

- Notice of Gift: This document notifies relevant parties, such as homeowners' associations or local governments, about the change in ownership due to the gift.

- Texas Certificate of Insurance: This document is crucial for Master Plumbers in Texas, as it serves as proof of the minimum required insurance coverage to comply with regulations. For more information, visit txtemplate.com/texas-certificate-insurance-pdf-template.

- Transfer Tax Declaration: Some jurisdictions require this declaration to report the transfer of property. It helps assess any applicable transfer taxes that may need to be paid.

- Settlement Statement: If the gift involves any financial considerations, this statement outlines the details of the transaction, including any costs or fees associated with the transfer.

Each of these documents plays a vital role in the gifting process, ensuring clarity and legal compliance. By preparing these forms in advance, both the donor and the recipient can navigate the transfer smoothly and with confidence.