Get Gift Letter Form

Key takeaways

When filling out and using a Gift Letter form, it is essential to understand several key aspects to ensure compliance and clarity. Below are important takeaways that can guide individuals through this process.

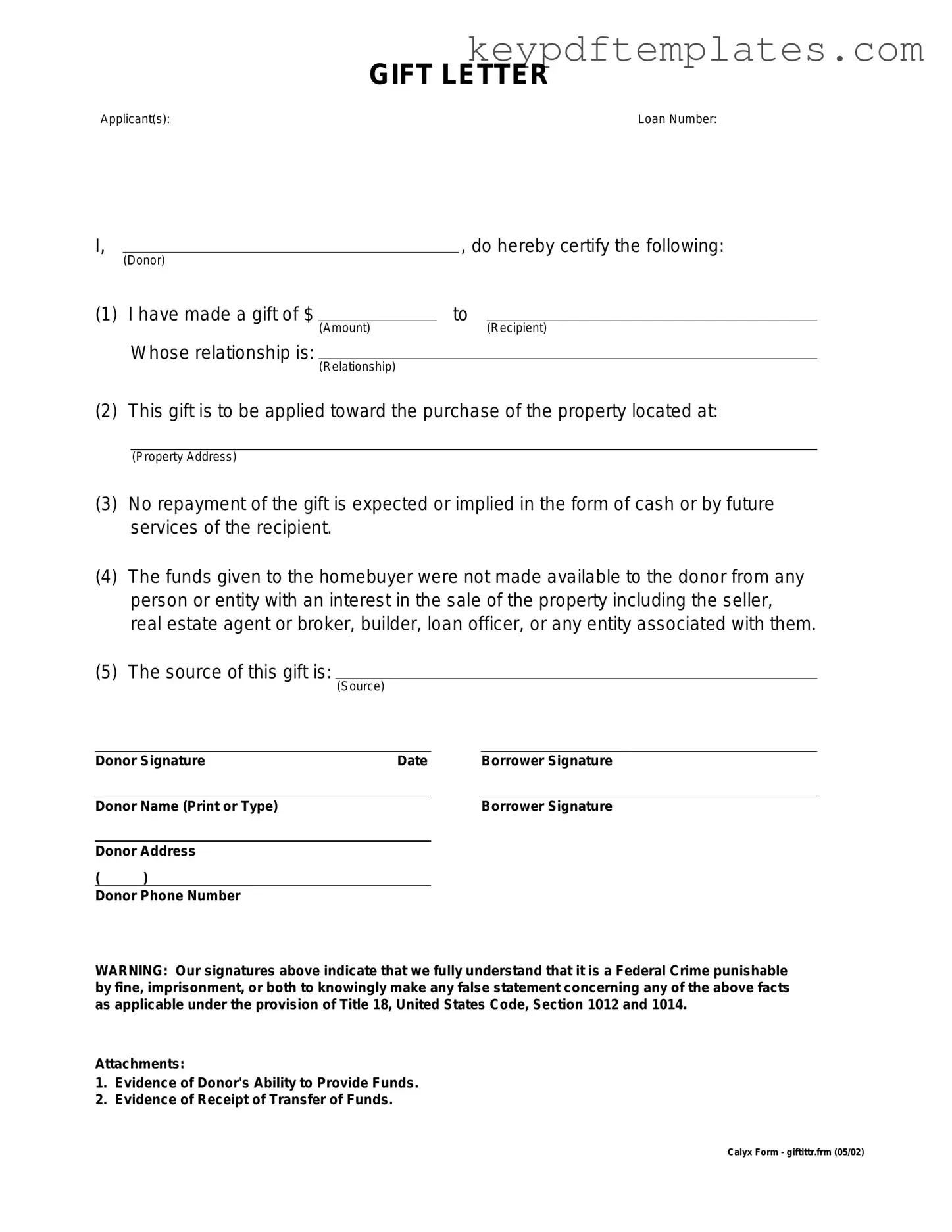

- Purpose of the Gift Letter: The Gift Letter serves as a formal declaration that funds given as a gift do not need to be repaid. This is particularly important in financial transactions, such as mortgage applications, where lenders require proof that the funds are indeed a gift.

- Required Information: When completing the form, it is crucial to include specific details. This typically includes the donor's name, address, and relationship to the recipient, as well as the amount of the gift and the purpose for which it is intended.

- Signature Requirement: Both the donor and the recipient should sign the Gift Letter. This adds an extra layer of authenticity and ensures that both parties acknowledge the terms of the gift.

- Documentation: It is advisable to keep a copy of the Gift Letter for personal records. Additionally, providing bank statements or other evidence of the transfer can further substantiate the gift if required by lenders or financial institutions.

Similar forms

-

Affidavit of Support: This document is often used in immigration cases to demonstrate that a sponsor can financially support an immigrant. Like the Gift Letter, it requires proof of funds and a commitment to provide financial assistance.

-

Loan Agreement: A Loan Agreement outlines the terms of a loan between parties. Similar to a Gift Letter, it details the amount of money involved, but it also includes repayment terms, which are not present in a Gift Letter.

-

Promissory Note: This document is a promise to pay back a specific amount of money. While it shares the financial aspect with the Gift Letter, it obligates the recipient to repay the funds, contrasting with the unconditional nature of a gift.

-

Financial Statement: A Financial Statement provides an overview of an individual's financial status. It can support a Gift Letter by showing the donor's ability to give, but it does not serve as a formal declaration of a gift.

- Release of Liability Form: To protect against unforeseen incidents, utilize the essential document for Release of Liability to ensure all parties are informed of risks involved.

-

Statement of Gift: This document is similar in that it formally declares a gift has been made. However, it often includes tax implications and requirements, which are typically not addressed in a standard Gift Letter.

Misconceptions

When it comes to the Gift Letter form, many people have misunderstandings that can lead to confusion. Here are five common misconceptions:

- Gift letters are only for large sums of money. Many believe that gift letters are only necessary for substantial financial gifts. In reality, any amount that is given as a gift, especially when used for a home purchase, may require a gift letter to clarify the nature of the funds.

- Gift letters are only needed for first-time homebuyers. Some think that only first-time homebuyers need to provide a gift letter. However, anyone receiving a monetary gift for a home purchase, regardless of their buying history, may need to submit this form.

- Gift letters must be notarized. A common myth is that gift letters must be notarized to be valid. While notarization can add an extra layer of authenticity, it is not a strict requirement for most lenders.

- Only family members can provide gifts. Many assume that only immediate family members can give monetary gifts for home purchases. In fact, friends, relatives, and even employers can provide gifts, as long as the source of the funds is clearly documented.

- Gift letters are a one-size-fits-all document. Some people think that there is a standard gift letter that everyone can use. While there are templates available, it’s important to customize the letter to fit the specific situation and requirements of the lender.

Understanding these misconceptions can help you navigate the process of using a Gift Letter more effectively. Always check with your lender for their specific requirements to ensure a smooth transaction.

More PDF Templates

Offer and Acceptance Form Wa Pdf - The application should be completed accurately and truthfully.

In order to facilitate the communication process in workers' compensation cases, it is crucial for attorneys and other representatives to utilize the Georgia WC 102B form, which not only serves as a formal notice of representation but can also be conveniently accessed at Georgia PDF.

Free Printable Shower Sheets for Cna - Effective communication tool between CNAs and nursing leadership.

Fake Restraining Order Template - Lack of compliance with this order can lead to serious legal ramifications, including imprisonment.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose of a Gift Letter | A gift letter is a document used to confirm that funds given to a recipient are a gift and not a loan. This distinction is crucial for mortgage applications. |

| Common Use | Gift letters are often used in real estate transactions, particularly when a buyer receives financial assistance from family or friends for a down payment. |

| Required Information | Typically, a gift letter includes the donor's name, the recipient's name, the amount of the gift, and a statement that the funds do not need to be repaid. |

| State-Specific Forms | Some states may have specific requirements for gift letters. For example, in California, the letter may need to comply with state gift tax laws. |

| Donor's Relationship | The letter often specifies the relationship between the donor and the recipient, which can help lenders assess the legitimacy of the gift. |

| Documentation Requirements | Lenders may require additional documentation, such as bank statements from the donor, to verify the source of the funds. |

| Impact on Loan Approval | Providing a gift letter can positively impact a buyer’s loan approval process by demonstrating financial support and stability. |

Documents used along the form

When applying for a mortgage or making a significant purchase, a Gift Letter is often required to document financial support from family or friends. However, several other forms and documents may accompany the Gift Letter to ensure a smooth transaction. Below is a list of commonly used documents that can enhance the clarity and legitimacy of the financial support being provided.

- Loan Application Form: This form collects personal and financial information from the borrower, including income, debts, and assets, which lenders use to assess creditworthiness.

- Bank Statements: Recent bank statements provide proof of the donor's ability to give the gift. They show the source of the funds and confirm that the money is available for the recipient.

- Gift Tax Return (Form 709): If the gift exceeds a certain threshold, the donor may need to file this form with the IRS to report the gift and ensure compliance with tax regulations.

- Proof of Relationship: Documents such as birth certificates or marriage licenses may be required to establish the relationship between the donor and the recipient, confirming the legitimacy of the gift.

- Settlement Statement: This document outlines the final costs associated with the purchase of a home. It helps to show how the gift funds will be applied in the transaction.

- Motorcycle Bill of Sale Form: For those buying or selling a motorcycle, the thorough motorcycle bill of sale process ensures all details are legally documented and ownership is clearly transferred.

- Income Verification: Pay stubs or tax returns may be requested to verify the recipient's income, ensuring they can manage mortgage payments alongside the gifted funds.

- Identification Documents: Copies of government-issued IDs for both the donor and recipient may be needed to confirm identities and prevent fraud.

- Affidavit of Support: This document may be used to declare that the donor is providing financial support without expecting repayment, further solidifying the nature of the gift.

- Credit Report: Lenders often review the recipient's credit report to assess their credit history and determine eligibility for a loan, which may be influenced by the gift.

- Purchase Agreement: This contract outlines the terms of the property sale, including price and contingencies, and is essential for understanding how the gift fits into the overall transaction.

Incorporating these documents alongside the Gift Letter can significantly streamline the mortgage process. Each piece plays a vital role in confirming the legitimacy of the gift and ensuring that all parties involved are protected and informed throughout the transaction.