Get Goodwill donation receipt Form

Key takeaways

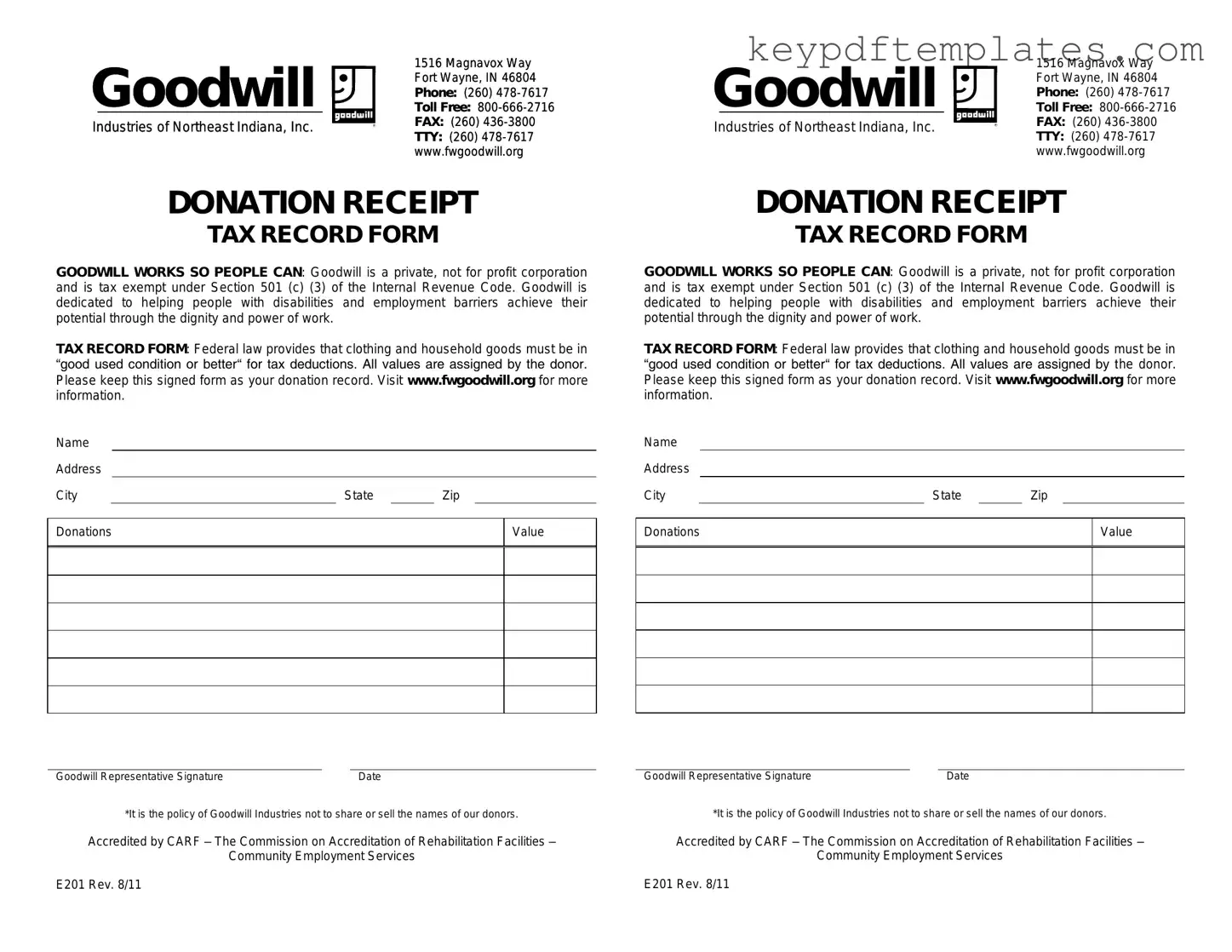

When donating to Goodwill, filling out the donation receipt form correctly is essential for both you and the organization. Here are some key takeaways to consider:

- Keep a copy for your records: Always retain a copy of the receipt for your personal records. This is important for tax purposes and tracking your charitable contributions.

- Accurate item description: Clearly describe each item you donate. This helps in determining the fair market value and can be beneficial for tax deductions.

- Estimate fair market value: Assign a reasonable value to your items. Use resources like thrift store pricing or online valuation guides to help you.

- Understand tax implications: Donations to Goodwill are generally tax-deductible. Familiarize yourself with the IRS guidelines to maximize your benefits.

- Sign and date the receipt: Ensure you sign and date the receipt. This confirms your donation and is necessary for tax documentation.

- Check for additional requirements: Some states may have specific requirements for donation receipts. Verify these to ensure compliance.

- Keep it organized: Store your donation receipts in a designated folder. This will make it easier to access them during tax season.

- Consult a tax professional: If you have questions about your donations and their impact on your taxes, consider seeking advice from a tax professional.

By following these guidelines, you can ensure that your donations are not only beneficial to Goodwill but also to your financial well-being.

Similar forms

Charitable Donation Receipt: Similar to the Goodwill donation receipt, this document serves as proof of a donation made to a registered charity. It typically includes the donor's name, the charity's name, the date of the donation, and a description of the items donated.

Tax Deduction Receipt: This receipt is provided to donors to substantiate their claims for tax deductions. Like the Goodwill receipt, it includes details such as the value of the donation and the date it was made, helping donors during tax filing.

- Residential Lease Agreement: To ensure all terms are clear and enforceable between landlords and tenants, it is essential to utilize the Florida PDF Forms designed for this purpose in Florida.

Nonprofit Acknowledgment Letter: This letter is issued by nonprofits to acknowledge contributions. It often mirrors the Goodwill receipt in that it confirms the donation and may include a statement regarding the donor's lack of goods or services received in return.

Itemized Donation List: This document lists all items donated, similar to the Goodwill receipt. While it may not serve as an official receipt, it provides a detailed account of what was given, which can be useful for record-keeping and tax purposes.

Misconceptions

When it comes to donating items to Goodwill, many people have misconceptions about the donation receipt form. Understanding the truth behind these myths can help ensure that donors have a smooth experience and can maximize their tax benefits. Here are six common misconceptions:

-

All donations are tax-deductible.

While many donations are indeed tax-deductible, it’s important to note that the value of the items must be substantiated. Donors should keep detailed records and understand the IRS guidelines to ensure their donations qualify.

-

The receipt must list the value of donated items.

The Goodwill receipt form typically does not include a value for the donated items. Donors are responsible for determining the fair market value of their contributions. This can be done by researching similar items online or using valuation guides.

-

Goodwill will provide a specific valuation for my items.

Goodwill does not assign values to donated items on the receipt. This is to maintain neutrality and avoid any potential conflict of interest. Donors should assess the value themselves.

-

I can claim the full retail value of my items on my taxes.

Donors cannot claim the retail value of their items. The IRS requires that only the fair market value, which is typically lower than retail, be claimed. This means that the value should reflect what someone would pay for the item at a thrift store.

-

I need to provide a detailed list of items on the receipt.

While it can be helpful to keep a detailed list for your own records, the Goodwill receipt does not require itemization. It is sufficient to note the general categories of items donated.

-

Donating to Goodwill is the only way to get a tax deduction.

While Goodwill is a popular option, there are many other charitable organizations that also accept donations and provide tax deductions. Donors should consider their options and choose organizations that align with their values.

By clearing up these misconceptions, donors can feel more confident in their contributions and understand how to properly document their charitable giving for tax purposes.

More PDF Templates

Convalescent Leave - Applicants must certify they have sufficient funds for round-trip travel.

USCIS Form I-864 - Sponsors must also report certain changes in financial circumstance to USCIS.

For anyone involved in a traffic accident, it is vital to understand the significance of the Florida Traffic Crash Report form, which must be filled out promptly to ensure compliance with state regulations. This form not only collects crucial details about the incident but also facilitates the insurance claims process. More information about this form can be found at https://allfloridaforms.com/, ensuring that drivers can efficiently navigate the necessary steps following an accident.

Florida Dh 680 Form Download - The form is crucial for children progressing into new schooling stages, especially 7th grade.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose of the Receipt | The Goodwill donation receipt serves as proof of a charitable contribution for tax purposes. |

| Tax Deductibility | Donors can often deduct the value of their donations on their tax returns, subject to IRS guidelines. |

| Itemized List Requirement | Donors should provide a detailed list of items donated, including their estimated values. |

| State-Specific Forms | Some states may have specific requirements for donation receipts, governed by local tax laws. |

| Timeframe for Issuance | Goodwill typically issues receipts at the time of donation or shortly thereafter. |

| Record Keeping | It is advisable for donors to keep the receipt for their records, especially when filing taxes. |

Documents used along the form

The Goodwill donation receipt form is an essential document for individuals who wish to claim tax deductions for charitable contributions. Several other forms and documents often accompany this receipt, each serving a specific purpose in the donation process or tax filing. Below is a list of such documents.

- IRS Form 8283: This form is used for non-cash charitable contributions over $500. It provides details about the donated property and must be attached to the tax return.

- Donation Log: A personal record kept by the donor that lists all items donated, their estimated values, and the dates of donation. This log can support claims made on tax returns.

- Trailer Bill of Sale: When transferring ownership of a trailer, it's essential to complete the Trailer Bill of Sale form, which serves as vital documentation for the transaction. For more information, download the pdf here.

- Goodwill Donation Guidelines: A document outlining what items are acceptable for donation. It helps donors understand what can be donated and ensures compliance with Goodwill's policies.

- Tax Deduction Worksheet: A tool used to calculate the total value of charitable contributions. This worksheet assists in organizing donations and estimating potential tax deductions.

- Charitable Contribution Statement: A statement provided by the charity summarizing the total contributions made during the year. This can help donors verify their donations for tax purposes.

- Appraisal Report: For high-value donations, an appraisal report may be necessary. This document provides a professional valuation of the donated items and is required for certain tax deductions.

- Form 990: This is the annual information return filed by tax-exempt organizations. It provides transparency about the charity’s financials and can give donors insight into how their contributions are used.

- State-Specific Charitable Contribution Forms: Some states require additional forms for claiming state tax deductions on charitable donations. These forms vary by state and should be checked for compliance.

Understanding these documents can help individuals navigate the donation process more effectively and ensure that they are fully prepared for tax filing. Proper documentation supports the legitimacy of claims and can facilitate a smoother experience when dealing with charitable contributions.