Get Intent To Lien Florida Form

Key takeaways

When filling out and using the Intent To Lien Florida form, there are several important points to consider. Understanding these key takeaways can help ensure compliance and protect your rights.

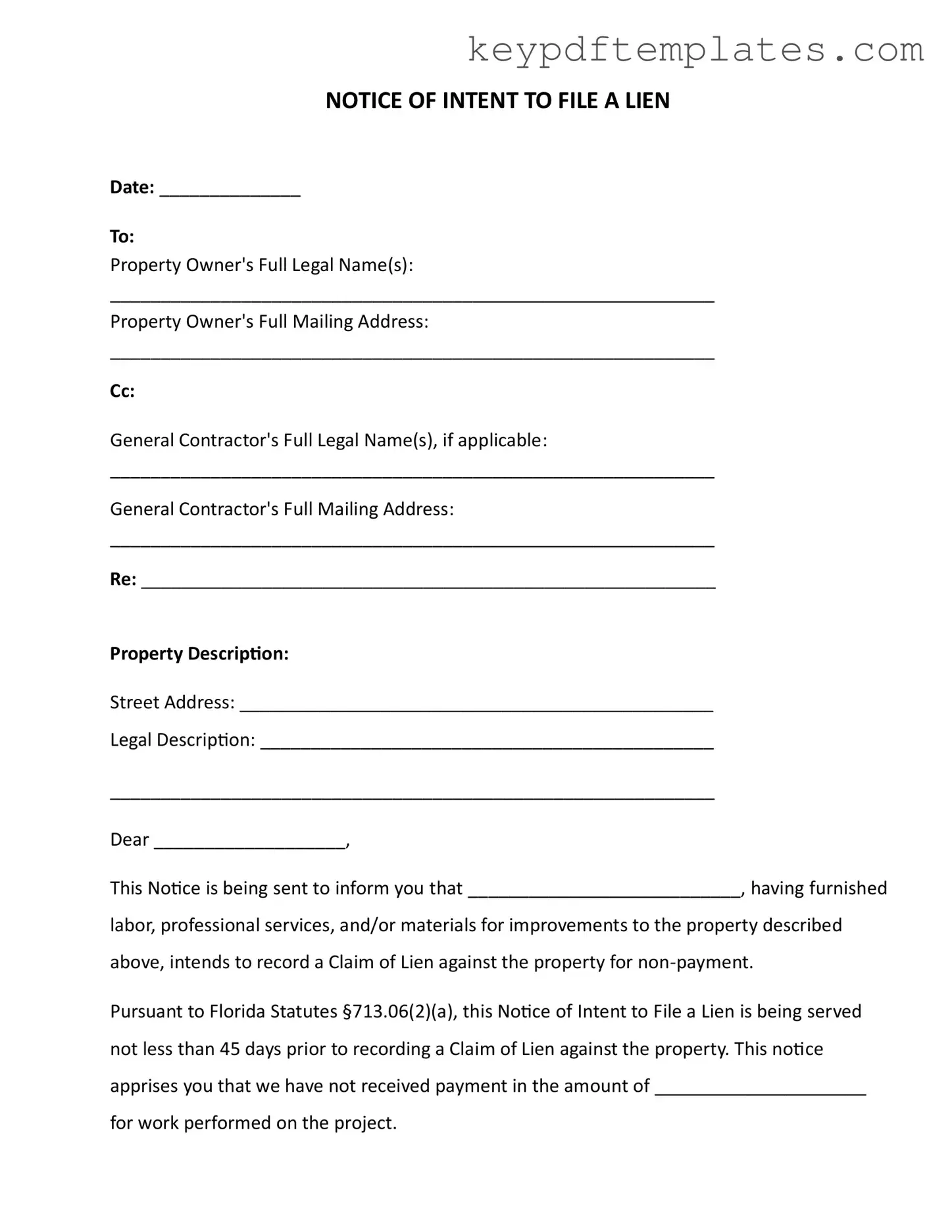

- Timeliness is Crucial: The notice must be sent at least 45 days before recording a Claim of Lien. This timeframe is mandated by Florida law.

- Complete Information: Ensure all sections of the form are filled out completely, including the property owner's full legal name and mailing address.

- Clear Description: Provide a detailed description of the property, including both the street address and the legal description. This clarity helps avoid disputes.

- Specify the Amount: Clearly state the amount owed for the labor, services, or materials provided. This figure should be accurate to avoid complications.

- Response Time: The property owner has 30 days to respond to your notice. If they fail to do so, you may proceed with recording the lien.

- Consequences of Non-Payment: Inform the property owner that failure to pay could lead to foreclosure proceedings and additional costs, such as attorney fees.

- Certificate of Service: After sending the notice, complete the Certificate of Service section. This proves that the notice was delivered to the property owner.

- Delivery Methods: Choose an appropriate method for delivering the notice, such as certified mail or hand delivery, and indicate this on the form.

- Maintain Records: Keep a copy of the completed form and any correspondence related to the notice. This documentation may be important if further action is needed.

By adhering to these guidelines, you can effectively utilize the Intent To Lien Florida form and protect your interests in the event of non-payment.

Similar forms

- Notice of Lien: This document is filed after the Intent to Lien. It formally claims a right to the property due to unpaid debts. It serves as a legal tool to secure payment and can lead to foreclosure if unresolved.

- Claim of Lien: Similar to the Notice of Lien, this document is a formal assertion of a lien on the property. It must be recorded in the county where the property is located and outlines the amount owed.

- Demand Letter: A demand letter requests payment for services rendered. It is often the first step before filing a lien. This document outlines the debt and provides a timeframe for payment.

- Notice of Non-Payment: This notice informs the property owner that payment has not been received. It serves as a warning that further action, such as filing a lien, may occur if the issue is not resolved.

Texas Employment Verification Form: Essential for confirming an employee's work status and affecting state benefit eligibility, this form must be completed by employers. For more details, visit txtemplate.com/texas-employment-verification-pdf-template.

- Waiver of Lien Rights: This document is used to waive the right to file a lien. It may be provided after payment is made, ensuring that the property owner is protected from future claims related to that specific debt.

- Release of Lien: Once a debt is paid, a release of lien is filed to remove the lien from the property records. This document confirms that the obligation has been satisfied and the property is free from the claim.

Misconceptions

Misconceptions about the Intent To Lien Florida form can lead to confusion and potential legal issues. Here are four common misunderstandings:

- Filing the Intent To Lien is the same as filing a lien. Many believe that submitting the Intent To Lien automatically places a lien on the property. In reality, this notice is a preliminary step. It informs the property owner of the intent to file a lien if payment is not made.

- The notice is optional. Some think they can skip sending the Intent To Lien. However, Florida law requires this notice to be sent at least 45 days before filing a lien. Failing to do so may jeopardize the ability to enforce the lien.

- Payment must be made immediately upon receipt of the notice. While the notice does prompt action, it does not demand immediate payment. The property owner has 30 days to respond satisfactorily before a lien can be filed.

- Receiving the notice means the property owner is automatically liable for the debt. This is not true. The notice serves as a warning, but it does not determine liability. The property owner can dispute the claim or negotiate payment.

Understanding these misconceptions can help all parties involved navigate the process more effectively and avoid unnecessary complications.

More PDF Templates

Fake Insurance Card Pdf - Your vehicle information is listed for easy reference in case of an emergency.

For individuals looking to navigate the process, the Texas bill of sale form is an important tool to document the transfer of ownership effectively. To learn more about the specifics, you can refer to our resource on the fundamental Texas bill of sale.

What's Advance Directive - The Advanced Health Care Directive facilitates meaningful conversations with your healthcare proxy and family.

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Intent to Lien form notifies property owners of an intention to file a lien for non-payment. |

| Governing Law | This form is governed by Florida Statutes §713.06. |

| Notice Period | The notice must be served at least 45 days before recording a Claim of Lien. |

| Response Time | Property owners have 30 days to respond to avoid lien recording. |

| Consequences of Non-Payment | Failure to pay may lead to foreclosure proceedings and additional costs. |

| Required Information | The form requires details such as property owner's name, address, and description of the property. |

| Certificate of Service | A certificate must confirm the delivery method of the notice to the property owner. |

| Preferred Resolution | The sender expresses a desire to resolve the matter amicably before further action is taken. |

Documents used along the form

The Intent to Lien Florida form is an important document for contractors and suppliers who wish to secure their right to payment for services rendered or materials supplied. However, several other forms and documents are often used in conjunction with it to ensure proper legal processes are followed. Below is a list of these documents, each accompanied by a brief description.

- Claim of Lien: This document officially records the lien against the property when payment has not been received. It serves as a public notice of the claim and can initiate foreclosure proceedings if the debt remains unpaid.

- Notice of Lien: Similar to the Claim of Lien, this notice informs interested parties that a lien has been placed on the property. It is often used to notify the property owner and other stakeholders of the lien's existence.

- Residential Lease Agreement: The Florida PDF Forms provides a comprehensive document outlining the terms between landlords and tenants in Florida, ensuring clarity and protecting the interests of both parties involved in the leasing process.

- Release of Lien: This form is used to formally remove a lien from a property once the debt has been settled. It is crucial for clearing the title of the property and allowing for future transactions.

- Waiver of Lien Rights: Contractors or suppliers may use this document to waive their right to file a lien. It is often signed after payment is received, ensuring that the property owner is protected from future claims.

- Construction Contract: This agreement outlines the terms of the project, including payment schedules, scope of work, and responsibilities of all parties involved. It is essential for establishing a clear understanding before work begins.

- Notice to Owner: This document informs the property owner that a contractor or subcontractor is working on their property. It is often required by law and helps protect the rights of those providing labor or materials.

- Invoice: An invoice details the work performed and the amount due. It serves as a formal request for payment and is essential for record-keeping and legal documentation.

- Payment Bond: This bond guarantees that a contractor will pay their subcontractors and suppliers. It provides additional security for those who may be at risk of non-payment.

- Affidavit of Payment: This document certifies that all parties involved have been paid for their work or materials. It is often required to ensure that no liens can be filed after a project is completed.

Understanding these forms and documents is essential for anyone involved in construction or property improvement in Florida. They help protect the rights of all parties and ensure that the process of securing payment is clear and legally sound.