Printable Investment Letter of Intent Template

Key takeaways

Filling out the Investment Letter of Intent (LOI) form is a crucial step in the investment process. Here are seven key takeaways to consider:

- Clarity is essential: Clearly articulate your intentions and objectives. A well-defined purpose helps all parties understand the goals of the investment.

- Provide accurate information: Ensure that all information provided is accurate and up-to-date. Inaccuracies can lead to misunderstandings and potential delays.

- Understand the terms: Familiarize yourself with the terms and conditions outlined in the LOI. This helps in negotiating and aligning expectations with potential partners.

- Include key stakeholders: Make sure to involve all relevant stakeholders in the process. Their input can be invaluable in shaping the final document.

- Review and revise: Take the time to review the LOI before submission. Revisions may be necessary to ensure clarity and completeness.

- Follow up: After submitting the LOI, follow up with the involved parties. This helps maintain momentum and keeps communication channels open.

- Document everything: Keep a record of all communications and versions of the LOI. Documentation is crucial for future reference and accountability.

By keeping these takeaways in mind, you can navigate the Investment Letter of Intent process more effectively and increase the likelihood of a successful investment outcome.

Similar forms

- Memorandum of Understanding (MOU): This document outlines the general terms of a partnership or agreement between parties. Like the Investment Letter of Intent, it serves as a preliminary agreement that sets the stage for more detailed contracts.

- Term Sheet: A term sheet summarizes the key terms and conditions of an investment deal. Similar to the Investment Letter of Intent, it provides an overview without binding the parties legally.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties during negotiations. Both documents emphasize the importance of confidentiality in the investment process.

- Purchase Agreement: This document outlines the terms of a sale of assets or shares. While it is more binding than the Investment Letter of Intent, both documents detail the intentions of the parties involved.

- Joint Venture Agreement: This agreement establishes a partnership for a specific project. Like the Investment Letter of Intent, it lays out the intentions and responsibilities of each party before formalizing the partnership.

- Letter of Interest: A Letter of Interest expresses a party's intention to engage in negotiations. Similar to the Investment Letter of Intent, it indicates a serious interest without creating a binding obligation.

Misconceptions

Misconceptions about the Investment Letter of Intent (LOI) can lead to confusion and missteps in the investment process. Here are six common misconceptions:

- An LOI is a legally binding contract. Many believe that once an LOI is signed, it creates a binding agreement. In reality, an LOI typically outlines the terms and intentions of the parties but is often non-binding unless specified otherwise.

- All terms in the LOI are final. Some think that the terms laid out in the LOI are set in stone. However, the LOI serves as a starting point for negotiations, and terms can change before a final agreement is reached.

- The LOI guarantees funding. A common misconception is that signing an LOI ensures that funding will be provided. In truth, the LOI indicates interest but does not guarantee that the investment will occur.

- Only large investors use LOIs. Many assume that only institutional or large investors utilize LOIs. In fact, both small and large investors can benefit from using an LOI to clarify intentions and terms.

- An LOI is unnecessary if negotiations are friendly. Some believe that if negotiations are amicable, an LOI is not needed. However, having an LOI helps document discussions and intentions, reducing the risk of misunderstandings.

- The LOI is the final step before closing. It is a common myth that the LOI is the last step before closing a deal. In reality, it is just one step in the process, often followed by due diligence and the creation of a formal agreement.

Understanding these misconceptions can help investors navigate the investment process more effectively.

Other Investment Letter of Intent Types:

Lease Proposal - A Letter of Intent is not a binding contract but indicates serious intent.

PDF Details

| Fact Name | Description |

|---|---|

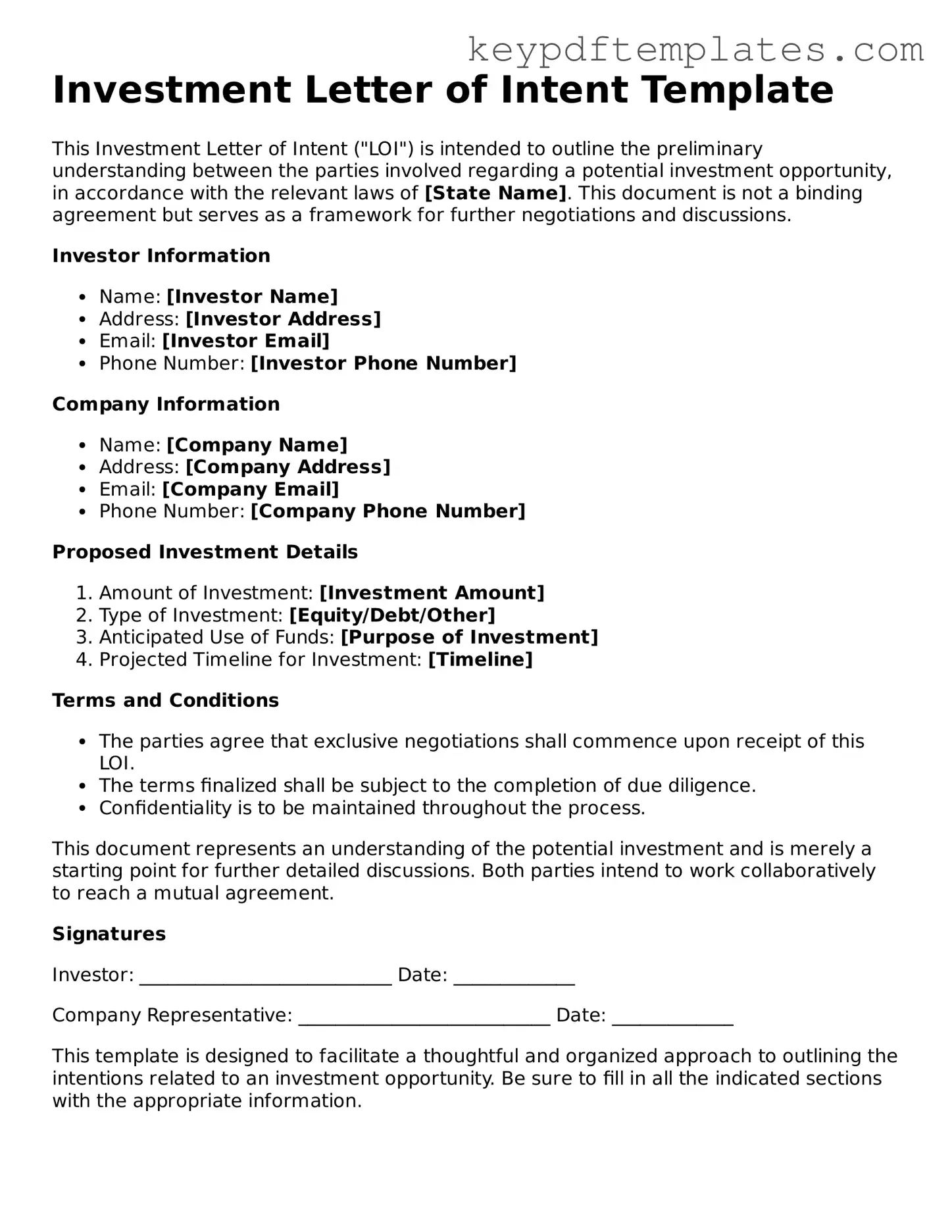

| Purpose | The Investment Letter of Intent form outlines the preliminary agreement between parties interested in pursuing an investment opportunity. |

| Binding Nature | This form is generally non-binding, meaning it expresses an intention to negotiate rather than a legally enforceable commitment. |

| Key Components | Essential elements often include the investment amount, terms, conditions, and a timeline for negotiations. |

| State-Specific Forms | Some states may have specific requirements for the form, governed by local laws. For example, California law may dictate specific disclosures. |

| Confidentiality | Many Investment Letters of Intent include confidentiality clauses to protect sensitive information shared during negotiations. |

| Expiration Date | Typically, the form will specify an expiration date, after which the terms may no longer be valid unless renewed or extended. |

Documents used along the form

An Investment Letter of Intent (LOI) is often accompanied by several other documents that help clarify the terms and intentions of the parties involved. These additional forms provide essential details and support the overall investment process.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains private. It protects the interests of all parties by preventing unauthorized disclosure of proprietary information.

- Term Sheet: A term sheet outlines the key terms and conditions of the proposed investment. It serves as a summary of the agreement and provides a foundation for drafting more detailed contracts.

- Due Diligence Checklist: This checklist is used to evaluate the financial, legal, and operational aspects of the investment opportunity. It helps investors assess risks and make informed decisions.

- Investment Agreement: This formal contract details the specific terms of the investment once negotiations are complete. It includes obligations, rights, and the responsibilities of each party involved.

Each of these documents plays a crucial role in the investment process, ensuring that all parties are aligned and informed as they move forward.