Get IRS 1040 Form

Key takeaways

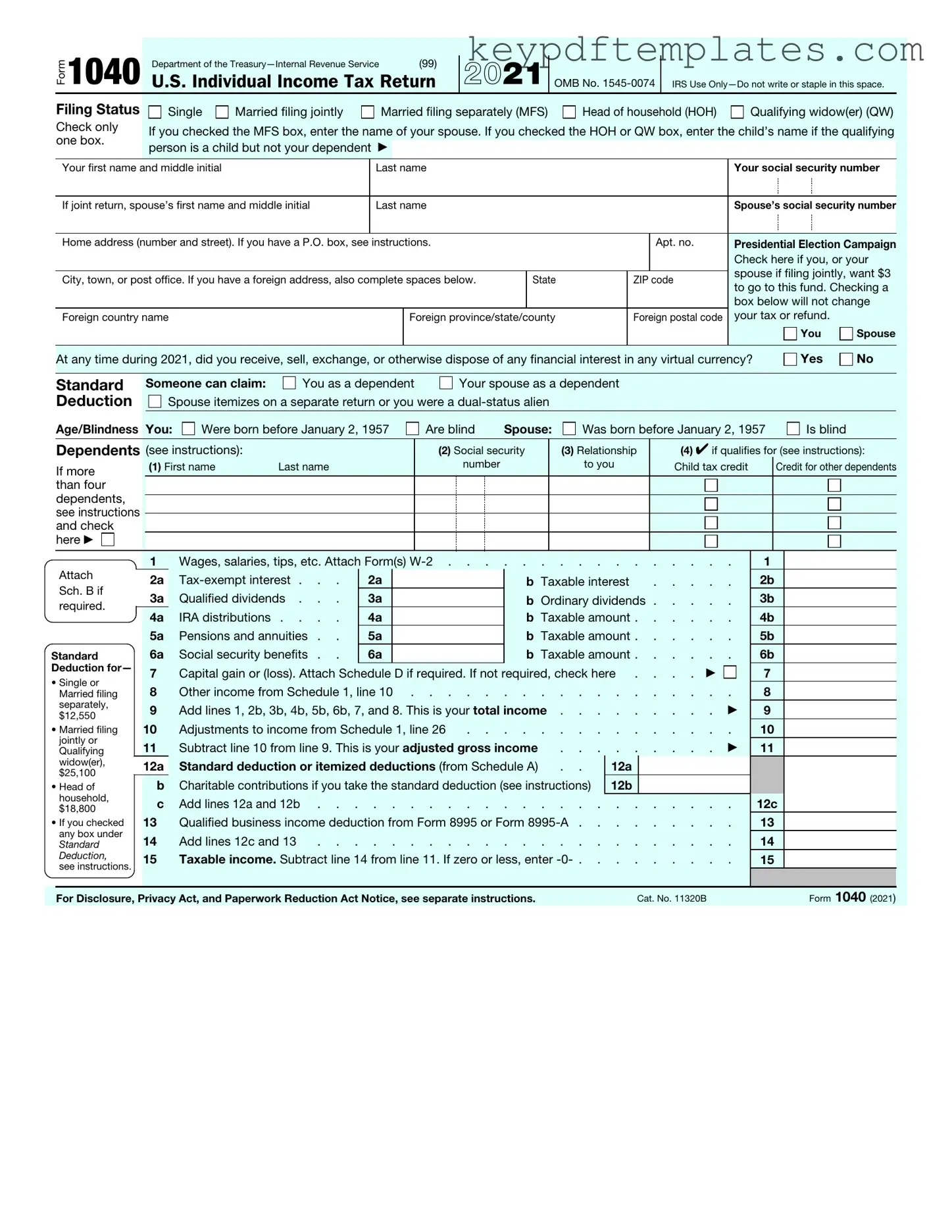

Filling out the IRS 1040 form is a crucial step in the tax filing process. Understanding its components can make this task more manageable. Here are some key takeaways to consider:

- Gather Necessary Documents: Before starting, collect all relevant financial documents, such as W-2s, 1099s, and any receipts for deductions.

- Choose the Right Filing Status: Your filing status affects your tax rate and eligibility for certain credits. Options include single, married filing jointly, and head of household.

- Report All Income: Ensure that you report all sources of income accurately. This includes wages, interest, dividends, and any self-employment income.

- Understand Deductions and Credits: Familiarize yourself with available deductions and credits. They can significantly reduce your tax liability.

- File on Time: Adhere to the filing deadlines to avoid penalties. If you cannot file by the deadline, consider requesting an extension.

By keeping these points in mind, individuals can navigate the IRS 1040 form more effectively and fulfill their tax obligations with confidence.

Similar forms

The IRS Form 1040 is a crucial document for individual taxpayers in the United States, serving as the primary means for reporting income and calculating tax obligations. Its structure and purpose share similarities with several other important documents. Here are seven such documents:

- W-2 Form: This form reports an employee's annual wages and the taxes withheld from their paycheck. Like the 1040, it is essential for accurately calculating taxable income.

- 1099 Form: Used to report various types of income received by individuals who are not employees, such as freelance earnings. Both the 1099 and 1040 are key in ensuring that all income is reported to the IRS.

- Schedule C: This document is used by sole proprietors to report income or loss from their business. It complements the 1040 by detailing business earnings and expenses.

- Form 4868: This is the application for an automatic extension of time to file your tax return. It is related to the 1040 as it allows taxpayers additional time to prepare their returns without incurring penalties.

- Form 8889: This form is used to report Health Savings Account (HSA) contributions and distributions. It can be attached to the 1040 to account for tax benefits related to HSAs.

- Schedule A: This document is utilized for itemizing deductions. Taxpayers who choose to itemize will attach this schedule to their 1040 to potentially reduce their taxable income.

- Trailer Bill of Sale: This form is essential for the legal transfer of ownership of a trailer in Texas. To facilitate this important transaction, complete the document accurately and ensure compliance. For more details, visit https://txtemplate.com/trailer-bill-of-sale-pdf-template/.

- Form 1040-SR: Designed for seniors, this form is similar to the 1040 but features a larger font and a simpler layout. It serves the same purpose of reporting income and calculating taxes.

Understanding these documents can help taxpayers navigate their obligations more effectively. Each form plays a distinct role in the tax process, yet they all connect back to the central function of the 1040 form.

Misconceptions

The IRS 1040 form is a crucial document for individual taxpayers in the United States. However, several misconceptions surround its use and requirements. Here are four common misconceptions:

- Everyone Must File a 1040 Form: Many people believe that all individuals are required to file a 1040 form. In reality, not everyone is obligated to file. Filing requirements depend on factors such as income, filing status, and age. Some individuals may fall below the income threshold and are not required to file.

- Only Employees Need to File: Another misconception is that only those who are employed must file a 1040 form. This is incorrect. Self-employed individuals, freelancers, and those with other sources of income, such as rental properties or investments, also need to file if they meet the income requirements.

- Filing a 1040 Guarantees a Refund: Some taxpayers believe that submitting a 1040 form will automatically result in a tax refund. While many people do receive refunds, it is not guaranteed. The amount of tax withheld from income, deductions, and credits will determine whether a refund is issued or if additional taxes are owed.

- Filing is Only Necessary Once a Year: Many assume that they only need to file their 1040 form annually. However, certain situations may require individuals to file more frequently, such as if they owe additional taxes or if they have significant changes in their financial situation.

More PDF Templates

Cg2010 Form - Addresses specific conditions under which additional insured coverage is valid.

To facilitate the sale and transfer of an all-terrain vehicle (ATV) in New York, it is important to utilize the New York ATV Bill of Sale form, which is a legal document capturing crucial details about the transaction. For those unfamiliar with the process, resources like NY PDF Forms can provide valuable guidance, ensuring that buyers and sellers comply with state regulations and maintain accurate records.

Sfa Age Range - It aims to ensure that all students can access the curriculum effectively.

Health Guarantee for Puppies Template - Buyers should maintain open lines of communication for their puppy's needs.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS 1040 form is used by individuals to file their annual income tax returns in the United States. |

| Filing Deadline | Typically, the deadline for filing the 1040 form is April 15 of each year, unless it falls on a weekend or holiday. |

| State-Specific Forms | Many states require their own tax forms alongside the federal 1040. For example, California uses Form 540, governed by the California Revenue and Taxation Code. |

| Changes Over Time | The 1040 form has undergone several revisions to simplify the filing process and accommodate changes in tax law. |

Documents used along the form

When filing taxes, the IRS 1040 form is often accompanied by various other forms and documents. Each of these serves a specific purpose and helps ensure that taxpayers report their income accurately and claim the appropriate deductions and credits. Below is a list of commonly used forms and documents.

- W-2 Form: This form reports an employee's annual wages and the taxes withheld from their paycheck. Employers must provide this form to their employees by the end of January each year.

- 1099 Form: This series of forms is used to report income received from sources other than employment, such as freelance work or interest income. Different types of 1099 forms exist for various income types.

- Schedule A: Taxpayers use this form to itemize deductions, such as mortgage interest, charitable contributions, and medical expenses, instead of taking the standard deduction.

- Schedule C: Self-employed individuals use this form to report income and expenses from their business. It helps determine net profit or loss for the year.

- Schedule D: This form is used to report capital gains and losses from the sale of assets, such as stocks or real estate, helping to calculate the tax owed on those transactions.

- Georgia WC 102B Form: Essential for attorneys representing employers and insurers, this form serves as a notice of representation in workers' compensation cases to the State Board of Workers' Compensation. For more details, refer to the Georgia PDF.

- Form 8889: Individuals with Health Savings Accounts (HSAs) use this form to report contributions, distributions, and any tax implications related to their HSA.

- Form 8862: This form is necessary for taxpayers who have previously been denied the Earned Income Tax Credit (EITC) and wish to claim it again. It helps establish eligibility.

- Form 1040-SR: Designed for seniors, this form is a simplified version of the 1040, featuring larger print and a straightforward layout to make it easier to read.

- Form 4506-T: Taxpayers use this form to request a transcript of their tax return from the IRS. It is often needed for loan applications or verification purposes.

Understanding these forms can simplify the tax filing process. Each document plays a crucial role in ensuring compliance and maximizing potential refunds or credits. It is advisable to gather all necessary paperwork before starting the filing process to avoid delays or errors.