Get IRS 1120 Form

Key takeaways

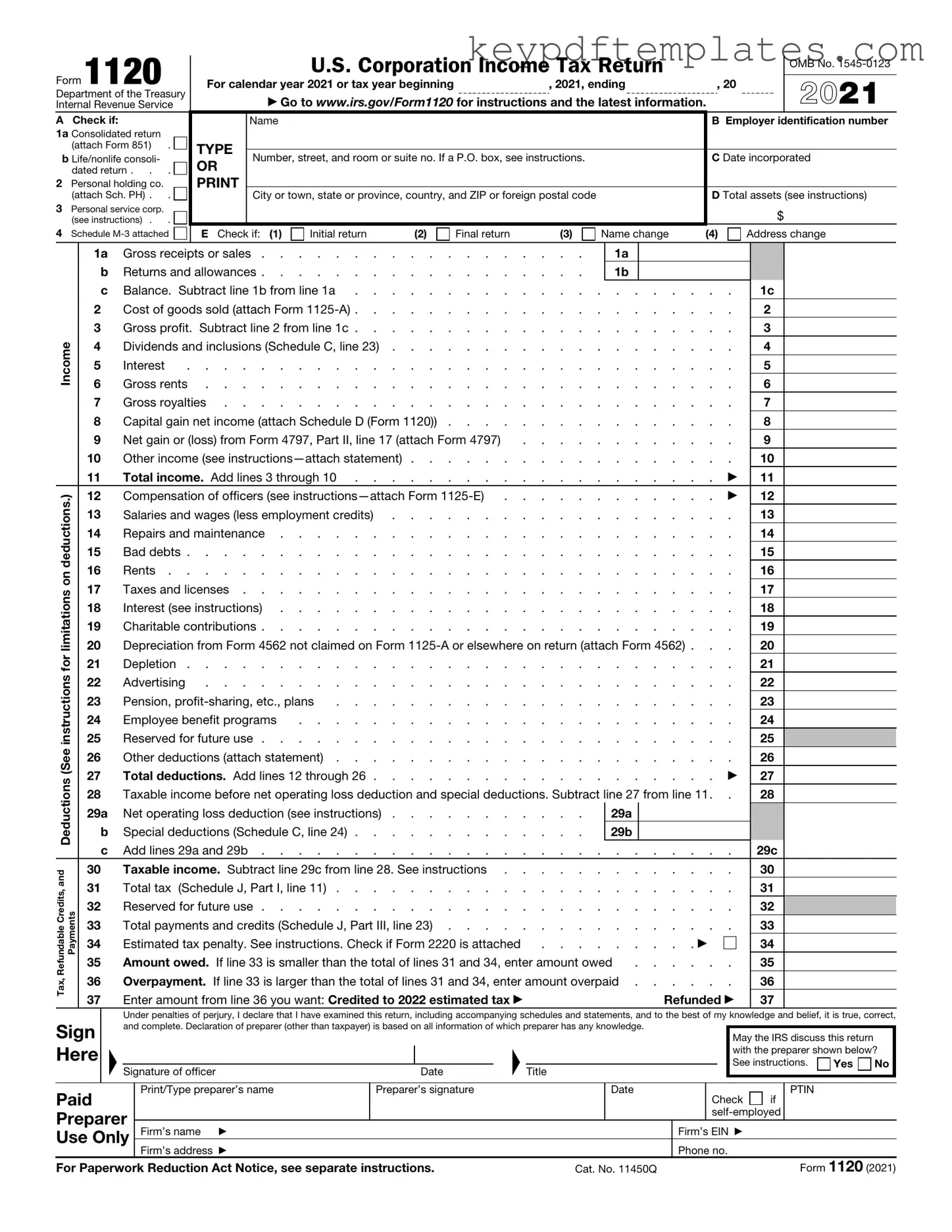

Filling out the IRS Form 1120 is an essential task for corporations in the United States. This form is used to report income, gains, losses, deductions, and credits, as well as to calculate the corporation's tax liability. Here are some key takeaways to keep in mind when completing and using this form:

- The IRS Form 1120 is specifically designed for C corporations. If your business is structured differently, such as an S corporation or partnership, different forms are required.

- Corporations must file Form 1120 annually, regardless of whether they owe taxes or not.

- Be aware of the filing deadline. Generally, Form 1120 is due on the 15th day of the fourth month after the end of the corporation’s tax year.

- Accurate record-keeping is crucial. Gather all necessary financial documents, including income statements and balance sheets, before starting the form.

- Double-check all calculations. Errors can lead to delays in processing or even penalties.

- Filing electronically can simplify the process. The IRS encourages e-filing for faster processing and confirmation.

- Understand the importance of deductions. Corporations can deduct a variety of business expenses, which can significantly reduce taxable income.

- Be mindful of the tax rates that apply. The Tax Cuts and Jobs Act established a flat corporate tax rate, which may differ from previous years.

- Consider consulting a tax professional. Navigating corporate taxes can be complex, and expert guidance can help ensure compliance.

- Keep copies of all submitted forms and supporting documents. This is vital for future reference or in case of an audit.

By following these key points, corporations can effectively manage their tax obligations and ensure compliance with IRS regulations.

Similar forms

The IRS Form 1120 is a crucial document for corporations in the United States, primarily used to report income, gains, losses, deductions, and credits. Several other forms share similarities with the 1120 in terms of purpose and the information they require. Below are five such documents:

- IRS Form 1065: This form is used by partnerships to report their income, deductions, and other financial information. Like Form 1120, it provides a comprehensive overview of the entity's financial status, although it focuses on partnerships rather than corporations.

- New York Trailer Bill of Sale Form: For transferring ownership of trailers, refer to the comprehensive Trailer Bill of Sale document to ensure all legal aspects are correctly handled.

- IRS Form 1040: This is the individual income tax return form. While it serves individuals rather than corporations, both forms require reporting of income and deductions. They share similar structures in terms of detailing various sources of income.

- IRS Form 990: Non-profit organizations use this form to report their financial activities. Similar to Form 1120, it aims to provide transparency about the organization’s financial health, including income and expenditures, although it is tailored for non-profits.

- IRS Form 1120-S: This form is specifically for S corporations. It resembles Form 1120 in that it reports income and deductions, but it is designed for entities that have elected to be taxed as S corporations, which pass income directly to shareholders.

- IRS Form 941: Employers use this form to report payroll taxes. While it focuses on employment taxes rather than corporate income, both forms require detailed reporting of financial information and are essential for compliance with federal tax obligations.

Understanding these documents can help individuals and businesses navigate their tax responsibilities more effectively. Each form serves a unique purpose but shares common elements that reflect the financial activities of the respective entities.

Misconceptions

The IRS Form 1120 is essential for corporations filing their income tax returns. However, several misconceptions surround this form. Understanding these misconceptions can help ensure accurate filing and compliance.

- All corporations must file Form 1120. Not all corporations are required to file this form. Only C corporations, which are taxed separately from their owners, must submit Form 1120. S corporations, on the other hand, use Form 1120S.

- Form 1120 is only for large corporations. This is incorrect. Both small and large C corporations must file Form 1120 if they meet the criteria. The size of the corporation does not exempt it from filing.

- Filing Form 1120 is optional for corporations. This is a misconception. Corporations that meet the requirements must file Form 1120 annually, regardless of whether they owe taxes or not.

- Only profits need to be reported on Form 1120. This is misleading. Corporations must report all income, including profits, losses, and deductions. Accurate reporting is crucial for compliance.

- Form 1120 can be filed at any time during the year. This is not true. Corporations must file Form 1120 by the 15th day of the fourth month after the end of their tax year. Missing this deadline can result in penalties.

- There is no penalty for filing Form 1120 late. This is incorrect. Late filings can incur penalties and interest on any taxes owed. Timely submission is essential to avoid additional costs.

- Form 1120 does not require supporting documentation. This is a misconception. While Form 1120 itself does not require attachments, corporations must maintain adequate records to support the information reported on the form.

- Once filed, Form 1120 cannot be amended. This is false. If errors are found after filing, corporations can submit an amended return using Form 1120-X to correct any mistakes.

Understanding these misconceptions can help ensure that corporations file correctly and on time, minimizing the risk of penalties and ensuring compliance with IRS regulations.

More PDF Templates

Australia Visa Application Form - Your completed application must include the passport matching the number on page two.

For those looking for more detailed information and resources on the legal requirements surrounding eviction procedures, you can visit the Florida PDF Forms website, which provides guidance on how to properly submit the Notice to Quit form and ensure all necessary steps are taken to comply with state regulations.

What Is Joint Tenancy in California - The affidavit helps to legitimize the survivor's claim to the jointly-owned property efficiently.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report income, gains, losses, deductions, and credits, as well as to calculate their federal income tax liability. |

| Filing Deadline | Corporations must file Form 1120 by the 15th day of the fourth month after the end of their tax year. |

| Who Must File | All domestic corporations, including C corporations, must file this form, regardless of whether they owe tax. |

| State-Specific Forms | Many states have their own corporate tax forms. For example, California uses Form 100, governed by the California Revenue and Taxation Code. |

| Estimated Tax Payments | Corporations may need to make estimated tax payments throughout the year if they expect to owe tax of $500 or more. |

| Penalties | Failure to file Form 1120 on time can result in penalties, including a late filing penalty based on the amount of tax due. |

| Signature Requirement | The form must be signed by an authorized officer of the corporation, affirming that the information provided is accurate. |

| Electronic Filing | Corporations can file Form 1120 electronically, which may speed up processing and reduce errors. |

| Record Keeping | Corporations should maintain records supporting the information reported on Form 1120 for at least three years from the date of filing. |

Documents used along the form

The IRS 1120 form is essential for corporations filing their income tax returns. However, several other forms and documents often accompany it to provide a complete picture of the corporation’s financial situation. Below is a list of these forms, each serving a specific purpose in the tax filing process.

- IRS Form 1125-E: This form is used to report compensation of officers. Corporations must disclose the salaries and bonuses paid to their top executives to ensure compliance with tax regulations.

- IRS Form 4562: This form is for depreciation and amortization. It allows corporations to claim deductions for the depreciation of their assets over time, which can significantly reduce taxable income.

- IRS Form 4797: Used for the sale of business property, this form reports gains and losses from the sale of assets such as real estate or equipment, providing necessary details for accurate tax calculations.

- Texas RV Bill of Sale: This document is essential for transferring ownership when buying or selling an RV in Texas, outlining all necessary details such as sale price and buyer/seller information—learn more at txtemplate.com/rv-bill-of-sale-pdf-template/.

- IRS Form 941: This is the Employer's Quarterly Federal Tax Return. Corporations use it to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks.

- IRS Form 940: This form is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It reports the unemployment taxes owed by the corporation, which fund unemployment benefits for workers.

- IRS Form W-2: This form is essential for reporting wages paid to employees and the taxes withheld. It must be provided to employees and submitted to the IRS to ensure accurate tax reporting.

- IRS Form W-3: This is the Transmittal of Wage and Tax Statements. It summarizes the information from all W-2 forms issued by the corporation, making it easier for the IRS to process the data.

- IRS Form 1099: Used to report various types of income other than wages, salaries, and tips. Corporations must issue 1099 forms to contractors and freelancers who were paid during the tax year.

- Schedule C: While typically used by sole proprietors, corporations may need to file this form if they have income from business activities that do not involve corporate structure.

- Schedule G: This schedule provides information about the corporation’s activities, including whether it has any foreign operations, which can affect tax liabilities.

Understanding these forms and their purposes can help corporations maintain compliance and optimize their tax filings. Each document plays a crucial role in ensuring accurate reporting and minimizing potential issues with the IRS.