Get IRS 2553 Form

Key takeaways

When filling out and using the IRS Form 2553, there are several important points to keep in mind. This form is essential for businesses that wish to elect S corporation status. Here are key takeaways:

- Form 2553 must be filed with the IRS to elect S corporation status for federal tax purposes.

- The form should be submitted within 75 days of the beginning of the tax year when the election is to take effect.

- All shareholders must consent to the S corporation election by signing the form.

- Eligibility requirements include having no more than 100 shareholders and only one class of stock.

- Shareholders must be individuals, certain trusts, or estates; corporations and partnerships cannot be shareholders.

- Provide accurate information about the corporation, including its name, address, and Employer Identification Number (EIN).

- Ensure that the corporation is eligible by meeting the IRS criteria before filing the form.

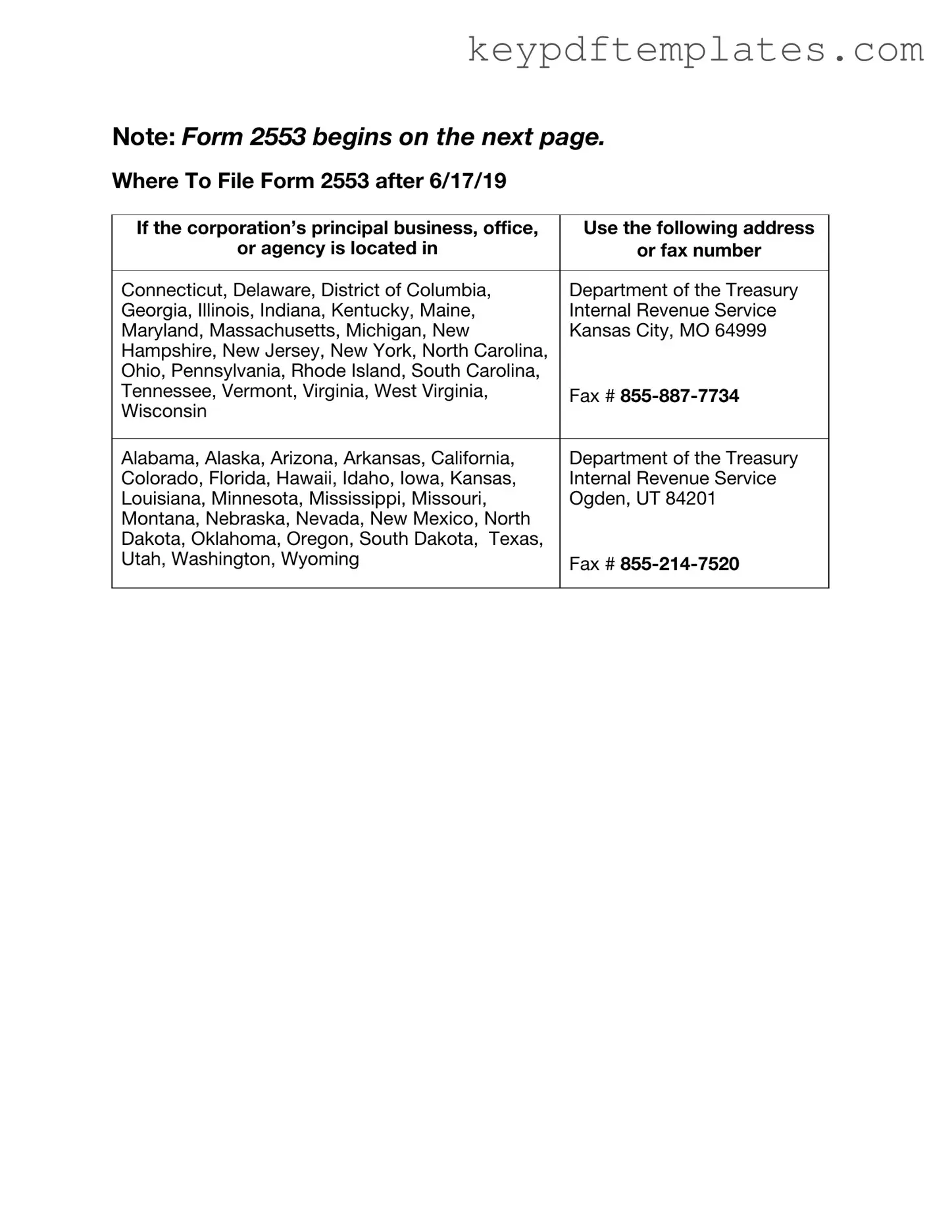

- Form 2553 can be filed electronically or by mail, but it is crucial to keep a copy for your records.

- If the form is filed late, the IRS may grant relief under certain circumstances, but it's not guaranteed.

- Consult a tax professional if you have questions about the process or eligibility requirements.

Similar forms

- Form 1120-S: This is the annual tax return for S corporations. Like Form 2553, it is specifically for S corporations and outlines income, deductions, and credits.

- Form 1065: Used by partnerships, this form reports income, deductions, and profits. Both forms are used to elect a specific tax treatment for business entities.

- ADP Pay Stub: Similar to IRS Form 2553, the ADP Check Stub provides critical financial information, detailing earnings and deductions that are essential for transparency in employee compensation.

- Form 1040: This is the individual income tax return. While it serves a different purpose, both forms ultimately affect the tax obligations of business owners.

- Form 8832: This form is used to elect the classification of a business entity. Like Form 2553, it allows businesses to choose how they are taxed.

- Form 941: This is the employer's quarterly federal tax return. Both forms relate to how businesses report and pay taxes, although they serve different timelines and purposes.

- Form 990: Nonprofit organizations use this form to report financial information. Similar to Form 2553, it provides transparency regarding the organization's tax status.

- Form W-2: This form reports wages paid to employees and taxes withheld. While it’s focused on employees, both forms are essential for understanding tax obligations in a business context.

Misconceptions

The IRS Form 2553 is crucial for businesses that want to elect S Corporation status. However, there are several misconceptions surrounding this form. Here’s a breakdown of eight common misunderstandings:

- It’s only for new businesses. Many believe Form 2553 is only applicable to startups. In reality, existing corporations can also file this form to change their tax status.

- Filing is optional. Some think that filing Form 2553 is optional for S Corporation election. In fact, if you want S Corporation status, you must file this form.

- There’s no deadline for filing. A common myth is that you can file Form 2553 at any time. However, there is a specific deadline, typically 75 days from the start of the tax year.

- All businesses can qualify. Many assume any business can elect S Corporation status. However, certain eligibility criteria must be met, such as the number of shareholders and types of stock.

- It’s the same as filing for LLC status. Some confuse Form 2553 with the paperwork for forming an LLC. They are different; Form 2553 is specifically for electing S Corporation tax treatment.

- Once filed, it cannot be changed. A misconception is that the S Corporation election is permanent. You can revoke this election or change your tax status later if needed.

- It guarantees tax savings. Many believe that filing Form 2553 automatically leads to tax savings. While it can provide benefits, it depends on various factors, including the business's income and expenses.

- It’s a complicated process. Some think filing Form 2553 is overly complex. In reality, the form is straightforward, and guidance is available to help you through the process.

Understanding these misconceptions can help you navigate the process of electing S Corporation status more effectively.

More PDF Templates

Apartment Owners Association of California - The form serves as a formal request to enter a rental agreement upon approval.

To facilitate a smooth and legally binding transfer of ownership for a vehicle in Wisconsin, it is essential to complete the Motor Vehicle Bill of Sale form, which provides vital details about the transaction, including the vehicle's specifications and the identities of both the seller and the buyer.

Dl 44 Form Pdf Dmv - All personal information provided on the DL 44 form may be subject to verification by the DMV.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 2553 is used by small businesses to elect S Corporation status for tax purposes. |

| Eligibility | To qualify, a business must be a domestic corporation and have no more than 100 shareholders. |

| Filing Deadline | The form must be filed within 75 days of the beginning of the tax year for which the election is to take effect. |

| Shareholder Requirements | All shareholders must be individuals, certain trusts, or estates; corporations and partnerships cannot be shareholders. |

| State-Specific Forms | Some states require additional forms for S Corporation election, such as California's Form 100S. |

| Tax Benefits | Electing S Corporation status allows income to pass through to shareholders, avoiding double taxation. |

| Revocation | An S Corporation can revoke its status by filing a statement with the IRS, but there are specific rules to follow. |

| Form Updates | The IRS periodically updates Form 2553, so it's essential to use the most current version. |

| Assistance | Consulting a tax professional can help ensure proper completion and filing of Form 2553. |

Documents used along the form

When forming an S Corporation, the IRS Form 2553 is essential for electing S Corporation status. However, several other forms and documents are commonly used alongside this form to ensure compliance and proper organization. Here’s a brief overview of five important documents that may accompany the IRS Form 2553.

- Form 1120S: This is the U.S. Income Tax Return for an S Corporation. Once the S Corporation status is established, this form is used annually to report income, deductions, and other relevant financial information to the IRS.

- California Residential Lease Agreement: This document is vital for landlords and tenants in California, outlining rental terms and obligations. For more information, visit Top Forms Online.

- Form SS-4: This form is used to apply for an Employer Identification Number (EIN). An EIN is crucial for S Corporations, as it serves as the business's tax identification number and is necessary for filing taxes and hiring employees.

- State S Corporation Election Form: Many states require a separate form to elect S Corporation status at the state level. This form varies by state and is important for ensuring that the business is recognized as an S Corporation for state tax purposes.

- Operating Agreement: Although not always required, an operating agreement outlines the management structure and operational procedures of the S Corporation. It helps clarify the roles of shareholders and can prevent disputes in the future.

- Form 941: This is the Employer's Quarterly Federal Tax Return. S Corporations with employees must file this form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks.

Understanding these documents is crucial for anyone looking to establish an S Corporation. Each form plays a significant role in ensuring compliance with tax laws and maintaining the corporation's good standing. By being aware of these additional forms, business owners can navigate the process more smoothly and focus on growing their enterprise.