Get IRS 433-F Form

Key takeaways

When dealing with the IRS 433-F form, it’s important to understand its purpose and how to fill it out correctly. Here are key takeaways to keep in mind:

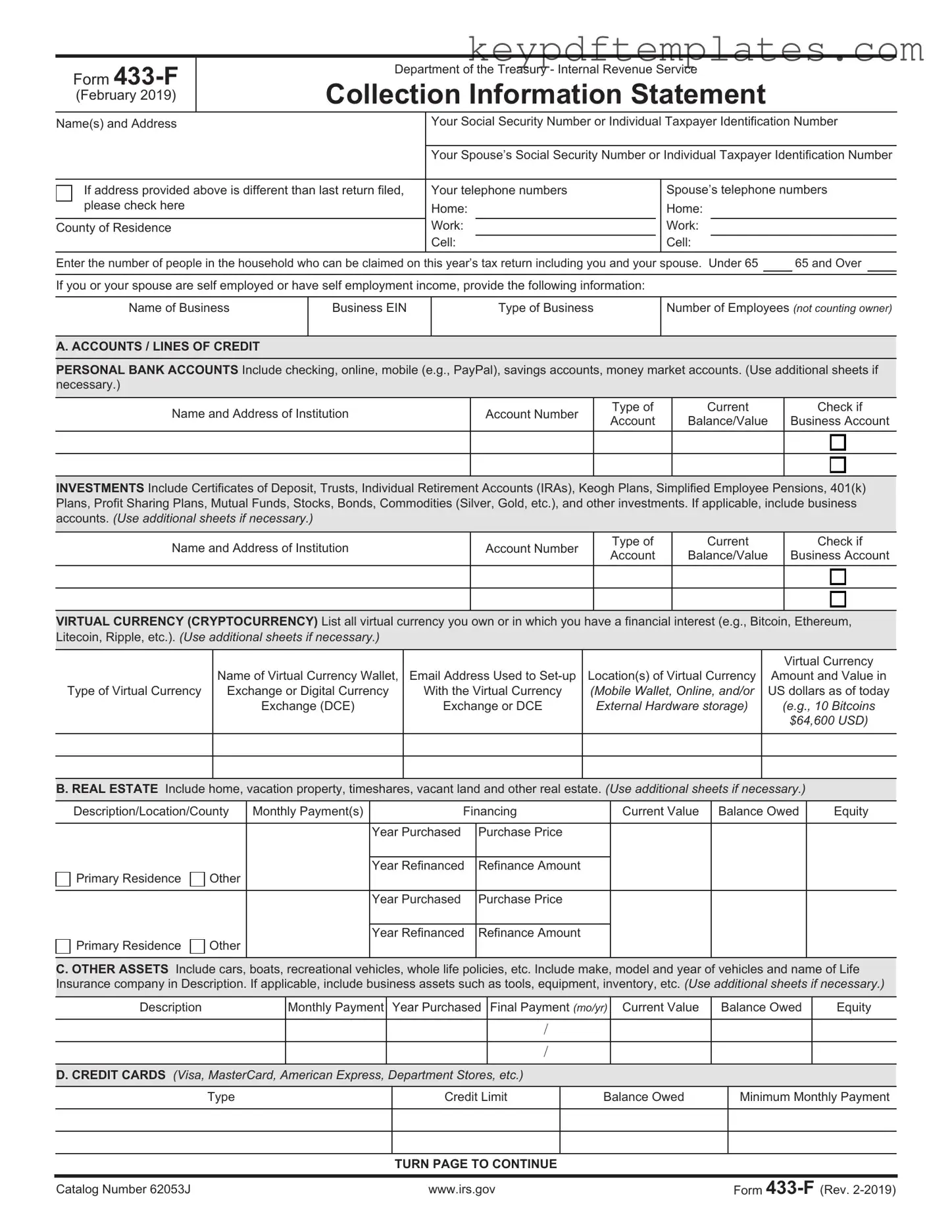

- The IRS 433-F form is used to collect financial information from individuals who owe taxes.

- It helps the IRS determine your ability to pay your tax debt.

- Completing the form accurately is crucial; incorrect information can lead to delays or complications.

- Be prepared to provide details about your income, expenses, assets, and liabilities.

- Include supporting documents, such as pay stubs and bank statements, to validate your financial information.

- Submit the form promptly to avoid additional penalties or interest on your tax debt.

- Keep a copy of the completed form for your records and future reference.

Understanding these points can make the process smoother and help you navigate your tax obligations effectively.

Similar forms

The IRS 433-F form is an important document used for financial disclosures to the IRS. Here are four other documents that share similarities with the IRS 433-F form:

- IRS Form 433-A: This form is used for individual taxpayers who owe more than $50,000. Like the 433-F, it collects financial information to assess the taxpayer's ability to pay debts.

- RV Bill of Sale: Necessary for documenting the sale and purchase of recreational vehicles, this form is crucial in Texas. For detailed information, visit https://txtemplate.com/rv-bill-of-sale-pdf-template/.

- IRS Form 433-B: This form is designed for businesses. It gathers financial data similar to the 433-F, helping the IRS understand a business's financial situation when assessing tax liabilities.

- IRS Form 9465: This is the Installment Agreement Request form. While it focuses on payment plans, it also requires financial information, much like the 433-F, to determine what a taxpayer can afford to pay.

- IRS Form 2848: This form is a Power of Attorney. Although its primary purpose is to authorize someone to represent a taxpayer, it often accompanies financial disclosures, including the 433-F, during negotiations with the IRS.

Misconceptions

The IRS 433-F form is often misunderstood, leading to confusion among taxpayers. Here are seven common misconceptions about this form, along with clarifications to help you navigate the process more effectively.

- Misconception 1: The IRS 433-F form is only for individuals with large tax debts.

- Misconception 2: Completing the IRS 433-F form guarantees that the IRS will accept my offer.

- Misconception 3: I can submit the IRS 433-F form without any supporting documentation.

- Misconception 4: The IRS 433-F form is the only form I need to file for a payment plan.

- Misconception 5: Once I submit the IRS 433-F form, I can stop making payments.

- Misconception 6: The IRS will automatically approve my request if I provide all the information.

- Misconception 7: I can fill out the IRS 433-F form without any help.

This form is used by anyone who owes taxes and is seeking to negotiate a payment plan or settle their tax debt, regardless of the amount owed.

While the form is an important part of the negotiation process, acceptance of your offer depends on various factors, including your financial situation and the IRS’s policies.

Supporting documents are essential. The IRS requires proof of income, expenses, and assets to evaluate your financial situation accurately.

In addition to the 433-F, you may need to submit other forms or documentation depending on your specific case and the type of resolution you are seeking.

It’s crucial to continue making payments until the IRS accepts your proposal. Failure to do so can lead to penalties and additional interest on your tax debt.

Providing complete information is important, but the IRS will review your financial situation thoroughly. Approval is not guaranteed.

While it is possible to complete the form on your own, seeking professional assistance can help ensure that you provide accurate information and improve your chances of a favorable outcome.

More PDF Templates

Alabama Sports Physical Form 2022 - Any clearance restrictions must be noted clearly on the form.

T47 Paralympics - Submitting a T-47 may alleviate concerns about potential undisclosed issues with the property.

In addition to the fundamental aspects of an LLC, a well-structured Operating Agreement can significantly enhance your business's credibility and provide clarity among members; to simplify this process, you can find the necessary document at Florida PDF Forms.

Netspend Customer Service Number 24/7 - Keeping a copy of your submitted form is advisable for your records.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS 433-F form is used to collect financial information from taxpayers to determine their ability to pay tax debts. |

| Who Uses It | This form is typically used by individuals and businesses who owe back taxes and are seeking a payment plan or settlement. |

| Submission Method | Taxpayers can submit the form via mail or electronically, depending on the IRS's current guidelines. |

| Required Information | It requires details about income, expenses, assets, and liabilities to assess the taxpayer's financial situation. |

| State-Specific Forms | Some states may have their own financial disclosure forms; for example, California uses the FTB 3567 form under California Revenue and Taxation Code. |

| Importance | Completing the IRS 433-F accurately is crucial, as it can significantly impact the resolution of tax liabilities. |

Documents used along the form

When dealing with tax issues, particularly those involving payment plans or offers in compromise, the IRS 433-F form is often accompanied by several other documents. Each of these forms plays a crucial role in providing a comprehensive view of an individual’s financial situation. Understanding these documents can help taxpayers navigate the complexities of their obligations more effectively.

- IRS Form 656: This form is used to submit an Offer in Compromise (OIC). It allows taxpayers to propose a settlement amount that is less than the total tax debt owed, based on their ability to pay.

- IRS Form 9465: This is the Installment Agreement Request form. Taxpayers use it to request a monthly payment plan for their tax debts, allowing them to pay off their obligations over time.

- IRS Form 433-A: This form is a detailed collection information statement for individuals. It provides a thorough snapshot of a taxpayer's financial situation, including assets, liabilities, income, and expenses.

- IRS Form 433-B: Similar to Form 433-A, this form is specifically designed for businesses. It collects information about a business's financial standing to assess its ability to pay tax debts.

- IRS Form 8821: This form authorizes a third party to receive and inspect a taxpayer's confidential tax information. It can be useful when seeking assistance from tax professionals.

- IRS Form 2848: Known as the Power of Attorney and Declaration of Representative, this form allows taxpayers to appoint someone to represent them before the IRS, which can be invaluable during negotiations.

- Divorce Settlement Agreement: This form outlines the terms of a divorce, addressing crucial elements like asset division and custody. It's important for those undergoing a divorce to understand its implications, and more information can be found at https://allfloridaforms.com/.

- IRS Form 1040: The individual income tax return form. This document provides the IRS with a taxpayer's income details and is often required when assessing financial situations.

- IRS Form 1099: This form reports various types of income other than wages, salaries, and tips. It is important for understanding all sources of income when negotiating tax debts.

Having these forms ready can streamline the process of dealing with the IRS. Each document serves a specific purpose, helping to clarify your financial situation and establish a path forward. Being well-prepared can make a significant difference in successfully managing tax obligations.