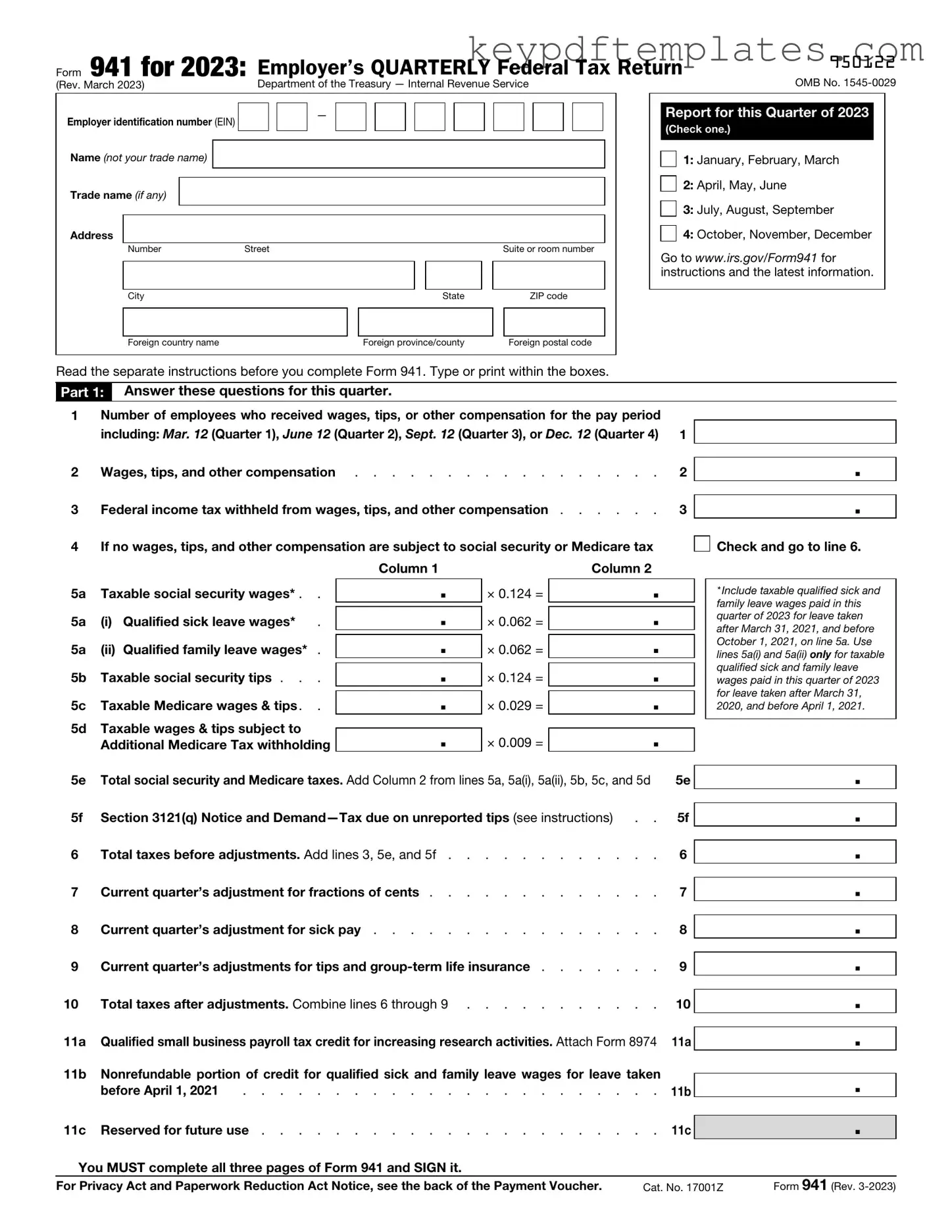

Get IRS 941 Form

Key takeaways

When it comes to filling out and using the IRS 941 form, understanding its purpose and requirements is essential for businesses. Here are some key takeaways to keep in mind:

- Quarterly Reporting: The IRS 941 form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks on a quarterly basis.

- Accurate Information: Ensure all information, including employee wages and tax amounts, is accurate to avoid penalties and interest from the IRS.

- Filing Deadlines: Be aware of the quarterly deadlines for filing the form. Missing these deadlines can lead to fines.

- Record Keeping: Maintain thorough records of your payroll and tax payments. This documentation is vital if the IRS requests it or if discrepancies arise.

- Electronic Filing: Consider filing electronically. It can simplify the process, reduce errors, and often provides quicker confirmation of receipt.

By keeping these points in mind, you can navigate the IRS 941 form with greater ease and confidence.

Similar forms

- IRS Form 940: This form is used to report annual unemployment taxes. Like Form 941, it is essential for employers to report their tax obligations, but it focuses specifically on the Federal Unemployment Tax Act (FUTA). Both forms require accurate calculations of taxes owed and are filed annually or quarterly.

- IRS Form W-2: This form summarizes an employee's annual wages and the taxes withheld. Similar to Form 941, which reports quarterly payroll taxes, the W-2 is crucial for employees to file their income taxes accurately. Both documents serve to ensure proper tax reporting and compliance.

- IRS Form W-3: This is a transmittal form that accompanies Form W-2 when submitted to the IRS. It provides a summary of all W-2 forms issued by an employer. Like Form 941, it helps the IRS track payroll tax contributions and ensures that the information is reported correctly.

- IRS Form 1099-MISC: This form reports payments made to independent contractors and other non-employees. While Form 941 focuses on employee wages and taxes, both forms are vital for tax reporting and compliance for businesses that engage workers in different capacities.

- IRS Form 944: This form is for small employers who report their annual payroll taxes instead of quarterly. It is similar to Form 941 in purpose but designed for those with lower payroll tax liabilities, making compliance easier for smaller businesses.

- Commercial Lease Agreement: This document is crucial for landlords and tenants in Florida, outlining essential terms regarding rental agreements. For more information, visit allfloridaforms.com/.

- IRS Form 945: This form is used to report backup withholding on payments made to non-employees. Like Form 941, it requires accurate reporting of taxes withheld but is specifically for non-employee payments, ensuring that all tax obligations are met.

Misconceptions

The IRS Form 941 is a crucial document for employers, but many misconceptions surround it. Understanding these myths can help employers navigate their responsibilities more effectively. Here are seven common misconceptions about the IRS 941 form:

-

Form 941 is only for large businesses.

This is not true. Any employer who pays wages to employees must file Form 941, regardless of the size of the business. This includes small businesses and even self-employed individuals who have employees.

-

Form 941 is filed only once a year.

In reality, Form 941 is filed quarterly. Employers must submit this form four times a year to report wages paid and taxes withheld from employees.

-

Filing Form 941 is optional.

This is a misconception. Filing Form 941 is a requirement for employers. Failure to file can result in penalties and interest on unpaid taxes.

-

Only payroll taxes are reported on Form 941.

While payroll taxes are a significant component, Form 941 also requires reporting of income taxes withheld from employees' wages. Thus, it encompasses a broader range of tax responsibilities.

-

Once filed, Form 941 cannot be amended.

Contrary to this belief, employers can amend Form 941 if they discover errors. Form 941-X is specifically designed for this purpose, allowing corrections to be made.

-

All employers have the same filing deadlines for Form 941.

This is misleading. While most employers follow the same quarterly deadlines, there can be variations based on specific circumstances, such as the type of business or tax year.

-

Form 941 is only for federal tax purposes.

Many assume this form is solely for federal tax reporting. However, some states also require similar reporting, so employers should be aware of their state obligations as well.

By clarifying these misconceptions, employers can better understand their obligations and ensure compliance with tax laws.

More PDF Templates

Complaint for Divorce Form Michigan - It includes essential details about the court, including its address and contact number.

USCIS Form I-864 - The I-864 establishes a legally binding agreement between the sponsor and the government.

For those interested in ensuring a smooth transaction, utilizing a Texas RV Bill of Sale is crucial, and you can find an excellent template at https://txtemplate.com/rv-bill-of-sale-pdf-template to simplify the process and meet all necessary legal requirements.

Acord 130 - Billing and audit information is prominently featured to ensure clarity on payment plans.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. |

| Filing Frequency | Employers must file Form 941 quarterly, meaning it is due four times a year. |

| Due Dates | The form is generally due on the last day of the month following the end of each quarter. For example, the due date for the first quarter is April 30. |

| Penalties | Failure to file Form 941 on time can result in penalties, which may accumulate over time if not addressed. |

| State-Specific Forms | Some states have their own forms for reporting similar information, governed by state tax laws. For example, California has the DE 9 form, governed by California Revenue and Taxation Code. |

Documents used along the form

The IRS Form 941 is a crucial document for employers, used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. However, several other forms and documents are often used in conjunction with Form 941 to ensure compliance with federal tax obligations. Below is a list of these related forms and documents, each serving a specific purpose in the payroll and tax reporting process.

- Form W-2: This form reports an employee's annual wages and the amount of taxes withheld from their paycheck. Employers must provide a W-2 to each employee by January 31 of the following year.

- Form W-3: This is a summary form that accompanies Form W-2 when submitted to the Social Security Administration. It reports the total earnings and taxes withheld for all employees.

- Form 940: Employers use this form to report their annual Federal Unemployment Tax Act (FUTA) tax. It is filed annually and is separate from the quarterly reporting of Form 941.

- Form 1099-MISC: This form is used to report payments made to independent contractors and other non-employees. It is important for businesses that hire freelancers or contractors.

- Form 944: Smaller employers may use this annual form to report payroll taxes instead of filing Form 941 quarterly. It simplifies the process for those with lower payroll tax liabilities.

- Form 1096: This is a summary form that accompanies certain information returns, including Form 1099. It is filed with the IRS to report the total amount of income reported on the 1099s.

- Form 941-X: This form is used to amend a previously filed Form 941. Employers may need to correct errors in tax reporting or adjustments for prior quarters.

- Florida Notice to Quit: This form is essential for landlords to communicate their intention to end a lease agreement, detailing the reasons for eviction and giving tenants time to vacate the property. For further assistance, visit Florida PDF Forms.

- Form 720: Employers may need this form to report and pay certain federal excise taxes. It is filed quarterly and covers various taxable activities.

- Form SS-4: This form is used to apply for an Employer Identification Number (EIN), which is necessary for reporting taxes and hiring employees.

Understanding these forms and their interconnections is essential for employers to maintain compliance with tax laws. Properly managing these documents can help avoid penalties and ensure smooth operations in payroll and tax reporting processes.