Get IRS Schedule C 1040 Form

Key takeaways

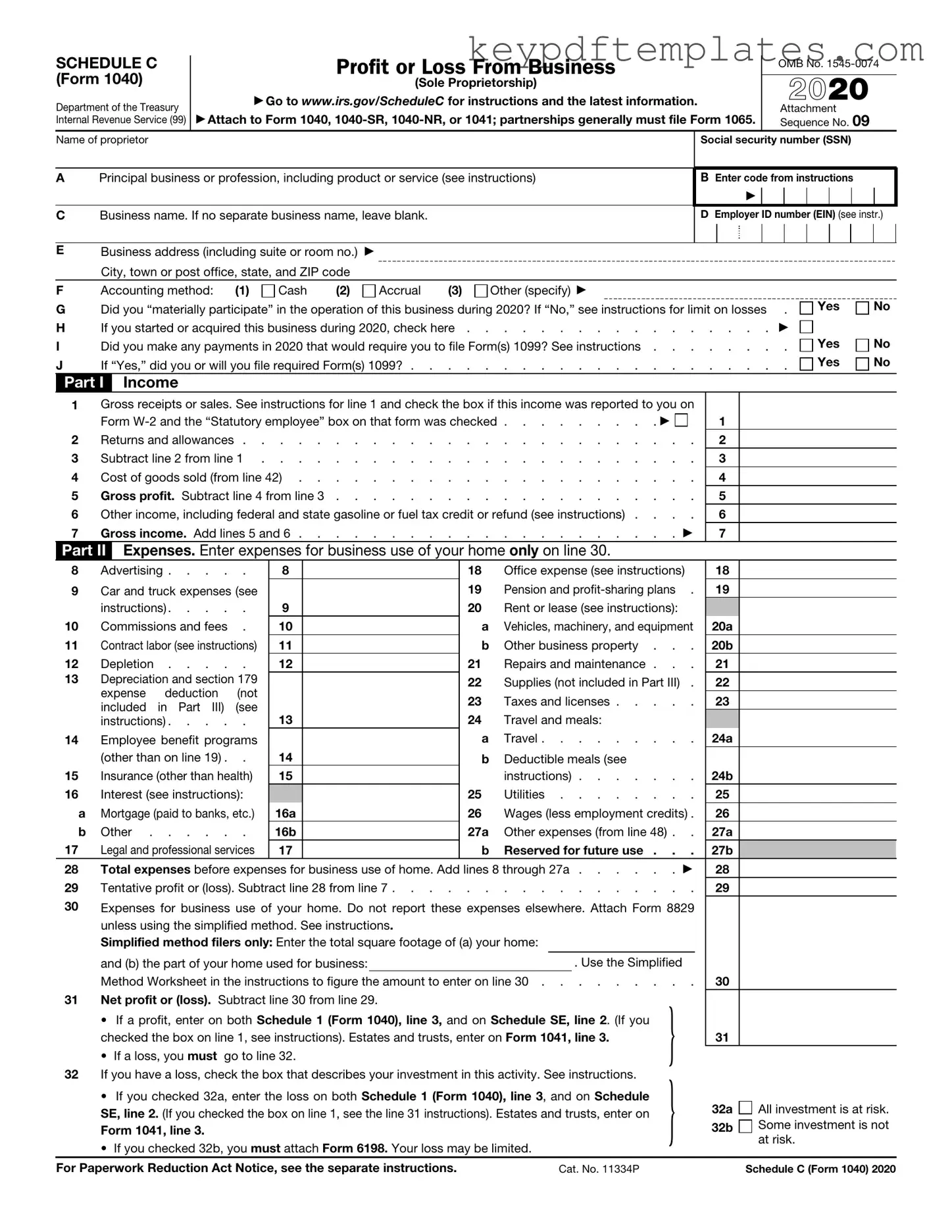

Filling out the IRS Schedule C (Form 1040) is essential for self-employed individuals or sole proprietors. Here are key takeaways to consider:

- Purpose: Schedule C is used to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

- Eligibility: Anyone who is self-employed or a sole proprietor must file this form, regardless of the business's size.

- Income Reporting: Report all income earned from your business, including cash, checks, and credit card payments.

- Expenses: You can deduct various business expenses, such as rent, utilities, and supplies, to reduce taxable income.

- Record Keeping: Maintain accurate records of all income and expenses to support the information reported on Schedule C.

- Net Profit or Loss: The form calculates your net profit or loss, which is then transferred to your Form 1040.

- Self-Employment Tax: If you have a net profit, you may also need to file Schedule SE to calculate self-employment tax.

- Filing Deadline: Schedule C is typically due on the same date as your personal income tax return, usually April 15.

Understanding these key points can help ensure accurate and timely filing of your taxes, minimizing the risk of errors or audits.

Similar forms

- Form 1040: This is the main individual income tax return form. Like Schedule C, it is used to report income, deductions, and credits to determine your tax liability. Schedule C is filed alongside Form 1040 when reporting income from self-employment.

- Schedule SE: This form is used to calculate self-employment tax. Individuals who file Schedule C must also complete Schedule SE to determine how much they owe in self-employment taxes, which cover Social Security and Medicare.

- Form 1065: This is the partnership return. Similar to Schedule C, it reports income and expenses, but it is specifically for partnerships. Both forms require detailed reporting of business income and expenses.

- Articles of Incorporation: To establish a corporation in New York, it is essential to complete the Articles of Incorporation form, which can be accessed through NY PDF Forms.

- Form 1120: This form is for corporate tax returns. Like Schedule C, it reports income and expenses, but it is used by corporations instead of sole proprietorships. Both forms share the goal of accurately detailing financial performance.

- Form 990: Nonprofit organizations use this form to report their financial information. While Schedule C is for individuals, both require comprehensive reporting of income and expenses, ensuring transparency in financial dealings.

- Schedule E: This form is used to report supplemental income and loss, such as rental income. Like Schedule C, it requires detailed reporting of income and expenses related to specific activities, although it focuses on different types of income.

Misconceptions

Many individuals have misconceptions about the IRS Schedule C (Form 1040), which is used by sole proprietors to report income or loss from their business. Understanding these misconceptions can help you navigate your tax obligations more effectively.

- Misconception 1: Schedule C is only for businesses with employees.

- Misconception 2: You cannot deduct business expenses if you operate from home.

- Misconception 3: All income must be reported on Schedule C.

- Misconception 4: You can only deduct expenses that have receipts.

- Misconception 5: Filing Schedule C is optional for small businesses.

- Misconception 6: You cannot file Schedule C if your business is not profitable.

This is incorrect. Schedule C is primarily for sole proprietors, regardless of whether they have employees or not. If you operate a business as a single owner, you need to file this form to report your income and expenses.

Many believe that home-based businesses cannot claim expenses. In reality, you can deduct certain expenses related to your home office, such as utilities and internet costs, as long as they are directly tied to your business operations.

While most business income goes on Schedule C, some income might be reported elsewhere. For example, if you receive 1099 forms for freelance work, that income should still be reported on Schedule C, but certain types of income may have different reporting requirements.

This is not entirely true. While having receipts is ideal for substantiating your expenses, you can still claim deductions based on reasonable estimates for certain expenses, such as mileage or some home office costs, as long as you can justify them.

This misconception can lead to serious consequences. If you are operating a business and earning income, you are required to file Schedule C. Failing to do so can result in penalties and interest from the IRS.

Even if your business incurs a loss, you still need to file Schedule C. Reporting a loss can provide tax benefits, such as offsetting other income, which may lower your overall tax liability.

More PDF Templates

How to Upgrade Other Than Honorable Discharge - The DD 149 can be submitted by the veteran or by a representative on their behalf.

When considering a divorce in Georgia, it is important to understand the necessary procedures and documentation involved, which can be facilitated by utilizing resources such as the Georgia PDF. This resource provides guidance on filling out the required Georgia Divorce form, ensuring all essential details are accurately captured for a smoother divorce process.

Make a Gift Certificate - A signed gift letter can serve as proof of funds when applying for a home loan.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used by sole proprietors to report income or loss from their business activities. This form helps in calculating the net profit or loss, which is then transferred to the individual’s tax return. |

| Eligibility | Only individuals who operate a business as a sole proprietorship can use Schedule C. This includes freelancers, independent contractors, and single-member LLCs that have not elected to be taxed as a corporation. |

| Filing Deadline | Schedule C must be filed along with Form 1040 by the tax deadline, which is typically April 15th of each year. If the deadline falls on a weekend or holiday, it is extended to the next business day. |

| Governing Law | Schedule C is governed by federal tax laws under the Internal Revenue Code (IRC). Additionally, state-specific regulations may apply based on the state where the business operates, which can affect state income tax filings. |

Documents used along the form

When filing taxes as a self-employed individual, the IRS Schedule C (Form 1040) is essential for reporting income and expenses from your business. However, several other forms and documents may accompany it to ensure accurate reporting and compliance. Here’s a list of common documents that are often used alongside Schedule C.

- Form 1040: This is the standard individual income tax return form. It summarizes all income, deductions, and credits for the taxpayer.

- Schedule SE: This form calculates self-employment tax, which is necessary for those who earn income from self-employment.

- Form 8829: This form is used to claim expenses for business use of your home, allowing you to deduct certain home-related expenses.

- Form 4562: This document is for reporting depreciation and amortization of business assets, which can help reduce taxable income.

- Last Will and Testament Form: To ensure your final wishes are documented, consult the comprehensive Last Will and Testament form guidelines for clear instructions on asset distribution.

- Form 1099-MISC: If you received payments from clients or other businesses, this form reports those payments to the IRS.

- Form 1099-NEC: Similar to the 1099-MISC, this form specifically reports non-employee compensation, often used for freelancers and independent contractors.

- Schedule A: This is used for itemizing deductions, which may include business-related expenses if they exceed the standard deduction.

- Form W-2: If you have employees, this form reports wages paid and taxes withheld, which is necessary for employer tax obligations.

- State Tax Forms: Depending on your state, you may need additional forms for state income tax reporting, which varies by location.

Each of these forms plays a vital role in ensuring that your tax return is complete and accurate. Gathering the necessary documents ahead of time can streamline the filing process and help avoid potential issues with the IRS.