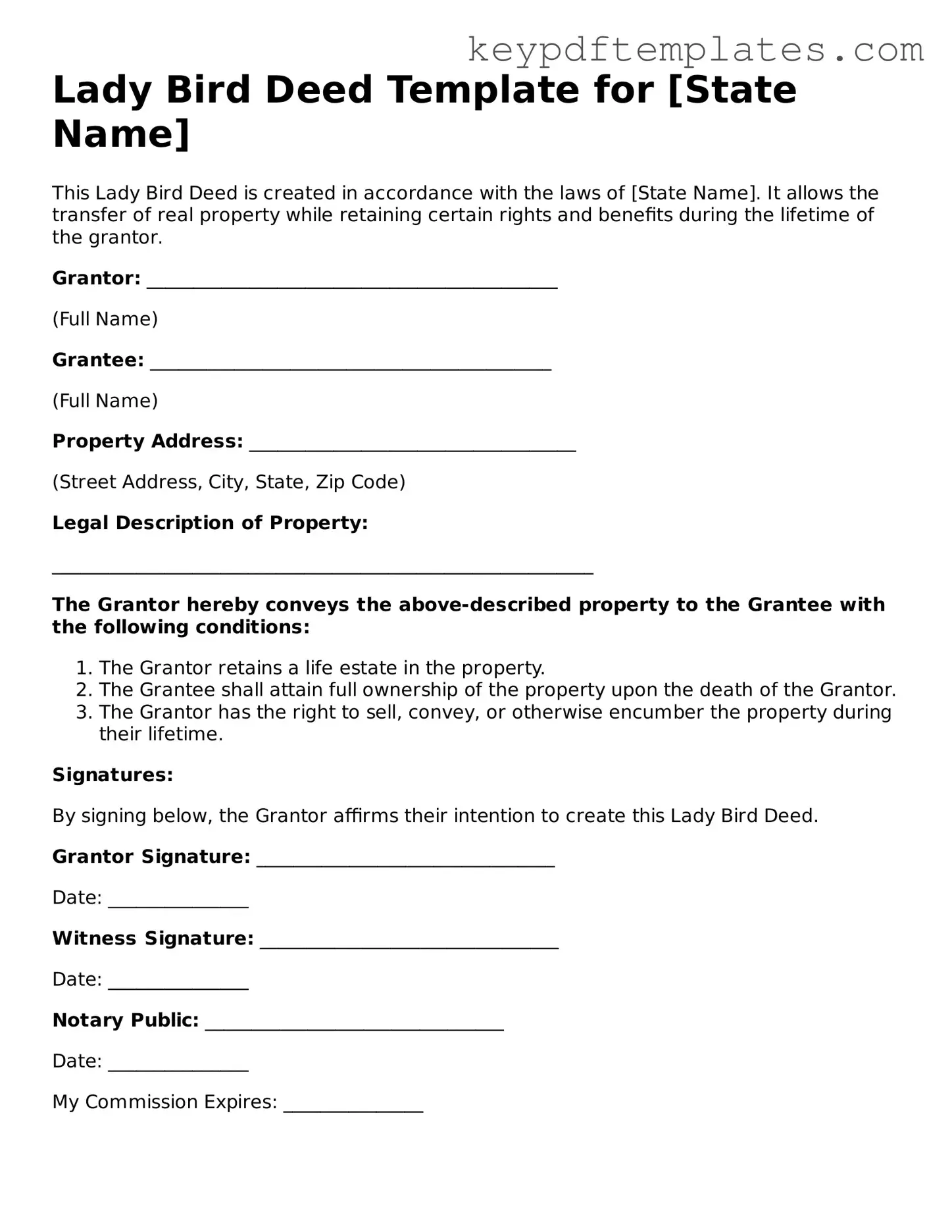

Printable Lady Bird Deed Template

Lady Bird Deed - Tailored for State

Key takeaways

Understanding the Lady Bird Deed can simplify the transfer of property while retaining certain rights. Here are some key takeaways to consider:

- The Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining the right to live in and control the property during their lifetime.

- This type of deed avoids probate, making the transfer process smoother and faster for your heirs.

- It is important to ensure that the deed is properly executed and recorded with the local county clerk's office to be legally effective.

- Beneficiaries receive the property with a "step-up" in basis, which can help reduce capital gains taxes when they sell the property.

- Property owners can revoke or change the deed at any time before their passing, providing flexibility and peace of mind.

- Consulting with a legal professional can help clarify the specific implications and requirements of a Lady Bird Deed in your state.

- Ensure that all parties involved understand the terms of the deed to prevent future disputes among beneficiaries.

Similar forms

The Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. Several other documents serve similar purposes in estate planning and property transfer. Here are eight documents that share similarities with the Lady Bird Deed:

- Will: A legal document that outlines how a person's assets will be distributed after their death. Like the Lady Bird Deed, it allows for the transfer of property but does not take effect until the individual passes away.

- Trust: A fiduciary arrangement where a trustee holds and manages property for the benefit of beneficiaries. Similar to the Lady Bird Deed, a trust can help avoid probate and provide control over asset distribution.

- Transfer on Death Deed (TOD): This document allows property owners to designate beneficiaries who will receive the property upon their death. It functions similarly to a Lady Bird Deed by facilitating a smooth transfer without probate.

- Quitclaim Deed: A legal instrument used to transfer interest in real property. While it does not provide the same retained rights as a Lady Bird Deed, it allows for the straightforward transfer of property ownership.

- Life Estate Deed: This deed creates a life estate for the property owner, allowing them to live in the property for their lifetime, with the remainder going to another party. Like the Lady Bird Deed, it allows for the transfer of ownership while retaining use rights.

- Durable Power of Attorney: A durable power of attorney is essential for ensuring that your financial and legal decisions can be managed by a trusted person if you become unable to do so. It is particularly important in Georgia, where you can find more information on the process by visiting Georgia PDF.

- Joint Tenancy Deed: This form of property ownership allows two or more individuals to own property together, with rights of survivorship. It shares the characteristic of transferring property rights upon death, similar to the Lady Bird Deed.

- Power of Attorney: This document grants someone the authority to act on behalf of another person regarding financial and legal matters. While it does not transfer property directly, it can facilitate property management during the grantor's lifetime, akin to the retained rights in a Lady Bird Deed.

- Beneficiary Designation: Commonly used for financial accounts and insurance policies, this document allows individuals to name beneficiaries who will receive assets upon their death. Like the Lady Bird Deed, it simplifies the transfer process and avoids probate.

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, is a legal instrument that allows property owners to transfer their property to beneficiaries while retaining certain rights. However, several misconceptions surround this deed. Below is a list of common misunderstandings.

- It eliminates the need for a will. Many believe that using a Lady Bird Deed means a will is unnecessary. In reality, while the deed can simplify the transfer of property, a will may still be needed for other assets and matters.

- It protects the property from creditors. Some think that a Lady Bird Deed provides complete protection from creditors. However, this is not the case. Creditors may still have claims against the property, especially if the owner has outstanding debts.

- It is only for elderly individuals. There is a misconception that only seniors can benefit from a Lady Bird Deed. In fact, anyone who owns property can use this deed, regardless of age, to facilitate estate planning.

- It automatically avoids probate. Many people assume that all properties transferred through a Lady Bird Deed automatically avoid probate. While the deed can help streamline the process, it does not guarantee avoidance in all situations.

- It transfers ownership immediately. Some individuals believe that a Lady Bird Deed transfers ownership right away. In truth, the property owner retains control and ownership during their lifetime, with the transfer occurring only upon their death.

- It cannot be revoked. A common myth is that once a Lady Bird Deed is executed, it cannot be changed or revoked. This is incorrect; the grantor retains the right to modify or revoke the deed at any time before death.

- It is the same as a traditional life estate deed. Many confuse a Lady Bird Deed with a traditional life estate deed. Unlike a traditional deed, the Lady Bird Deed allows the grantor to retain the right to sell or mortgage the property without the consent of the beneficiaries.

- It has no tax implications. Some people believe that using a Lady Bird Deed avoids all tax implications. However, there can be tax consequences related to capital gains and property taxes that should be considered.

Other Lady Bird Deed Types:

Trust Deed Sample - Different states may have unique requirements for the content of a Deed of Trust.

When engaging in a trailer sale, it is important to utilize the appropriate legal documents, such as the Florida PDF Forms, to ensure a proper transfer of ownership and avoid any future disputes.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of property deed that allows property owners to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. |

| Retained Rights | With a Lady Bird Deed, the property owner retains the right to sell, lease, or mortgage the property without needing consent from the beneficiaries. |

| Probate Avoidance | This deed allows for the property to pass directly to beneficiaries upon the owner's death, thus avoiding the probate process. |

| State-Specific Law | Lady Bird Deeds are primarily recognized in states like Florida and Texas, governed by state laws that outline their use and validity. |

| Tax Implications | Transferring property via a Lady Bird Deed can have favorable tax implications, such as avoiding capital gains taxes for beneficiaries. |

| Revocation | The property owner can revoke or change the Lady Bird Deed at any time during their lifetime, providing flexibility in estate planning. |

| Limitations | Not all states recognize Lady Bird Deeds, and there may be limitations on how they can be used, particularly concerning Medicaid eligibility. |

Documents used along the form

The Lady Bird Deed is a unique legal document that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. When preparing this deed, several other forms and documents may also be necessary to ensure a smooth and legally sound transfer of property. Here is a list of commonly used documents that often accompany the Lady Bird Deed.

- Quitclaim Deed: This document transfers any interest the grantor has in a property without making any guarantees about the title. It is often used to clear up title issues or to transfer property between family members.

- Warranty Deed: Unlike a quitclaim deed, a warranty deed guarantees that the grantor holds clear title to the property and has the right to transfer it. This document provides protection to the grantee against any future claims.

- Texas Form: This essential document is crucial for various legal and administrative processes within the state. Before you start filling it out, https://txtemplate.com/texas-pdf-template/ ensure you have all the relevant details ready to avoid any ambiguities.

- Affidavit of Heirship: This sworn statement identifies the heirs of a deceased property owner. It can help establish ownership when the property is passed down without a will.

- Power of Attorney: This document grants someone the authority to act on behalf of another person in legal or financial matters. It can be crucial if the property owner is unable to sign documents themselves.

- Living Will: A living will outlines a person's wishes regarding medical treatment in situations where they cannot communicate. While not directly related to property transfer, it can be important for overall estate planning.

- Trust Agreement: A trust agreement creates a legal entity that holds property for the benefit of designated beneficiaries. This can help manage assets and avoid probate.

- Estate Planning Documents: These include wills and other documents that outline how a person's assets will be distributed after their death. They work alongside the Lady Bird Deed to ensure comprehensive planning.

- Property Tax Exemption Application: If applicable, this document can be submitted to claim exemptions for property taxes based on ownership changes, particularly if the property is intended to be a primary residence for a beneficiary.

Understanding these accompanying documents can simplify the process of property transfer and help ensure that all legal requirements are met. Each document serves a distinct purpose, contributing to a comprehensive estate plan that protects the interests of all parties involved.