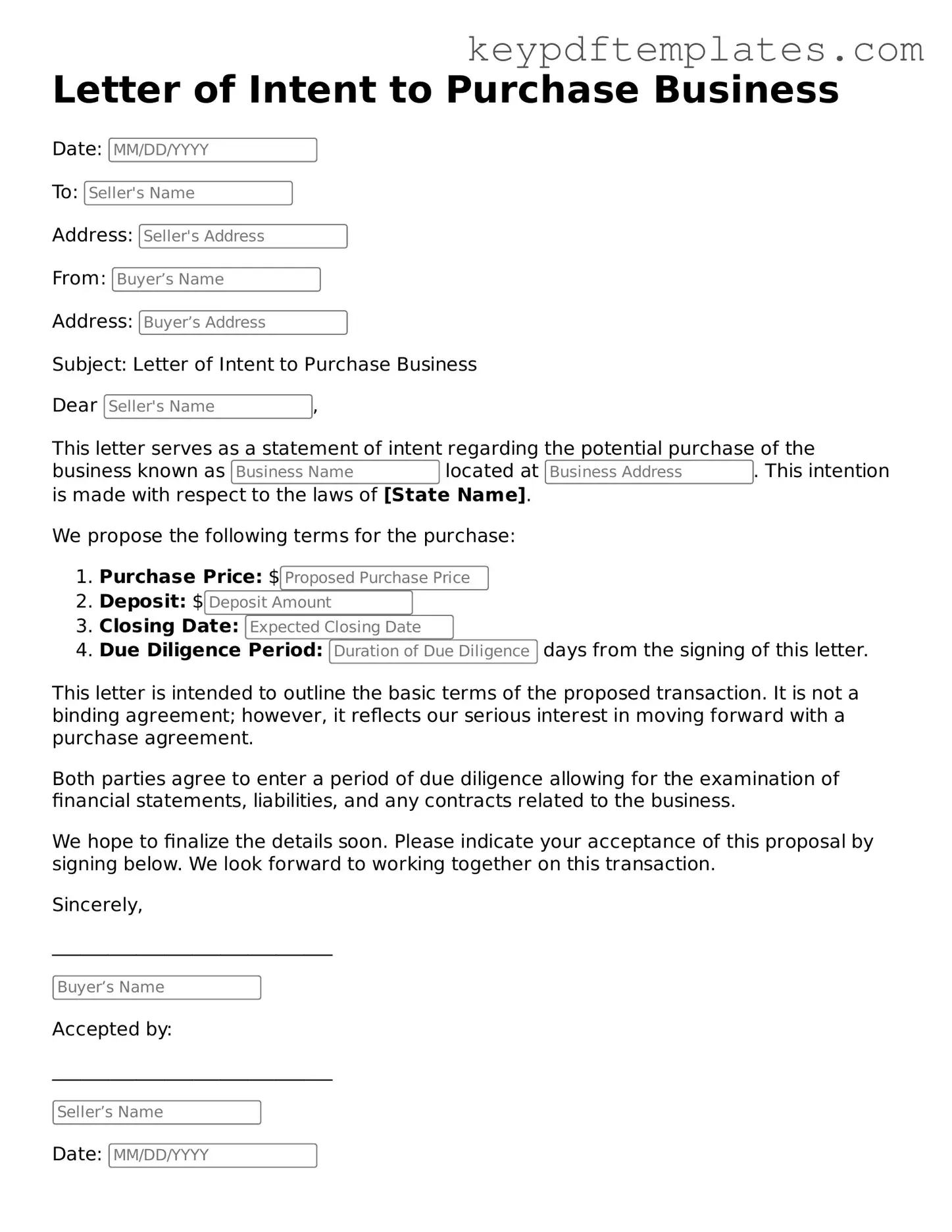

Printable Letter of Intent to Purchase Business Template

Key takeaways

When filling out and using the Letter of Intent to Purchase Business form, consider the following key takeaways:

- Clarity is Essential: Clearly state your intentions and the terms of the purchase. Ambiguity can lead to misunderstandings later in the process.

- Detail the Purchase Price: Specify the proposed purchase price and any conditions attached to it. This helps set expectations for both parties.

- Outline Due Diligence: Include a timeline for due diligence. This allows both parties to prepare and ensures that the process moves forward smoothly.

- Legal Considerations: While the Letter of Intent is not a binding contract, it may have legal implications. Consider consulting with a legal professional to ensure compliance with relevant laws.

Similar forms

- Purchase Agreement: This document outlines the terms and conditions of the sale, similar to a Letter of Intent, but it is more detailed and legally binding.

- Non-Disclosure Agreement (NDA): Like a Letter of Intent, an NDA protects sensitive information shared during negotiations, ensuring confidentiality.

- Term Sheet: A term sheet provides a summary of the key terms of a deal, similar to a Letter of Intent, but typically less formal and detailed.

Homeschool Letter of Intent: This formal document notifies the local school system of a parent's decision to homeschool their children. It is crucial for compliance with state regulations and can be found in detail at Homeschool Letter of Intent.

- Memorandum of Understanding (MOU): An MOU expresses a mutual agreement between parties, similar in purpose to a Letter of Intent, but usually non-binding.

- Letter of Interest: This document indicates a party's interest in a transaction, much like a Letter of Intent, but often less formal and without specific terms.

- Due Diligence Checklist: This document outlines the information needed for a thorough evaluation of the business, similar to a Letter of Intent in that it helps clarify intentions before finalizing a deal.

- Business Proposal: A business proposal presents a plan for a transaction, similar to a Letter of Intent, but it focuses more on the benefits and logistics rather than the terms of the sale.

Misconceptions

When considering a Letter of Intent (LOI) to purchase a business, many individuals and organizations hold misconceptions that can lead to misunderstandings. Here are eight common misconceptions about this important document:

- 1. An LOI is a legally binding contract. Many believe that once an LOI is signed, it creates a binding agreement. In reality, while some terms may be binding, most LOIs are intended to outline intentions and facilitate negotiations rather than serve as a final contract.

- 2. An LOI guarantees the sale of the business. A signed LOI does not guarantee that the sale will occur. It simply expresses the buyer's interest and outlines the key terms for discussion. The final sale is contingent upon further negotiations and due diligence.

- 3. All terms in an LOI are negotiable. While many terms can be negotiated, some may be more rigid based on the seller's requirements or market conditions. Understanding which terms are flexible is crucial during the negotiation process.

- 4. The LOI is only for the buyer's benefit. Some think that the LOI only serves the buyer's interests. However, it also protects the seller by ensuring that the buyer is serious and committed to the process, which can help avoid wasting time and resources.

- 5. An LOI is not necessary for small transactions. Many assume that small business purchases do not require an LOI. However, having a written expression of intent can clarify expectations and prevent misunderstandings, regardless of the transaction size.

- 6. Verbal agreements are enough. Relying solely on verbal discussions can lead to confusion and disputes. An LOI provides a clear written record of the agreed-upon terms, which can be referenced later if needed.

- 7. An LOI is a final step in the purchasing process. Some view the LOI as the last step before closing the deal. In fact, it is just the beginning of a more detailed negotiation and due diligence process that will follow.

- 8. The LOI can be ignored once signed. Once an LOI is signed, it should not be ignored. It serves as a roadmap for the negotiations that follow and can influence the final agreement. Parties should adhere to the terms outlined in the LOI as they proceed.

Understanding these misconceptions can help both buyers and sellers navigate the complexities of purchasing a business more effectively. Clarity and communication are essential in this process.

Other Letter of Intent to Purchase Business Types:

Loi Investment - Can facilitate expert consultations and advice related to the investment.

Filing the proper documentation is crucial for any parent, and understanding the Colorado Homeschool Letter of Intent process ensures that educational regulations are met effectively and efficiently.

Lease Proposal - A Letter of Intent can cover zoning requirements relevant to the property.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | A Letter of Intent to Purchase Business outlines the preliminary agreement between a buyer and a seller, indicating the buyer's interest in acquiring the business. |

| Non-Binding Nature | This document is typically non-binding, meaning it expresses intent rather than creating a legal obligation to complete the sale. |

| Governing Law | In the United States, the governing law for such agreements varies by state. For example, in California, the relevant laws include the California Commercial Code. |

| Key Components | Common elements of the letter include purchase price, terms of payment, and timelines for due diligence and closing. |

Documents used along the form

When considering the purchase of a business, a Letter of Intent (LOI) serves as a starting point for negotiations. However, several other important documents often accompany the LOI to ensure that both parties are protected and understand the terms of the transaction. Below are five commonly used forms and documents that complement the Letter of Intent.

- Purchase Agreement: This is a detailed contract that outlines the specific terms and conditions of the sale. It includes information about the purchase price, payment terms, and any contingencies that must be met before the sale is finalized.

- Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document ensures that sensitive information shared during negotiations remains confidential. It protects both the buyer and seller from potential misuse of proprietary information.

- Homeschool Letter of Intent: This form notifies the local school district of a family's decision to homeschool, ensuring compliance with educational guidelines. For more information, visit https://smarttemplates.net/fillable-california-homeschool-letter-of-intent/.

- Due Diligence Checklist: This is a list of items that the buyer needs to review before completing the purchase. It may include financial statements, tax returns, employee contracts, and other relevant documents that help assess the business's value and risks.

- Financing Agreement: If the buyer requires financing to complete the purchase, this document outlines the terms of the loan or financing arrangement. It includes details about interest rates, repayment schedules, and any collateral involved.

- Bill of Sale: This document serves as proof of the transfer of ownership from the seller to the buyer. It includes a description of the business and its assets, as well as the purchase price, and is typically signed at the closing of the sale.

These documents work together with the Letter of Intent to create a clear framework for the business purchase process. Having them in place can help facilitate a smoother transaction and provide clarity for both parties involved.