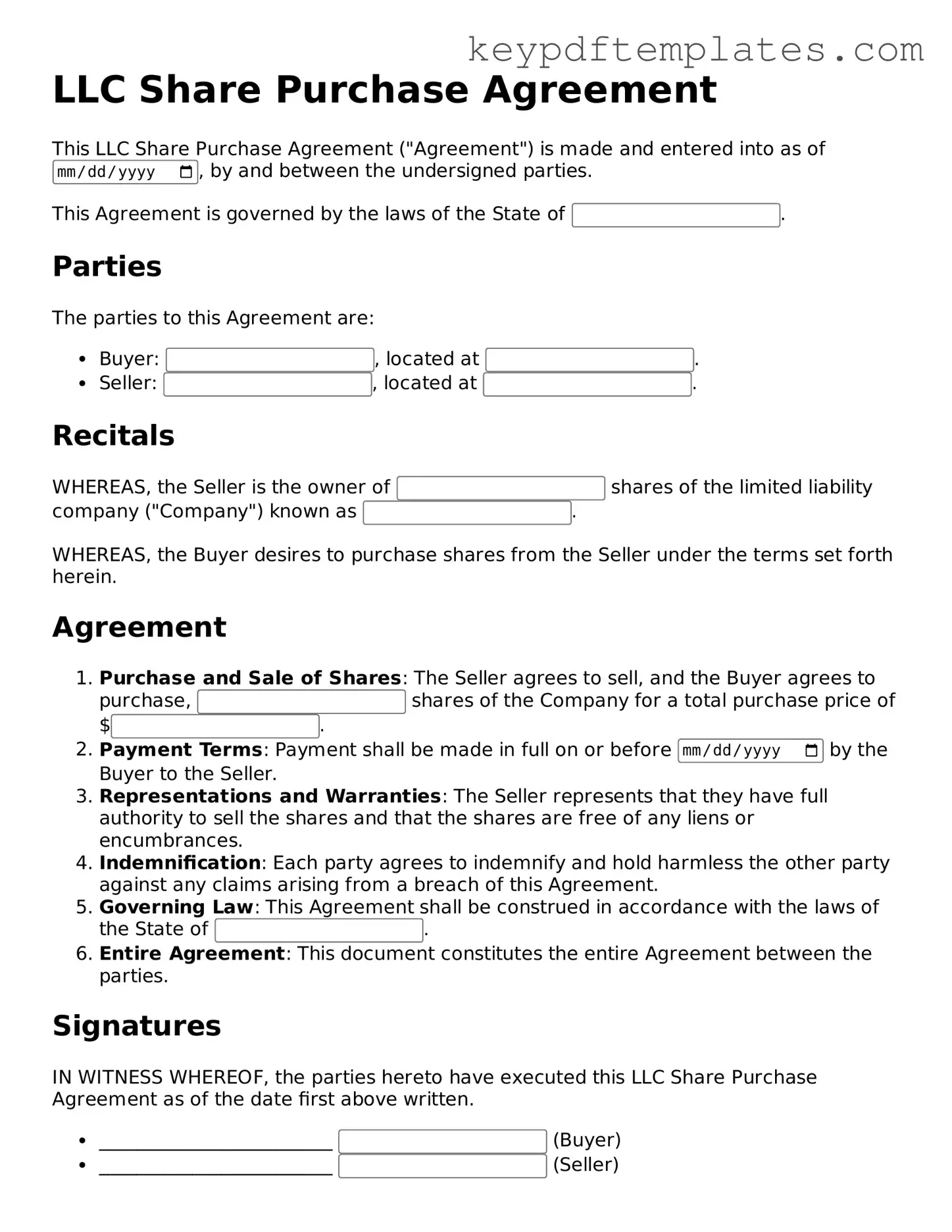

Printable LLC Share Purchase Agreement Template

Key takeaways

When filling out and using the LLC Share Purchase Agreement form, it’s important to keep a few key points in mind. Here are some essential takeaways:

- Understand the Purpose: This agreement outlines the terms of the sale of ownership shares in a limited liability company (LLC). It serves to protect both the buyer and the seller by clearly defining rights and obligations.

- Accurate Information: Ensure that all details, such as the names of the parties involved, the number of shares being sold, and the purchase price, are accurate. Inaccuracies can lead to disputes later on.

- Review Terms Thoroughly: Pay close attention to the terms and conditions outlined in the agreement. This includes payment methods, timelines, and any warranties or representations made by either party.

- Seek Legal Guidance: It’s wise to consult with a legal professional before finalizing the agreement. They can provide valuable insights and help ensure that your interests are protected.

Similar forms

Stock Purchase Agreement: This document outlines the terms under which one party purchases stock from another. Similar to an LLC Share Purchase Agreement, it specifies the purchase price, payment terms, and representations of the seller regarding the stock being sold.

Asset Purchase Agreement: In this agreement, one party buys specific assets of a business rather than its stock. Like the LLC Share Purchase Agreement, it details the assets being sold, the purchase price, and any liabilities that may be assumed by the buyer.

Membership Interest Purchase Agreement: This document is used when a buyer acquires a member's interest in an LLC. It shares similarities with the LLC Share Purchase Agreement in that it outlines the terms of the sale, including price and conditions, focusing specifically on membership interests.

- Durable Power of Attorney Form: For crucial decisions when you cannot act, consider our effective Durable Power of Attorney resources to ensure your wishes are carried out by someone you trust.

Joint Venture Agreement: This agreement establishes a partnership between two or more parties to undertake a specific project. While it differs in purpose, it includes terms and conditions similar to those found in an LLC Share Purchase Agreement, such as contributions, profit sharing, and responsibilities of each party.

Confidentiality Agreement: Often used alongside purchase agreements, this document protects sensitive information shared during negotiations. Like the LLC Share Purchase Agreement, it is crucial for maintaining privacy and trust between the parties involved.

Operating Agreement: While primarily governing the internal workings of an LLC, it can relate closely to an LLC Share Purchase Agreement by outlining how ownership interests can be transferred and what rights members have, ensuring clarity in ownership transitions.

Misconceptions

Understanding the LLC Share Purchase Agreement is crucial for anyone involved in the purchase or sale of shares in a limited liability company. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

-

All LLCs require a Share Purchase Agreement.

Not all LLCs have shares. Some operate as member-managed entities where ownership is defined by membership interests rather than shares. In such cases, a different type of agreement may be needed.

-

The agreement is only necessary for large transactions.

Even small transactions can benefit from a Share Purchase Agreement. This document helps clarify terms and protect the interests of both parties, regardless of the transaction size.

-

Once signed, the agreement cannot be changed.

While the agreement is a binding document, it can be amended if both parties agree to the changes in writing. Flexibility is often necessary as circumstances evolve.

-

It is the same as a standard contract.

While it is a type of contract, the LLC Share Purchase Agreement has specific provisions and language tailored to the transfer of ownership in an LLC. Understanding these nuances is important.

-

Legal assistance is not needed for drafting.

Although some may attempt to draft the agreement independently, legal assistance can ensure that all necessary provisions are included and that the document complies with state laws.

-

It protects only the buyer.

The agreement is designed to protect both the buyer and the seller. It outlines the rights and obligations of each party, ensuring that both sides are treated fairly.

-

Once the purchase is complete, the agreement is no longer relevant.

The agreement remains important even after the transaction is finalized. It serves as a reference for any future disputes or questions regarding the terms of the sale.

Addressing these misconceptions can help individuals navigate the complexities of LLC transactions with greater confidence and clarity.

Common Forms

Chic Fil a Jobs - Become part of a brand renowned for its customer loyalty and satisfaction.

The Texas form, a crucial document required for various legal and administrative processes within the state, serves as an official means to submit necessary information. This document is vital for residents engaging in activities ranging from business registration to personal legal matters. For a seamless experience, ensure you have all the relevant details ready before you start. To access a reliable template for assistance, visit txtemplate.com/texas-pdf-template and click the button below to begin filling out your form.

Business Credit Application Form - Verify any corporate structure changes before submitting.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | An LLC Share Purchase Agreement outlines the terms under which shares of an LLC are bought and sold. |

| Parties Involved | The agreement typically involves a seller, who owns the shares, and a buyer, who wishes to acquire them. |

| Purchase Price | The document specifies the price for which the shares will be sold, including payment terms. |

| Governing Law | The agreement is subject to the laws of the state where the LLC is registered, such as Delaware or California. |

| Representations and Warranties | Both parties make assurances about their authority to enter into the agreement and the condition of the shares. |

| Closing Conditions | The agreement outlines any conditions that must be met before the sale can be finalized. |

| Transfer of Ownership | It details how and when the ownership of the shares will be transferred from the seller to the buyer. |

| Confidentiality | Many agreements include clauses to protect sensitive information shared during the transaction. |

| Dispute Resolution | Provisions for how disputes will be handled, such as mediation or arbitration, are often included. |

| Amendments | The agreement usually specifies how it can be modified or amended after it has been signed. |

Documents used along the form

The LLC Share Purchase Agreement is a key document in the process of transferring ownership interests in a limited liability company. However, several other forms and documents are commonly used in conjunction with this agreement to ensure a smooth transaction. Below is a list of these important documents, along with a brief description of each.

- Operating Agreement: This document outlines the management structure and operating procedures of the LLC. It defines the rights and responsibilities of members and managers, serving as a foundational governance document.

- Membership Interest Assignment: This form is used to formally transfer ownership interests from one member to another. It specifies the percentage of ownership being transferred and is often required for record-keeping purposes.

- Due Diligence Checklist: This checklist helps the buyer assess the LLC's financial health and legal compliance. It typically includes items like financial statements, tax returns, and contracts.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this document protects sensitive information shared during the negotiation process. It ensures that both parties maintain confidentiality regarding proprietary information.

- Escrow Agreement: This agreement outlines the terms under which funds or documents are held by a neutral third party until all conditions of the sale are met. It provides security for both the buyer and seller during the transaction.

- Trailer Bill of Sale: This legal document is essential for the transfer of ownership of a trailer and includes critical details such as the identification number, make, model, and sale price. You can find the form at Florida PDF Forms.

- Purchase Price Allocation: This document details how the purchase price is allocated among the various assets of the LLC. It can have tax implications for both the buyer and seller.

- Tax Forms: Various tax forms may be required to report the sale of LLC interests to the IRS. These forms ensure compliance with tax obligations and help avoid future issues.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the final purchase price and any adjustments. It is typically reviewed and signed by both parties at closing.

- Indemnification Agreement: This agreement provides protection to the buyer against potential losses or liabilities that may arise after the sale. It outlines the responsibilities of the seller in the event of claims related to the LLC's past actions.

Understanding these documents is crucial for anyone involved in the purchase or sale of an LLC. Each plays a vital role in ensuring that the transaction is legally sound and that all parties are protected throughout the process.