Printable Loan Agreement Template

Loan Agreement - Tailored for State

Key takeaways

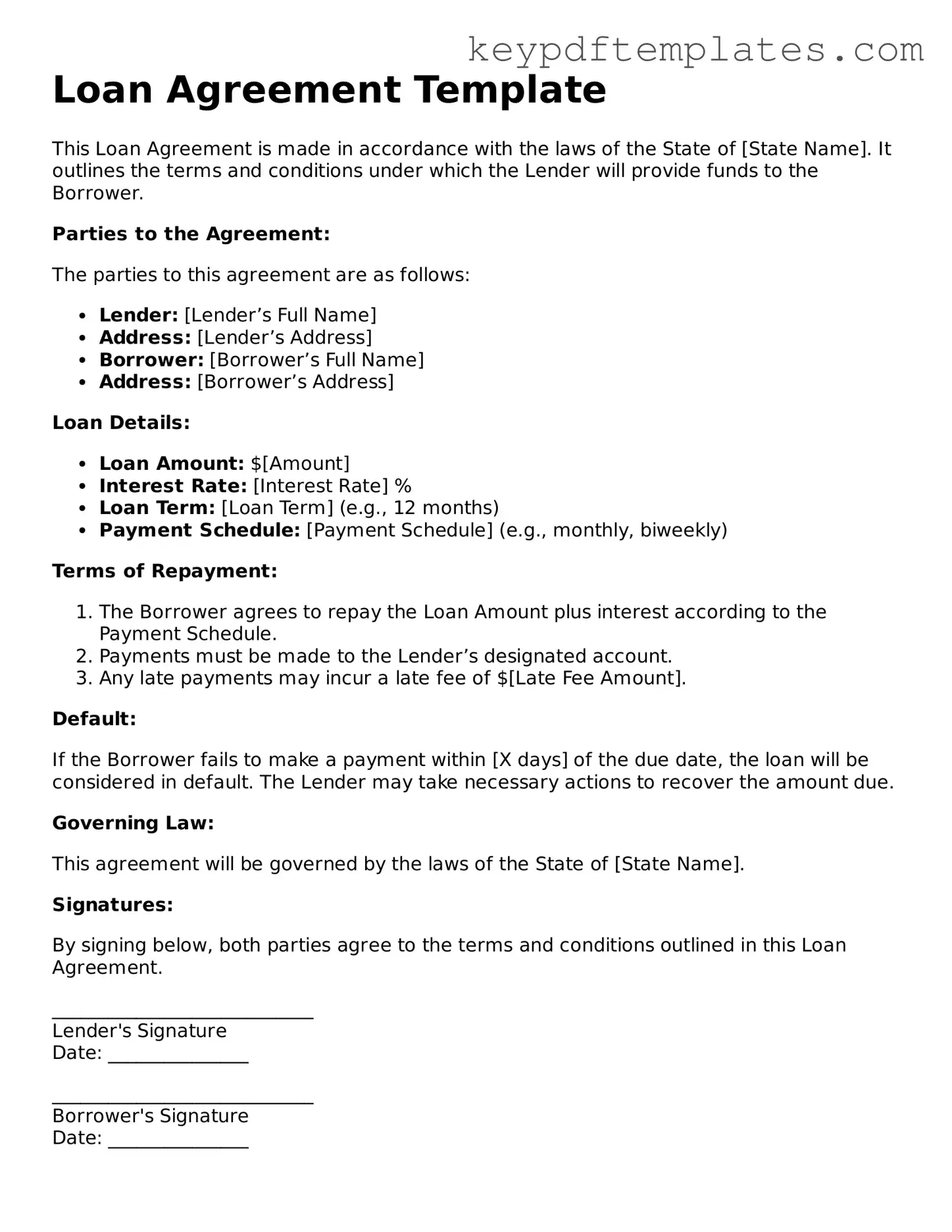

When dealing with a Loan Agreement form, understanding its components and implications is crucial for both borrowers and lenders. Here are some key takeaways to keep in mind:

- Identify the Parties: Clearly state the names and contact information of both the borrower and the lender. This ensures that all parties are properly recognized in the agreement.

- Loan Amount: Specify the exact amount being borrowed. This figure should be clear to avoid any misunderstandings later on.

- Interest Rate: Include the interest rate applicable to the loan. This can be fixed or variable, but it must be explicitly stated to avoid confusion.

- Repayment Terms: Outline the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the total duration of the loan.

- Late Fees: Define any penalties for late payments. This helps to encourage timely repayment and clarifies consequences for delays.

- Default Conditions: Clearly outline what constitutes a default on the loan. This could include missed payments or failure to meet other terms of the agreement.

- Collateral: If applicable, specify any collateral that secures the loan. This provides additional security for the lender in case of default.

- Governing Law: Indicate which state’s laws will govern the agreement. This is important in case of any legal disputes.

- Signatures: Ensure that both parties sign and date the agreement. This formalizes the contract and makes it legally binding.

By paying attention to these key elements, both borrowers and lenders can create a clear and effective Loan Agreement that protects their interests.

Similar forms

- Promissory Note: This document outlines the borrower's promise to repay a specific amount of money to the lender, detailing the terms of repayment, interest rates, and consequences of default.

- Mortgage Agreement: Similar to a loan agreement, this document secures a loan with real property. It includes terms regarding the property and the obligations of both the borrower and lender.

- Credit Agreement: This document specifies the terms under which a lender extends credit to a borrower, including limits on borrowing, interest rates, and repayment schedules.

- Lease Agreement: While primarily for renting property, a lease agreement shares similarities in outlining terms and conditions for use and payment, establishing the rights and responsibilities of both parties.

- Invoice Template - A useful tool for both individuals and businesses to create professional billing documents, similar to the Free And Invoice Pdf form, streamlining the invoicing process with essential details like items sold and payment terms.

- Security Agreement: This document creates a security interest in personal property, detailing the collateral and terms under which the lender can seize the property in case of default.

- Personal Guarantee: This document involves a third party agreeing to repay the loan if the primary borrower defaults, similar in intent to ensuring repayment.

- Loan Application: This document gathers information about the borrower and the loan request, establishing the basis for the loan agreement and assessing risk.

- Debt Settlement Agreement: This document outlines the terms under which a borrower agrees to settle a debt for less than the full amount owed, similar in negotiating terms between borrower and lender.

- Forbearance Agreement: This document temporarily suspends or reduces payments, detailing the terms under which a borrower may delay repayment, akin to modifications in a loan agreement.

Loan Agreement Categories

Misconceptions

Understanding loan agreements can be tricky. Here are some common misconceptions that people have about loan agreements:

- All loan agreements are the same. Each loan agreement is unique, tailored to the specific terms and conditions of the loan. They can vary widely based on the lender, the amount borrowed, and the purpose of the loan.

- You don’t need to read the loan agreement. It’s crucial to read the entire agreement. Knowing the terms helps you understand your rights and obligations.

- Signing a loan agreement means you can’t negotiate. Many terms can be negotiated, including interest rates and repayment schedules. Don’t hesitate to ask for changes.

- Loan agreements are only for large amounts. Even small loans can come with agreements. Always get the terms in writing, regardless of the amount.

- Once signed, you can’t change your mind. While it’s true that a signed agreement is binding, you may have options to refinance or renegotiate under certain circumstances.

- Loan agreements are only for personal loans. They are used for various types of loans, including business loans, mortgages, and student loans.

- All lenders are the same. Different lenders have different policies, fees, and interest rates. Researching your options can save you money.

- Defaulting on a loan has no consequences. Defaulting can lead to serious repercussions, including damage to your credit score and legal action.

- You don’t need a lawyer to review your loan agreement. While it’s not mandatory, having a lawyer review the agreement can help you spot potential issues.

- Loan agreements are a one-time deal. Many loans have ongoing obligations, and it’s important to stay informed about any changes to your agreement.

By clearing up these misconceptions, you can approach loan agreements with greater confidence and understanding.

Common Forms

Konami Decklist - Document any specific infractions to understand any discrepancies.

Partial Lien Release Florida - Instrumental in managing liens efficiently within construction finances.

Understanding the intricacies of the workers' compensation process is vital for both employees and employers; for those looking to acquire the necessary documentation, including the Georgia WC-3 form, you can find it through resources like Georgia PDF, ensuring you are equipped to address any claims accurately.

Release of Liability Ca Dmv - A legal way to confirm the sale and outline liability transfer on a vehicle.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. |

| Parties Involved | The form must clearly identify the lender and the borrower, including their legal names and contact information. |

| Governing Law | For state-specific forms, the governing law is typically the state where the borrower resides or where the loan is executed. |

| Repayment Terms | The form specifies the repayment schedule, including the amount, frequency, and due dates for payments. |

| Default Clauses | It includes provisions outlining the consequences if the borrower defaults on the loan. |

Documents used along the form

When entering into a loan agreement, several other forms and documents often accompany it. These documents provide additional information, clarify terms, and protect the interests of all parties involved. Below is a list of common documents associated with a loan agreement, along with brief descriptions of each.

- Promissory Note: This is a written promise from the borrower to repay the loan amount, detailing the terms of repayment, including interest rates and payment schedules.

- Loan Application: This document is completed by the borrower to provide the lender with necessary information regarding their financial status and the purpose of the loan.

- Credit Report: A report that provides the lender with the borrower's credit history, helping to assess their creditworthiness and ability to repay the loan.

- Collateral Agreement: If the loan is secured, this document outlines the assets pledged as collateral, which the lender can claim if the borrower defaults.

- Personal Guarantee: This is a document where an individual agrees to be personally responsible for the loan, adding an extra layer of security for the lender.

- Disclosure Statement: This statement provides important information about the loan, including fees, terms, and conditions, ensuring transparency in the borrowing process.

- Motor Vehicle Bill of Sale: This document is crucial for the transfer of vehicle ownership, ensuring that both parties are protected. For more information, refer to the Motor Vehicle Bill of Sale form.

- Loan Closing Statement: A summary of the final terms of the loan, including the total amount financed, interest rates, and any closing costs associated with the loan.

- Amortization Schedule: This schedule outlines the breakdown of each payment over the life of the loan, showing how much goes towards interest and how much goes towards the principal balance.

Understanding these documents can help borrowers navigate the loan process more effectively. Each document plays a crucial role in ensuring that both the lender and borrower are on the same page regarding the terms and obligations of the loan.