Get Louisiana act of donation Form

Key takeaways

When dealing with the Louisiana Act of Donation form, it is important to understand its significance and the process involved. Here are some key takeaways to consider:

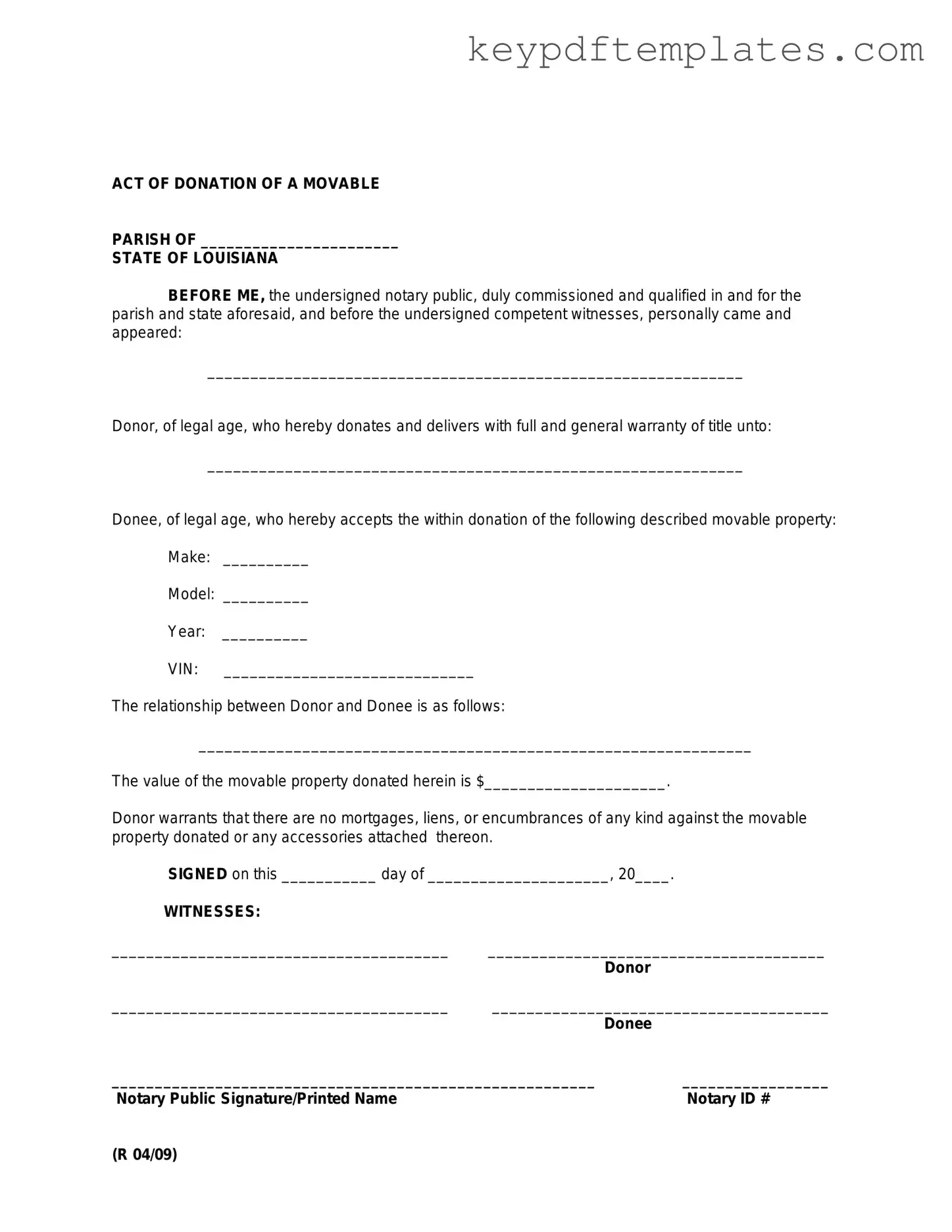

- Purpose of the Form: The Louisiana Act of Donation form is used to legally transfer ownership of property or assets from one person to another without any exchange of money. This can include real estate, personal property, or financial assets.

- Requirements for Validity: To ensure the act of donation is legally binding, it must be in writing and signed by both the donor and the recipient. Additionally, certain types of property may require notarization.

- Tax Implications: Donors should be aware of potential gift tax implications when transferring property. Understanding how these taxes work can help avoid unexpected financial burdens.

- Revocation of Donation: In some cases, a donor may wish to revoke the donation. It is essential to understand the conditions under which a donation can be revoked and the legal steps required to do so.

By keeping these points in mind, individuals can navigate the process of filling out and using the Louisiana Act of Donation form more effectively.

Similar forms

- Gift Deed: A gift deed is a legal document that transfers property from one person to another without any exchange of money. Like the act of donation, it requires the consent of the donor and the acceptance of the recipient.

- Will: A will outlines how a person's assets should be distributed after their death. Both documents express the intention to transfer property, but a will takes effect only upon death, while an act of donation is effective immediately.

- Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds property for the benefit of another. Similar to the act of donation, it involves the transfer of ownership, but a trust can be revocable or irrevocable.

- Sales Contract: A sales contract is an agreement between a buyer and a seller for the exchange of property. While a sales contract involves payment, both documents require a clear intention to transfer ownership.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for rent. Both documents involve the use of property, but a lease does not transfer ownership, unlike an act of donation.

- Power of Attorney: A power of attorney grants someone the authority to act on behalf of another person in legal matters. Both documents can involve property, but a power of attorney does not transfer ownership; it only allows for management of the property.

- Assignment of Rights: An assignment of rights transfers specific rights or benefits from one party to another. Similar to the act of donation, it requires the consent of both parties and can involve property or other rights.

- Quitclaim Deed: A quitclaim deed transfers any ownership interest the grantor has in a property without guaranteeing that the title is clear. Both documents facilitate the transfer of property, but a quitclaim does not offer the same level of assurance as a gift deed.

- Affidavit of Gift: To simplify the legal transfer of property, utilize the official Affidavit of Gift form guidelines that clarify the necessary documentation and procedures.

- Deed of Trust: A deed of trust secures a loan by transferring property to a trustee until the loan is paid off. Both documents involve property transfer, but a deed of trust is typically used in financial transactions rather than as a gift.

Misconceptions

The Louisiana act of donation form is often misunderstood. Here are seven common misconceptions:

- It is only for wealthy individuals. Many believe that only the wealthy can use this form. In reality, anyone can utilize the act of donation to transfer property.

- It requires a lawyer to complete. While legal advice can be helpful, individuals can fill out the form without a lawyer. Clear instructions are provided to assist in the process.

- It is the same as a will. The act of donation is not a will. It is a gift transfer that takes effect during the donor's lifetime, unlike a will that comes into play after death.

- Donors lose all rights to the property. Donors can retain certain rights, such as the right to use the property during their lifetime, depending on how the donation is structured.

- It is only applicable to real estate. The act of donation can apply to various types of property, including personal belongings and financial assets, not just real estate.

- It cannot be revoked. Donors can revoke the donation under certain circumstances, especially if the donation was not formalized properly.

- It is a complicated process. The process can be straightforward. With the right information and documentation, individuals can complete the act of donation efficiently.

More PDF Templates

Dmv Forms Online - The form must be filled out completely before submission, ensuring no sections are left blank.

For those looking to understand the importance of the Texas Certificate of Insurance, it is vital to know that this document not only validates your insurance coverage but also positions you as a credible Responsible Master Plumber in Texas. This ensures that you are compliant with the state regulations that govern plumbing practices, all while safeguarding your business and clients from potential liabilities. If you are ready to take the next step, be sure to visit txtemplate.com/texas-certificate-insurance-pdf-template to access the necessary documentation and streamline your application process.

What Does a Dog Need to Travel - Pet owners are responsible for providing accurate information.

Form Specs

| Fact Name | Description |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer property ownership as a gift. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1469 to 1483. |

| Types of Donations | Donations can be either inter vivos (between living persons) or mortis causa (effective upon death). |

| Requirements | The form must be signed by both the donor and the donee, and it may require notarization. |

| Revocation | Donations can be revoked under certain circumstances, such as if the donee commits a serious offense against the donor. |

| Tax Implications | Gift taxes may apply, and it is advisable to consult with a tax professional regarding any potential liabilities. |

Documents used along the form

The Louisiana Act of Donation form is a legal document that facilitates the transfer of property or assets from one individual to another without any payment. Alongside this form, several other documents may be necessary to ensure the donation process is clear and legally binding. Below is a list of commonly used forms and documents related to the Act of Donation in Louisiana.

- Donation Agreement: This document outlines the terms and conditions of the donation, including the description of the property being donated and any obligations of the donor or recipient.

- Affidavit of Identity: This affidavit verifies the identities of the parties involved in the donation. It serves to prevent fraud and ensures that all parties are who they claim to be.

- Property Description Document: This document provides a detailed description of the property being donated. It may include legal descriptions, addresses, and any relevant identification numbers.

- Notarized Witness Statements: These statements, signed by witnesses, confirm that the donation was made voluntarily and that the donor was of sound mind at the time of the donation.

- Quitclaim Deed: A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees about the property’s title. For more details, visit Florida PDF Forms.

- Tax Exemption Form: This form may be required to claim any tax benefits associated with the donation. It outlines the eligibility criteria and the process for claiming deductions.

- Transfer of Title Document: This document officially transfers ownership of the property from the donor to the recipient. It is essential for real estate donations and must be recorded with the appropriate authorities.

Using these documents in conjunction with the Louisiana Act of Donation form helps to ensure a smooth and legally compliant donation process. Each document serves a specific purpose, contributing to the clarity and legality of the transaction.