Printable Mobile Home Purchase Agreement Template

Key takeaways

When filling out and using the Mobile Home Purchase Agreement form, it is important to keep several key points in mind. These takeaways will help ensure a smooth transaction.

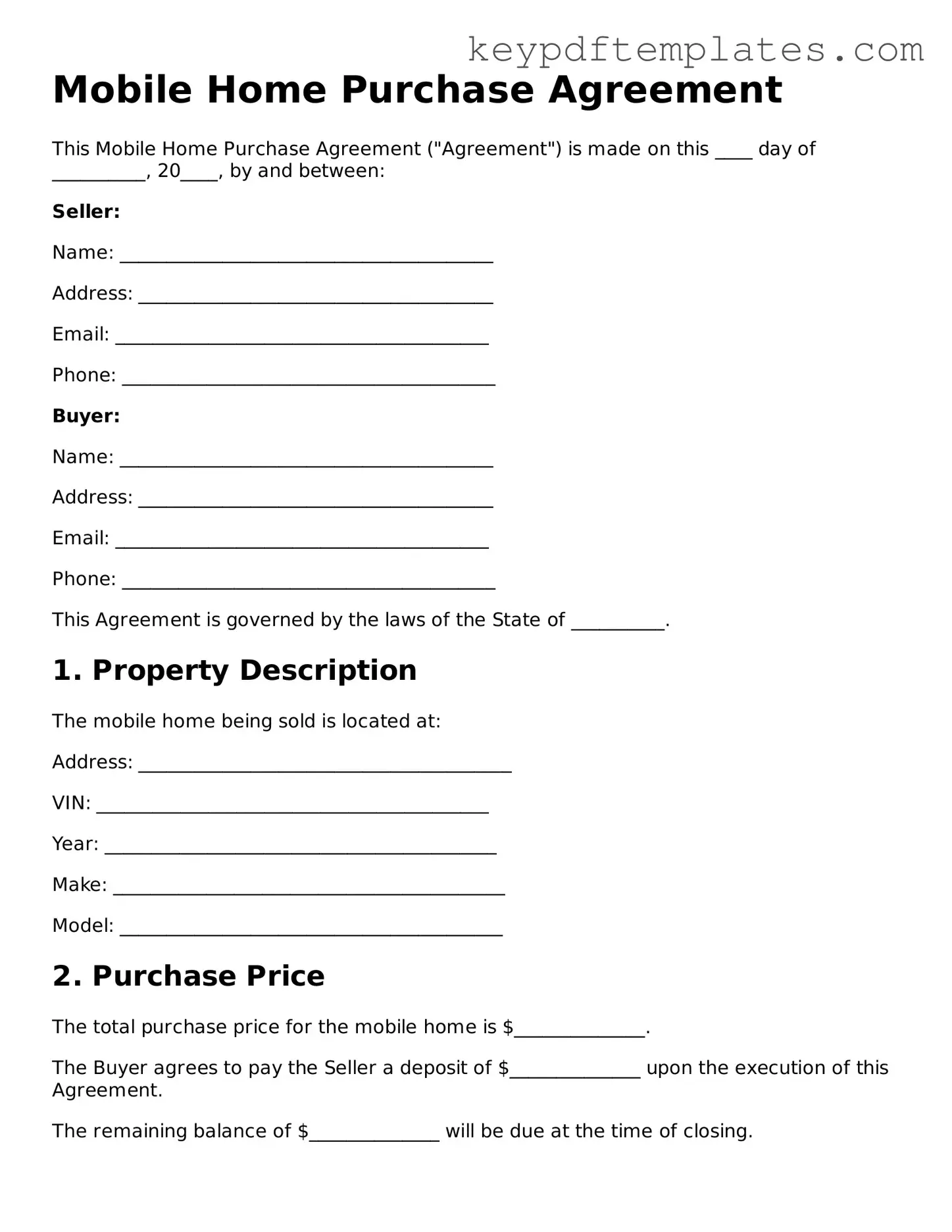

- Understand the purpose of the Mobile Home Purchase Agreement. It outlines the terms and conditions of the sale between the buyer and seller.

- Ensure all parties involved are identified clearly. Include full names and contact information for both the buyer and seller.

- Specify the mobile home details. Include the make, model, year, and identification number to avoid confusion.

- State the purchase price clearly. Both parties should agree on the total amount and any deposit required.

- Include payment terms. Specify how and when payments will be made, including any financing arrangements.

- Outline any contingencies. This may include inspections, financing approval, or other conditions that must be met before the sale is finalized.

- Address warranties and disclosures. Sellers should disclose any known issues with the mobile home, and warranties should be clearly stated.

- Include a closing date. This is the date when the sale will be finalized, and ownership will be transferred.

- Ensure signatures are obtained. Both the buyer and seller should sign and date the agreement to make it legally binding.

- Keep a copy of the agreement. Each party should retain a signed copy for their records after the transaction is completed.

By following these key takeaways, individuals can navigate the process of purchasing a mobile home more effectively.

Similar forms

- Real Estate Purchase Agreement: This document outlines the terms of buying a home or property. Like the Mobile Home Purchase Agreement, it includes details about the purchase price, payment terms, and contingencies.

- Power of Attorney: This essential document empowers an individual to act on behalf of another, especially in critical situations. For more information and to complete the form, visit Florida PDF Forms.

- Lease Agreement: A lease agreement is a contract between a landlord and tenant. Similar to the Mobile Home Purchase Agreement, it specifies the duration of the lease, payment obligations, and rules regarding the property.

- Bill of Sale: This document transfers ownership of personal property from one party to another. It shares similarities with the Mobile Home Purchase Agreement in that it includes descriptions of the item being sold and the sale price.

- Financing Agreement: This outlines the terms of a loan for purchasing a home. Like the Mobile Home Purchase Agreement, it details the loan amount, interest rates, and repayment terms.

- Home Inspection Agreement: This document is used to arrange for a home inspection before a purchase. It is similar in that it protects the buyer’s interests by ensuring the property meets certain standards before finalizing the sale.

Misconceptions

When it comes to purchasing a mobile home, many people have misunderstandings about the Mobile Home Purchase Agreement form. Here are six common misconceptions:

-

It’s just a simple handshake agreement.

Some believe that a verbal agreement is enough to secure a mobile home purchase. In reality, a written agreement provides legal protection and clarity for both the buyer and seller.

-

All mobile home agreements are the same.

Each Mobile Home Purchase Agreement can differ based on state laws and the specifics of the transaction. It's essential to use a form that meets your local requirements.

-

Once signed, the agreement cannot be changed.

While the agreement is binding, it can be amended if both parties agree to the changes. Always document any modifications in writing.

-

The seller is responsible for everything until the sale is finalized.

Buyers often think they have no responsibilities until they take possession. However, buyers may need to conduct inspections and secure financing during the process.

-

A Mobile Home Purchase Agreement guarantees financing.

This agreement does not guarantee that a buyer will secure financing. Buyers should seek pre-approval before entering into a purchase agreement.

-

It’s only necessary if you’re buying from a dealer.

Whether purchasing from a dealer or an individual, a Mobile Home Purchase Agreement is crucial. It protects both parties and outlines the terms of the sale.

Understanding these misconceptions can help you navigate the process of buying a mobile home more effectively. Always consult with a professional if you have questions about your specific situation.

Common Forms

Form I-9 - The document is crucial in maintaining accurate employment records.

To facilitate the gift transfer process in Texas, it is advisable to utilize the streamlined Affidavit of Gift form, ensuring a clear record of the transaction and avoiding any potential misunderstandings in the future.

Proof of Residency Template - A versatile tool for individuals needing to establish their living situation.

2b Mindset Tracker Spiral - Document any changes in body measurements to celebrate physical progress.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Mobile Home Purchase Agreement is a legal document that outlines the terms and conditions for buying a mobile home. |

| Parties Involved | The agreement typically includes the buyer, the seller, and may involve a third-party lender. |

| Governing Law | The laws of the state where the mobile home is located govern the agreement. For example, in California, the California Civil Code applies. |

| Purchase Price | The total cost of the mobile home is clearly stated in the agreement, along with any deposit required. |

| Financing Terms | If applicable, the agreement outlines financing options, including interest rates and payment schedules. |

| Contingencies | Common contingencies may include inspections, financing approval, and title clearance. |

| Signatures | Both the buyer and seller must sign the agreement for it to be legally binding. |

Documents used along the form

When engaging in the purchase of a mobile home, various forms and documents may be required to ensure a smooth transaction. Below is a list of commonly used documents that accompany the Mobile Home Purchase Agreement. Each document plays a vital role in the process, providing necessary information and legal protections for both the buyer and seller.

- Bill of Sale: This document serves as proof of the transfer of ownership from the seller to the buyer. It includes details such as the purchase price, date of sale, and identification of the mobile home.

- Title Transfer Document: This form is essential for officially transferring the title of the mobile home. It is typically filed with the state’s Department of Motor Vehicles (DMV) or equivalent agency.

- General Bill of Sale: This document serves as proof of purchase for the transaction and acknowledges the transfer of ownership of the mobile home. More information can be found at https://onlinelawdocs.com/general-bill-of-sale/.

- Inspection Report: An inspection report outlines the condition of the mobile home. It is often conducted by a professional inspector and helps the buyer understand any potential issues before finalizing the sale.

- Financing Agreement: If the buyer is financing the purchase, a financing agreement will detail the terms of the loan, including interest rates, repayment schedule, and any collateral involved.

- Affidavit of Title: This document provides a sworn statement from the seller affirming that they hold clear title to the mobile home and that there are no liens or encumbrances.

- Purchase Agreement Addendum: This is an additional document that modifies or adds to the original purchase agreement. It can cover contingencies or specific conditions agreed upon by both parties.

- Lease Agreement (if applicable): If the mobile home is located in a park, a lease agreement may be required to outline the terms of renting the land on which the home sits.

- Homeowner’s Association (HOA) Documents: If the mobile home is in a community governed by an HOA, these documents will provide rules, regulations, and fees associated with the community.

- Insurance Policy: Proof of insurance may be required to protect the buyer’s investment. This document outlines coverage details and policy limits for the mobile home.

Understanding these documents is crucial for both buyers and sellers. Each form serves a specific purpose and helps facilitate a legally sound transaction. Ensure that all necessary paperwork is completed accurately to avoid complications in the future.