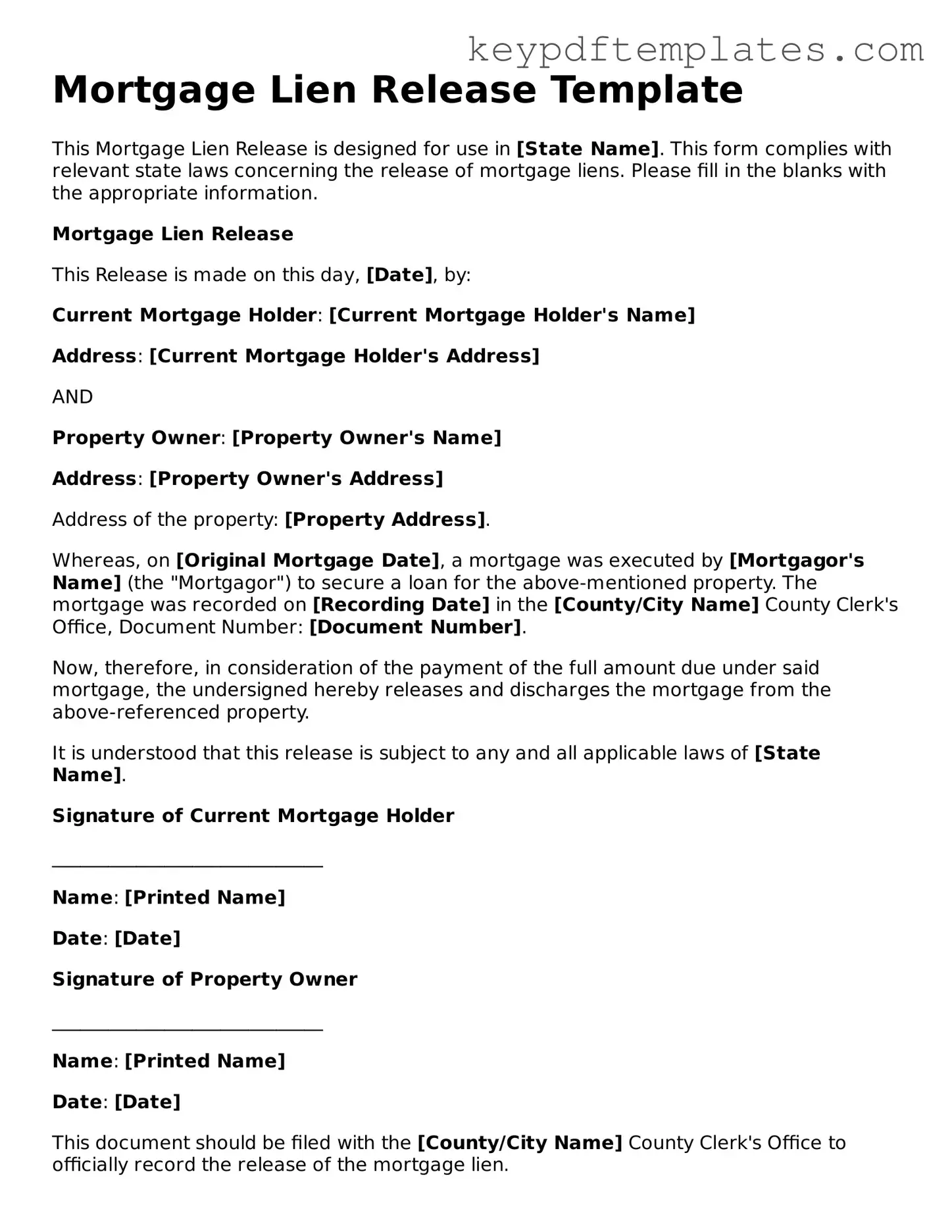

Printable Mortgage Lien Release Template

Key takeaways

When dealing with a Mortgage Lien Release form, there are several important points to keep in mind. Understanding these can help ensure a smooth process.

- Ensure accuracy: Fill out the form with correct details about the property and the parties involved. Any errors can lead to delays or complications.

- Obtain necessary signatures: All relevant parties must sign the form. This typically includes the lender and the borrower to validate the release.

- File with the appropriate authority: After completing the form, submit it to the local county recorder's office or similar entity to officially record the release.

- Keep copies for your records: Always retain a copy of the filed form for personal records. This documentation can be useful in future transactions or disputes.

Similar forms

- Deed of Trust: This document secures a loan by placing a lien on the property. Like the Mortgage Lien Release, it outlines the rights of the lender and borrower, detailing what happens if the borrower defaults.

- Mortgage Agreement: This agreement establishes the terms of the loan and the obligations of the borrower. Similar to the Mortgage Lien Release, it involves the property as collateral and includes provisions for release upon full payment.

- Quitclaim Deed: This form transfers ownership of property without guaranteeing that the title is clear. It can be used to release a lien, much like the Mortgage Lien Release, by transferring interest back to the borrower.

- Vehicle Release of Liability: This form is essential when a vehicle's ownership changes hands, as it releases the seller from future claims regarding the vehicle. For more information, visit toptemplates.info/release-of-liability/vehicle-release-of-liability/.

- Title Insurance Policy: This document protects against losses from defects in the title. It is similar to the Mortgage Lien Release in that it confirms the removal of liens and encumbrances once the mortgage is paid off.

Misconceptions

Understanding the Mortgage Lien Release form is crucial for homeowners and lenders alike. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this form, along with clarifications.

-

Misconception 1: The Mortgage Lien Release form is only necessary for paid-off loans.

Many believe this form is only relevant after a loan is fully paid. In reality, it is important to file this form whenever a mortgage is satisfied, regardless of the payment status.

-

Misconception 2: A Mortgage Lien Release is automatically filed by the lender.

Some homeowners assume that lenders will automatically file this form upon loan completion. However, it is the borrower's responsibility to ensure that the form is filed with the appropriate authorities.

-

Misconception 3: The form is the same as a satisfaction of mortgage.

While both documents serve to release the lien, they may have different requirements and implications depending on state laws. It is essential to understand the distinctions.

-

Misconception 4: Filing a Mortgage Lien Release is a lengthy process.

In many cases, the filing process can be completed quickly, especially if the necessary information is readily available and correctly submitted.

-

Misconception 5: Only the original borrower can file the release.

Any authorized individual, including a representative or attorney, can file the Mortgage Lien Release form on behalf of the borrower, provided they have the necessary permissions.

-

Misconception 6: The form is not needed if the property is sold.

When a property is sold, a Mortgage Lien Release may still be necessary to clear the title for the new owner. This ensures that the new owner has a clear claim to the property.

-

Misconception 7: A Mortgage Lien Release is only relevant in certain states.

While the process and requirements may vary by state, the need for a Mortgage Lien Release exists nationwide. Homeowners should be aware of their local regulations.

-

Misconception 8: There is no fee associated with filing the release.

Some individuals believe that filing the form is free of charge. However, many jurisdictions may impose a fee for processing the release, which should be taken into account.

-

Misconception 9: Once filed, the Mortgage Lien Release cannot be revoked.

In certain circumstances, if an error occurs, it may be possible to contest or amend the release. Legal advice may be beneficial in such cases.

-

Misconception 10: The Mortgage Lien Release form is a one-size-fits-all document.

Different lenders and states may have specific requirements for the form. It is crucial to use the correct version that meets all local regulations and lender guidelines.

By addressing these misconceptions, homeowners and lenders can better navigate the process of filing a Mortgage Lien Release, ensuring a smoother transition when dealing with property ownership and loans.

Other Mortgage Lien Release Types:

Actor Release Form Pdf - Essential for protecting both the actor's and producer's rights.

The importance of a properly executed California Release of Liability form cannot be overstated, as it serves to protect both parties involved by clearly outlining the risks and responsibilities during activities. By agreeing to its terms, participants recognize the inherent dangers and forgo the right to pursue claims against the organizer, thus ensuring a smoother experience for everyone. To take the necessary steps in protecting yourself, you can access the form at californiapdfforms.com/.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Mortgage Lien Release form is a document that removes a mortgage lien from a property once the debt has been paid in full. |

| Purpose | The form serves to officially acknowledge that the borrower has fulfilled their financial obligation to the lender. |

| Importance | Releasing the lien is crucial for the property owner, as it clears the title and allows for the sale or refinancing of the property. |

| Governing Law | The laws governing mortgage lien releases vary by state. For example, in California, it is governed by Civil Code Section 2941. |

| Filing Process | The completed form must be filed with the appropriate county recorder's office to be effective. |

| Signature Requirement | The form typically requires signatures from both the lender and the borrower to validate the release. |

| Timing | It is recommended to file the release promptly after the final payment to avoid complications. |

| Potential Fees | Some counties may charge a fee for recording the Mortgage Lien Release form. |

| Record Keeping | Both parties should keep a copy of the filed form for their records. |

| Legal Advice | Consulting with a legal professional can help ensure that all requirements are met and the form is completed correctly. |

Documents used along the form

When dealing with the Mortgage Lien Release form, several other documents may also be necessary to ensure a smooth process. Each of these documents serves a specific purpose and can help clarify or finalize the terms of a mortgage agreement. Below is a list of commonly used forms and documents associated with the Mortgage Lien Release.

- Mortgage Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and obligations of both the borrower and lender.

- Release of Liability Form: This document is essential for protecting parties involved in an activity. It allows individuals or organizations to safeguard themselves from potential legal claims. For further resources, check Documents PDF Online.

- Promissory Note: A legal document in which the borrower promises to repay the loan under specified terms. It includes details like the loan amount, interest rate, and payment schedule.

- Deed of Trust: This document secures the mortgage by transferring the property title to a trustee, who holds it until the loan is repaid. It typically involves three parties: the borrower, the lender, and the trustee.

- Loan Payoff Statement: Issued by the lender, this statement details the total amount required to pay off the mortgage, including any outstanding fees or penalties.

- Notice of Default: If the borrower fails to meet payment obligations, this document notifies them of the default status and may initiate foreclosure proceedings.

- Foreclosure Notice: This document is issued when a lender begins the foreclosure process, informing the borrower of their default and the lender's intent to reclaim the property.

- Title Insurance Policy: This policy protects against losses due to defects in the title, ensuring that the property is free of liens or claims that could affect ownership.

- Settlement Statement: Also known as a HUD-1, this document outlines all costs and fees associated with the mortgage closing process, providing transparency for both parties.

- Release of Lien: This document is filed with the county clerk after the mortgage has been paid off, formally removing the lender's claim on the property.

Understanding these documents can help borrowers navigate the complexities of mortgage agreements and ensure that all legal requirements are met. Having the right paperwork in order is essential for a successful release of the mortgage lien and for securing clear title to the property.