Get Netspend Dispute Form

Key takeaways

When filling out and using the Netspend Dispute form, consider the following key takeaways:

- Timeliness is crucial. Submit the form as soon as possible, and ensure it reaches Netspend within 60 days of the disputed transaction.

- Documentation strengthens your case. Include supporting documents such as receipts, emails, and police reports to facilitate the dispute process.

- Liability can vary. If your card was lost or stolen, you may not be liable for unauthorized transactions that occur after you report the loss and request to block your card.

- Detail matters. Provide a thorough explanation of the dispute, including specific transaction details and any communication with the merchant.

- Follow up. After submission, expect a decision regarding your dispute within 10 business days; keep track of your claim number for reference.

Similar forms

The Netspend Dispute form is similar to several other documents used for reporting and resolving financial discrepancies. Below is a list of seven such documents, along with a brief explanation of how they are similar to the Netspend Dispute form.

- Fraud Report Form: Like the Netspend Dispute form, this document is used to report unauthorized transactions. It typically requires details about the fraudulent activity and may also ask for supporting documentation.

- Georgia WC-100 Form - This essential document initiates mediation for settling workers' compensation claims in Georgia, ensuring all parties agree to participate effectively. For more details, visit the Georgia PDF.

- Chargeback Request Form: This form is submitted to a bank or credit card issuer to dispute a charge. It shares similarities in that it requires transaction details and a reason for the dispute, much like the Netspend form.

- Identity Theft Report: When identity theft occurs, individuals can file this report with law enforcement. It is similar in that it documents unauthorized use of personal information and often requires supporting evidence.

- Merchant Dispute Form: This document is used to formally dispute a transaction with a merchant. It parallels the Netspend Dispute form by requiring transaction specifics and the nature of the dispute.

- Credit Reporting Dispute Form: Consumers can use this form to challenge inaccuracies on their credit reports. It is similar as it necessitates detailed information about the disputed item and supporting documents.

- Bank Statement Dispute Form: This form is used to address errors found on bank statements. Like the Netspend Dispute form, it requires transaction details and a clear explanation of the issue.

- Consumer Complaint Form: This document allows consumers to file complaints about financial services. It is similar to the Netspend form in that it collects detailed information about the issue at hand and the desired resolution.

Misconceptions

Misconceptions about the Netspend Dispute Form can lead to confusion regarding the dispute process. Below are six common misconceptions along with clarifications.

- The form must be submitted immediately after the transaction. While it is advisable to submit the form as soon as possible, it is not required to be submitted immediately. The form must be submitted within 60 days of the transaction date.

- All disputes will be resolved within a few days. The review process takes time. A decision regarding the dispute will be made within 10 business days after the completed form is received.

- Supporting documentation is optional. In fact, providing supporting documentation can significantly assist in the determination of the dispute. It is recommended to include any relevant documents.

- Cardholders are liable for all unauthorized transactions. Cardholders are not liable for unauthorized transactions that occur after reporting the card as lost or stolen. However, they may be liable for transactions before the report is made.

- The dispute form can only address one transaction at a time. The form allows for the submission of disputes for up to five transactions on a single form, making it more efficient for cardholders.

- Contacting the merchant is not necessary. It is encouraged to contact the merchant before submitting the dispute form. This may help resolve the issue directly and could provide additional information for the dispute.

More PDF Templates

How to Print Payroll Checks - Maintaining accurate Payroll Check forms can simplify tax filing.

W9 Form Sample - Payments made to individuals without a W-9 may incur extra taxes.

When buying or selling a trailer in Texas, having a properly executed Texas Trailer Bill of Sale is essential for avoiding any potential disputes regarding ownership. This document not only legitimizes the sale but also protects the interests of both parties involved. To simplify the process of creating this important form, you can find a comprehensive template at https://txtemplate.com/trailer-bill-of-sale-pdf-template/.

Notice of Intent to Lien Letter Sample - The notice is sent at least 45 days before any lien recording action is taken.

Form Specs

| Fact Name | Description |

|---|---|

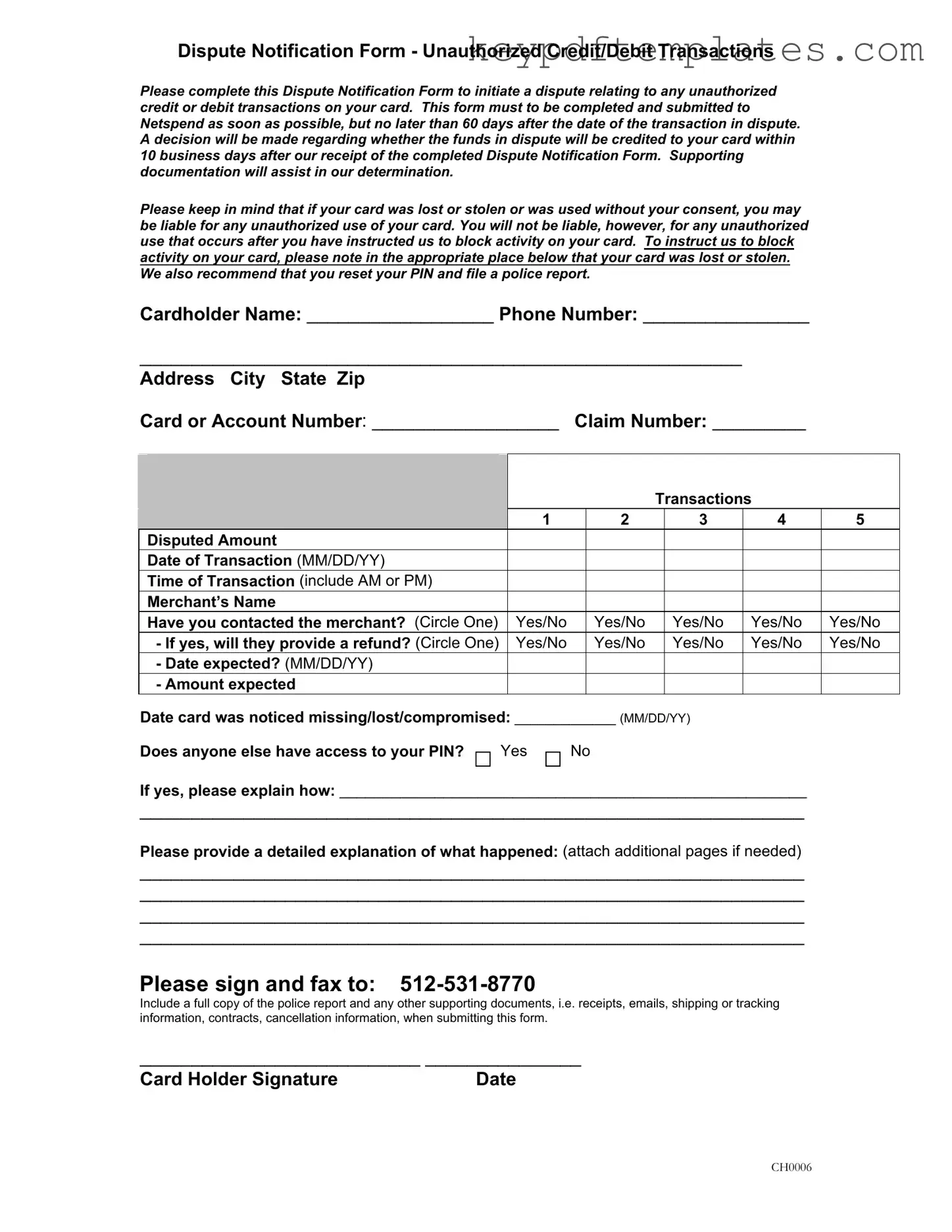

| Form Purpose | This form initiates a dispute for unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | The form must be submitted within 60 days of the disputed transaction date. |

| Response Time | Netspend will provide a decision regarding the dispute within 10 business days of receiving the completed form. |

| Liability for Unauthorized Use | If a card is lost or stolen, the cardholder may be liable for unauthorized transactions until they report the loss. |

| Blocking Card Activity | Cardholders can block activity on their card by indicating it was lost or stolen on the form. |

| Supporting Documentation | Submitting supporting documents, such as a police report, can assist in the dispute resolution process. |

| State-Specific Laws | For states like California, the governing law includes the California Consumer Privacy Act (CCPA). |

Documents used along the form

When filing a dispute using the Netspend Dispute form, several other documents may be required or helpful to support your claim. These documents can provide additional context and evidence, ensuring a thorough review of your situation. Below is a list of forms and documents commonly used alongside the Netspend Dispute form.

- Police Report: If your card was lost or stolen, a police report serves as official documentation of the incident. It can strengthen your dispute by confirming that unauthorized transactions occurred.

- Motor Vehicle Power of Attorney Form: If you need to delegate vehicle-related tasks, the Motor Vehicle Power of Attorney form guide provides the necessary legal documentation to authorize another individual on your behalf.

- Transaction Receipts: Providing copies of receipts for the disputed transactions can help verify your claims. These documents can show that you did not authorize the transactions in question.

- Email Correspondence: Emails exchanged with the merchant regarding the disputed transaction can provide evidence of your attempts to resolve the issue directly with them.

- Shipping or Tracking Information: If the dispute involves a purchase that was never received, shipping or tracking information can demonstrate that the item was not delivered as expected.

- Cancellation Confirmation: If you canceled a service or transaction, documentation confirming the cancellation can support your claim that the charge was unauthorized.

- Account Statements: Recent account statements can help outline the transactions in question and provide a broader context for your dispute.

- Identity Theft Affidavit: If you suspect that your identity has been stolen, this affidavit can serve as a formal declaration of the theft, assisting in the dispute process.

- Affidavit of Unauthorized Use: This document is a sworn statement confirming that you did not authorize the transactions, which can bolster your claim.

- Bank or Card Issuer Correspondence: Any communication with your bank or card issuer regarding the unauthorized transactions can be useful in demonstrating your efforts to resolve the matter.

Gathering these documents will help ensure that your dispute is handled efficiently. Providing comprehensive evidence can facilitate a quicker resolution and increase the likelihood of a favorable outcome.