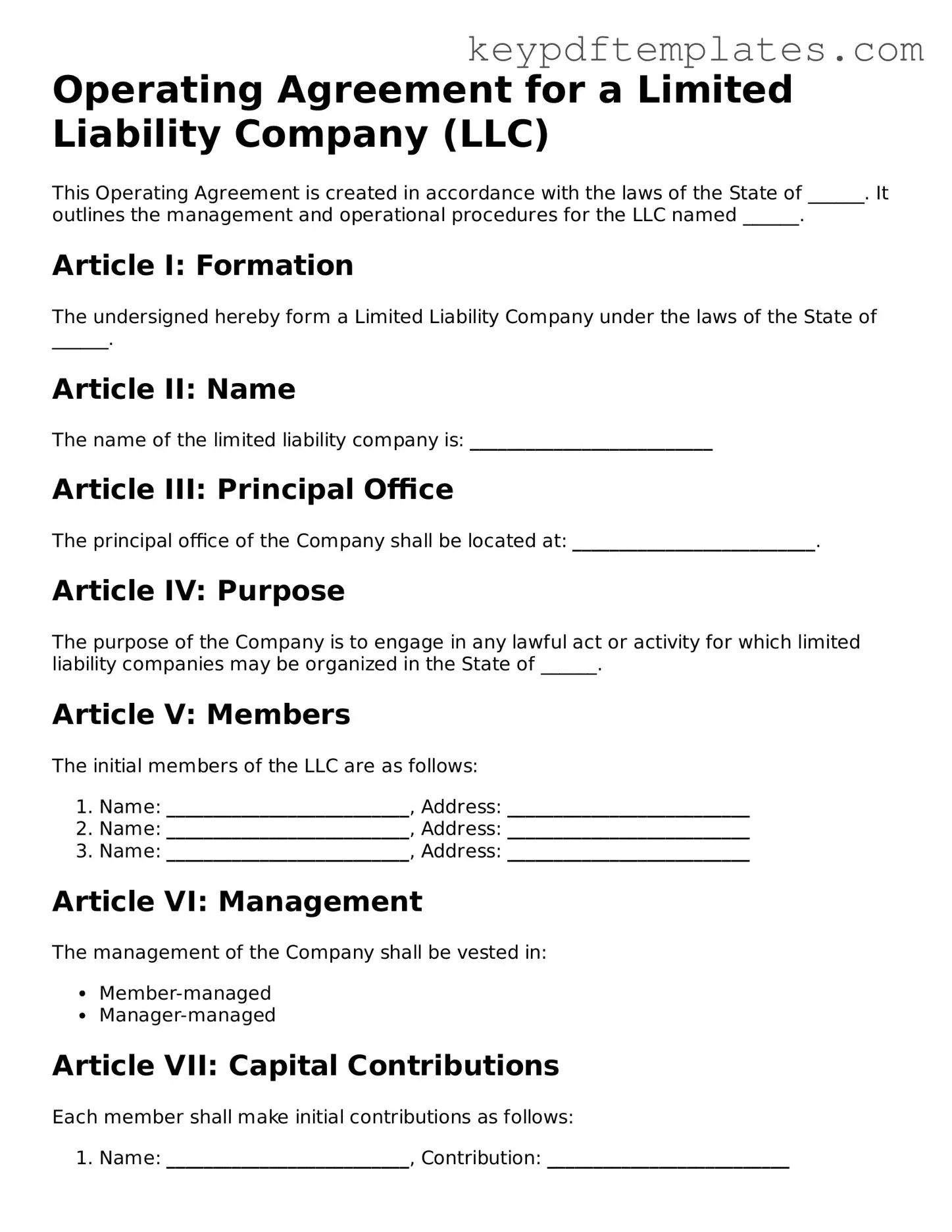

Printable Operating Agreement Template

Operating Agreement - Tailored for State

Key takeaways

When filling out and using the Operating Agreement form, keep these key takeaways in mind:

- Understand the purpose of the Operating Agreement. It outlines the management structure and operational procedures of your business.

- Clearly define the roles and responsibilities of each member. This clarity helps avoid conflicts down the line.

- Include details about profit and loss distribution. Specify how profits and losses will be shared among members.

- Establish guidelines for decision-making. Outline how decisions will be made and what majority is needed for approval.

- Address member changes. Include provisions for adding or removing members to ensure smooth transitions.

- Consider dispute resolution methods. Specify how conflicts will be resolved to prevent lengthy legal battles.

- Review state requirements. Ensure that your Operating Agreement complies with local laws to avoid issues later.

- Keep it flexible. Allow for amendments to adapt to changing business needs while maintaining member agreement.

- Store it securely. Keep a signed copy of the Operating Agreement in a safe place, accessible to all members.

Similar forms

The Operating Agreement is a crucial document for LLCs, outlining the management structure and operational procedures. It shares similarities with several other legal documents. Here are four documents that are comparable to the Operating Agreement:

- Partnership Agreement: This document governs the relationship between partners in a partnership. Like the Operating Agreement, it details the roles, responsibilities, and profit-sharing arrangements among partners.

- Bylaws: Bylaws are used by corporations to regulate their internal management. Similar to an Operating Agreement, bylaws specify the rules for meetings, voting, and the duties of officers, ensuring smooth operations.

- Shareholder Agreement: This agreement outlines the rights and obligations of shareholders in a corporation. It parallels the Operating Agreement by addressing issues like transfer of shares and decision-making processes among shareholders.

- Motorcycle Bill of Sale: A Texas Motorcycle Bill of Sale form is essential for documenting the transfer of motorcycle ownership and details including make, model, and VIN. For more information, refer to the Motorcycle Bill of Sale form.

- Joint Venture Agreement: In a joint venture, parties collaborate on a specific project. This agreement is akin to an Operating Agreement as it defines each party's contributions, management roles, and profit distribution for the duration of the venture.

Operating Agreement Categories

Misconceptions

Operating agreements are essential for any limited liability company (LLC), yet several misconceptions can lead to confusion. Understanding these misunderstandings can help ensure that your business runs smoothly and remains compliant with legal requirements. Here are four common misconceptions about operating agreements:

-

Misconception 1: An Operating Agreement is Optional.

Many people believe that an operating agreement is not necessary if the LLC has only one member. This is incorrect. Even single-member LLCs benefit from having an operating agreement. It outlines the structure and management of the business, protecting your personal assets and clarifying your business operations.

-

Misconception 2: The Operating Agreement is a Public Document.

Some individuals think that operating agreements must be filed with the state and are accessible to the public. In reality, operating agreements are private documents. They are kept within the LLC’s records and are not required to be submitted to state authorities, ensuring confidentiality regarding the internal workings of your business.

-

Misconception 3: An Operating Agreement is a One-Time Document.

It’s a common belief that once an operating agreement is created, it never needs to be updated. However, as your business evolves—whether through new members, changes in management, or shifts in operations—updating your operating agreement is crucial. Regular reviews can help maintain clarity and ensure compliance with current laws.

-

Misconception 4: All Operating Agreements are the Same.

Some assume that a generic template will suffice for every LLC. This is misleading. Each operating agreement should be tailored to fit the specific needs and goals of the business. Customizing your agreement helps address unique situations and can prevent disputes among members down the line.

By dispelling these misconceptions, LLC owners can better appreciate the importance of an operating agreement. Taking the time to create a well-thought-out document can save time, money, and headaches in the future.

Common Forms

Rx Pad - Allows easy tracking of prescribed medications.

Will Affidavit - A Self-Proving Affidavit boosts the credibility of a will during the probate process.

To ensure your legal affairs are managed effectively, it's crucial to complete a necessary Power of Attorney document. This form can simplify decision-making during challenging times, safeguarding your best interests.

Free Printable Bill of Lading - It can provide invaluable data for businesses tracking their inventory flow.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC). |

| Purpose | This document serves to protect the members’ interests, clarify roles, and establish rules for decision-making and profit distribution. |

| State-Specific Requirements | Some states require LLCs to have an Operating Agreement, while others do not mandate it but recommend it for clarity. |

| Governing Laws | The laws governing Operating Agreements vary by state. For example, in California, the California Corporations Code applies, while in Delaware, the Delaware Limited Liability Company Act governs. |

| Flexibility | Members of an LLC have significant flexibility in drafting their Operating Agreement, allowing them to customize it to fit their specific needs. |

| Enforceability | When properly executed, an Operating Agreement is legally binding and enforceable in a court of law, providing a framework for resolving disputes among members. |

Documents used along the form

An Operating Agreement is a vital document for any Limited Liability Company (LLC). It outlines the management structure, responsibilities, and operational procedures of the business. However, several other forms and documents often accompany the Operating Agreement to ensure smooth operations and compliance with legal requirements. Here’s a brief overview of some of these essential documents.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the company name, address, and the names of the members.

- Residential Lease Agreement: A California Residential Lease Agreement is a crucial document for landlords and tenants, detailing essential aspects of the rental relationship. For more information, visit Top Forms Online.

- Bylaws: While not always required for LLCs, bylaws provide a detailed framework for the internal governance of the company, including procedures for meetings and decision-making processes.

- Member Resolution: This document records important decisions made by the members, such as the approval of new members or major business transactions. It serves as an official record of the LLC’s actions.

- Membership Certificates: These certificates represent ownership in the LLC. They can be issued to members to signify their stake in the company and may be required for certain transactions.

- Tax Identification Number (TIN): Obtaining a TIN from the IRS is essential for tax purposes. This number is used to identify the business for tax filings and other official documents.

- Operating Procedures: This document outlines the day-to-day operational guidelines for the LLC, detailing processes for handling finances, employee roles, and customer interactions.

- Annual Reports: Many states require LLCs to file annual reports to maintain good standing. These reports typically update the state on the LLC’s status and any changes in its structure or operations.

Each of these documents plays a crucial role in the establishment and management of an LLC. Together, they create a comprehensive framework that helps protect the interests of the members while ensuring compliance with state regulations. Understanding these documents is key to navigating the complexities of running a successful business.