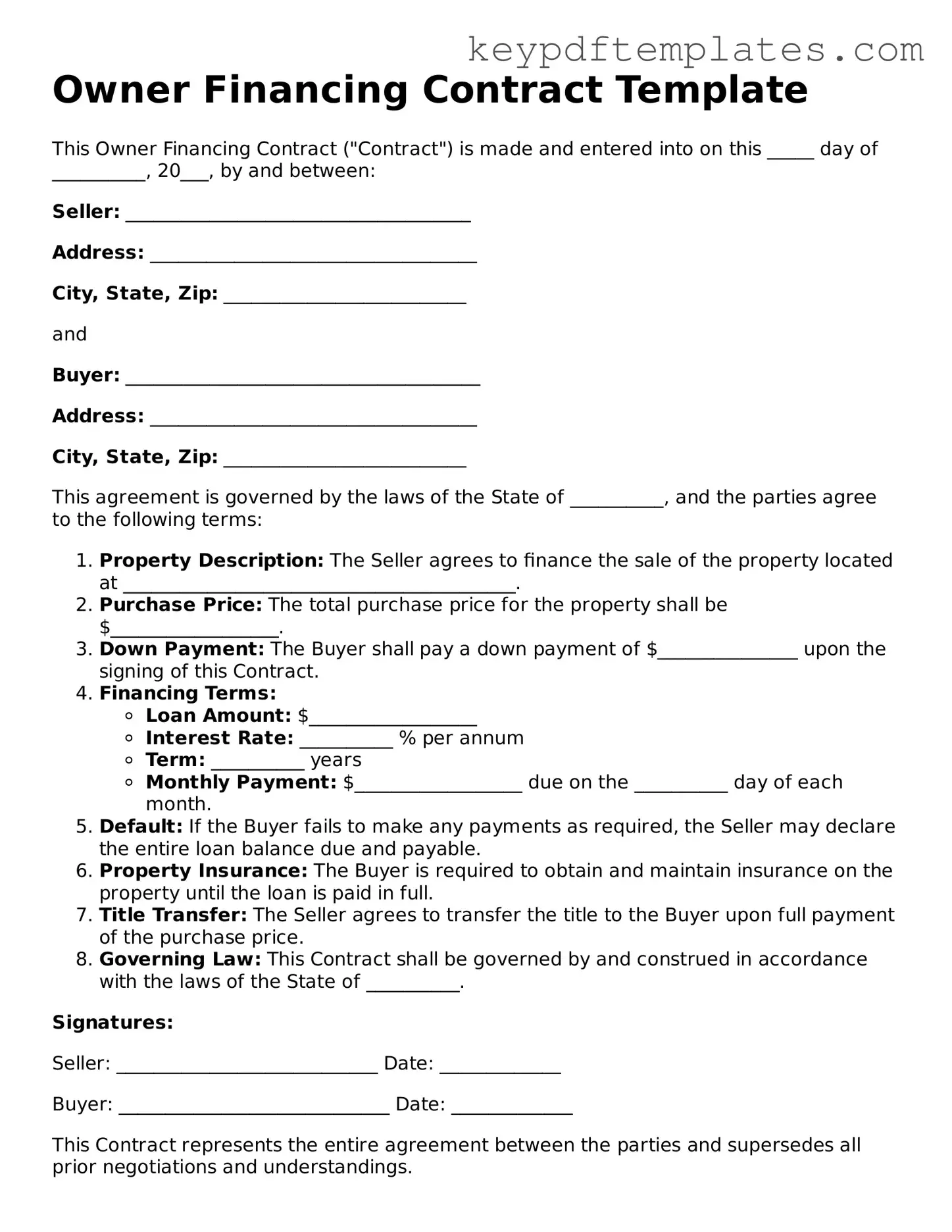

Printable Owner Financing Contract Template

Key takeaways

When filling out and using the Owner Financing Contract form, there are several important points to keep in mind. These takeaways will help ensure that the process is clear and effective.

- Understand the Terms: Familiarize yourself with all terms outlined in the contract. This includes interest rates, payment schedules, and any penalties for late payments.

- Clearly Define the Property: Ensure that the property description is detailed and accurate. Include the address, legal description, and any relevant identifiers.

- Include Contingencies: Specify any contingencies that may affect the sale, such as inspections or financing approvals. This protects both parties in the transaction.

- Consult with Professionals: It is advisable to seek guidance from real estate professionals or attorneys. Their expertise can help avoid potential pitfalls.

- Keep Copies: Retain copies of the signed contract and any related documents. This is essential for record-keeping and future reference.

Similar forms

-

Lease Option Agreement: This document allows a tenant to lease a property with the option to purchase it later. Like owner financing, it provides an alternative path to homeownership while securing the property for the buyer.

-

Installment Sale Agreement: Similar to owner financing, this agreement allows the buyer to make payments over time to the seller, who retains the title until the full purchase price is paid.

-

Land Contract: This is a type of seller financing where the buyer makes payments directly to the seller, who retains the title until the contract is fulfilled, akin to owner financing.

-

Promissory Note: This document outlines the borrower's promise to repay a loan. In owner financing, it serves as a formal record of the debt between the buyer and seller.

-

Deed of Trust: This document secures the loan by transferring the property title to a trustee until the buyer pays off the debt, similar to the security interest in owner financing.

-

Mortgage Agreement: This is a legal document where the borrower agrees to repay a loan secured by the property. Like owner financing, it involves a lender and borrower relationship.

-

Sales Agreement: This document outlines the terms of a property sale. Owner financing can be incorporated into a sales agreement, specifying payment terms directly between buyer and seller.

-

Real Estate Purchase Agreement: The essential form for property transactions in Minnesota, the Minnesota PDF Forms offers a comprehensive template to help buyers and sellers navigate their agreements effectively.

-

Equity Sharing Agreement: This agreement involves sharing the equity of a property between parties. Like owner financing, it can provide alternative financial arrangements for purchasing a home.

-

Seller Financing Addendum: This is an addition to a standard purchase agreement that outlines the terms of seller financing, directly relating to owner financing contracts.

-

Real Estate Option Agreement: This document grants the buyer the right to purchase a property at a later date. It shares similarities with owner financing by providing flexible purchasing options.

Misconceptions

Owner financing can be a beneficial option for both buyers and sellers in real estate transactions. However, several misconceptions surround the Owner Financing Contract form. Here are four common misunderstandings:

-

Owner financing is only for buyers with poor credit.

Many believe that owner financing is a last resort for buyers who cannot secure traditional financing due to poor credit. In reality, owner financing can appeal to a wide range of buyers, including those who may have good credit but prefer the flexibility and terms offered by the seller.

-

Owner financing means the seller has to wait for the entire loan term to receive full payment.

Some think that once they enter into an owner financing agreement, sellers must wait until the buyer pays off the loan completely. However, sellers can negotiate terms that allow them to receive a lump sum payment or sell the note to a third party, providing immediate cash flow.

-

The terms of an owner financing contract are not negotiable.

This misconception suggests that once an owner financing contract is drafted, the terms are set in stone. In fact, both parties can negotiate various aspects of the contract, such as interest rates, payment schedules, and other conditions, to ensure that the agreement meets their needs.

-

Owner financing is always risky for the seller.

While there are risks involved, such as the possibility of the buyer defaulting, many sellers mitigate these risks through careful screening of potential buyers and by including protective clauses in the contract. With proper due diligence, owner financing can be a secure option for sellers.

Other Owner Financing Contract Types:

How to Fire a Realtor Example Letter - This document can protect parties from future legal complications after ending a purchase agreement.

Completing the Oklahoma Real Estate Purchase Agreement form is essential for anyone involved in a real estate transaction in Oklahoma, as it provides a clear and legally binding framework for the sale. This document specifies the necessary details like the price and property description, ensuring both parties understand their rights and responsibilities. For further information on this important document, you can visit https://formsoklahoma.com/.

Personal Guarantee Agreement - This agreement can influence the speed of funding approvals.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller finances the purchase of the property for the buyer, allowing the buyer to make payments directly to the seller. |

| Benefits for Buyers | This type of financing can provide easier access to homeownership, especially for those who may not qualify for traditional bank loans. |

| Benefits for Sellers | Sellers can attract more buyers and potentially receive a higher selling price by offering financing options. |

| Down Payment | Typically, the buyer makes a down payment, which can vary based on the agreement between the buyer and seller. |

| Interest Rates | Interest rates in owner financing contracts are often negotiable and can be higher than traditional mortgage rates. |

| Governing Law | Each state has specific laws governing owner financing contracts. For example, in California, the relevant laws are found in the California Civil Code. |

| Contract Duration | The duration of the contract can vary widely, typically ranging from a few years to several decades. |

| Default Consequences | If the buyer defaults on payments, the seller may have the right to foreclose on the property, similar to a traditional mortgage. |

| Property Title | In most cases, the seller retains the title until the buyer has paid off the full purchase price. |

| Legal Assistance | It is advisable for both parties to seek legal assistance to ensure the contract complies with state laws and protects their interests. |

Documents used along the form

When engaging in owner financing, several key documents often accompany the Owner Financing Contract. Each document serves a specific purpose to ensure clarity and protect the interests of all parties involved. Below is a list of commonly used forms and documents.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount, detailing the interest rate, payment schedule, and consequences of default.

- Deed of Trust: This serves as a security instrument that gives the lender a claim to the property if the borrower fails to make payments.

- Disclosure Statement: This document informs the borrower of the terms of the financing arrangement, including any fees and charges associated with the loan.

- Real Estate Purchase Agreement: This essential document outlines the terms of the property sale in Nevada, including purchase price and closing details, and can be accessed here: https://nvforms.com/fillable-real-estate-purchase-agreement-pdf-template/.

- Purchase Agreement: This contract specifies the terms of the sale, including the purchase price, closing date, and any contingencies that must be met.

- Title Insurance Policy: This protects the lender and borrower against potential issues with the property's title, ensuring clear ownership.

- Property Inspection Report: This document provides an assessment of the property's condition, identifying any necessary repairs or maintenance issues.

- Closing Statement: This outlines all financial transactions that occur at closing, including fees, credits, and the final amount due from the buyer.

- Amortization Schedule: This table details each payment over the life of the loan, showing how much goes toward interest and principal.

- Loan Application: This form collects personal and financial information from the borrower to assess their eligibility for financing.

- Power of Attorney: This document allows one party to act on behalf of another in legal or financial matters related to the transaction.

Each of these documents plays a vital role in facilitating a smooth and transparent owner financing process. Understanding their purpose can help ensure that all parties are well-informed and protected throughout the transaction.