Get Payroll Check Form

Key takeaways

When filling out and using the Payroll Check form, keep the following key points in mind:

- Always ensure that you have the correct employee information, including their full name and employee ID.

- Double-check the pay period dates to ensure accuracy in payment calculations.

- Calculate the gross pay carefully, taking into account hours worked and any overtime.

- Deduct the appropriate taxes and other withholdings to arrive at the net pay.

- Make sure to include any bonuses or additional compensation in the gross pay if applicable.

- Sign the Payroll Check form to validate it before processing the payment.

- Keep a copy of the completed Payroll Check form for your records.

- Distribute the checks promptly to ensure employees receive their payments on time.

- Review the form for any errors or omissions before finalizing the payroll process.

- Stay updated on any changes to tax rates or payroll regulations that might affect the form.

Similar forms

-

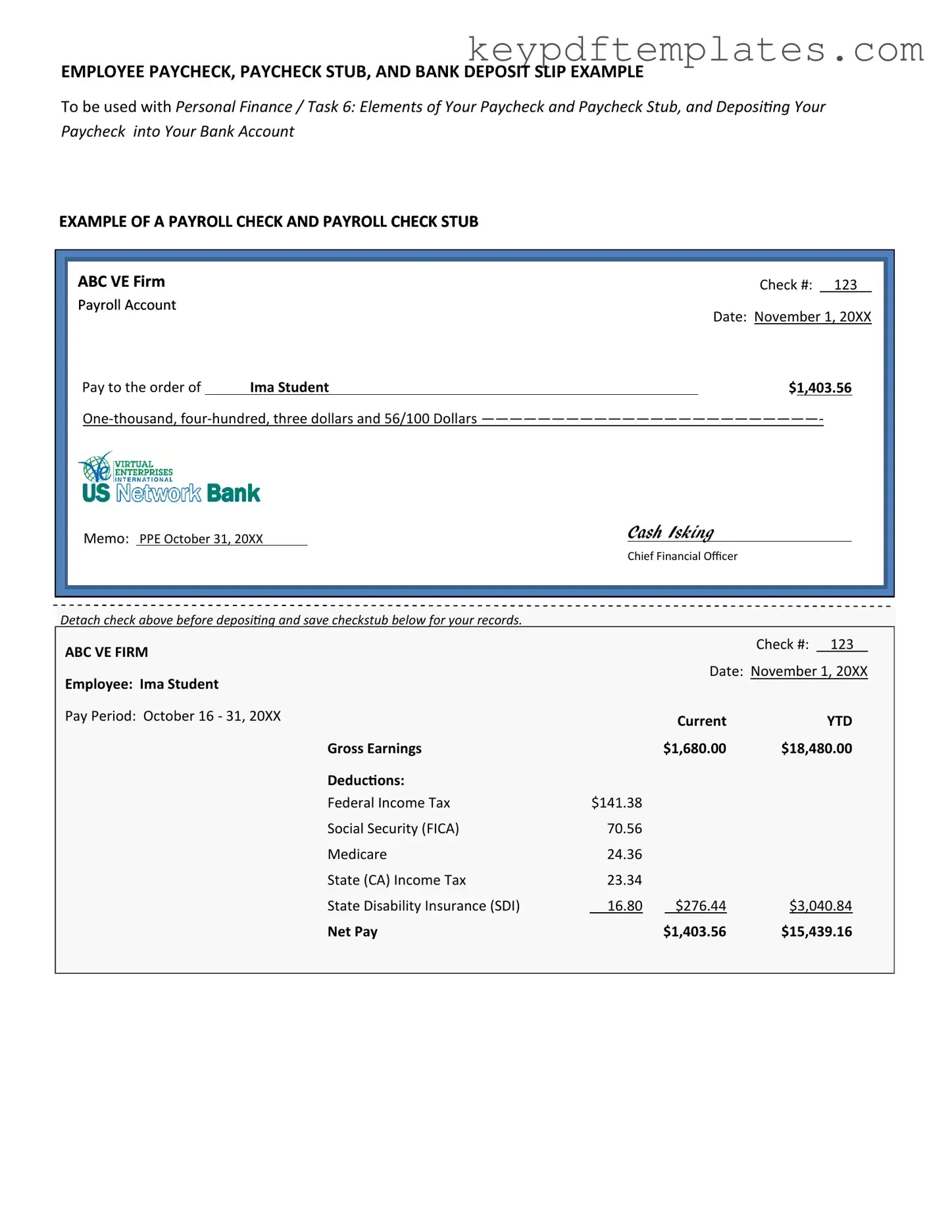

Pay Stub: Similar to the Payroll Check form, a pay stub provides employees with a breakdown of their earnings for a specific pay period. It includes information such as gross pay, deductions, and net pay, helping employees understand how their paycheck was calculated.

- Motor Vehicle Power of Attorney Form: For those needing to delegate vehicle-related tasks, the Motor Vehicle Power of Attorney for vehicle transactions simplifies handling such responsibilities effectively.

-

W-2 Form: The W-2 form is issued annually and summarizes an employee's total earnings and tax withholdings for the year. Like the Payroll Check form, it is essential for tax reporting and provides a clear overview of an employee's financial information.

-

Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their paycheck directly into their bank account. It is similar to the Payroll Check form in that it facilitates the payment process, ensuring employees receive their wages in a timely manner.

-

Time Sheet: A time sheet records the hours worked by an employee during a specific period. This document is crucial for payroll processing, as it directly influences the amounts reflected on the Payroll Check form, ensuring accurate compensation for hours worked.

-

Payroll Register: The payroll register is a comprehensive report that details all payroll transactions for a specific period. It includes information on each employee's earnings, deductions, and net pay, similar to the Payroll Check form, but offers a broader overview of the entire payroll process.

Misconceptions

Understanding payroll check forms is crucial for both employers and employees. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about payroll check forms:

- Payroll checks are always printed on special paper. Many believe that payroll checks must be printed on specific paper. In reality, any standard check paper can be used as long as it meets bank requirements.

- All payroll checks must be signed by hand. Some think that a handwritten signature is necessary for every payroll check. However, electronic signatures are often acceptable, depending on company policy and state laws.

- Payroll checks can only be issued weekly. There is a misconception that payroll checks must follow a weekly schedule. Companies can choose their pay periods, which can be weekly, bi-weekly, or monthly.

- Employees cannot change their direct deposit information. Many believe that once they set up direct deposit, they cannot make changes. In fact, employees can update their direct deposit information at any time, subject to company procedures.

- All deductions on payroll checks are mandatory. Some assume that all deductions are required. While certain deductions, like taxes, are mandatory, others, such as retirement contributions, may be optional.

- Payroll checks do not need to include year-to-date earnings. There is a belief that payroll checks can omit year-to-date earnings. However, providing this information is often required for transparency and record-keeping.

- Only full-time employees receive payroll checks. Many think that payroll checks are exclusive to full-time workers. In truth, part-time employees and contractors can also receive payroll checks.

- Payroll checks must be issued in person. Some believe payroll checks can only be given in person. However, checks can be mailed or deposited directly into an employee's bank account.

- Once issued, payroll checks cannot be canceled. There is a misconception that payroll checks are final once issued. In reality, checks can be canceled or reissued under certain circumstances.

Clearing up these misconceptions can help ensure a smoother payroll process for everyone involved.

More PDF Templates

U.S. Corporation Income Tax Return - A thorough review of all entries on the 1120 is crucial before submission.

When engaging in the process of transferring trailer ownership in Texas, it is essential for both parties to utilize a proper Texas Trailer Bill of Sale form, which can be obtained at txtemplate.com/trailer-bill-of-sale-pdf-template/. This document not only solidifies the sale but also protects the rights of the buyer, ensuring they have clear proof of ownership.

Australia Visa Application Form - The renewal process cannot be initiated without presenting your previous passport.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to issue payments to employees for their work during a specific pay period. |

| Information Required | It typically includes employee details, hours worked, pay rate, deductions, and total payment amount. |

| State-Specific Forms | Some states require specific formats or additional information based on local labor laws. |

| Governing Laws | In the U.S., the Fair Labor Standards Act (FLSA) sets standards for wage and hour laws, which can affect payroll processing. |

| Record Keeping | Employers must keep payroll records for a minimum period, often three years, to comply with federal and state regulations. |

Documents used along the form

When managing payroll, various forms and documents accompany the Payroll Check form to ensure accurate processing and compliance with regulations. Each document serves a unique purpose in the payroll cycle, contributing to a seamless experience for both employers and employees.

- W-4 Form: This form is completed by employees to indicate their tax withholding preferences. It allows employers to determine the correct amount of federal income tax to withhold from each paycheck.

- Pay Stub: A pay stub provides employees with a detailed breakdown of their earnings for a specific pay period. It typically includes information on gross pay, deductions, and net pay, helping employees understand their compensation.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account. It streamlines the payment process and enhances convenience for employees.

- Georgia WC-100 Form: The Georgia PDF is a Settlement Mediation Request utilized by the Georgia State Board of Workers' Compensation, essential for initiating mediation aimed at settling workers' compensation claims.

- I-9 Form: The I-9 form is used to verify an employee’s identity and eligibility to work in the United States. Employers must keep this form on file for each employee to comply with federal regulations.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state taxes. Employees fill it out to indicate their state tax withholding preferences, ensuring compliance with state tax laws.

- Employee Time Sheet: This document records the hours worked by employees during a pay period. Accurate timekeeping is essential for calculating wages and ensuring that employees are compensated correctly for their work.

Each of these documents plays a critical role in the payroll process, ensuring that employers meet their obligations while providing transparency and clarity to employees. Understanding the purpose of each form can facilitate smoother payroll operations and enhance overall workplace efficiency.