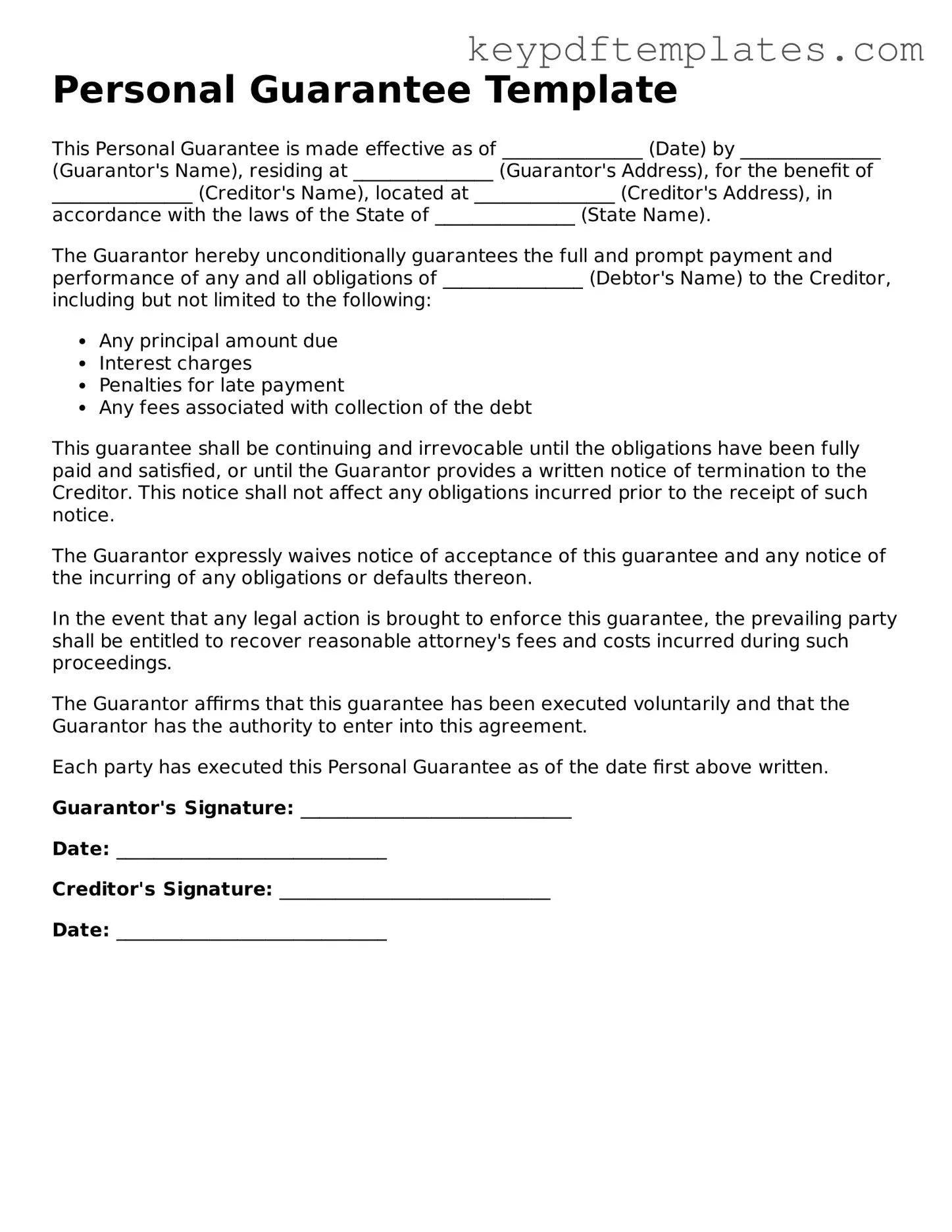

Printable Personal Guarantee Template

Key takeaways

When filling out and using the Personal Guarantee form, it is essential to keep several key points in mind.

- Ensure that all personal information is accurate and complete. This includes your name, address, and contact details.

- Read the entire document carefully before signing. Understand your obligations and the implications of the guarantee.

- Consider consulting with a legal professional if you have any questions or concerns about the terms.

- Be aware that signing a Personal Guarantee makes you personally liable for the debts of the business.

- Keep a copy of the signed form for your records. This will be important for future reference.

- Submit the form to the appropriate party promptly to avoid delays in processing.

- Understand that the guarantee may impact your credit score and financial standing.

Similar forms

- Lease Agreement: A lease agreement outlines the terms under which a tenant rents property from a landlord. Like a personal guarantee, it often requires a signature to confirm responsibility for obligations, such as payment of rent.

- Loan Agreement: This document details the terms of a loan between a borrower and a lender. Both documents establish personal accountability for repayment, similar to how a personal guarantee holds an individual liable for another's debt.

- Business Partnership Agreement: A partnership agreement defines the roles and responsibilities of partners in a business. It can include personal guarantees for business debts, paralleling the commitment found in a personal guarantee.

- Credit Application: When applying for credit, individuals often provide personal guarantees to secure financing. This document serves a similar purpose by ensuring that the applicant is personally liable for the debt incurred.

- Real Estate Purchase Agreement: The California Real Estate Purchase Agreement is crucial in ensuring clarity in real estate transactions. It defines key terms such as the purchase price and contingencies between buyer and seller, making it essential for a smooth transfer of ownership. For more details, visit https://formcalifornia.com/editable-real-estate-purchase-agreement-form/.

- Promissory Note: A promissory note is a written promise to pay a specific amount of money at a future date. Like a personal guarantee, it establishes a personal commitment to fulfill financial obligations.

- Indemnity Agreement: An indemnity agreement protects one party from losses or damages incurred by another. Similar to a personal guarantee, it involves a promise to cover certain liabilities.

- Corporate Resolution: This document records decisions made by a corporation's board of directors. It may include personal guarantees by officers, linking it to the personal accountability aspect of a personal guarantee.

- Security Agreement: A security agreement outlines collateral for a loan. It often includes personal guarantees, reinforcing the borrower's obligation to repay the loan.

- Letter of Credit: A letter of credit is a financial document issued by a bank guaranteeing payment. It may require personal guarantees to ensure that the bank is protected against default, similar to a personal guarantee.

- Surety Bond: A surety bond involves a third party guaranteeing the performance of an obligation. Like a personal guarantee, it holds an individual accountable if the primary party fails to meet their obligations.

Misconceptions

Understanding the Personal Guarantee form is crucial for individuals entering into agreements that require personal liability. Here are eight common misconceptions about this form:

- It is only for business owners. Many believe that only business owners need to sign a Personal Guarantee. However, individuals can also be required to provide a guarantee for loans or leases.

- It protects the guarantor. Some think that signing a Personal Guarantee offers them protection. In reality, it exposes the guarantor to personal liability if the primary party defaults.

- It is a standard procedure. While Personal Guarantees are common, not all agreements require them. The necessity depends on the lender's or landlord's policies and the creditworthiness of the primary party.

- It only applies to large loans. Many assume that Personal Guarantees are only relevant for significant financial commitments. However, they can apply to smaller loans or leases as well.

- Once signed, it cannot be changed. Some believe that a Personal Guarantee is permanent and unchangeable. In fact, it may be possible to negotiate terms or release the guarantee under certain conditions.

- It only affects business credit. People often think that Personal Guarantees impact only business credit scores. In truth, they can also affect personal credit scores if the primary party defaults.

- It is a formality without consequences. Many view the Personal Guarantee as a mere formality. However, it carries significant legal consequences that can lead to personal financial loss.

- Signing means unlimited liability. Some believe that all Personal Guarantees involve unlimited liability. While many do, some agreements may limit the guarantor's liability to a specific amount.

Awareness of these misconceptions can help individuals make informed decisions when dealing with Personal Guarantees.

Other Personal Guarantee Types:

How to Fire a Realtor Example Letter - A clear understanding of local laws can guide the filled-out termination form process.

Before signing any agreements, it is essential for both buyers and sellers to understand the specifics of the transaction to prevent issues down the line. The Kentucky Real Estate Purchase Agreement form is critical in achieving that clarity. For those looking for a reliable source to obtain the necessary documentation, visit All Kentucky Forms to ensure you have the correct legal templates needed for a smooth process.

Purchase Agreement Addendum - The addendum allows both parties to ensure mutual understanding regarding changes in terms, conditions, or contingencies.

Private Mortgage Contract - The Owner Financing Contract can include contingencies for inspections and appraisals.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A personal guarantee is a promise made by an individual to repay a debt or fulfill an obligation if the primary borrower fails to do so. |

| Purpose | This form is often used by lenders to mitigate risk when extending credit to businesses, especially startups or those with limited credit history. |

| Common Usage | Personal guarantees are frequently required for business loans, leases, and credit agreements. |

| State-Specific Forms | Some states have specific forms or requirements for personal guarantees. For example, California requires adherence to the California Civil Code. |

| Legal Binding | Once signed, a personal guarantee is a legally binding document, meaning the guarantor can be held accountable for the debt. |

| Duration | The obligation under a personal guarantee typically lasts until the debt is paid off or the agreement is formally terminated. |

| Impact on Credit | If the primary borrower defaults, the guarantor’s credit score may be negatively impacted, as the lender can pursue repayment from them. |

| Revocation | In some cases, a personal guarantee can be revoked, but this often requires formal notification and agreement from the lender. |

| Negotiability | The terms of a personal guarantee can sometimes be negotiated, including limits on liability or specific conditions under which it applies. |

Documents used along the form

A Personal Guarantee form is often used in conjunction with various other documents to ensure comprehensive coverage of legal obligations and responsibilities. Below is a list of related forms and documents that may be utilized alongside a Personal Guarantee.

- Loan Agreement: This document outlines the terms and conditions of a loan, including the amount borrowed, interest rates, and repayment schedule. It establishes the legal framework for the lender-borrower relationship.

- Promissory Note: A written promise from the borrower to repay a specified amount of money to the lender by a certain date. This document serves as evidence of the debt.

- Real Estate Purchase Agreement Form: When engaging in real estate transactions, it is vital to utilize our detailed Real Estate Purchase Agreement form guide to ensure that all terms and conditions are clearly defined.

- Security Agreement: This form details the collateral pledged by the borrower to secure the loan. It specifies what assets can be claimed by the lender in case of default.

- Business License: A legal authorization for a business to operate within a certain jurisdiction. It may be required by local, state, or federal authorities.

- Operating Agreement: This document is essential for LLCs and outlines the management structure, responsibilities, and operational procedures of the business.

- Partnership Agreement: A contract between partners in a business that defines their roles, responsibilities, profit-sharing arrangements, and procedures for resolving disputes.

- Articles of Incorporation: This document establishes a corporation as a legal entity. It includes details such as the company name, purpose, and the number of shares authorized.

- Financial Statements: These documents provide a snapshot of a company's financial health, including balance sheets, income statements, and cash flow statements. They are often required by lenders.

- Credit Application: A form that potential borrowers fill out to provide information about their creditworthiness. Lenders use this to assess the risk of lending money.

Understanding these documents can help individuals and businesses navigate their financial obligations more effectively. Each form plays a crucial role in establishing clear expectations and protecting the interests of all parties involved.