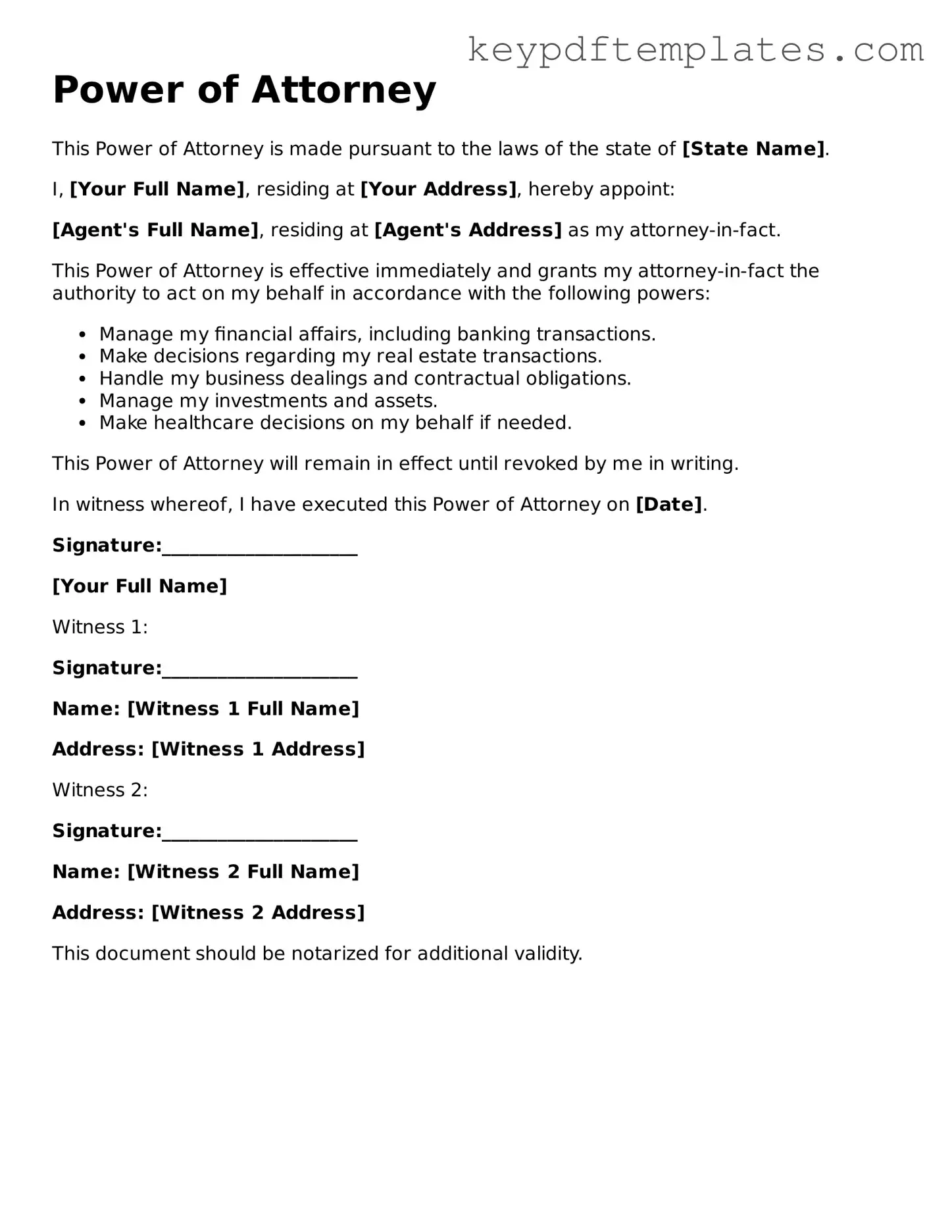

Printable Power of Attorney Template

Power of Attorney - Tailored for State

Key takeaways

When considering the Power of Attorney (POA) form, it is essential to understand its significance and implications. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Power of Attorney allows you to designate someone to make decisions on your behalf, particularly in financial or medical matters.

- Choose Your Agent Wisely: Select a trusted individual as your agent. This person will have significant authority and responsibility.

- Specify the Powers Granted: Clearly outline what powers you are granting. This can include managing finances, making healthcare decisions, or handling real estate transactions.

- Consider a Durable POA: A durable Power of Attorney remains effective even if you become incapacitated. This can provide peace of mind for you and your family.

- Consult Legal Advice: It may be beneficial to seek legal advice to ensure the document meets your needs and complies with state laws.

- Keep Copies Accessible: After completing the form, make copies and provide them to your agent, family members, and relevant institutions.

- Review Regularly: Life circumstances change. Regularly review and update your Power of Attorney to reflect your current wishes and situation.

- Understand Revocation: You have the right to revoke a Power of Attorney at any time, as long as you are competent. Ensure you follow the proper procedures to do so.

By keeping these points in mind, you can navigate the process of creating and using a Power of Attorney with greater confidence and clarity.

Similar forms

- Living Will: A living will outlines a person's wishes regarding medical treatment in case they become incapacitated. Like a Power of Attorney, it ensures that decisions reflect the individual's preferences when they cannot communicate them.

- Healthcare Proxy: This document allows someone to make medical decisions on behalf of another person. Similar to a Power of Attorney, it designates a trusted individual to act in the best interest of the person when they are unable to do so themselves.

- Durable Power of Attorney: A durable Power of Attorney remains effective even if the principal becomes incapacitated. It shares the same purpose as a standard Power of Attorney but offers additional protection for ongoing financial and legal matters.

- California Trailer Bill of Sale: This form is crucial for transferring ownership of a trailer, ensuring that both parties understand the transaction details. For more information, visit Top Forms Online.

- Financial Power of Attorney: This document specifically grants authority to manage financial affairs. It is similar to a general Power of Attorney but focuses solely on financial decisions, ensuring that someone can handle bills, investments, and other monetary concerns.

Power of Attorney Categories

Misconceptions

Many people have misunderstandings about the Power of Attorney (POA) form. Here are four common misconceptions and explanations to clarify them:

- Misconception 1: A Power of Attorney gives someone complete control over your life.

- Misconception 2: A Power of Attorney is only needed for elderly individuals.

- Misconception 3: A Power of Attorney is permanent and cannot be revoked.

- Misconception 4: A Power of Attorney is the same as a living will.

This is not true. A POA allows an agent to act on your behalf in specific situations. You can limit the powers granted to the agent, such as handling financial matters or making medical decisions. The agent cannot make decisions outside the scope of the authority you provide.

This is incorrect. Anyone can benefit from having a POA, regardless of age. Unexpected events, such as accidents or sudden illnesses, can happen to anyone. Having a POA ensures that someone you trust can make decisions for you if you cannot.

This is false. You can revoke a POA at any time, as long as you are mentally competent. To revoke it, you should provide written notice to your agent and any institutions that may have a copy of the document.

This is a common misunderstanding. A POA and a living will serve different purposes. A POA allows someone to make decisions on your behalf, while a living will outlines your wishes regarding medical treatment if you become unable to communicate them yourself.

Common Forms

Bill of Lading - This form can also help clarify joint venture responsibilities between several entities.

For those seeking to enhance their mental well-being, obtaining an Emotional Support Animal Letter form can be an essential step in securing the vital companionship of their pets, as this document is crucial in validating the support provided by emotional support animals.

Welder Qualification Record - Provides a comprehensive overview of each welder’s testing history.

Lady Bird Deed Example - A Lady Bird Deed provides property owners with strong legal benefits with minimal complexity.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Types | There are several types of POA, including General, Durable, and Limited, each serving different purposes. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated, while a non-durable one does not. |

| State-Specific Forms | Each state has its own requirements for POA forms, governed by state laws, such as the Uniform Power of Attorney Act. |

| Revocation | The principal can revoke a Power of Attorney at any time, provided they are mentally competent to do so. |

| Agent's Responsibilities | The agent must act in the best interest of the principal and follow their wishes as outlined in the POA document. |

| Legal Requirements | Most states require the POA to be signed by the principal and witnessed or notarized to be valid. |

Documents used along the form

When creating a Power of Attorney, several other documents may be necessary to ensure that all aspects of the principal's affairs are managed effectively. Below is a list of commonly used forms and documents that often accompany a Power of Attorney.

- Durable Power of Attorney: This document remains in effect even if the principal becomes incapacitated, allowing the agent to make decisions on their behalf.

- Motor Vehicle Bill of Sale: Essential for documenting the sale and transfer of ownership for a vehicle; you can access the Motor Vehicle Bill of Sale form for convenience.

- Healthcare Proxy: A legal document that designates someone to make medical decisions for the principal if they are unable to do so themselves.

- Living Will: This outlines the principal's wishes regarding medical treatment and end-of-life care, guiding the agent in making healthcare decisions.

- Financial Power of Attorney: Specifically focuses on financial matters, allowing the agent to manage the principal's financial affairs.

- Will: A legal document that specifies how the principal's assets will be distributed upon their death, complementing the Power of Attorney in estate planning.

- Trust Agreement: This document creates a trust, allowing the agent to manage assets for the benefit of the principal or other beneficiaries.

- Authorization for Release of Information: This form allows designated individuals to access the principal's personal and medical information, ensuring the agent can make informed decisions.

- Banking Authorization: A specific document that grants the agent permission to access and manage the principal's bank accounts.

- Property Management Agreement: This outlines how the agent will manage real estate or personal property on behalf of the principal.

- Guardianship Documents: If the principal is unable to care for themselves, these documents appoint a guardian to make personal and financial decisions.

These documents work together to provide comprehensive support for the principal's needs and ensure that their wishes are honored. Always consult with a qualified professional when preparing these forms to ensure they meet legal requirements.