Printable Prenuptial Agreement Template

Prenuptial Agreement - Tailored for State

Key takeaways

When considering a prenuptial agreement, it's essential to understand its purpose and implications. Here are some key takeaways to keep in mind:

- Open Communication: Discuss the idea of a prenuptial agreement openly with your partner. Honesty fosters trust and understanding.

- Define Your Goals: Clearly outline what you hope to achieve with the agreement. This could include asset protection, debt management, or other financial considerations.

- Consult Professionals: Seek advice from legal and financial professionals. Their expertise can guide you in drafting an agreement that meets your needs.

- Be Transparent: Full disclosure of assets and debts is crucial. Hiding information can lead to disputes and may invalidate the agreement.

- Review Regularly: Life circumstances change. Periodically review and update your prenuptial agreement to reflect your current situation.

- Consider State Laws: Prenuptial agreements are subject to state laws. Understanding these laws can help ensure your agreement is enforceable.

- Emotional Preparedness: Be ready for the emotional aspects of discussing a prenuptial agreement. It can be a sensitive topic but addressing it can strengthen your relationship.

Similar forms

- Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is created after marriage. It outlines how assets will be divided in the event of a divorce or separation. Both documents serve to protect individual interests and clarify financial responsibilities.

- Separation Agreement: This document is used when a couple decides to live apart but is not yet divorced. A separation agreement details the division of property, child custody, and support arrangements. Like a prenuptial agreement, it aims to prevent disputes and provide clarity.

- Last Will and Testament: A crucial document for ensuring that your assets are distributed according to your wishes after death. By incorporating a Florida Last Will and Testament form, you can clarify your preferences for your belongings and financial matters. For more information on this essential legal form, visit allfloridaforms.com.

- Marital Settlement Agreement: Often used during divorce proceedings, this agreement outlines how assets and debts will be divided. It can include provisions for spousal support and child custody. Both this and a prenuptial agreement focus on asset distribution and financial responsibilities.

- Living Together Agreement: This document is for couples who live together but are not married. It addresses property rights, financial responsibilities, and what happens if the relationship ends. Similar to a prenuptial agreement, it aims to protect the interests of both parties involved.

Misconceptions

Many individuals hold misconceptions about prenuptial agreements, often leading to misunderstandings about their purpose and benefits. Here are five common misconceptions:

- Prenuptial agreements are only for the wealthy. This is not true. Prenuptial agreements can benefit couples of all income levels. They help clarify financial expectations and protect assets, regardless of wealth.

- Prenuptial agreements are a sign of distrust. While some may view them this way, they can actually foster open communication about finances. Discussing financial matters before marriage can strengthen the relationship.

- Prenuptial agreements are not legally binding. When properly drafted and executed, prenuptial agreements are legally enforceable in most jurisdictions. It is important to follow the correct legal procedures to ensure validity.

- Prenuptial agreements can cover anything. While they can address many financial matters, they cannot dictate child custody or support issues. Courts typically determine these matters based on the child's best interests.

- Once signed, a prenuptial agreement cannot be changed. This is a misconception. Couples can modify their prenuptial agreements at any time, as long as both parties agree to the changes and follow the legal requirements for amendments.

Common Forms

Roommate Rules Template - Establish what happens in case of late rent payments.

Family Rental Agreement - This form sets clear expectations for both landlord and tenant in a familial context.

To ensure the transfer of ownership is handled correctly, it is important to use the appropriate documentation, such as the Florida PDF Forms, which provides the necessary template for your Trailer Bill of Sale.

Separation Agreement Template Alberta - Ensures both parties are on the same page regarding the separation timeline.

PDF Details

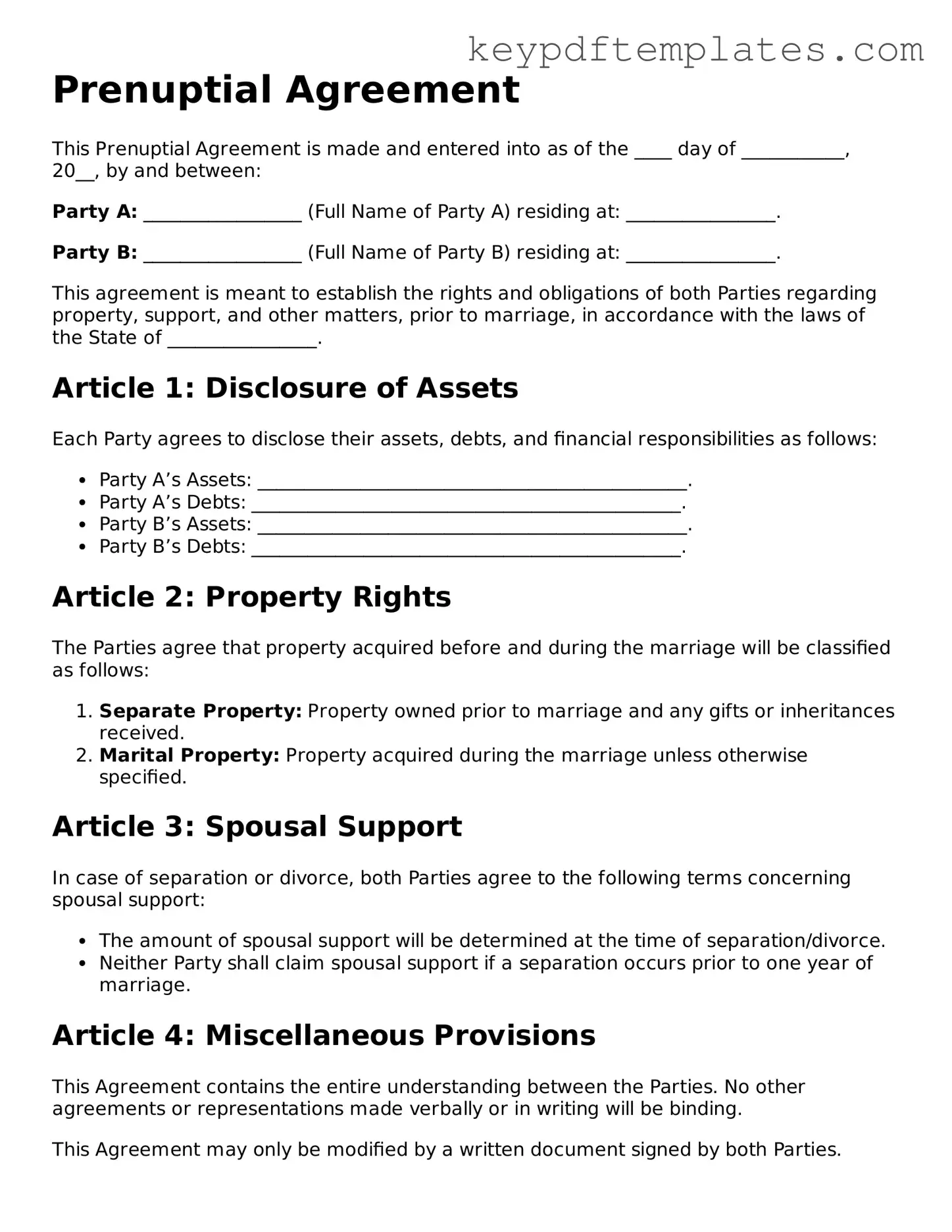

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a contract made before marriage that outlines the distribution of assets and responsibilities in the event of divorce or separation. |

| Purpose | The main purpose is to protect individual assets and clarify financial responsibilities during the marriage and in case of a divorce. |

| State Laws | Prenuptial agreements are governed by state law. Each state has specific requirements for enforceability, including full disclosure of assets. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing, signed by both parties, and entered into voluntarily. |

| Modification | A prenuptial agreement can be modified or revoked after marriage, but this typically requires a written agreement signed by both parties. |

| Legal Advice | It is advisable for both parties to seek independent legal advice before signing a prenuptial agreement to ensure fairness and understanding. |

| Common Misconceptions | Many people believe prenuptial agreements are only for the wealthy. However, they can benefit anyone who wants to protect their financial interests. |

Documents used along the form

A prenuptial agreement is an important document that helps couples outline their financial rights and responsibilities before marriage. However, there are several other forms and documents that are commonly used alongside a prenuptial agreement to ensure a comprehensive understanding of each party's situation. Here are four additional documents that can complement a prenuptial agreement:

- Financial Disclosure Statement: This document provides a detailed account of each partner's financial situation, including assets, debts, income, and expenses. It promotes transparency and helps both parties make informed decisions.

- Vehicle Purchase Agreement: An essential document for anyone buying or selling a vehicle in California, detailing the terms of the sale and providing a formal record of the transaction; for more information, view the pdf.

- Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is created after marriage. It outlines how assets and debts will be handled in the event of divorce or separation, making it useful for couples who wish to revisit their financial arrangements.

- Separation Agreement: If a couple decides to separate, a separation agreement can help clarify the terms of their separation. This document typically addresses issues like property division, spousal support, and child custody, providing a roadmap for both parties during this challenging time.

- Will or Estate Plan: While not directly related to a prenuptial agreement, having a will or estate plan is crucial for married couples. It ensures that each partner's wishes regarding asset distribution and guardianship are clearly outlined, protecting both parties and any children involved.

Understanding these documents can help couples navigate the complexities of marriage and financial planning. Each one serves a unique purpose and can significantly contribute to a well-rounded approach to managing marital assets and responsibilities.