Get Profit And Loss Form

Key takeaways

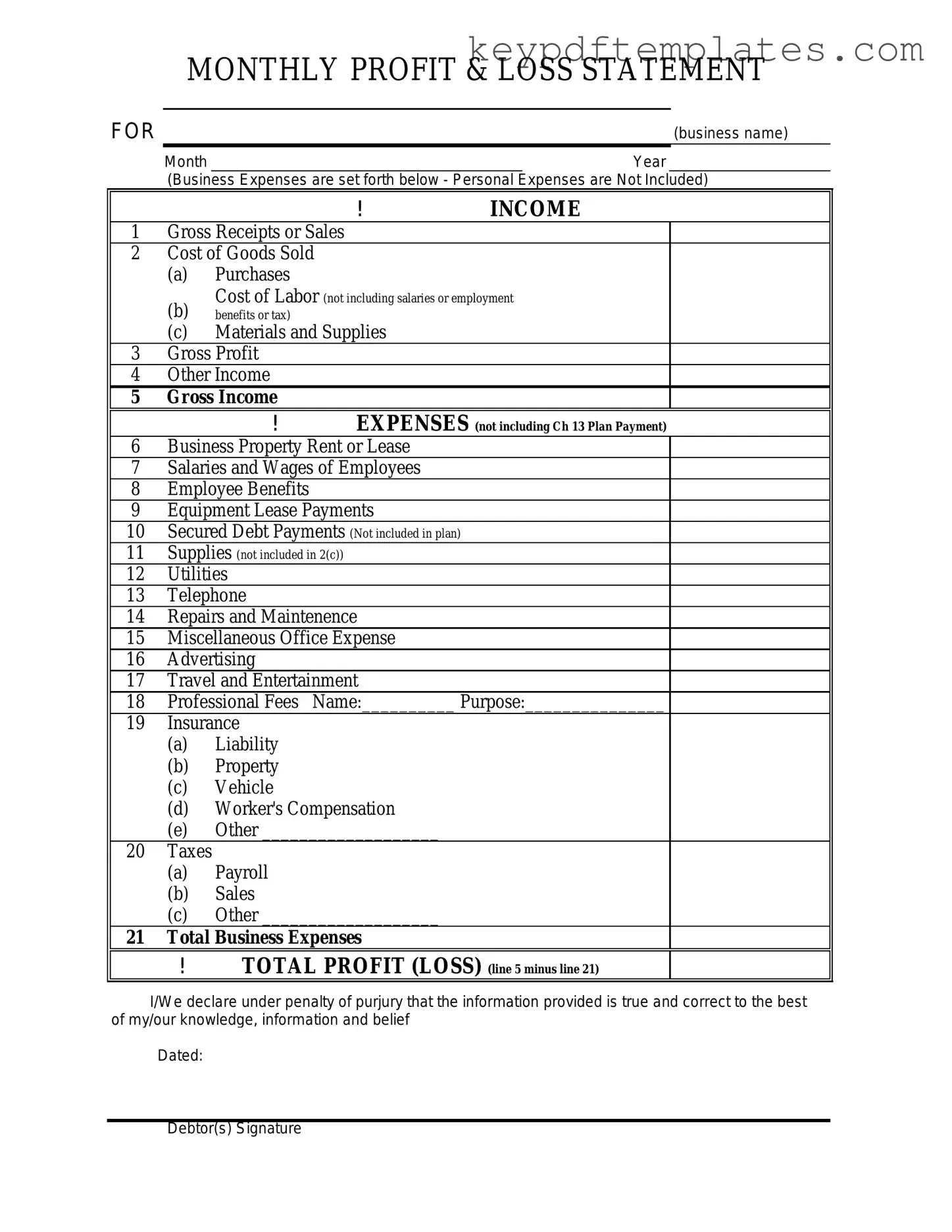

Filling out the Profit and Loss form is essential for understanding your business's financial health. Here are some key takeaways to consider:

- Accuracy is crucial. Double-check all entries to ensure they reflect true income and expenses.

- Organize your data. Categorizing income and expenses helps in analyzing trends and making informed decisions.

- Regular updates are necessary. Fill out the form monthly or quarterly to keep track of your financial progress.

- Use the form to identify areas for improvement. Look for patterns in expenses that can be reduced or eliminated.

- Compare your results over time. This helps you gauge your business's growth and profitability.

- Seek professional advice if needed. A financial advisor can provide insights that enhance your understanding of the data.

Similar forms

The Profit and Loss form is a vital document for assessing a business's financial performance. Several other documents share similarities with the Profit and Loss form, each serving its unique purpose in financial reporting. Here are four such documents:

- Balance Sheet: This document provides a snapshot of a company's financial position at a specific point in time. While the Profit and Loss form summarizes revenues and expenses over a period, the Balance Sheet lists assets, liabilities, and equity, showing what the business owns and owes.

- Cash Flow Statement: This statement tracks the flow of cash in and out of a business. Like the Profit and Loss form, it covers a specific period, detailing how cash is generated and used. It emphasizes liquidity, whereas the Profit and Loss form focuses on profitability.

- Hold Harmless Agreement: This important document serves to protect parties from liability during activities, ensuring mutual agreement on risk acceptance. For more information, visit Georgia PDF.

- Income Statement: Often used interchangeably with the Profit and Loss form, the Income Statement outlines a company's revenues and expenses. Both documents aim to show how much money the business made or lost during a given time frame, making them essential for understanding financial health.

- Statement of Retained Earnings: This document details the changes in retained earnings over a specific period. It is similar to the Profit and Loss form in that it reflects the impact of profits and losses on the company's equity. It shows how much of the profit is retained for reinvestment versus distributed as dividends.

Misconceptions

Understanding the Profit and Loss form is essential for anyone involved in business finance. However, several misconceptions often arise. Here are four common misunderstandings:

-

It only shows revenue and expenses.

Many people believe that the Profit and Loss form simply lists income and expenses. In reality, it provides a comprehensive overview of a business's financial performance, including gross profit, operating income, and net profit, giving a clearer picture of overall financial health.

-

It is only relevant for large businesses.

Some think that the Profit and Loss form is only necessary for large corporations. However, small businesses and startups also benefit from this document. It helps them track their financial progress and make informed decisions, regardless of size.

-

It is the same as a balance sheet.

Another misconception is that the Profit and Loss form and the balance sheet serve the same purpose. While both documents are vital for understanding a business's financial situation, they serve different functions. The Profit and Loss form focuses on performance over a specific period, whereas the balance sheet provides a snapshot of assets, liabilities, and equity at a single point in time.

-

It is only useful for tax purposes.

Some individuals believe that the Profit and Loss form is primarily for tax reporting. While it does play a role in tax preparation, its value extends far beyond that. Business owners can use it to assess profitability, manage budgets, and plan for future growth.

More PDF Templates

Fake Restraining Order Template - The restrained person cannot possess firearms or ammunition while the order is in effect.

In an increasingly complex financial landscape, securing necessary documents is essential; among these, the Income Comfirmation Letter plays a significant role in verifying one's employment status, ensuring that individuals can meet the requirements for loans, housing, and other essential services.

Kink Form - Defines limits for both emotional and physical boundaries.

Dd 214 - Understanding the DD 214 can aid in navigating the VA benefits system.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form is used to summarize the revenues, costs, and expenses incurred during a specific period, typically a fiscal quarter or year. |

| Importance | This form is crucial for businesses to assess their financial performance, helping owners make informed decisions about future operations. |

| Components | Key components include total revenue, cost of goods sold, gross profit, operating expenses, and net profit or loss. |

| Filing Requirements | Many states require businesses to submit a Profit and Loss statement as part of their annual tax filings. Specific requirements vary by state. |

| Governing Laws | In California, for example, the Profit and Loss form is governed by the California Revenue and Taxation Code. Each state has its own regulations. |

| Frequency of Use | Businesses typically prepare this form on a quarterly or annual basis, but it can also be generated monthly for more frequent analysis. |

Documents used along the form

When managing a business's financial health, several key documents complement the Profit and Loss form. Each of these documents provides valuable insights into different aspects of a company’s financial performance. Understanding these forms can help stakeholders make informed decisions.

- Balance Sheet: This document provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It helps assess the financial stability and liquidity of the business.

- Cash Flow Statement: This statement tracks the flow of cash in and out of the business over a certain period. It highlights how well the company generates cash to meet its obligations and fund its operations.

- Power of Attorney: To ensure you have the necessary legal authority to make decisions on someone’s behalf, utilize our comprehensive Power of Attorney form resources for accurate completion and compliance.

- Income Statement: Often used interchangeably with the Profit and Loss form, this document summarizes revenues, costs, and expenses during a specific period, providing insight into profitability.

- Budget: A budget outlines projected revenues and expenses for a future period. It serves as a financial plan that helps businesses allocate resources effectively and set financial goals.

- Tax Returns: These forms report income, expenses, and other relevant financial information to the government. They are essential for compliance and provide a historical view of a company’s financial performance.

By utilizing these documents alongside the Profit and Loss form, businesses can gain a comprehensive understanding of their financial landscape. This holistic view is crucial for strategic planning and sustainable growth.