Printable Promissory Note Template

Promissory Note - Tailored for State

Key takeaways

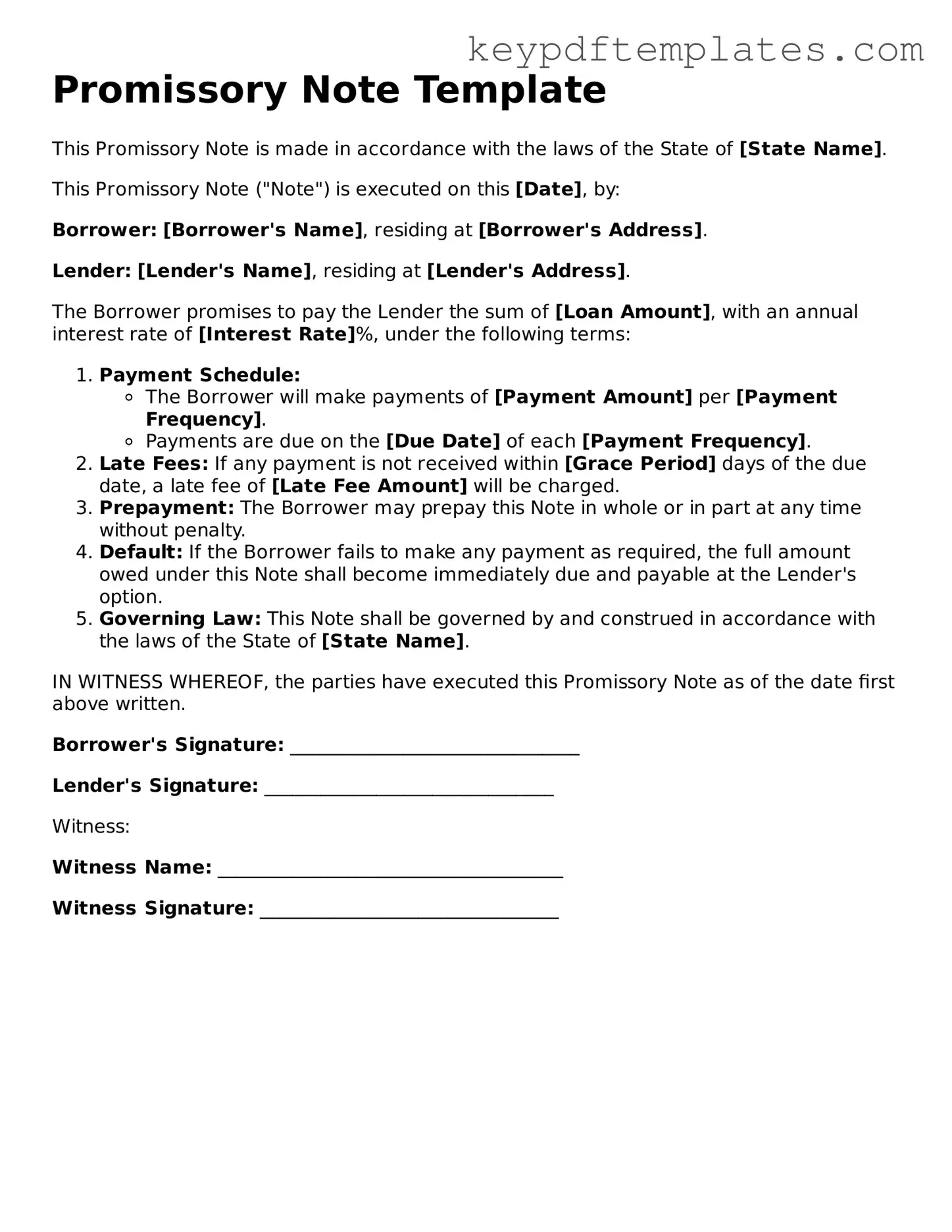

When filling out and using a Promissory Note form, there are several important points to keep in mind. Understanding these can help ensure that the document serves its intended purpose effectively.

- Clearly Define the Loan Amount: Specify the exact amount being borrowed. This clarity helps prevent misunderstandings later on.

- Include Interest Rates: If applicable, state the interest rate clearly. This detail is crucial for both parties to understand the total amount to be repaid.

- Set a Repayment Schedule: Outline how and when the borrower will repay the loan. A clear schedule can help avoid confusion and ensure timely payments.

- Detail Consequences of Default: Include what happens if the borrower fails to repay. This can protect the lender’s interests and encourage timely repayment.

- Signatures Are Essential: Both parties must sign the document for it to be legally binding. Without signatures, the note may not hold up in court.

- Keep Copies: Both the lender and borrower should retain copies of the signed Promissory Note. This ensures that each party has access to the terms agreed upon.

By paying attention to these key elements, individuals can create a Promissory Note that is clear, effective, and legally sound.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including repayment schedules and interest rates. However, it is usually more detailed and may include conditions for default.

- Mortgage: A mortgage is a type of promissory note secured by real property. It establishes the borrower's obligation to repay the loan while giving the lender the right to foreclose on the property if payments are not made.

- General Power of Attorney: This important legal document allows an individual to make decisions on behalf of another. For assistance in preparing this form, visit Georgia PDF.

- Credit Agreement: This document outlines the terms under which credit is extended to a borrower. Like a promissory note, it specifies repayment terms but often includes additional covenants and conditions.

- Installment Agreement: An installment agreement allows for payment of a debt in regular installments over time. It shares similarities with a promissory note in that it defines the repayment schedule and amounts due.

- Business Loan Agreement: This document is specifically tailored for business loans. It details the loan amount, interest rate, and repayment terms, similar to a promissory note but often includes business-specific terms.

- Personal Loan Agreement: A personal loan agreement is akin to a promissory note but typically involves borrowing between individuals. It outlines the loan amount, repayment schedule, and any interest charged.

- Lease Agreement: While primarily used for renting property, a lease agreement often includes a payment schedule similar to a promissory note. It specifies the obligations of the lessee to make regular payments.

- Debt Settlement Agreement: This document outlines terms for settling a debt for less than the full amount owed. It resembles a promissory note in that it establishes a payment plan, albeit for a reduced debt amount.

- Forbearance Agreement: A forbearance agreement allows a borrower to temporarily reduce or suspend payments. It is similar to a promissory note in that it outlines the borrower's obligations, albeit with modified terms.

- Security Agreement: This document provides a lender with a security interest in collateral to secure a loan. It shares similarities with a promissory note by establishing the borrower's obligation to repay the loan.

Promissory Note Categories

Misconceptions

Understanding the Promissory Note form is essential for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

-

A Promissory Note is the same as a loan agreement.

This is not accurate. While both documents relate to borrowing money, a Promissory Note is a simpler document that outlines the borrower's promise to repay the loan. A loan agreement often includes additional terms, such as collateral and repayment schedules.

-

All Promissory Notes must be notarized.

This is a misconception. While notarization can add an extra layer of authenticity, it is not a legal requirement for a Promissory Note to be valid. The essential element is the borrower's signature.

-

Promissory Notes are only for large loans.

Many people believe that Promissory Notes are only necessary for significant amounts of money. In reality, they can be used for any loan amount, regardless of size, providing clarity and legal protection for both parties.

-

Once signed, a Promissory Note cannot be changed.

This is not true. Parties can amend a Promissory Note if both agree to the changes. However, it’s important to document these changes properly to avoid future disputes.

-

Only financial institutions can issue Promissory Notes.

This misconception overlooks the fact that individuals can also create and issue Promissory Notes. Any person or entity can enter into a loan agreement and document it using this form.

-

Promissory Notes are not enforceable in court.

This is incorrect. A properly executed Promissory Note is a legally binding document. If a borrower fails to repay the loan, the lender can take legal action to enforce the terms outlined in the note.

Common Forms

Trader Joe's Hiring - Contribute to a culture that encourages teamwork and camaraderie.

The Texas Hold Harmless Agreement is vital for protecting involved parties from unforeseen liabilities. For those looking to ensure their safety during events, consider utilizing the essential Hold Harmless Agreement to formalize your arrangements by visiting this link.

Doctor Note for Work - The note outlines the patient’s name, date of the appointment, and brief reasons for absence.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Parties Involved | There are typically two parties: the maker (borrower) and the payee (lender). |

| Governing Law | The laws governing promissory notes vary by state. For example, in California, it falls under the California Commercial Code. |

| Interest Rate | The note can specify an interest rate, which is the cost of borrowing the money. |

| Repayment Terms | Repayment terms detail how and when the borrower will repay the loan, including any installment plans. |

| Default Clause | A default clause outlines what happens if the borrower fails to make payments as agreed. |

| Transferability | Promissory notes can often be transferred or sold to another party, unless otherwise stated. |

| Signature Requirement | The maker's signature is typically required for the note to be legally binding. |

| Notarization | While notarization is not always required, it can add an extra layer of authenticity. |

| Legal Enforcement | If the borrower defaults, the payee can take legal action to enforce the note and recover the owed amount. |

Documents used along the form

A Promissory Note is a crucial document that outlines a borrower's promise to repay a loan under specific terms. However, it often accompanies several other forms and documents that help clarify the terms of the agreement and protect the interests of both parties involved. Below are some commonly used documents that may accompany a Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document specifies what assets are pledged to guarantee repayment. It outlines the rights of the lender in case of default.

- Disclosure Statement: This form provides important information about the loan, including fees, interest rates, and any potential penalties. It ensures that borrowers are fully informed before agreeing to the loan terms.

- Personal Guarantee: In some cases, a personal guarantee may be required from the borrower or a third party. This document holds an individual personally responsible for the loan if the primary borrower defaults.

- Amortization Schedule: This document breaks down the repayment process into individual payments over time. It shows how much of each payment goes toward interest and how much goes toward reducing the principal balance.

- Articles of Incorporation: This document is essential for starting a business in New York, as it establishes a corporation's legal identity and outlines pivotal details such as its name and purpose. Crucially, for further assistance, you can access the NY PDF Forms to find the requisite forms and guidance.

- Loan Modification Agreement: If the terms of the loan need to change after the Promissory Note is signed, this document outlines the new terms and conditions. It must be agreed upon by both parties.

- Default Notice: This is a formal notification sent to the borrower if they fail to meet the repayment terms. It typically outlines the consequences of default and may initiate collection actions.

These documents work together with the Promissory Note to create a clear and enforceable agreement between the lender and borrower. Understanding each of these forms can help ensure that both parties are protected and aware of their rights and responsibilities throughout the loan process.