Printable Promissory Note for a Car Template

Key takeaways

When filling out and using a Promissory Note for a Car, there are several important points to keep in mind. Here are some key takeaways:

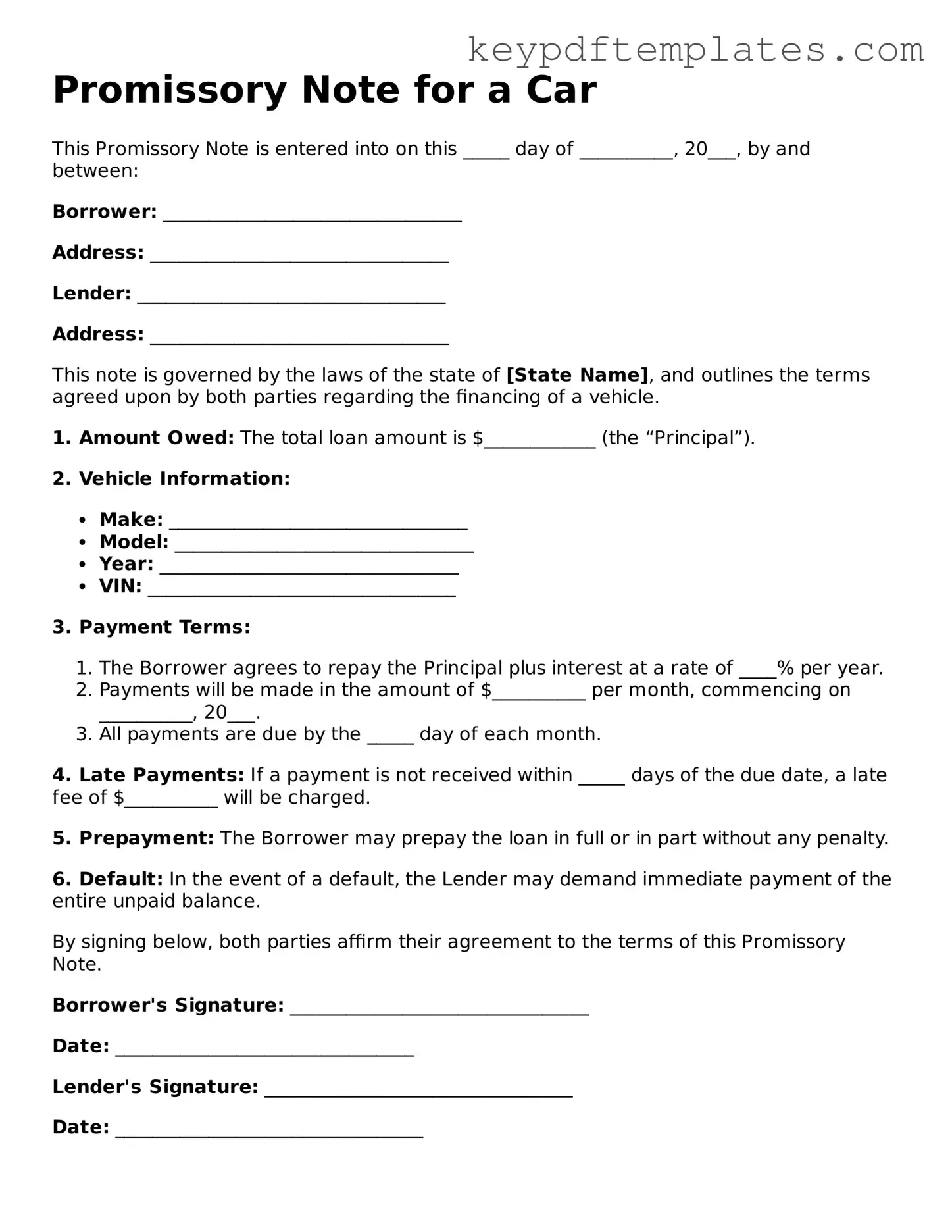

- Clearly State the Loan Amount: Ensure the total amount borrowed is clearly indicated. This avoids any confusion about the financial obligation.

- Detail the Payment Terms: Specify the repayment schedule, including the due dates and the amount of each payment. This helps both parties understand their responsibilities.

- Include Interest Rate Information: If applicable, state the interest rate on the loan. This information is crucial for understanding the total cost of the loan over time.

- Signatures Are Essential: Both the borrower and lender must sign the document. This step formalizes the agreement and makes it legally binding.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of borrowing money. It specifies the amount borrowed, interest rates, repayment schedule, and consequences of default. Both documents serve as a formal acknowledgment of the debt.

- Lease Agreement: A lease agreement can resemble a promissory note in that it details the terms under which a vehicle is leased. It includes payment amounts, duration of the lease, and responsibilities of both parties, ensuring clarity in financial obligations.

- Payment Plan Agreement: Similar to a promissory note, a payment plan agreement lays out the terms for paying off a debt over time. It specifies the total amount owed, installment amounts, due dates, and any applicable late fees, ensuring both parties understand their financial responsibilities. Additional resources for drafting such documents can be found at https://patemplates.com/.

- Sales Contract: A sales contract for a vehicle often includes a promissory note as part of the financing terms. It outlines the purchase price, payment plan, and any warranties or guarantees, providing a comprehensive understanding of the transaction.

- Secured Loan Agreement: This document is similar in that it involves borrowing funds with collateral, such as a vehicle. It details the terms of the loan, including interest rates and repayment schedules, while also establishing the lender's rights to the collateral in case of default.

- Personal Guarantee: A personal guarantee may accompany a promissory note when an individual agrees to be personally liable for the debt. This document reinforces the borrower's commitment and outlines the consequences if the borrower fails to meet their obligations.

Misconceptions

When it comes to financing a car, many people encounter the Promissory Note for a Car form. Unfortunately, several misconceptions can lead to confusion and poor decision-making. Here are six common misunderstandings:

- It’s just a formality. Many believe that signing a Promissory Note is merely a formality, but it is a legally binding document. Once signed, it obligates the borrower to repay the loan under the agreed terms.

- It only benefits the lender. While lenders certainly have protections through the note, borrowers also gain clarity. The note outlines the repayment schedule, interest rates, and any penalties for late payments, ensuring that both parties understand their obligations.

- All Promissory Notes are the same. This is far from the truth. Promissory Notes can vary significantly in terms of interest rates, repayment terms, and conditions. Always read the specific terms of your note carefully.

- Signing means you can’t negotiate. Some individuals think that once they sign the note, they cannot negotiate terms. In reality, discussions can continue even after signing. If you have concerns, communicate with the lender as soon as possible.

- It doesn’t affect your credit. Many assume that a Promissory Note won’t impact their credit score. However, failing to make timely payments can lead to negative credit reporting, affecting future borrowing opportunities.

- You can’t get out of it. Some believe that once they sign a Promissory Note, they are trapped. While it is a binding agreement, options like refinancing or negotiating for better terms may be available if circumstances change.

Understanding these misconceptions can empower borrowers to make informed decisions and protect their financial interests. Always approach the Promissory Note with caution and clarity.

Other Promissory Note for a Car Types:

Release of Promissory Note Sample - A concise way to express that debt obligations have been met and fulfilled.

For those seeking a detailed template for drafting a promissory note, you can find a comprehensive option at https://nyforms.com/promissory-note-template/, which helps ensure that all necessary terms are included and reduces the likelihood of misunderstandings between parties.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specific amount for the purchase of a vehicle. |

| Parties Involved | The note involves at least two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Payment Terms | The note outlines the payment schedule, including the amount of each payment and the due dates. |

| Interest Rate | It specifies the interest rate, which can be fixed or variable, affecting the total amount paid over time. |

| Governing Law | In most states, the Uniform Commercial Code (UCC) governs promissory notes, but specific state laws may apply. |

| Default Consequences | The note details what happens if the borrower fails to make payments, including potential repossession of the vehicle. |

| Transferability | Promissory notes can often be sold or transferred to another party, subject to certain conditions. |

| Signature Requirement | The borrower’s signature is typically required to make the note legally binding. |

| Notarization | While not always necessary, notarization can add an extra layer of authenticity to the document. |

Documents used along the form

A Promissory Note for a Car is a crucial document in financing a vehicle. It outlines the terms under which the borrower agrees to repay the loan. However, several other forms and documents often accompany this note to ensure clarity and legal compliance in the transaction. Below is a list of commonly used documents.

- Bill of Sale: This document serves as proof of the sale and transfer of ownership of the vehicle from the seller to the buyer. It includes details such as the vehicle identification number (VIN), purchase price, and the names of both parties.

- Promissory Note: A critical document that outlines the borrower's obligation to repay the loan, detailing the repayment terms and conditions. For more information, you can refer to the Promissory Note.

- Title Transfer Form: Required for officially transferring the vehicle's title from the seller to the buyer, this form must be completed and submitted to the appropriate state agency to update ownership records.

- Loan Agreement: This document outlines the terms of the loan, including interest rates, payment schedules, and any penalties for late payments. It serves as a comprehensive guide for both parties involved in the financing arrangement.

- Credit Application: When applying for financing, a credit application is often required. This form collects personal and financial information to assess the borrower's creditworthiness.

- Security Agreement: This document establishes the lender's rights to the vehicle in case of default on the loan. It outlines the collateral being used and the lender's ability to repossess the vehicle if necessary.

- Insurance Policy: Proof of insurance is typically required to protect both the lender and borrower. This document provides details of the coverage and ensures that the vehicle is insured during the loan period.

- Payment Schedule: A detailed outline of the repayment terms, including the amount due, due dates, and total number of payments. This document helps both parties track the loan repayment process.

- Disclosure Statement: This statement provides important information about the loan, including the total cost of financing, interest rates, and any fees associated with the loan. It ensures transparency in the lending process.

Understanding these documents can help facilitate a smooth transaction when financing a vehicle. Each form plays a significant role in protecting the interests of both the borrower and the lender, ensuring a clear understanding of the terms involved.