Printable Quitclaim Deed Template

Quitclaim Deed - Tailored for State

Key takeaways

When it comes to using a Quitclaim Deed, understanding its purpose and proper usage is essential. Here are some key takeaways to keep in mind:

- A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. This means the seller is not liable for any claims against the property.

- This type of deed is often used between family members or in situations where the parties know each other well.

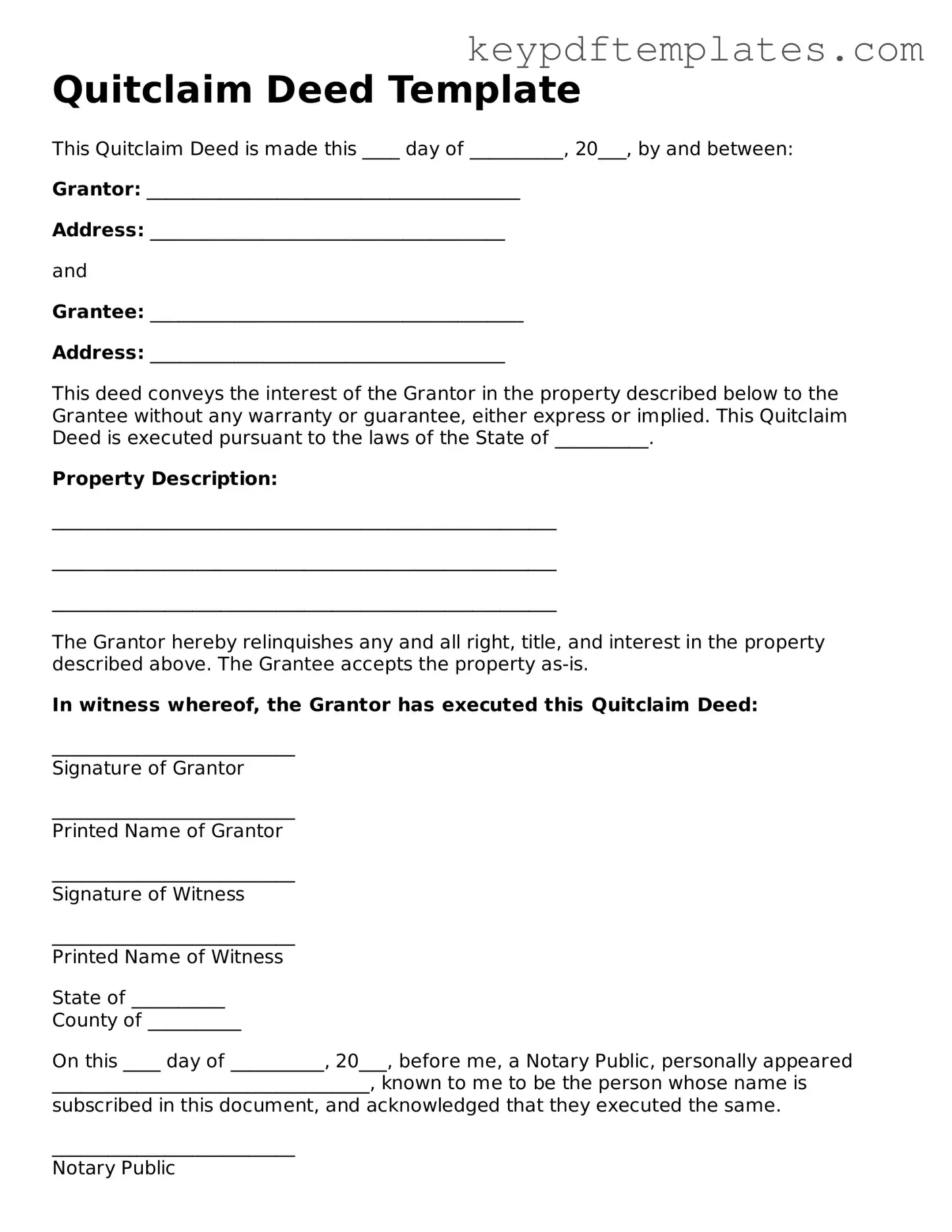

- Filling out the Quitclaim Deed form requires accurate details about the property, including its legal description and the names of both the grantor (seller) and grantee (buyer).

- It’s crucial to have the Quitclaim Deed notarized. This adds a layer of authenticity and helps prevent future disputes.

- After filling out and notarizing the deed, it must be filed with the appropriate county office to make the transfer official.

- Be aware of any local laws or requirements that may affect the Quitclaim Deed process. Each state may have specific rules.

- Using a Quitclaim Deed can be a quick way to transfer property, but it’s wise to consult with a legal expert if you have any doubts about the implications.

By keeping these points in mind, you can navigate the Quitclaim Deed process with greater confidence and clarity.

Similar forms

- Warranty Deed: A Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. Unlike a Quitclaim Deed, which offers no such guarantees, a Warranty Deed ensures that the buyer is protected against any future claims to the property.

- Grant Deed: A Grant Deed conveys ownership of property and includes implied warranties that the property has not been sold to someone else and is free from encumbrances. While both Grant Deeds and Quitclaim Deeds transfer ownership, the former provides some assurance about the title.

- General Power of Attorney: A General Power of Attorney allows you to appoint someone to manage your financial and legal affairs when you are unable to do so. This form is crucial for ensuring your interests are taken care of. To learn more, visit Georgia PDF.

- Deed of Trust: A Deed of Trust secures a loan by transferring the title of the property to a trustee until the loan is paid off. This document is similar in that it involves property transfer but serves a different purpose related to securing financing.

- Special Purpose Deed: A Special Purpose Deed, such as a Personal Representative Deed, is used in specific situations, like transferring property from an estate. Like a Quitclaim Deed, it can transfer ownership without guarantees, but it is tailored for unique circumstances.

Misconceptions

Misconceptions about the Quitclaim Deed can lead to confusion and potential issues in property transactions. Here are seven common misunderstandings:

-

A Quitclaim Deed transfers ownership completely.

This is not entirely accurate. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor has any ownership interest at all.

-

Quitclaim Deeds are only used in divorce cases.

While they are often utilized in divorce settlements to transfer property between spouses, Quitclaim Deeds can also be used in various situations, such as transferring property to family members or clearing up title issues.

-

Using a Quitclaim Deed eliminates all liability.

This is a misconception. The grantor may still be liable for any liens or debts associated with the property, even after the Quitclaim Deed is executed.

-

A Quitclaim Deed is the same as a Warranty Deed.

These two types of deeds serve different purposes. A Warranty Deed provides guarantees about the title and protects the buyer, while a Quitclaim Deed offers no such protections.

-

Quitclaim Deeds are only for transferring real estate.

This is misleading. While they are primarily used for real property, Quitclaim Deeds can also be used for transferring interests in other assets, such as stocks or personal property.

-

Once a Quitclaim Deed is signed, it cannot be revoked.

This is incorrect. A Quitclaim Deed can be revoked or challenged in certain circumstances, especially if fraud or undue influence is involved.

-

Quitclaim Deeds do not need to be recorded.

Although recording is not mandatory, it is highly advisable. Recording the deed provides public notice of the transfer and protects the interests of the new owner.

Other Quitclaim Deed Types:

Transfer on Death Deed California - A Transfer-on-Death Deed can be revoked or modified by the owner at any time before their death.

The Florida Motor Vehicle Power of Attorney form is a legal document that allows an individual to appoint another person to act on their behalf regarding motor vehicle transactions. This form is essential for those who may be unable to handle their vehicle-related matters due to various circumstances. For further assistance and resources, you can visit allfloridaforms.com/, which provides valuable information to help ensure that your vehicle transactions are managed effectively and efficiently.

What Is a Deed in Lieu - This form helps avoid lengthy foreclosure processes by simplifying the property transfer to the bank.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property from one person to another without any warranties or guarantees. |

| Purpose | It is commonly used to clear up title issues, transfer property between family members, or convey property in divorce settlements. |

| Warranties | Unlike warranty deeds, a quitclaim deed offers no assurances about the property’s title. The grantor simply transfers whatever interest they have. |

| State-Specific Forms | Each state has its own specific requirements and forms for quitclaim deeds. For example, California's quitclaim deed must comply with California Civil Code Section 1092. |

| Execution Requirements | Most states require the deed to be signed by the grantor. Some may also require notarization and witnesses. |

| Recording | To provide public notice of the transfer, the quitclaim deed should be recorded with the local county recorder's office. |

| Tax Implications | Transferring property via a quitclaim deed may have tax consequences. It's important to check local laws regarding property tax reassessment. |

| Revocation | Once a quitclaim deed is executed and delivered, it cannot be revoked unilaterally by the grantor. |

| Common Uses | Quitclaim deeds are frequently used in family transactions, such as transferring property between spouses or parents and children. |

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of property. However, it often accompanies other forms and documents to ensure the process is smooth and legally sound. Here’s a list of some common documents you might encounter when dealing with a Quitclaim Deed.

- Property Title Search: This document shows the history of ownership for the property. It helps confirm that the seller has the right to transfer the property and reveals any liens or claims against it.

- Title Insurance Policy: This insurance protects the buyer from any future claims against the property. It covers issues that might arise from past ownership, such as unpaid debts or disputes.

- Affidavit of Identity: This sworn statement verifies the identity of the parties involved in the transaction. It can help prevent fraud and ensures that the correct individuals are transferring ownership.

- Transfer Tax Declaration: This form reports the sale price of the property to the tax authorities. It may be required for tax purposes when the property is transferred.

- Hold Harmless Agreement: To safeguard your interests during events or activities, consider our essential Hold Harmless Agreement guidelines for comprehensive protection against liability.

- Closing Statement: This document outlines all the financial aspects of the property transfer, including fees, taxes, and the final sale price. It ensures transparency for both parties.

- Power of Attorney: If someone is signing on behalf of the property owner, this document grants them the authority to do so. It’s crucial for ensuring that the transfer is valid.

- Notice of Transfer: This form informs local authorities about the change in property ownership. It may be necessary for updating tax records and ensuring the new owner receives relevant information.

- Homestead Declaration: This document can protect a portion of the property from creditors. It may be filed after the Quitclaim Deed to secure the owner's rights to the property.

- Deed of Trust: This document secures a loan with the property as collateral. If the buyer is financing the property, this deed may be necessary to protect the lender's interest.

Using these documents alongside a Quitclaim Deed helps ensure a clear and legal transfer of property. Each plays a vital role in protecting the interests of both the buyer and seller, making the process more secure and efficient.