Printable Real Estate Purchase Agreement Template

Real Estate Purchase Agreement - Tailored for State

Key takeaways

When filling out and using the Real Estate Purchase Agreement form, consider the following key takeaways:

- Accuracy is crucial. Ensure all details, including names, addresses, and property descriptions, are correct to avoid future disputes.

- Understand the terms. Familiarize yourself with the agreement’s terms, such as contingencies, financing, and closing dates, to ensure you meet all requirements.

- Negotiate wisely. Use the agreement as a tool for negotiation. Be clear about your needs and be prepared to compromise where necessary.

- Seek professional advice. Consult with a real estate agent or attorney to review the agreement before signing. Their expertise can help you navigate any complexities.

Similar forms

Lease Agreement: A lease agreement outlines the terms under which a tenant can occupy a property. Like the Real Estate Purchase Agreement, it specifies the parties involved, the property description, and the financial obligations. Both documents serve to protect the interests of the parties and detail their rights and responsibilities.

Hold Harmless Agreement: A Hold Harmless Agreement is essential for protecting parties from liability during events or activities. In Georgia, you can find more details on this important legal document by visiting Georgia PDF.

Sales Contract: A sales contract is used in various transactions, including the sale of goods. Similar to the Real Estate Purchase Agreement, it establishes the terms of the sale, including price, delivery, and payment methods. Both documents aim to ensure that all parties understand their commitments.

Option to Purchase Agreement: This document grants a potential buyer the right to purchase a property within a specified time frame. It shares similarities with the Real Estate Purchase Agreement in that it outlines the purchase price and terms but differs in that it does not obligate the buyer to proceed with the purchase unless they choose to do so.

Joint Venture Agreement: A joint venture agreement is used when two or more parties collaborate on a project, such as real estate development. It is similar to the Real Estate Purchase Agreement in that it outlines the roles, responsibilities, and financial contributions of each party involved, ensuring clarity in the partnership.

Real Estate Purchase Agreement Categories

Misconceptions

Understanding the Real Estate Purchase Agreement (REPA) is crucial for anyone involved in buying or selling property. However, several misconceptions can lead to confusion. Here are seven common misunderstandings about this important document:

-

The Real Estate Purchase Agreement is a legally binding contract.

While it is true that a REPA can be legally binding, it is only enforceable when all parties have signed it. Until then, it is merely a proposal.

-

All terms in the agreement are set in stone.

Many believe that once a REPA is signed, all terms are final. However, terms can be negotiated before closing, as long as both parties agree to the changes.

-

The REPA is the only document needed to finalize a property sale.

This is a common myth. In addition to the REPA, other documents, such as disclosures and title reports, are also necessary to complete the transaction.

-

Real estate agents handle all aspects of the agreement.

While agents play a significant role in facilitating the process, buyers and sellers must still be actively involved in reviewing and understanding the agreement.

-

A Real Estate Purchase Agreement guarantees a successful sale.

Signing a REPA does not ensure that the sale will go through. Issues like financing problems or inspections can still derail the process.

-

Only buyers need to be concerned about the REPA.

Both buyers and sellers should thoroughly understand the REPA. Each party has rights and responsibilities outlined in the agreement that must be acknowledged.

-

Once signed, the REPA cannot be changed.

This is not accurate. Amendments can be made to the agreement if both parties consent to the changes, ensuring that the document reflects their current intentions.

Being aware of these misconceptions can help individuals navigate the complexities of real estate transactions more effectively. Always seek clarification when needed, and do not hesitate to ask questions about the agreement.

Common Forms

Release of Liability Ca Dmv - A document specifying that the buyer assumes full responsibility for the vehicle.

For those seeking to understand key documentation for business operations, the fundamental importance of the Texas Operating Agreement is evident for any limited liability company. Familiarizing yourself with this process enhances governance and member protection, making it a prudent step towards success. To delve into the specifics, visit this comprehensive guide on the Texas Operating Agreement form requirements.

Where to Sell Signed and Numbered Prints - It often includes a warranty clause, stating the artwork's authenticity and condition upon sale.

Form 6059B Customs Declaration - Properly completing the CBP 6059B can prevent future complications with customs.

PDF Details

| Fact Name | Description |

|---|---|

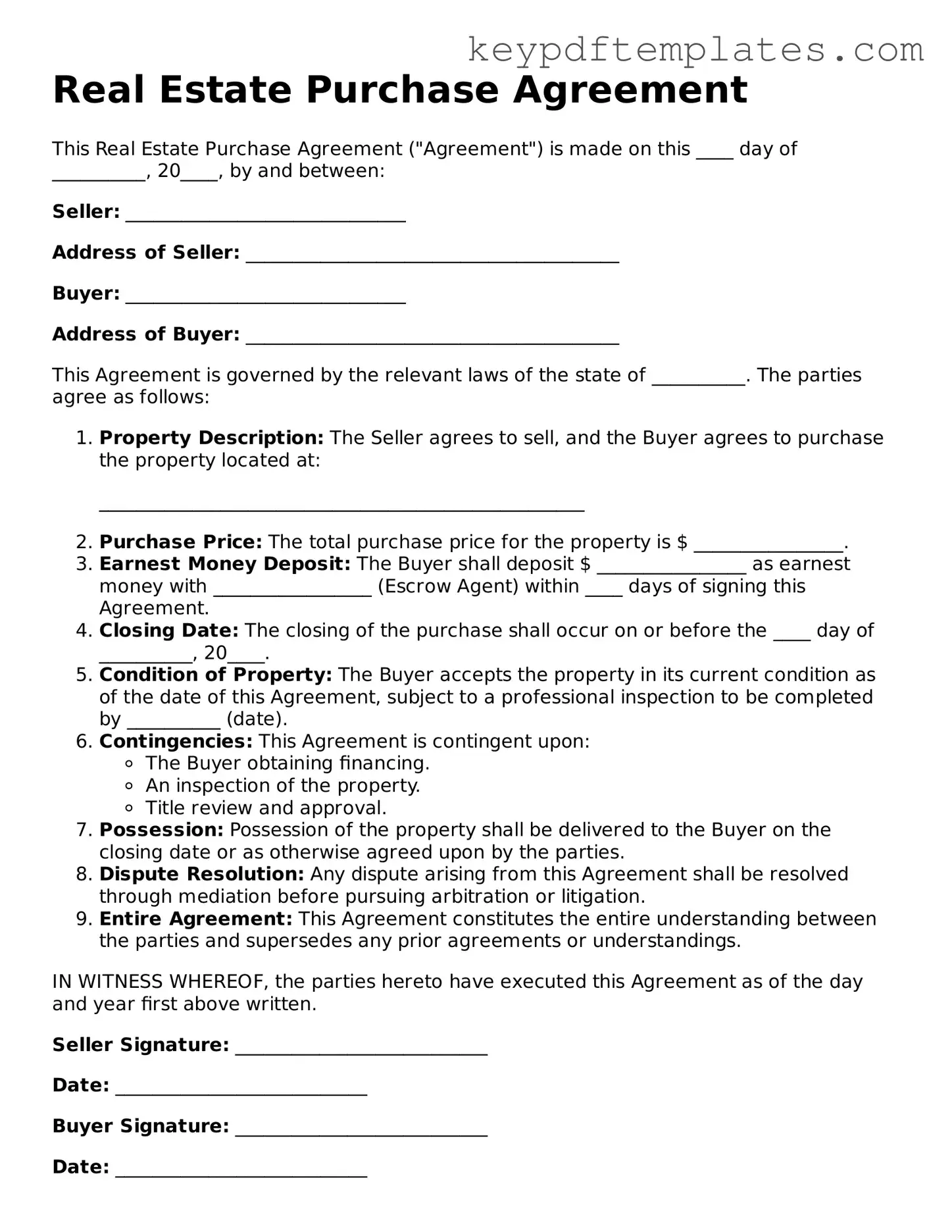

| Purpose | A Real Estate Purchase Agreement outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. |

| Key Components | This agreement typically includes details such as the purchase price, financing terms, contingencies, and closing date. |

| State-Specific Forms | Many states have their own versions of the Real Estate Purchase Agreement, which may incorporate specific state laws and regulations. |

| Governing Laws | In California, for example, the agreement is governed by the California Civil Code, while in Texas, it adheres to the Texas Property Code. |

Documents used along the form

When buying or selling real estate, several important documents accompany the Real Estate Purchase Agreement. Each of these documents serves a specific purpose and helps ensure a smooth transaction. Below is a list of commonly used forms that you may encounter during this process.

- Property Disclosure Statement: This document provides information about the property's condition and any known issues. Sellers are typically required to disclose defects or problems to potential buyers.

- Motor Vehicle Power of Attorney: This form allows individuals to grant authority to another person for managing motor vehicle-related transactions, making it essential for those unable to handle vehicle matters themselves. More details can be found in the Motor Vehicle Power of Attorney form.

- Title Report: A title report outlines the legal ownership of the property. It reveals any liens, easements, or other claims against the property, ensuring the buyer knows what they are purchasing.

- Home Inspection Report: Conducted by a professional inspector, this report assesses the property's condition. It covers structural integrity, plumbing, electrical systems, and more, helping buyers make informed decisions.

- Appraisal Report: An appraisal determines the property's market value. Lenders often require this report to ensure that the loan amount does not exceed the property's worth.

- Loan Estimate: This document provides details about the mortgage loan, including interest rates, monthly payments, and closing costs. It helps buyers understand the financial aspects of their purchase.

- Closing Disclosure: Issued a few days before closing, this document outlines the final terms of the mortgage and all costs associated with the transaction. Buyers must review it carefully before signing.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be valid.

- Escrow Agreement: This agreement outlines the terms of the escrow process, where a neutral third party holds funds and documents until all conditions of the sale are met.

Understanding these documents can help buyers and sellers navigate the real estate process with confidence. Each form plays a crucial role in protecting the interests of all parties involved, ensuring a fair and transparent transaction.