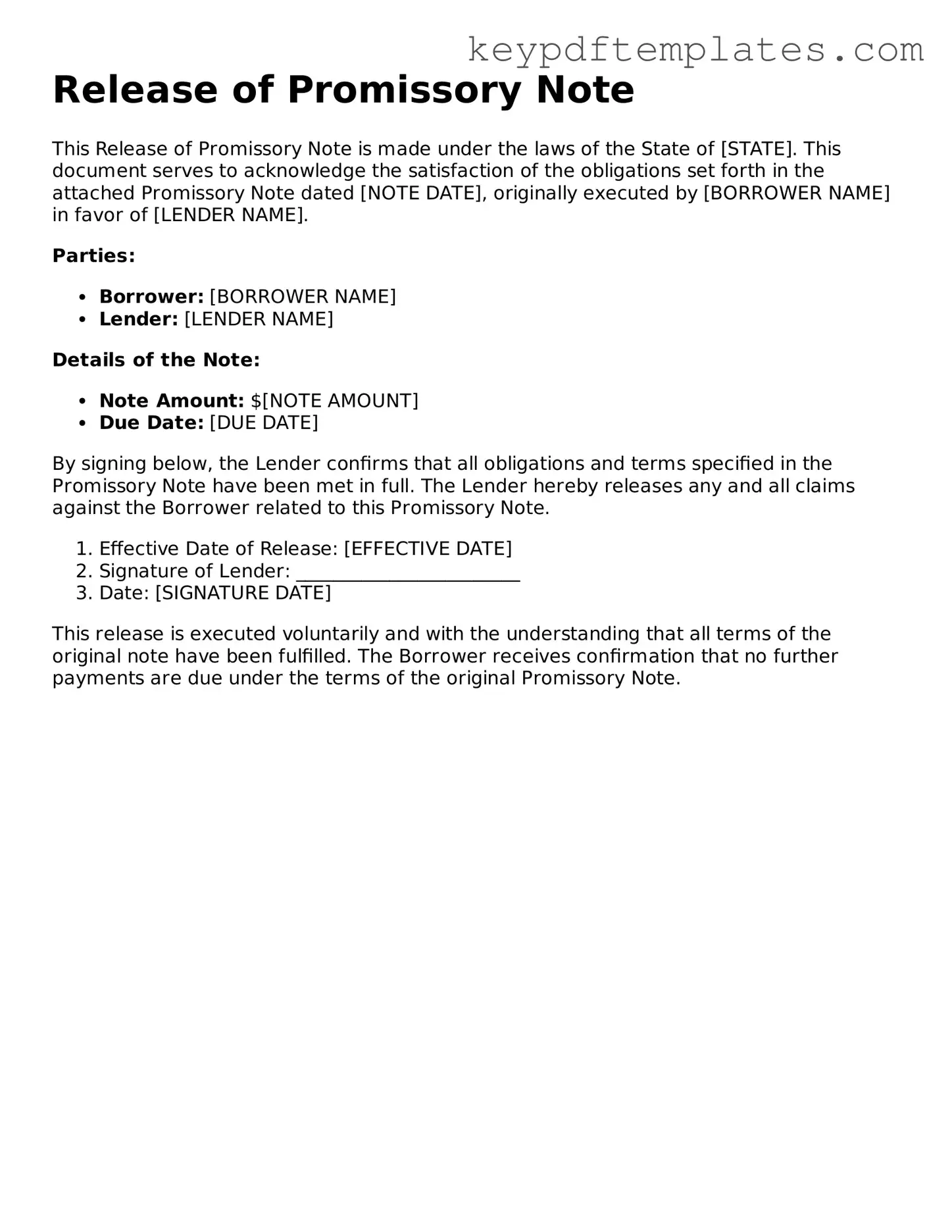

Printable Release of Promissory Note Template

Key takeaways

When filling out and using the Release of Promissory Note form, consider the following key takeaways:

- Ensure that all parties involved in the promissory note are correctly identified on the form.

- Clearly state the date of the release to establish a timeline for the transaction.

- Include specific details about the original promissory note, such as the amount and date of issuance.

- Both the lender and borrower should sign the form to validate the release.

- Consider having the signatures notarized to add an extra layer of authenticity.

- Retain copies of the signed release for personal records and future reference.

- Understand that this release indicates that the debt has been satisfied or canceled.

- Consult a legal professional if there are any uncertainties about the implications of the release.

- File the release in a safe place to ensure it is accessible if needed in the future.

Similar forms

Release of Mortgage: This document formally terminates a mortgage agreement, similar to how a Release of Promissory Note discharges the borrower from their obligation to repay a loan. Both documents signify the end of a financial obligation.

Release of Lien: A Release of Lien removes a legal claim against a property, much like a Release of Promissory Note removes the borrower's obligation to pay. Both documents clear encumbrances, allowing for unencumbered ownership.

Promissory Note Template: Utilizing a well-structured template can help ensure that all essential elements of a Promissory Note are included. For more information and resources, visit nytemplates.com/.

Settlement Agreement: This document outlines the terms under which parties agree to resolve a dispute. Similar to a Release of Promissory Note, it signifies the conclusion of obligations between parties, often involving the payment or forgiveness of debts.

Deed of Release: A Deed of Release serves to release one party from certain obligations or claims. This is akin to a Release of Promissory Note, as both documents formally end a financial relationship.

Cancellation of Contract: This document nullifies a contract, effectively ending the parties' obligations. Like the Release of Promissory Note, it signifies that the parties are no longer bound by the terms of their agreement.

Misconceptions

The Release of Promissory Note form is an important document in financial transactions. However, several misconceptions surround its purpose and use. Here are six common misunderstandings:

-

It is only necessary for large loans.

Many people think that the release form is only required for substantial amounts. In reality, it can be important for any loan, regardless of size, to formally document that the debt has been satisfied.

-

It is the same as a cancellation of the note.

While both documents serve to terminate the obligation, a release specifically acknowledges that the borrower has fulfilled their payment responsibilities, whereas cancellation may imply the note is void for other reasons.

-

Only the lender needs to sign it.

Some believe that only the lender's signature is necessary. However, both parties should sign the release to ensure mutual agreement on the termination of the debt.

-

It is not legally binding.

This form is indeed legally binding once signed. It serves as proof that the borrower has paid off the debt and releases them from further obligations.

-

It can be verbal.

Many think a verbal agreement suffices. However, a written release is essential for legal protection and clarity, as it provides a tangible record of the transaction.

-

It is only needed in certain states.

Some assume that the release form is only applicable in specific jurisdictions. In truth, it is a standard practice across the United States to ensure proper documentation of debt satisfaction.

Understanding these misconceptions can help individuals navigate their financial agreements more effectively.

Other Release of Promissory Note Types:

How to Write a Promissory Note for a Personal Loan - Acknowledges the car as collateral for the loan amount.

A comprehensive understanding of various financial documents is crucial, and a valuable resource for transactions involving money is the Promissory Note. This document not only clarifies the obligations of the parties involved but also serves to protect their interests by delineating terms such as payment schedules and interest rates.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note form is a document that formally acknowledges the satisfaction of a debt represented by a promissory note. |

| Purpose | This form serves to release the borrower from any further obligations under the promissory note once the debt is paid in full. |

| Parties Involved | The form typically involves the lender and the borrower, both of whom must sign to validate the release. |

| Governing Law | The governing law may vary by state; for example, in California, the relevant laws are found in the California Civil Code. |

| Filing Requirements | In some jurisdictions, the completed form may need to be filed with a local court or recorded with a county clerk. |

| Format | The form can be completed in writing and should include details such as the date, names of the parties, and the amount paid. |

| Effectiveness | Once signed, the release is effective immediately unless otherwise specified in the document. |

| Importance | This form is crucial for protecting the borrower's credit record and ensuring that the lender cannot claim further payments. |

| Legal Implications | Failure to use a Release of Promissory Note may lead to disputes over the status of the debt. |

Documents used along the form

The Release of Promissory Note form serves as a formal acknowledgment that a debt has been satisfied, and it is often accompanied by other important documents. Each of these documents plays a crucial role in ensuring that all parties involved have a clear understanding of their rights and obligations. Below is a list of commonly used forms that may accompany the Release of Promissory Note.

- Promissory Note: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late payments. It serves as the primary agreement between the lender and borrower.

- Loan Agreement: A more comprehensive document than a promissory note, the loan agreement details the terms and conditions of the loan. It often includes provisions regarding collateral, default, and dispute resolution, ensuring that both parties are protected.

- Payment Receipt: This document acts as proof that a payment has been made. It typically includes the date, amount, and method of payment, and it is essential for both the lender and borrower to keep accurate records of transactions.

- Release of Lien: If the loan was secured by collateral, a release of lien form may be necessary. This document confirms that the lender has relinquished any claim to the collateral once the debt is paid in full, providing the borrower with clear ownership.

- Editable Promissory Note: For those seeking a customizable option, the newjerseyformspdf.com/editable-promissory-note provides a template that can be tailored to meet specific needs and conditions, ensuring clarity and compliance with New Jersey regulations.

- Settlement Agreement: In cases where a debt is settled for less than the full amount owed, a settlement agreement outlines the terms of the settlement. It specifies the agreed-upon amount and any conditions that must be met, protecting both parties from future claims related to the original debt.

Understanding these documents can help ensure a smoother transaction and reduce potential disputes in the future. Each form serves a distinct purpose, and together, they create a comprehensive framework for managing financial agreements. By being well-informed, individuals can navigate their financial responsibilities with greater confidence.