Get Sample Tax Return Transcript Form

Key takeaways

Filling out and using the Sample Tax Return Transcript form can be straightforward if you keep the following key points in mind:

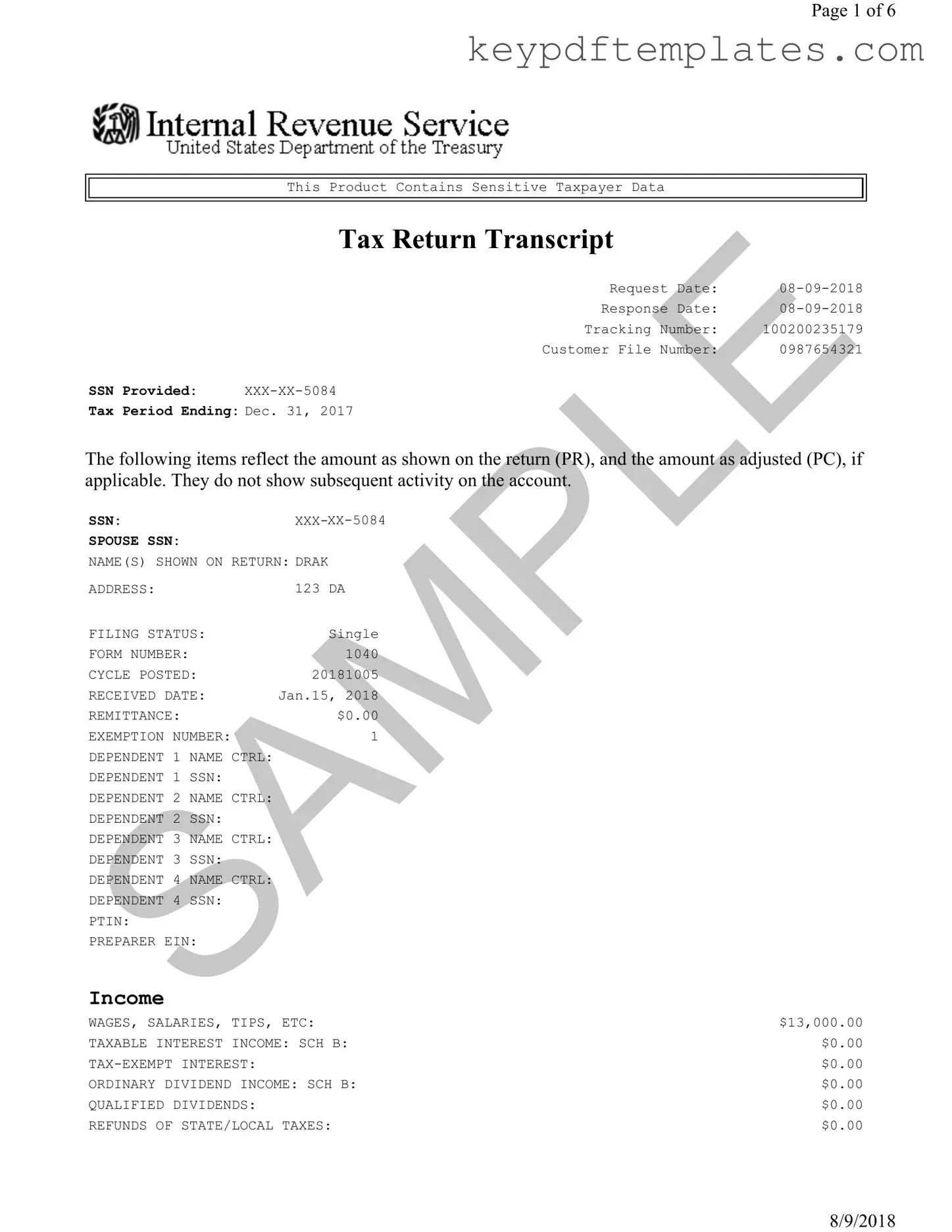

- Purpose of the Form: This form provides a summary of your tax return information, including income, deductions, and tax liabilities.

- Personal Information: Ensure that your Social Security Number (SSN) and the SSN of your spouse (if applicable) are correctly entered to avoid processing delays.

- Tax Period: The form reflects the tax period ending on December 31, 2017. Always verify that you are referencing the correct tax year.

- Income Details: Review the income section carefully. It includes wages, business income, and other income sources. Ensure all amounts are accurate.

- Adjustments to Income: The adjustments section outlines any deductions that affect your adjusted gross income. Confirm that these figures are correct.

- Tax Calculations: The form summarizes your tax liability and any credits that may apply. Pay attention to these numbers as they determine your total tax owed or refund.

- Payments Section: This section lists any federal income tax withheld and other payments made. Ensure all payments are accounted for to avoid discrepancies.

- Refund or Amount Owed: The final section indicates whether you owe money or are due a refund. Double-check these figures for accuracy.

By following these key takeaways, you can navigate the Sample Tax Return Transcript form with confidence and ensure that all necessary information is accurately reported.

Similar forms

- Form 1040: The standard individual income tax return form that taxpayers use to report their income, claim deductions, and calculate their tax liability.

- Form 1040-SR: Designed for seniors, this form is similar to the standard Form 1040 but features larger print and a simplified layout for ease of use.

- Form W-2: This form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It provides essential income information similar to what is found in a tax return transcript.

- Form 1099: Used to report various types of income other than wages, salaries, and tips. It serves as a record of income received, similar to the income details in a tax return transcript.

- Form 4868: This form is an application for an automatic extension of time to file a U.S. individual income tax return, providing a snapshot of expected income and tax liability.

- Form 1040-X: This form is used to amend a previously filed tax return. It contains information about changes to income or deductions, reflecting adjustments similar to those found in a tax return transcript.

- Schedule C: This form reports income and expenses from a business operated by a sole proprietor. It details income similar to that shown in a tax return transcript.

- California Trailer Bill of Sale: This important document facilitates the transfer of ownership of a trailer, ensuring both parties agree on essential details. For more information, visit Top Forms Online.

- Schedule E: Used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more, providing detailed income information akin to a tax return transcript.

- Form 1098: This form reports mortgage interest paid, which can affect tax deductions. It provides relevant financial data similar to what taxpayers may find in their tax return transcript.

- Form 8889: This form is used to report Health Savings Account (HSA) contributions and distributions. It provides details on health-related expenses that can impact tax calculations, similar to other financial information found in a tax return transcript.

Misconceptions

Understanding the Sample Tax Return Transcript form is crucial for taxpayers and professionals alike. However, several misconceptions often arise regarding this document. Here are ten common misunderstandings:

- It contains all tax information. Many believe the transcript provides a complete picture of a taxpayer's financial situation. In reality, it only reflects the information as filed on the return, without subsequent adjustments or account activity.

- It is the same as a tax return. Some think a transcript is identical to a tax return. While it summarizes the return, it does not include all details or supporting documents.

- It is only for the current tax year. A common belief is that transcripts are limited to the most recent year. However, transcripts can be requested for multiple years, depending on the taxpayer's needs.

- It is not necessary for filing. Many taxpayers assume they do not need a transcript when filing their taxes. In some cases, it can help verify income and deductions, making it a valuable tool.

- It is automatically sent to taxpayers. Some individuals think they will receive a transcript automatically. Transcripts must be requested, either online or through other means.

- It shows the status of a refund. There is a misconception that the transcript provides information about refund status. In fact, it does not track refunds or payments.

- It is free of charge. Many people believe that obtaining a transcript incurs a fee. In reality, most transcripts can be obtained for free through the IRS.

- It can be used as proof of income. Some assume the transcript serves as sufficient proof of income for loans or other financial applications. While it can support income claims, lenders may require additional documentation.

- It is a secure document. There is a belief that transcripts are completely secure. While they contain sensitive information, it is important to handle them with care to prevent identity theft.

- It is difficult to obtain. Many think that the process of requesting a transcript is complicated. In fact, it can be done easily through the IRS website or by submitting a simple form.

Clearing up these misconceptions can help taxpayers better navigate their financial responsibilities and understand the importance of the Sample Tax Return Transcript.

More PDF Templates

Australia Visa Application Form - Passports must be stored securely even after a renewal application is submitted.

What Does a Job Application Look Like - The application asks whether any relatives work for the company.

The Texas Real Estate Purchase Agreement is a vital legal document, providing clarity and structure to real estate transactions. It is designed to define the terms and conditions that govern the relationship between buyers and sellers, ensuring that both parties are aware of their obligations. To further assist in this process, you can access the Real Estate Purchase Agreement form which serves as a comprehensive guide for those looking to navigate property sales in Texas effectively.

Guardianship Documents - This form serves as a legal way to obtain temporary control over a child’s welfare.

Form Specs

| Fact Name | Details |

|---|---|

| Request Date | The tax return transcript was requested on August 9, 2018. |

| Tax Period | This transcript covers the tax period ending December 31, 2017. |

| Filing Status | The individual filing status is recorded as Single. |

| Total Income | The total income reported on the transcript is $15,500.00. |

| Amount Owed | The amount owed as per this transcript is $103.00. |

Documents used along the form

When preparing your taxes or applying for financial aid, you may need several documents alongside the Sample Tax Return Transcript. Each of these documents serves a specific purpose and can provide valuable information. Below is a list of commonly used forms that may be helpful.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. It summarizes your income, deductions, and credits for the tax year.

- W-2 Form: Issued by employers, this form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It's essential for accurately reporting income.

- Recommendation Letter Form: To enhance your application process, consider utilizing the valuable Recommendation Letter form resources that can provide essential endorsement details.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. For example, independent contractors receive a 1099 for their earnings.

- Schedule C: This form is used by self-employed individuals to report income and expenses related to their business. It helps determine net profit or loss.

- Form 8862: If you have previously been denied the Earned Income Tax Credit (EITC), this form allows you to claim the credit again after meeting certain requirements.

- Form 4506-T: This form allows taxpayers to request a transcript of their tax return. It can be useful for verifying income when applying for loans or financial aid.

Each of these forms plays a vital role in the tax preparation process. Ensure that you gather all necessary documents to facilitate a smoother experience when filing your taxes or seeking financial assistance.