Printable Single-Member Operating Agreement Template

Key takeaways

When filling out and using the Single-Member Operating Agreement form, keep these key takeaways in mind:

- Understand the Purpose: This document outlines how your single-member LLC will operate. It serves as a roadmap for your business, clarifying your rights and responsibilities.

- Identify Your Business: Clearly state the name of your LLC and its principal address. This ensures that your operating agreement is specific to your business.

- Define Your Role: As the sole member, you will have full control over the LLC. The agreement should reflect your decision-making authority and responsibilities.

- Outline Financial Matters: Include details about how profits and losses will be handled. Specify how funds will be distributed to you as the owner.

- Include Management Procedures: Even as a single member, it’s helpful to outline how decisions will be made and what processes will be followed for major business actions.

- Address Amendments: Your business may evolve over time. Include a section on how the operating agreement can be amended to accommodate changes in your business structure or strategy.

- Keep It Accessible: Store your operating agreement in a safe place, and ensure you can easily access it when needed. This document is important for legal and financial purposes.

By following these key points, you can effectively fill out and utilize your Single-Member Operating Agreement to support your business goals.

Similar forms

The Single-Member Operating Agreement is an important document for a single-member LLC. It outlines the management structure and operational guidelines. Similar documents serve various purposes in business and legal contexts. Here are four documents that share similarities with the Single-Member Operating Agreement:

- Partnership Agreement: This document outlines the terms and conditions between partners in a business. Like the operating agreement, it specifies management roles, profit sharing, and responsibilities.

- Bylaws: Bylaws govern the internal management of a corporation. They detail the structure of the organization and the rules for conducting business, similar to how an operating agreement manages an LLC.

- Operating Agreement Form: This essential document ensures all financial and operational decisions are clearly outlined for a limited liability company (LLC), helping members to be unified in understanding their business. For more information, visit formsillinois.com/fillable-operating-agreement-form/.

- Shareholder Agreement: This agreement is used among shareholders of a corporation. It addresses issues such as ownership rights, management decisions, and transfer of shares, much like an operating agreement does for a single-member LLC.

- Business Plan: A business plan outlines the goals, strategies, and operational plans of a business. While it serves a broader purpose, it shares the function of guiding the business's operations and objectives, akin to the operational guidelines found in an operating agreement.

Misconceptions

The Single-Member Operating Agreement is a crucial document for individuals operating a single-member limited liability company (LLC). However, several misconceptions often cloud its importance and functionality. Below is a list of common misunderstandings regarding this form.

- It is not necessary for a single-member LLC. Many believe that because they are the sole owner, an operating agreement is unnecessary. However, having one can help clarify the structure and operations of the business.

- It has to be filed with the state. Some think that the operating agreement must be submitted to state authorities. In reality, it is an internal document and does not require filing.

- It is the same as the Articles of Organization. While both documents are important, they serve different purposes. The Articles of Organization establish the LLC, while the operating agreement outlines the management and operational guidelines.

- It cannot be changed once created. This is a common myth. The operating agreement can be amended as needed to reflect changes in the business or ownership structure.

- It is only for legal protection. While it does provide legal benefits, the operating agreement also serves to clarify the owner’s intentions and operational procedures.

- It must be complicated and lengthy. Some believe that an operating agreement must be a complex document. In reality, it can be as simple or detailed as the owner desires, depending on their specific needs.

- All single-member LLCs need the same operating agreement. This is not true. Each agreement can and should be tailored to fit the unique circumstances of the business.

- It is only relevant for tax purposes. While tax implications are a factor, the operating agreement also addresses management, decision-making, and other operational aspects of the LLC.

- Verbal agreements are sufficient. Some may think that a verbal understanding is enough. However, having a written agreement provides clarity and can help prevent disputes in the future.

- It is only for larger businesses. This misconception overlooks the fact that all single-member LLCs, regardless of size, can benefit from having a structured operating agreement.

Understanding these misconceptions can help single-member LLC owners appreciate the value of an operating agreement, ensuring better management and protection for their business.

Other Single-Member Operating Agreement Types:

How to Create an Operating Agreement - Sets forth guidelines for member contributions.

The Florida Operating Agreement form is indispensable for newly formed LLCs, streamlining governance and delineating roles. For those seeking more information, the critical Operating Agreement guidelines provide invaluable insights into its application and requirements.

PDF Details

| Fact Name | Details |

|---|---|

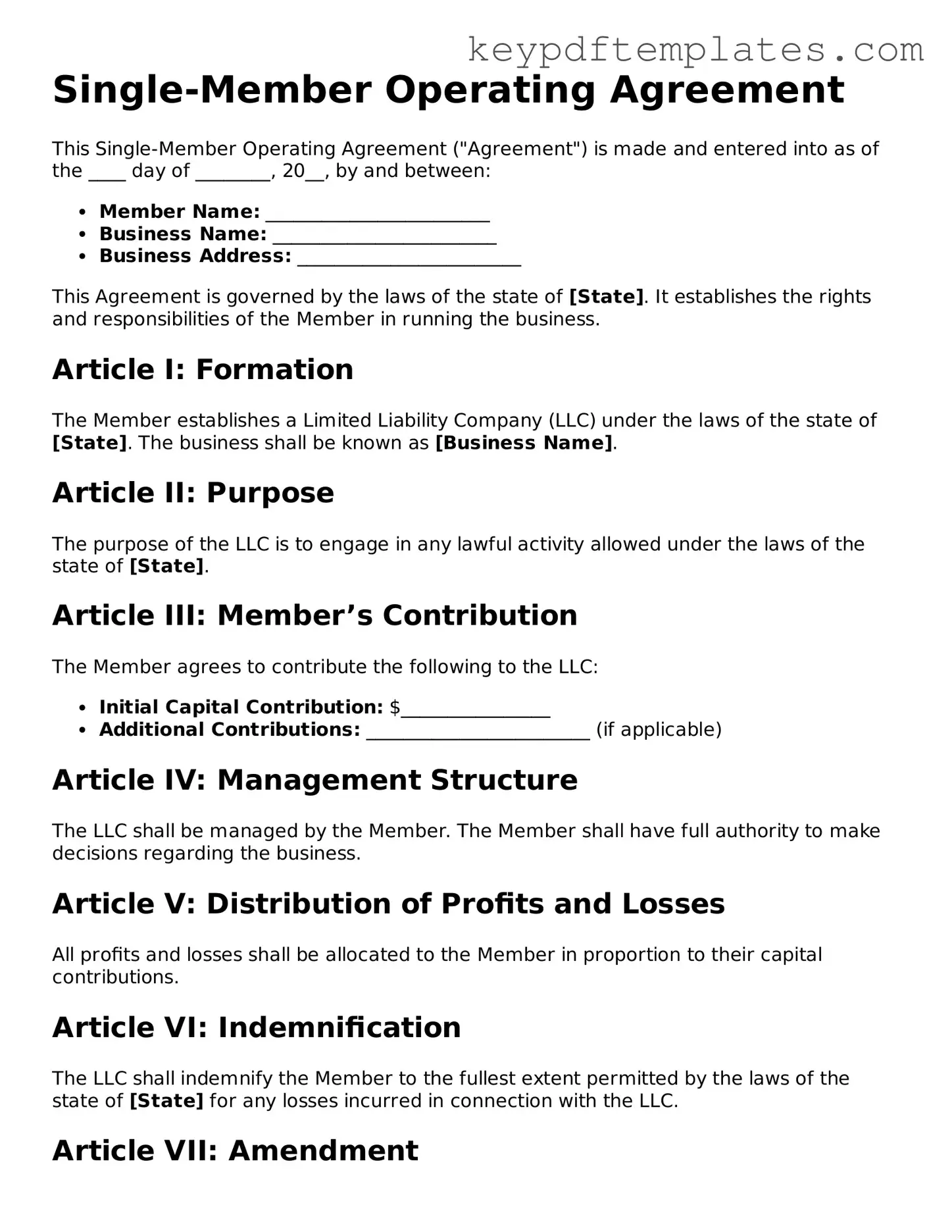

| Definition | A Single-Member Operating Agreement outlines the management structure and operating procedures of a single-member LLC. |

| Purpose | This document helps establish the LLC as a separate legal entity, protecting personal assets from business liabilities. |

| Governing Law | The agreement is governed by state law, which varies by location. For example, in California, it follows the California Corporations Code. |

| Ownership | The agreement confirms that the single member owns 100% of the LLC, detailing their rights and responsibilities. |

| Flexibility | Single-member LLCs can customize their operating agreement to fit their specific business needs, unlike multi-member agreements. |

| Tax Treatment | Typically, single-member LLCs are treated as disregarded entities for tax purposes, meaning profits and losses pass through to the owner's personal tax return. |

| Banking Requirements | Many banks require a copy of the operating agreement to open a business bank account for the LLC. |

| Dispute Resolution | The agreement can include provisions for resolving disputes, which can help avoid costly litigation. |

| Amendments | Single-member LLCs can amend their operating agreement as needed, allowing for adjustments in management or ownership structure. |

Documents used along the form

A Single-Member Operating Agreement is a crucial document for a sole proprietorship structured as a limited liability company (LLC). However, several other forms and documents often accompany it to ensure proper management and compliance with state laws. Here are five important documents that you might consider alongside your operating agreement.

- Articles of Organization: This document is filed with the state to officially create your LLC. It includes basic information about your business, such as its name, address, and the name of the registered agent.

- Operating Agreement: This document establishes the framework for your LLC's operations and outlines the rights and responsibilities of its members. For more information, you can refer to All Colorado Forms.

- Employer Identification Number (EIN): An EIN is a unique number assigned by the IRS for tax purposes. It is essential for opening a business bank account and filing taxes.

- Bylaws: While not always required for single-member LLCs, bylaws outline how the business will be run. They can cover decision-making processes, meetings, and other operational details.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. For a single-member LLC, this document can be a simple acknowledgment of ownership.

- Business Licenses and Permits: Depending on your location and the nature of your business, you may need specific licenses or permits to operate legally. These vary widely by state and industry.

Having these documents in place can help streamline your business operations and ensure compliance with legal requirements. Each plays a vital role in establishing a solid foundation for your LLC.