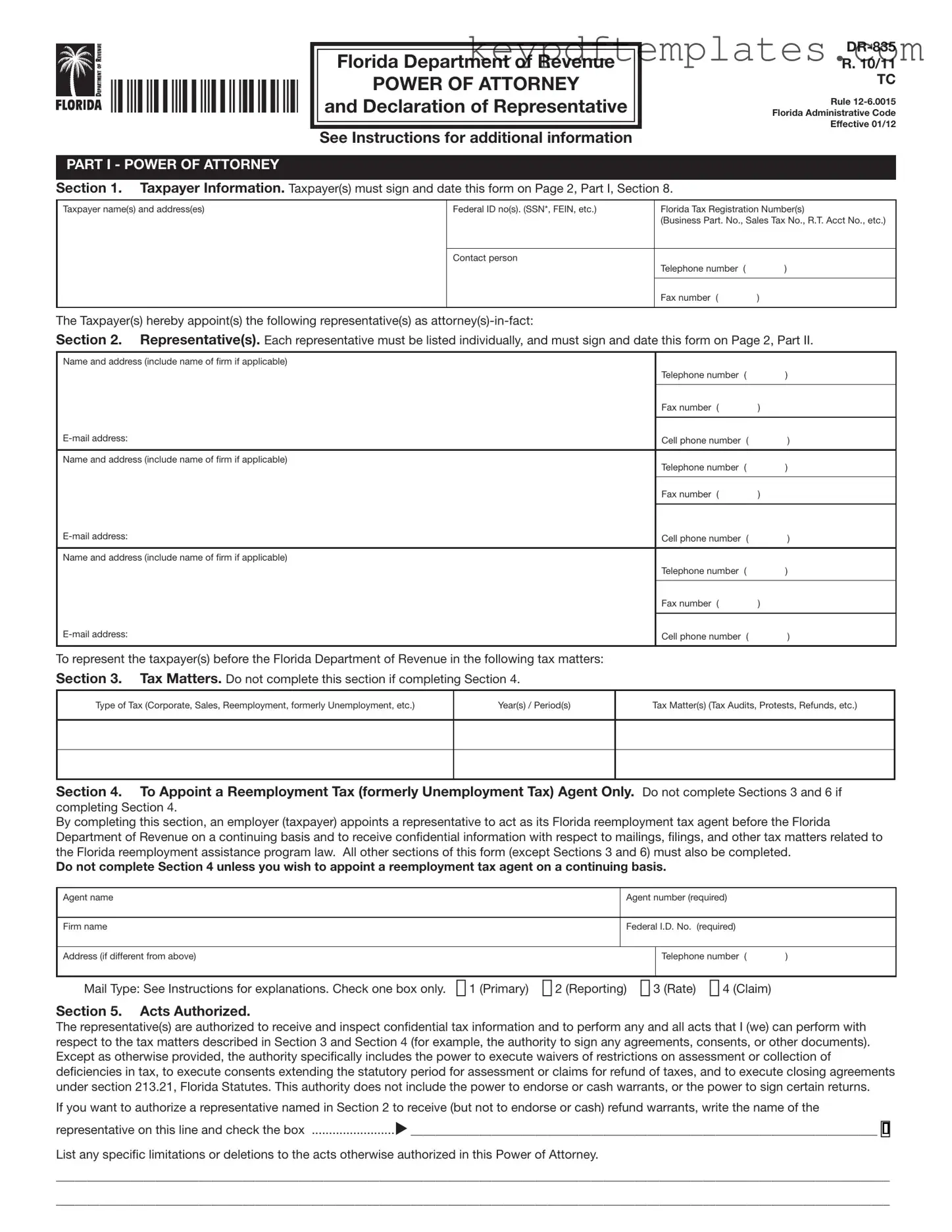

Get Tax POA dr 835 Form

Key takeaways

Here are key takeaways regarding the Tax POA DR 835 form:

- Ensure that all required fields are completed accurately to avoid processing delays.

- Use the form to grant power of attorney to an individual or entity to represent you before the tax authority.

- Clearly specify the tax matters for which the power of attorney is granted.

- Sign and date the form to validate it; an unsigned form will not be accepted.

- Provide your contact information to facilitate communication regarding your tax matters.

- Keep a copy of the completed form for your records after submission.

- Be aware of any state-specific requirements that may apply in addition to the federal guidelines.

- Submit the form to the appropriate tax authority promptly to ensure timely processing.

Similar forms

The Tax POA DR 835 form is a document that allows individuals to designate someone to represent them in tax matters. Several other documents serve similar purposes in different contexts. Below is a list of these documents and their similarities to the Tax POA DR 835 form.

- IRS Form 2848: This is the Power of Attorney and Declaration of Representative form used for tax matters at the federal level. Like the Tax POA DR 835, it allows taxpayers to authorize someone to act on their behalf with the IRS.

- State Power of Attorney Forms: Each state has its own version of a Power of Attorney form, which grants authority to an individual to act on behalf of another in various legal matters. Similar to the Tax POA DR 835, these forms can be specific to tax-related issues.

- Form 8821: This is the Tax Information Authorization form. It allows individuals to authorize someone to receive confidential tax information from the IRS. While it does not grant the same authority as the Tax POA DR 835, it serves a similar purpose in terms of representation.

- Durable Power of Attorney: This document allows someone to make decisions on behalf of another person, even if that person becomes incapacitated. Like the Tax POA DR 835, it enables representation but is broader in scope beyond just tax matters.

- Employment Verification Form: This document is vital for employers to confirm the employment status of individuals. It plays a significant role in background checks and loan applications, emphasizing the importance of clarity in the verification process. For more information, visit https://allfloridaforms.com.

- Healthcare Power of Attorney: This form allows an individual to designate someone to make healthcare decisions on their behalf. While it pertains to health rather than tax, it shares the fundamental principle of granting authority to act for another.

- Financial Power of Attorney: This document allows a person to manage another’s financial affairs. Similar to the Tax POA DR 835, it involves the delegation of authority for specific matters, although it may cover a wider range of financial issues.

Misconceptions

Understanding the Tax Power of Attorney (POA) Form DR 835 can be tricky. Here are nine common misconceptions that often lead to confusion:

- It’s only for businesses. Many people think the Tax POA is only necessary for businesses. In reality, individuals can also use this form to authorize someone to handle their tax matters.

- It allows unlimited access to my financial information. While the form grants authority to act on your behalf, it does not give the representative unlimited access. The powers are specific to tax matters.

- Once I sign it, I can’t revoke it. This is false. You can revoke the POA at any time, as long as you follow the proper procedures to do so.

- Only lawyers can be authorized representatives. This is not true. You can appoint anyone you trust, including family members or friends, as your representative.

- It’s the same as filing my taxes. The POA does not replace your tax filing responsibilities. It simply allows someone else to manage your tax affairs.

- It’s a one-time use form. The Tax POA can be used for multiple tax years, but you may need to submit a new form if you change your representative.

- All states use the same form. While many states have similar forms, each state may have its own requirements and versions of the POA.

- It’s too complicated to fill out. The form is designed to be straightforward. With clear instructions, most people can complete it without difficulty.

- My representative can make decisions about my finances. The POA is limited to tax matters. Your representative cannot make financial decisions outside of that scope.

By clearing up these misconceptions, you can better understand how to use the Tax POA DR 835 effectively.

More PDF Templates

Puppy Shot Record Printable Free - This is how you prove your dog's health in veterinary settings.

The Florida Power of Attorney for a Child form is a vital legal document, allowing a parent or guardian to designate another individual to make decisions for their child in various scenarios, including emergencies or temporary relocations. To access and complete this necessary form, you can visit Florida PDF Forms, ensuring that your child's needs are promptly addressed.

Imm1294 Guide - Applicants must sign and date the application for it to be valid.

Western Union Form - Set limits on your transfer amounts for better tracking.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Tax POA DR 835 form is used to authorize an individual or organization to represent a taxpayer before the tax authorities. |

| Governing Law | This form is governed by the Internal Revenue Code and applicable state tax laws. |

| Who Can Use It | Any taxpayer, including individuals and businesses, can use this form to designate a representative. |

| Required Information | The form requires the taxpayer's name, address, Social Security number or Employer Identification Number, and the representative's information. |

| Signature Requirement | The taxpayer must sign the form to validate the authorization of the representative. |

| Submission Method | The completed form can be submitted electronically or via mail, depending on the specific tax authority's guidelines. |

| Duration of Authorization | The authorization remains in effect until revoked by the taxpayer or until the tax matter is resolved. |

| Revocation Process | Taxpayers can revoke the authorization by submitting a written notice to the tax authority, specifying the representative's name and the reason for revocation. |

| Limitations | The form does not grant the representative the authority to make payments or change the taxpayer’s address without additional consent. |

| State Variations | Some states may have specific variations of the POA form; it is essential to check state-specific requirements. |

Documents used along the form

The Tax Power of Attorney (POA) DR 835 form is a critical document that allows individuals to authorize someone else to act on their behalf regarding tax matters. Alongside this form, several other documents may be required to ensure a comprehensive approach to tax representation. Below is a list of commonly used forms and documents that complement the Tax POA DR 835.

- Form 2848: This is the IRS Power of Attorney and Declaration of Representative. It allows taxpayers to appoint someone to represent them before the IRS, covering various tax matters.

- Form 8821: This form is used to authorize an individual to receive confidential tax information from the IRS. It does not grant the authority to represent the taxpayer.

- Form 4506: This document is a Request for Copy of Tax Return. Taxpayers use it to obtain copies of previously filed tax returns, which may be necessary for various tax-related processes.

- Form 1040: This is the individual income tax return form. It is essential for filing annual income taxes and may be referenced in conjunction with the POA for specific tax years.

- Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is crucial for businesses and may relate to the POA if an employer is represented.

- Form W-2: This form reports wages paid to employees and the taxes withheld. It is necessary for individual taxpayers and is often referenced in tax filings.

- Form W-9: This is the Request for Taxpayer Identification Number and Certification. It is used to provide taxpayer information to entities that are required to report income to the IRS.

- Texas Vehicle Purchase Agreement: This form outlines the terms of vehicle sales in Texas and is crucial for both buyers and sellers. You can access the form here.

- Form 1099: Various 1099 forms report different types of income other than wages, salaries, and tips. These forms are essential for individuals and businesses to report income accurately.

- Form 8962: This form is used to claim the Premium Tax Credit, which helps eligible individuals pay for health insurance coverage under the Affordable Care Act.

- Form 8862: This document is the Information to Claim Certain Credits After Disallowance. Taxpayers who have had certain credits disallowed must file this form to claim them again.

Understanding these forms and documents is vital for anyone navigating tax representation. Each serves a specific purpose and can significantly impact the efficiency and effectiveness of tax-related matters.