Get Texas Odometer Statement Form

Key takeaways

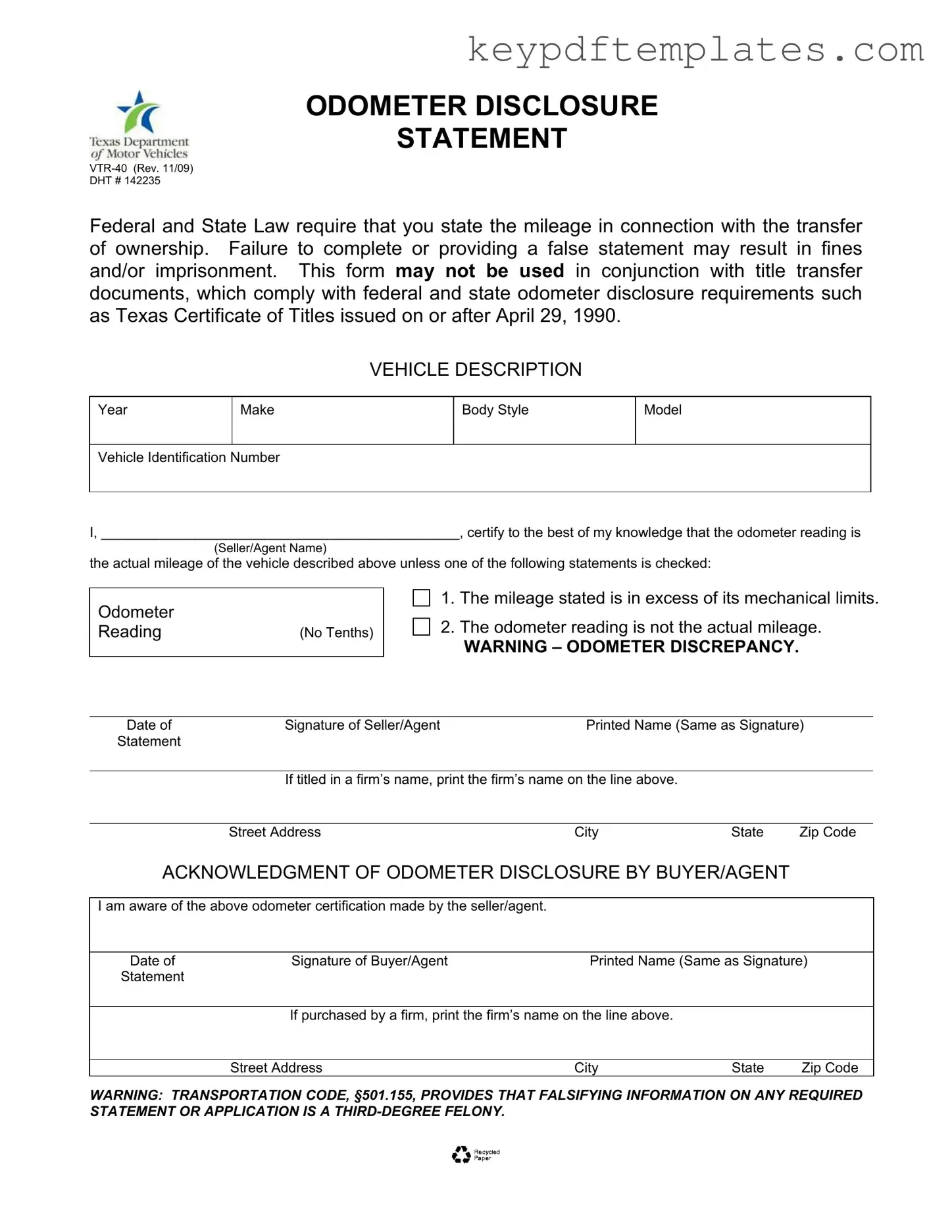

When dealing with the Texas Odometer Statement form, there are several important points to keep in mind. This form is essential for ensuring accurate mileage disclosure during the transfer of vehicle ownership.

- Legal Requirement: Both federal and state laws mandate that the odometer reading must be disclosed when transferring vehicle ownership. This helps prevent fraud and ensures transparency.

- Consequences of Inaccuracy: Providing false information or failing to complete the form can lead to serious penalties, including fines or even imprisonment.

- Not for Title Transfer: The Texas Odometer Statement cannot be used alongside title transfer documents that already meet federal and state odometer disclosure requirements.

- Complete Vehicle Information: Ensure that the vehicle description is filled out completely, including the year, make, body style, model, and Vehicle Identification Number (VIN).

- Certification of Mileage: The seller or agent must certify that the odometer reading reflects the actual mileage, unless specific exceptions apply.

- Odometer Discrepancy Options: If applicable, check the appropriate box if the mileage is either beyond mechanical limits or not the actual mileage.

- Buyer Acknowledgment: The buyer or their agent must acknowledge the odometer disclosure by signing the form, indicating awareness of the certification.

- Serious Legal Ramifications: Falsifying any information on this form can result in severe legal consequences, classified as a third-degree felony under Texas law.

Understanding these key aspects can help ensure a smooth transaction when buying or selling a vehicle in Texas.

Similar forms

The Texas Odometer Statement form shares similarities with several other documents related to vehicle ownership and mileage disclosure. Here are five such documents:

- Vehicle Title: The vehicle title serves as the official document proving ownership. Like the Texas Odometer Statement, it requires accurate mileage disclosure at the time of transfer to protect both the seller and buyer.

- Bill of Sale: This document outlines the transaction details between the buyer and seller. It typically includes the vehicle's mileage, similar to the Odometer Statement, ensuring transparency in the sale.

- Odometer Disclosure Statement (Federal Form): This federal form is required for vehicle sales and also mandates the disclosure of the odometer reading. It functions similarly to the Texas form in providing legal protection against fraud.

- Vehicle Registration Application: When registering a vehicle, applicants must provide the odometer reading. This requirement aligns with the Texas Odometer Statement's purpose of ensuring accurate mileage reporting.

- Trailer Bill of Sale: The California Trailer Bill of Sale form is crucial for confirming ownership transfer and documenting the sale details. To learn more about this essential document, view the pdf.

- Transfer of Title Application: This document is used when transferring a vehicle's title from one owner to another. It includes a section for odometer disclosure, mirroring the requirements of the Texas Odometer Statement.

Misconceptions

Misconceptions about the Texas Odometer Statement form can lead to confusion and potential legal issues. Below are some common misunderstandings clarified for better understanding.

- The form is optional for vehicle sales. Many believe that the Texas Odometer Statement is optional, but it is actually required by both federal and state law when transferring ownership of a vehicle.

- Only the seller needs to complete the form. It’s a common misconception that only the seller is responsible for filling out the form. In reality, both the seller and the buyer must acknowledge the odometer disclosure.

- Odometer readings can be estimated. Some people think they can provide an estimated mileage. However, the form requires the actual mileage reading to be stated, and providing false information can lead to serious penalties.

- The form is valid for any vehicle. Not all vehicles require this specific form. The Texas Odometer Statement is not applicable for vehicles titled under certain regulations, such as those that comply with federal and state odometer disclosure requirements.

- It can be used alongside title transfer documents. Many assume that the Odometer Statement can be submitted with title transfer documents. This is incorrect, as it cannot be used in conjunction with other title transfer forms.

- Fines are only civil penalties. Some individuals think that failing to provide accurate odometer information results only in fines. In fact, it can also lead to imprisonment, as it is considered a serious offense.

- Odometer discrepancies are minor issues. People often underestimate the severity of odometer discrepancies. They can lead to significant legal consequences, including felony charges under Texas law.

- The form does not need to be retained. It’s a misconception that once the form is completed, it can be discarded. Both parties should keep a copy for their records as proof of the transaction.

- Signing the form is just a formality. Some view the signature on the form as a mere formality. However, it is a legal affirmation of the accuracy of the odometer reading, and any false claims can have serious repercussions.

Understanding these misconceptions can help ensure that both buyers and sellers navigate the vehicle transfer process smoothly and legally.

More PDF Templates

Da 1750 Pdf - It requires a requisition number that corresponds to the original order for tracking purposes.

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees about the property's title. This form is often used in situations like transferring property between family members or clearing up title issues. For a convenient way to obtain this essential document, you can access the necessary form at Florida PDF Forms. If you're ready to complete your transfer, click the button below to fill out the form.

W9 Form Sample - W-9 information is critical for year-end tax summaries.

Form Specs

| Fact Name | Detail |

|---|---|

| Form Title | Odometer Disclosure Statement VTR-40 |

| Governing Laws | Federal and Texas State Laws |

| Purpose | To disclose the vehicle's mileage during ownership transfer. |

| Consequences of False Information | Providing false statements may lead to fines or imprisonment. |

| Eligibility | This form is not valid with title transfer documents issued after April 29, 1990. |

| Odometer Reading | Must be stated without tenths; options for discrepancies are provided. |

| Legal Warning | Falsifying information is a third-degree felony under Transportation Code, §501.155. |

Documents used along the form

The Texas Odometer Statement form is essential for documenting the mileage of a vehicle during ownership transfer. However, several other forms and documents are often used alongside it to ensure a smooth transaction. Here’s a brief overview of some of these important documents.

- Texas Certificate of Title: This is the primary document that proves ownership of a vehicle. It contains details like the vehicle's make, model, and VIN. The title must be signed over from the seller to the buyer to complete the transfer of ownership.

- Bill of Sale: This document serves as proof of the transaction between the buyer and seller. It includes information about the vehicle, the sale price, and the parties involved. A bill of sale can help protect both parties in case of disputes.

- Vehicle Registration Application: After purchasing a vehicle, the buyer must complete this application to register the vehicle in their name. This document is usually submitted to the local Department of Motor Vehicles (DMV) along with the title and any applicable fees.

- Automobile Purchase Agreement: This crucial document outlines the terms and conditions of the sale, ensuring both the buyer and seller are aware of their obligations. For more information, refer to the Automobile Purchase Agreement.

- Proof of Insurance: Before registering a vehicle, buyers must show proof of insurance. This document verifies that the vehicle is covered by an insurance policy, which is a requirement in Texas and many other states.

Using these forms in conjunction with the Texas Odometer Statement can help ensure a clear and legal transfer of vehicle ownership. Each document plays a crucial role in protecting the interests of both the buyer and the seller.