Get Texas residential property affidavit T-47 Form

Key takeaways

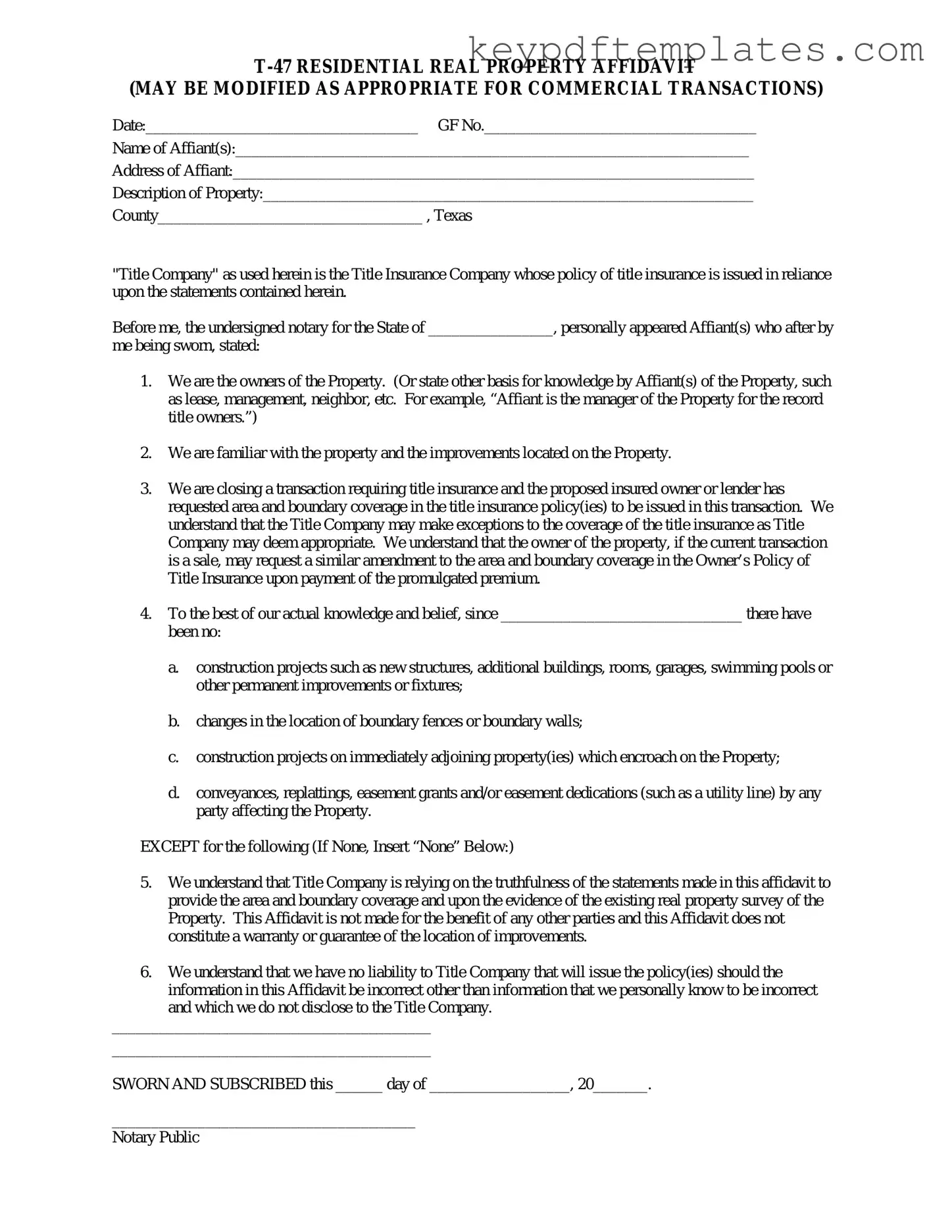

When filling out and using the Texas residential property affidavit T-47 form, it is essential to keep several key points in mind. This form serves as a declaration regarding property ownership and can be important for various legal and financial processes.

- The T-47 form is typically used in real estate transactions to confirm ownership and the absence of liens on the property.

- It is crucial to provide accurate information about the property, including its legal description and address.

- Ensure that all parties involved in the transaction sign the affidavit to validate the information provided.

- The form must be notarized, which adds a layer of authenticity to the declaration.

- Filing the T-47 can help streamline the closing process by providing necessary documentation to lenders and title companies.

- Keep a copy of the completed T-47 form for your records, as it may be needed for future reference.

- Be aware of any deadlines associated with submitting the T-47, as timely filing can prevent complications.

- Consulting with a real estate professional can be beneficial if there are any uncertainties about filling out the form.

- Understand that the T-47 does not replace a title insurance policy; it serves a different purpose in the transaction.

By following these guidelines, individuals can effectively navigate the use of the T-47 form and support their real estate transactions.

Similar forms

- Affidavit of Heirship: This document is used to establish the heirs of a deceased property owner. Like the T-47, it serves to clarify ownership and can affect property rights.

- Warranty Deed: A warranty deed transfers ownership of property and guarantees that the seller has the right to sell it. Similar to the T-47, it provides assurance about the title.

- Quitclaim Deed: This document transfers any interest the grantor has in the property without guaranteeing a clear title. Both the quitclaim deed and T-47 can be used to clarify ownership issues.

- Title Insurance Policy: This policy protects against losses from defects in the title. The T-47 supports the information needed for title insurance by affirming the current ownership status.

- Florida Board Nursing Application: This form is essential for those pursuing a nursing license in Florida and can be found at allfloridaforms.com/, ensuring that applicants are equipped with the necessary information for a successful licensing process.

- Property Disclosure Statement: Sellers provide this document to disclose any known issues with the property. Like the T-47, it aims to inform potential buyers about the property’s condition.

- Lease Agreement: This document outlines the terms under which a property is rented. While the T-47 focuses on ownership, both documents relate to property rights and usage.

- Deed of Trust: A deed of trust secures a loan with real property as collateral. Similar to the T-47, it establishes legal relationships regarding property ownership and financing.

Misconceptions

The Texas residential property affidavit T-47 form is often misunderstood. Below are some common misconceptions about this form, along with clarifications to enhance understanding.

- The T-47 form is only for sellers. This form is utilized by both buyers and sellers during a real estate transaction. It provides essential information about the property’s condition and ownership history.

- The T-47 form is optional. While it is not always legally required, many lenders and title companies request it as part of the closing process. Failing to provide it could delay or complicate the transaction.

- The T-47 form guarantees clear title. Completing the T-47 does not guarantee that the title is free of defects. It simply provides a sworn statement regarding the property’s condition and ownership.

- The T-47 form is the same as a title policy. The T-47 is not a title policy. It is an affidavit that supports the title search but does not replace the need for a title insurance policy.

- You can fill out the T-47 form without legal assistance. While individuals can complete the form on their own, consulting with a real estate attorney or professional is advisable to ensure accuracy and compliance.

- The T-47 form is only for residential properties. Although primarily used for residential properties, the T-47 can also apply to certain types of commercial properties in Texas.

- The T-47 form is a one-time use document. The T-47 can be used multiple times, especially if the property is sold again or if additional information needs to be disclosed.

- The T-47 form is only relevant during closing. The information provided in the T-47 can be important throughout the entire transaction process, including negotiations and inspections.

- Once signed, the T-47 form cannot be changed. While the T-47 is a sworn statement, it can be amended if new information arises or if errors are discovered before closing.

Understanding these misconceptions can help individuals navigate the complexities of real estate transactions in Texas more effectively.

More PDF Templates

Lyft Inspection Form 2023 - Verify that the odometer is functional and accurately displays mileage.

Fake Restraining Order Template - Compliance with the order is monitored through the California Restraining and Protective Orders System.

For those looking to create or review a rental agreement, a blank document is here to help streamline the process and ensure that all necessary terms and conditions are included, promoting a clear understanding between landlords and tenants.

Konami Decklist - Detail the side deck's total separately from the main deck counts.

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The T-47 form is used in Texas to provide an affidavit regarding the ownership and boundaries of residential property. |

| Governing Law | The T-47 form is governed by Texas Property Code, specifically Sections 12.001 and 12.002. |

| Usage Requirement | This form is typically required by title companies during real estate transactions to confirm property details. |

| Signature Requirement | The affidavit must be signed by the property owner and may require notarization to be valid. |

Documents used along the form

The Texas residential property affidavit T-47 form is an important document used in real estate transactions, particularly in the context of title insurance. It serves to clarify the ownership and the condition of the property. Alongside this form, several other documents are often utilized to ensure a smooth transaction process. Below are some commonly used forms and documents that complement the T-47.

- Title Commitment: This document outlines the terms under which a title insurance policy will be issued. It provides information about the property’s ownership history, existing liens, and any other encumbrances that may affect the title.

- Seller's Disclosure Notice: This form requires the seller to disclose any known issues with the property, such as structural problems, pest infestations, or environmental hazards. It helps buyers make informed decisions about the property.

- Deed: A deed is a legal document that transfers ownership of the property from the seller to the buyer. It includes details about the property and must be recorded with the county clerk to be legally binding.

- House Purchase Agreement: This essential document outlines the terms and conditions of the sale and is crucial for a smooth transaction. For more information, visit the House Purchase Agreement page.

- Closing Statement: Also known as a settlement statement, this document summarizes the financial aspects of the real estate transaction. It details the costs involved, including closing costs, taxes, and any adjustments made between the buyer and seller.

Understanding these documents can significantly aid in navigating the complexities of real estate transactions in Texas. Each form plays a vital role in ensuring that both buyers and sellers are protected and informed throughout the process.