Get Time Card Form

Key takeaways

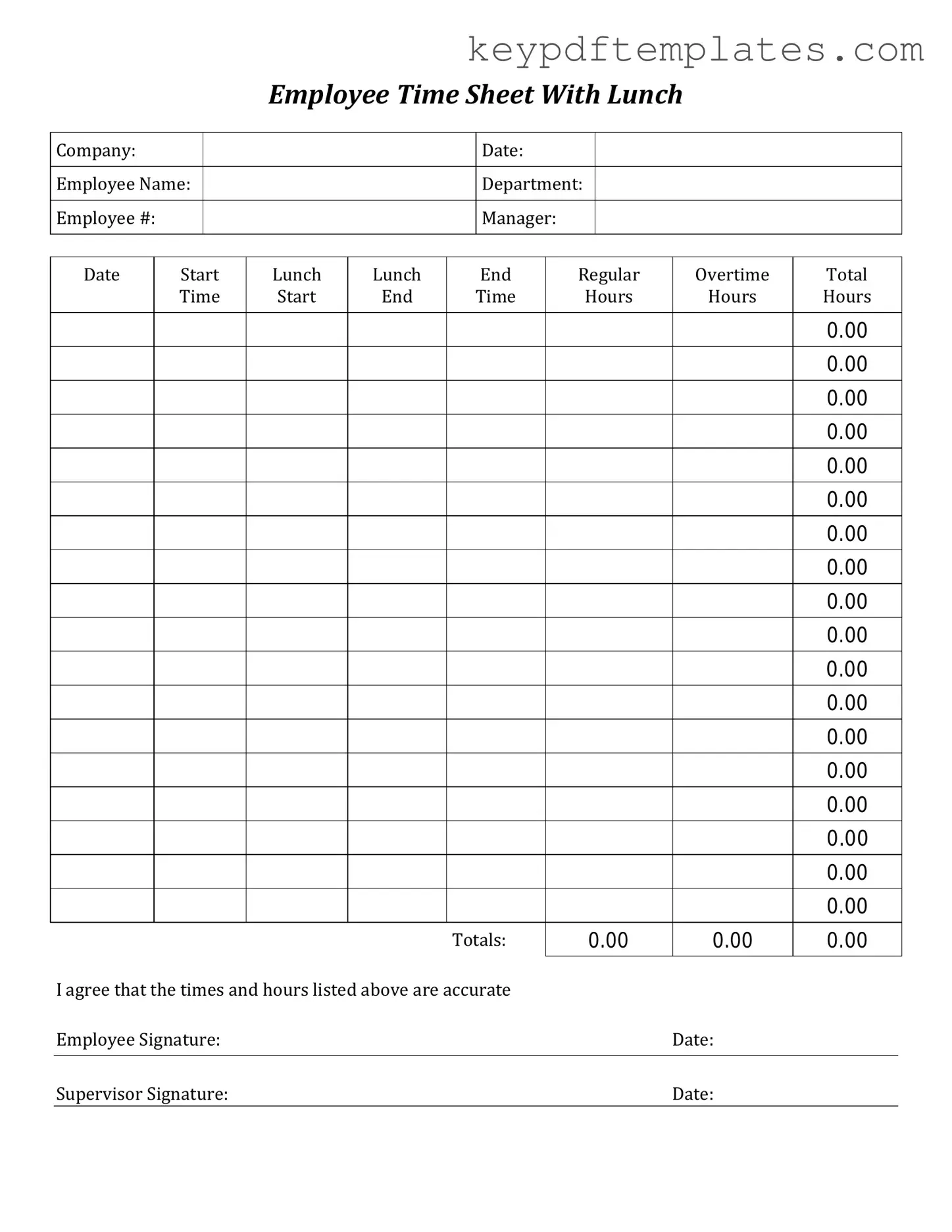

When it comes to filling out and using the Time Card form, there are several important points to keep in mind. Here are some key takeaways to ensure accuracy and efficiency:

- Accuracy is crucial. Double-check your hours worked to avoid discrepancies.

- Be consistent. Use the same format for dates and times throughout the form.

- Include all relevant details. Make sure to note breaks and any overtime hours.

- Submit on time. Adhere to your employer’s deadlines for submitting time cards.

- Keep a copy. Always save a copy of your submitted time card for your records.

- Understand your employer's policies. Familiarize yourself with how your company handles timekeeping and payroll.

- Ask questions if unsure. Don’t hesitate to reach out to your supervisor or HR for clarification.

- Review before submission. A final check can help catch any errors that might have been overlooked.

Similar forms

Employee Attendance Sheet: Similar to a Time Card, this document tracks when employees arrive and leave work, helping to monitor attendance and punctuality.

Payroll Register: This document summarizes employee earnings and deductions for each pay period, aligning with the information recorded on Time Cards for accurate payroll processing.

Work Schedule: A Work Schedule outlines the hours employees are expected to work, which can be compared to the hours logged on Time Cards to ensure compliance.

Overtime Request Form: Employees use this form to request approval for overtime hours, which must be documented alongside Time Cards for proper compensation.

Leave Request Form: This document allows employees to formally request time off, which is essential to track against Time Card entries to manage staffing effectively.

Job Costing Sheet: This sheet tracks labor costs associated with specific projects, similar to how Time Cards record hours worked on various tasks.

Time Off Tracking Log: This log keeps a record of all time off taken by employees, which complements the information found on Time Cards.

Performance Review Form: While not directly related to timekeeping, this form often references attendance and punctuality as part of the evaluation process, making it relevant to Time Cards.

Articles of Incorporation: The completion of the NY PDF Forms is essential for establishing a corporation in New York, documenting vital details about the business's name, purpose, and structure.

Expense Report: Employees use this report to claim reimbursements for work-related expenses. It often requires time tracking to justify the expenses submitted.

Misconceptions

Misconceptions about the Time Card form can lead to confusion and inaccuracies in tracking work hours. Here are four common misunderstandings:

- All employees must submit a Time Card every week. This is not always true. Some employees may be on a different payroll schedule or may not be required to track hours in the same way.

- Time Cards are only for hourly employees. In fact, salaried employees may also need to submit Time Cards for tracking purposes, especially if they are involved in project-based work.

- Filling out a Time Card is optional. This is a misconception. Accurate time reporting is often a requirement for payroll processing and project management.

- Late submissions of Time Cards will not affect payroll. Late submissions can cause delays in payroll processing, which may result in employees not receiving their pay on time.

More PDF Templates

1098 Form - You can review important messages regarding your mortgage status.

When completing a transaction involving a trailer, it is essential to utilize a proper documentation process, which includes acquiring a Texas Trailer Bill of Sale. This legal form not only confirms the transfer of ownership but also protects the interests of both the buyer and seller. For those interested in obtaining a template for this important document, visit https://txtemplate.com/trailer-bill-of-sale-pdf-template for a reliable option that ensures compliance and accuracy.

Ms Word Chart - Ensure headings are aligned with the overall purpose of the chart.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Time Card form is used to track employee work hours for payroll purposes. |

| Employee Identification | Each form must include the employee's name, ID number, and department to ensure accurate record-keeping. |

| Hourly vs. Salaried | Hourly employees typically submit Time Cards, while salaried employees may not need to track hours in the same way. |

| State-Specific Requirements | Some states have specific laws governing timekeeping practices. For example, California requires employers to maintain accurate records of hours worked. |

| Submission Frequency | Employees usually submit Time Cards weekly or bi-weekly, depending on the employer's payroll schedule. |

| Overtime Calculation | Time Cards help in calculating overtime pay, which is required under the Fair Labor Standards Act (FLSA) for eligible employees. |

| Digital vs. Paper | Many companies now use digital Time Card systems, but paper forms are still common in various industries. |

| Record Retention | Employers must retain Time Card records for a minimum period, often three years, to comply with labor laws. |

Documents used along the form

The Time Card form is an essential document for tracking employee hours worked. However, it is often accompanied by several other forms and documents that help manage payroll and employee records more effectively. Below is a list of these related documents, each serving a specific purpose in the overall payroll process.

- Payroll Register: This document summarizes the payroll for a specific period, detailing the wages, deductions, and net pay for each employee. It serves as a comprehensive record for accounting purposes.

- Employee Information Form: This form collects essential personal details about the employee, including their name, address, Social Security number, and tax withholding preferences. It is crucial for accurate payroll processing.

- Settlement Mediation Request: This form is crucial for initiating mediation aimed at resolving workers' compensation claims, and you can learn more about it on the Georgia PDF.

- W-4 Form: Employees fill out this form to indicate their tax withholding preferences. It helps employers determine how much federal income tax to withhold from an employee's paycheck.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their paychecks directly into their bank accounts. It streamlines the payment process and enhances convenience.

- Leave Request Form: Employees use this form to formally request time off from work. It helps employers track absences and manage staffing levels effectively.

- Overtime Approval Form: This form is used to document and approve any overtime hours worked by an employee. It ensures that overtime pay is calculated correctly and in compliance with labor laws.

- Expense Reimbursement Form: Employees submit this form to request reimbursement for work-related expenses. It helps maintain accurate records of business expenses and ensures timely payments.

- Performance Review Form: This document is used during employee evaluations to assess performance, set goals, and document feedback. It plays a vital role in employee development and compensation decisions.

These forms and documents work together with the Time Card form to create a comprehensive payroll system. Each serves a distinct function, ensuring that employee records are accurate and that payroll is processed efficiently.