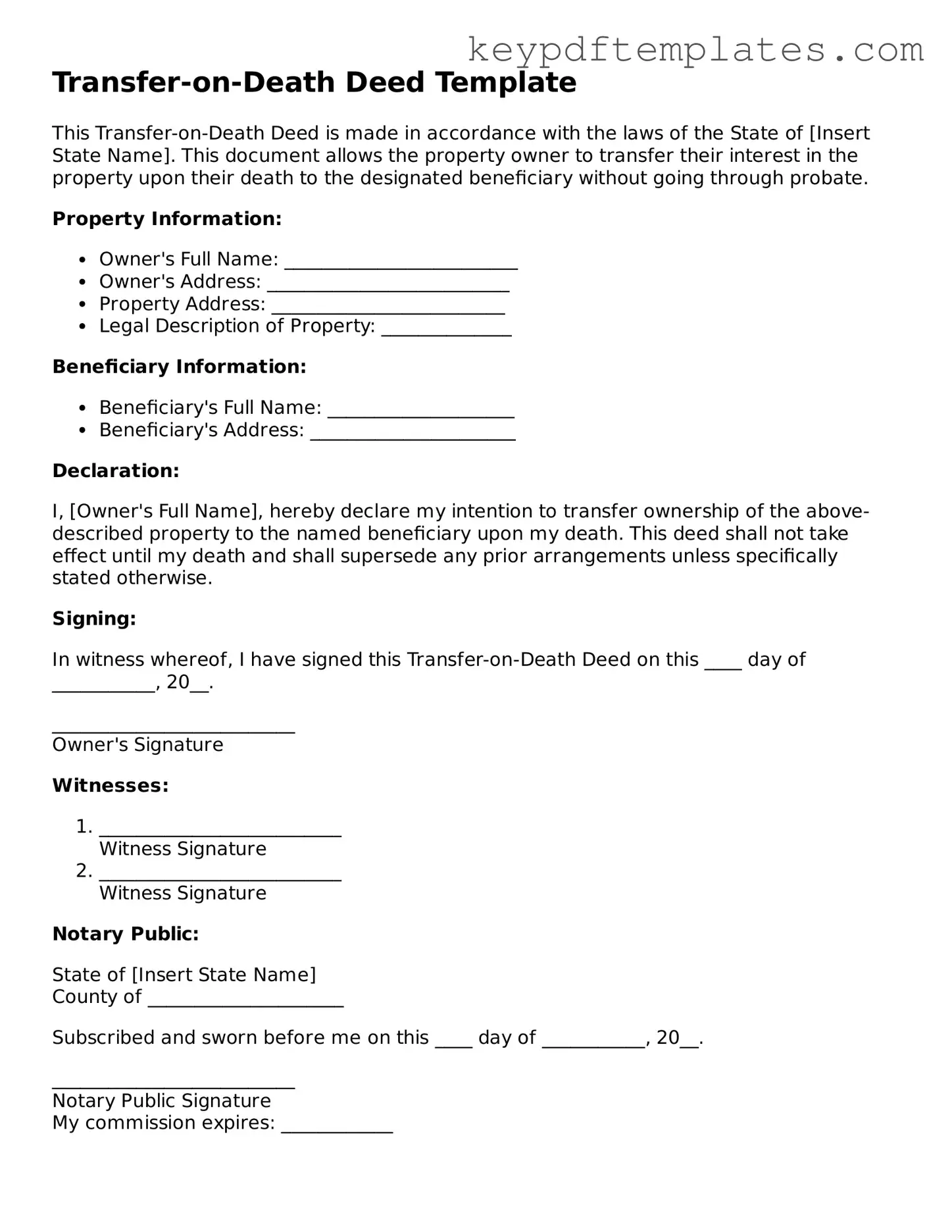

Printable Transfer-on-Death Deed Template

Transfer-on-Death Deed - Tailored for State

Key takeaways

When considering a Transfer-on-Death (TOD) Deed, it's important to understand its implications and how to properly fill out and use the form. Here are some key takeaways to keep in mind:

- Purpose of the TOD Deed: This deed allows you to transfer real estate directly to a beneficiary upon your death, avoiding probate.

- Eligibility: Not all states recognize TOD Deeds. Check your state's laws to ensure it is a valid option.

- Filling Out the Form: Provide accurate information about the property and the beneficiary. Double-check names and addresses.

- Signature Requirements: Most states require your signature and that of a witness or notary public to validate the deed.

- Recording the Deed: After completing the form, it must be recorded with the appropriate local government office to be effective.

- Revocation: You can revoke or change the beneficiary at any time before your death by filing a new deed.

- Tax Implications: Be aware that the transfer may have tax consequences for your beneficiaries. Consulting a tax professional is advisable.

- Property Liabilities: The beneficiary will inherit the property along with any existing liabilities, such as mortgages or liens.

- Consulting Professionals: Consider seeking advice from a legal or financial professional to ensure that the TOD Deed aligns with your overall estate plan.

By understanding these key points, you can effectively utilize a Transfer-on-Death Deed to ensure your property is passed on according to your wishes without unnecessary complications.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries for their property. However, a will typically requires probate, while a Transfer-on-Death Deed does not.

- Texas Employment Verification Form: This essential form is necessary for employers to verify an employee's or former employee's work status and is significant for those applying for state benefits. To understand more about this form, visit txtemplate.com/texas-employment-verification-pdf-template/.

- Living Trust: A living trust is a legal arrangement where assets are held for the benefit of specific individuals. Similar to a Transfer-on-Death Deed, a living trust allows for the direct transfer of assets without going through probate, ensuring a smoother transition of ownership.

- Beneficiary Designation: This document is often used for financial accounts, such as life insurance policies or retirement accounts. It allows account holders to name beneficiaries who will receive the assets upon their death, similar to how a Transfer-on-Death Deed designates property recipients.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more people to own property together. Upon the death of one owner, the surviving owner(s) automatically inherit the deceased's share, akin to the automatic transfer of property through a Transfer-on-Death Deed.

- Payable-on-Death (POD) Accounts: A POD account allows individuals to designate beneficiaries who will receive the funds in the account upon the account holder's death. This is similar to a Transfer-on-Death Deed, as it facilitates the direct transfer of assets without the need for probate.

Misconceptions

Understanding the Transfer-on-Death Deed (TODD) can help individuals make informed decisions regarding their estate planning. However, several misconceptions often arise about this legal tool. Here are eight common misunderstandings:

- It automatically transfers property upon death. Many people believe that a TODD transfers property immediately after the owner's death. In reality, the transfer occurs only after the death of the owner and only if the deed is properly executed and recorded.

- It replaces a will. Some individuals think that a TODD can serve as a substitute for a will. However, a TODD is simply a way to transfer specific property outside of probate, while a will covers the distribution of all assets.

- All property can be transferred using a TODD. There is a misconception that any type of property can be transferred through a TODD. In fact, only real estate can be transferred using this deed; personal property requires different methods.

- It is only for wealthy individuals. Many assume that TODDs are only beneficial for those with significant assets. However, anyone who owns real estate can utilize a TODD to simplify the transfer process for their beneficiaries.

- It requires court approval. Some people think that a TODD needs to go through the court system for approval. In truth, as long as the deed is valid and properly executed, it does not require court involvement.

- It can be revoked at any time without consequences. While it is true that a TODD can be revoked, individuals may not realize that revocation must be done according to specific legal procedures. Failure to follow these procedures could lead to unintended consequences.

- Beneficiaries have immediate access to the property. There is a belief that beneficiaries can access the property right after the owner's death. However, they must wait until the estate is settled, which may involve legal processes.

- It is a complicated process. Some individuals think that creating a TODD is a complicated task. In reality, the process is relatively straightforward, especially when compared to other estate planning methods.

Being aware of these misconceptions can help individuals make better choices regarding their estate planning strategies and ensure that their wishes are honored after their passing.

Other Transfer-on-Death Deed Types:

Lady Bird Deed Example - This tool ensures that the property goes directly to the designated beneficiaries upon death.

For those interested in transferring assets or property without any expectation of payment, the convenient Affidavit of Gift form is an important legal document that ensures both parties clearly understand this generous transaction.

Trust Deed Sample - The lender benefits from having a secured interest in the property, reducing their risk.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | In the United States, Transfer-on-Death Deeds are governed by state law, with specific provisions varying by state. For example, in California, it is governed by California Probate Code Section 5600. |

| Revocability | This deed can be revoked at any time before the owner's death, allowing for flexibility in estate planning. |

| Beneficiary Designation | Property owners can designate multiple beneficiaries, and the deed can specify how the property will be divided among them. |

Documents used along the form

A Transfer-on-Death Deed (TOD) is a useful tool for estate planning, allowing individuals to transfer property directly to beneficiaries upon their passing. However, several other forms and documents often accompany the TOD deed to ensure a smooth transition of assets and to clarify intentions. Here’s a list of these essential documents:

- Will: A legal document that outlines how a person's assets should be distributed after their death. It may also name guardians for minor children.

- Living Trust: This document allows a person to place assets into a trust during their lifetime, specifying how those assets should be managed and distributed after their death.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies to specify who will receive the assets upon the account holder's death.

- Power of Attorney: A document that grants someone the authority to act on another person's behalf in financial or legal matters, often effective during the person's lifetime.

- Healthcare Proxy: This form designates someone to make medical decisions on behalf of an individual if they become unable to do so themselves.

- Affidavit of Heirship: A sworn statement that identifies the heirs of a deceased person, often used when there is no will or when assets are not formally probated.

- Death Certificate: An official document that confirms a person's death, often required for settling estates and accessing financial accounts.

- Quitclaim Deed: This legal document is essential for transferring ownership of real estate without warranties or guarantees. It is commonly used in family property transfers or to rectify title issues. For more information and to access the form, visit Florida PDF Forms.

- Real Estate Transfer Forms: These documents are used to officially transfer ownership of real property, which may be necessary if the property is not covered by the TOD deed.

- Estate Inventory: A comprehensive list of all assets owned by a deceased person, which helps in the administration of the estate and ensures all assets are accounted for.

Having these documents prepared and organized can greatly simplify the process of transferring assets and managing an estate. Each document plays a crucial role in ensuring that the wishes of the deceased are honored and that beneficiaries receive their intended inheritance smoothly.