Get USCIS I-9 Form

Key takeaways

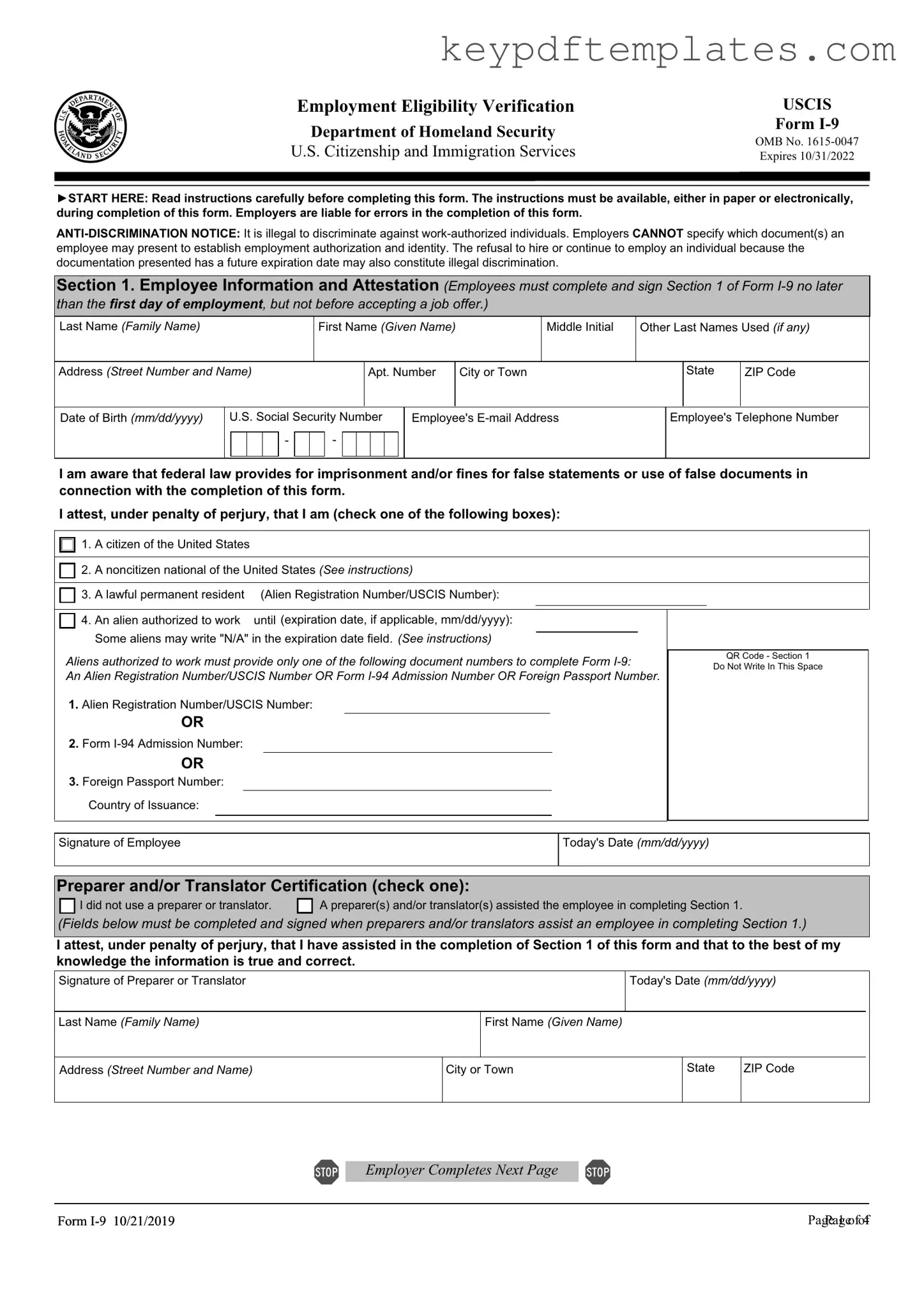

- Understand the Purpose: The I-9 form is used to verify the identity and employment authorization of individuals hired for employment in the United States.

- Complete on Time: Employers must complete the I-9 form within three days of an employee's start date. This is crucial for compliance.

- Employee Responsibilities: Employees must fill out Section 1 of the I-9 form, providing accurate personal information and attesting to their eligibility to work.

- Employer Responsibilities: Employers must complete Section 2, which involves reviewing the employee's documents to confirm their identity and work authorization.

- Acceptable Documents: Employees can present various documents to establish identity and work eligibility. A list of acceptable documents is provided on the I-9 form.

- Keep Records: Employers should retain completed I-9 forms for three years after the date of hire or for one year after the employee's termination, whichever is longer.

- Be Aware of Updates: The I-9 form may be updated periodically. Always use the latest version to ensure compliance.

- Training is Important: Employers should train staff on how to properly complete the I-9 form to avoid common mistakes and ensure compliance.

- Use Caution with E-Verify: If using E-Verify, understand that it is an additional step to verify employment eligibility and must be done after the I-9 process.

- Privacy Matters: Protect the personal information contained in the I-9 form. Secure storage and restricted access are essential to maintain confidentiality.

Similar forms

W-4 Form: Similar to the I-9, the W-4 form is used by employers to gather information about an employee's tax withholding preferences. Both forms are essential for compliance with federal regulations, ensuring that the correct amount of taxes is withheld from an employee's paycheck.

Form 1099: This document is issued to independent contractors and freelancers, much like how the I-9 is for employees. Both forms serve to document employment status and are used for tax purposes, helping the IRS track earnings.

Form I-20: For international students, the I-20 form is crucial for obtaining a student visa. Like the I-9, it verifies eligibility to work, albeit in a different context, by confirming enrollment and eligibility for work under specific conditions.

Employment Verification Letter: Employers often provide this letter to confirm an employee's job status. Similar to the I-9, it serves as proof of employment and may be required for various applications, including loans or housing.

Form SS-5: This form is used to apply for a Social Security number. Just as the I-9 verifies identity and eligibility to work, the SS-5 is essential for individuals to obtain the necessary identification for employment.

Form I-797: This notice is used by USCIS to communicate about immigration status. Like the I-9, it can confirm an individual’s eligibility to work in the U.S., especially for those on work visas.

Power of Attorney Form: When planning for future contingencies, it's advisable to utilize the comprehensive Power of Attorney form instructions to ensure your preferences are legally documented.

Form 1040: The individual income tax return form is used by employees to report their income. Similar to the I-9, it reflects an individual's employment status and income, which is crucial for tax compliance.

State Employment Application: Many states require applicants to fill out an employment application. This document, like the I-9, collects personal information and verifies qualifications for a job.

Job Offer Letter: This letter outlines the terms of employment and is often required before an employee starts work. It serves a similar purpose to the I-9 by confirming employment intentions and details.

Misconceptions

The USCIS I-9 form is essential for verifying the employment eligibility of individuals in the United States. However, several misconceptions surround its use and requirements. Here are six common misunderstandings:

-

Only new employees need to complete the I-9 form.

Many believe that the I-9 form is only necessary for new hires. In reality, any employee hired after November 6, 1986, must complete the form, regardless of their length of employment.

-

Employers must keep the I-9 form on file indefinitely.

Some think that employers are required to retain the I-9 form forever. In truth, employers must keep the form for three years after the date of hire or one year after the employee's termination, whichever is later.

-

Only U.S. citizens can complete the I-9 form.

This misconception suggests that only U.S. citizens are eligible to fill out the I-9. However, the form is for all employees, including non-citizens, as long as they have the legal right to work in the U.S.

-

Employers can choose which documents to accept.

Some people think employers have the discretion to accept any documents for verification. In fact, the I-9 form specifies a list of acceptable documents, and employers must adhere to these guidelines.

-

The I-9 form is only required for full-time employees.

Many assume that only full-time employees need to complete the I-9. However, all employees, including part-time and temporary workers, must fill out the form.

-

Once completed, the I-9 form does not need to be updated.

Some believe that the I-9 form is a one-time requirement. In reality, if an employee's work authorization expires, the employer must update the form with new documentation.

Understanding these misconceptions can help ensure compliance with employment laws and regulations. It's important for both employers and employees to be informed about the correct procedures regarding the I-9 form.

More PDF Templates

How to Upgrade Other Than Honorable Discharge - The DD 149 allows veterans to request a change based on their service record or mitigating circumstances.

The Texas Motor Vehicle Power of Attorney form allows an individual to grant another person the authority to manage their motor vehicle-related transactions. This form is particularly useful for those who may be unable to handle these matters personally, ensuring that their vehicle-related needs are addressed seamlessly. For further details, you can refer to the Motor Vehicle Power of Attorney form, understanding its importance can empower vehicle owners to delegate tasks with confidence.

Roof Inspection Report Template - This form represents a commitment to safety in residential roofing projects.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The I-9 form is used to verify the identity and employment authorization of individuals hired for employment in the United States. |

| Who Needs to Fill It Out? | All employers must have their employees complete the I-9 form, regardless of the employee's citizenship status. |

| Completion Timeline | Employees must complete Section 1 of the I-9 form on or before their first day of work. |

| Employer's Responsibilities | Employers must complete Section 2 of the I-9 form within three business days of the employee's start date. |

| Acceptable Documents | Employees must provide documents that establish identity and employment eligibility. A list of acceptable documents is provided on the I-9 form. |

| Retention Period | Employers must keep the I-9 forms for three years after the date of hire or one year after the employee's termination, whichever is later. |

| State-Specific Forms | Some states may have additional requirements or forms. For example, California has its own set of regulations under the California Labor Code. |

| Penalties for Non-Compliance | Failure to properly complete and retain I-9 forms can result in fines and penalties for employers. |

| Updates | The I-9 form is periodically updated. It's important to use the latest version to ensure compliance with current laws. |

Documents used along the form

The USCIS I-9 form is essential for verifying an employee's identity and eligibility to work in the United States. Alongside the I-9, several other forms and documents may be required to ensure compliance with employment regulations. Below is a list of commonly used forms and documents that complement the I-9 form.

- W-4 Form: This form is used by employees to indicate their tax withholding preferences. It helps employers determine the amount of federal income tax to withhold from an employee's paycheck.

- Form 1099: Typically used for independent contractors, this form reports income earned outside of traditional employment. It is essential for tax reporting purposes.

- Form 1040: This is the individual income tax return form used by employees to report their annual income to the IRS. It summarizes income, deductions, and credits.

- State Tax Withholding Form: Similar to the W-4, this form is used to determine state income tax withholding. Each state may have its own version.

- Form I-765: This application is for individuals seeking work authorization in the U.S. It is often used by those with certain visas or statuses.

- Form I-20: Issued to international students, this document certifies eligibility for a student visa and may be required for work authorization under certain conditions.

- Form DS-2019: This form is used for exchange visitors participating in programs sponsored by the U.S. government. It is necessary for obtaining a J-1 visa and may be linked to work permissions.

- Georgia Hold Harmless Agreement: This important legal document is designed to protect one party from liability for damages or injuries that may occur during an activity or event. For more information on this form, visit Georgia PDF.

- Employment Contract: This document outlines the terms of employment, including job responsibilities, salary, and duration of employment. It serves as a legal agreement between the employer and employee.

Understanding these forms and documents is crucial for both employers and employees. Proper completion and submission help ensure compliance with federal and state regulations, facilitating a smoother employment process.